Despite criticisms of being too slow, the market preference for Bitcoin’s secure and decentralized structure over alternatives like BSV highlights its effectiveness as a global decentralized money.

The transaction speed of Bitcoin has been a topic of discussion within the Bitcoin community and among new adopters. Evaluating Bitcoin's throughput is essential to understanding its potential as a global settlement layer.

Bitcoin SV (BSV) is a hard fork of Bitcoin Cash (BCH), which itself is a hard fork of Bitcoin (BTC). The creators of BSV claim they created it to adhere more closely to what they perceive as Satoshi Nakamoto's original vision of Bitcoin, particularly concerning larger block sizes. The project faced intense criticism and has never gained significant support.

The market capitalization of BSV stands at approximately $1.7 billion, a fraction of Bitcoin's market cap, which is around $1.3 trillion. The value of BSV relative to BTC has decreased significantly, indicating market preference for the latter.

BSV claims to support a higher transaction volume due to its larger block sizes. While theoretically capable of handling over 50,000 transactions per second (TPS), real-world usage peaks around 3,000 TPS, with averages closer to one or two TPS. In contrast, Bitcoin processes approximately four to seven TPS.

