Free banking on bitcoin is here. It's just not evenly distributed.

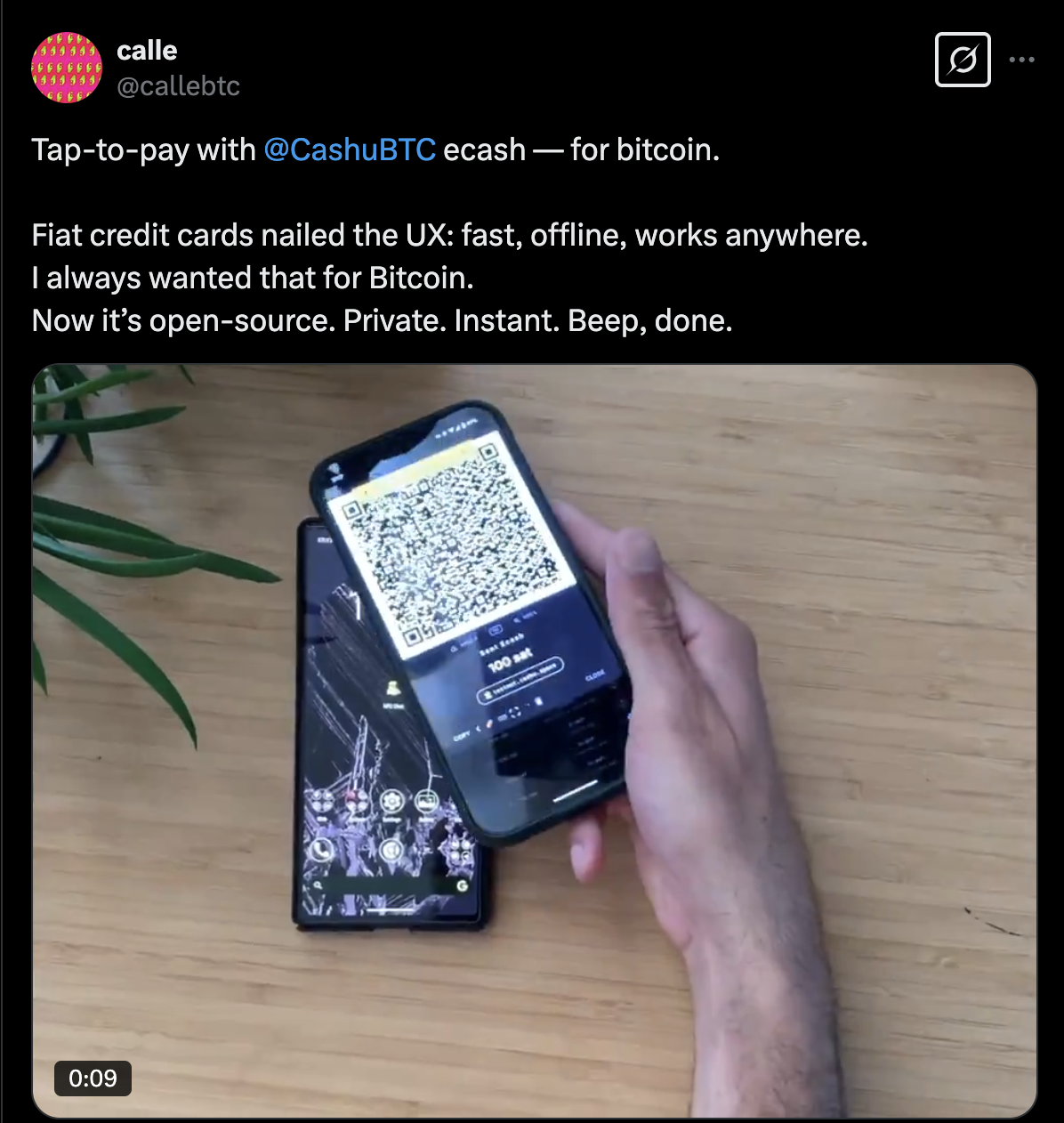

While everyone is focused on Michael Saylor and Strategy's latest bitcoin purchase, which has pushed the company's treasury to 506,137 bitcoin, I thought it would be appropriate to highlight that bitcoin's UX is improving rapidly. If you click the link above and watch the short demo from calle you'll be able to see that bitcoin wallet UX features are reaching parity with state-of-the-art fiat UX. Specifically, the ability to "tap to pay" using NFC technology. A massive step for bitcoin in terms of making it easier and more intuitive to use for people who are used to the convenience of the fiat rails they have grown accustomed to.

Under the hood, what is actually being transferred are ecash tokens representing bitcoin. Specifically, ecash created via the Cashu protocol. For those who are unaware, Cashu is a protocol that makes it easy to spin up and maintain Chaumian mints backed by bitcoin. These mints are like private banks. Users send bitcoin to an address associated with the mint, a commensurate amount of ecash tokens are created by the mint that the user can spend wherever he or she sees fit, and the mint is maintained by a trusted third party.

The tradeoff balance that users engage in is one where they give up full control of their bitcoin in exchange for ecash tokens that come with more inherent privacy - ecash tokens uses blinded signature schemes to make it so the mint operator and other ecash users have no idea who is spending ecash associated with a particular mint, faster transactions - ecash is stored in files that are transferred instantly and can even be transferred without devices being online, and lower fees. Ecash mints are also interoperable with the lightning network, so users can easily pay lightning network invoices from their ecash wallets.

No one needs to ask permission to create ecash mints on the Cashu protocol, so it is completely permissionless in that sense. Anyone can spin up a mint and start facilitating ecash payments. The privacy benefits are a 10x improvement from the status quo of on-chain and lightning bitcoin payments as they stand today. And the extend-ability of the Cashu protocol makes it so mint operators can offer end users an array of products that leverage the core tech of blinded signatures.

Even though end users of ecash mints are not as sovereign as someone who holds their own keys and transacts onchain using those keys, the trade off balance presented by Chaumian mints is incredibly enticing because it brings with it significant UX improvements in terms of privacy, speed and offline payment capabilities. All things that are desperately needed to make bitcoin payments better than the fiat alternatives that already exist on the market.

Being able to pay bitcoin invoices at point of sale terminals via tap to pay that comes with better privacy and less fees will be the standard by the end of the decade. This may seem far fetched, but when you consider how much a company like Block has invested in bitcoin and lightning infrastructure it is hard to imagine that every Block merchant won't be able to accept bitcoin via the lightning network by 2030. And any merchant that accepts bitcoin over lightning also probably accepts ecash payments by default due to the fact that ecash mints are interoperable with the lightning network via lightning gateways that are enabled by the Chaumian mint protocols that exist today (Cashu and Fedimint).

There are many out there who have gripes with the tradeoff model of Chaumian mints, but I am comfortable with them. Ecash wallets will be used as spending wallets that people top up when they go to make purchases in their day to day lives. No one is recommending that people go out there and put all of their bitcoin into a Cashu or Fedimint bank. However, putting small amounts of money in to be able to spend privately, cheaply and online by leveraging a mint operator who cannot see what payments you are making is extremely valuable.

I believe that an interconnected free banking system, which Hal Finney imagined in December 2010, is beginning to emerge on bitcoin. The stack is bitcoin + lightning + ecash mints. Pay attention to the innovations here in the coming years.

In our recent quarterly discussion with Matty Mezinskis, a compelling case emerged that Bitcoin's price appreciation is fundamentally driven by network adoption rather than central bank policies. While many assume Bitcoin rises primarily in response to money printing, Mezinskis presented data showing Bitcoin has continued its upward trajectory despite global central banks contracting monetary bases since 2021. This "countercyclical" behavior challenges conventional Bitcoin investment theses.

"If you look at things like global liquidity or how much money is floating around in the system... at the moment, I don't think any of that is the most important driver of Bitcoin's price." - Matthew Mežinskis

This decoupling validates what we've long suspected - Bitcoin's power curve growth represents organic network adoption that transcends monetary policy cycles. Mezinskis demonstrated how Bitcoin's relationship to the monetary base shows Bitcoin growing from 1% of global base money in 2018 to approximately 8% today, regardless of expansion or contraction phases. This reinforces my conviction that we're witnessing a fundamental network effect that will continue regardless of what central banks do in the coming years.

Check out the full podcast here for more on strategic Bitcoin reserves, the repo market's influence on liquidity, and the mathematical models predicting Bitcoin's future price trajectory.

Michael Saylor Signals More Bitcoin Buys in Strategy Update - via X

Sanders Storms Out When Asked About AOC Senate Prospects - Via X

Walz's Tesla Joke Sparks Pension Debate - Via X

IMF Labels Bitcoin as Digital Gold in Bullish Statement - Via X

ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

Get on the waiting list now before it fills up!

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Final thought...

My wife has perfected her made-from-scratch lasagna.

Subscribe to our YouTube channels and follow us on Nostr and X: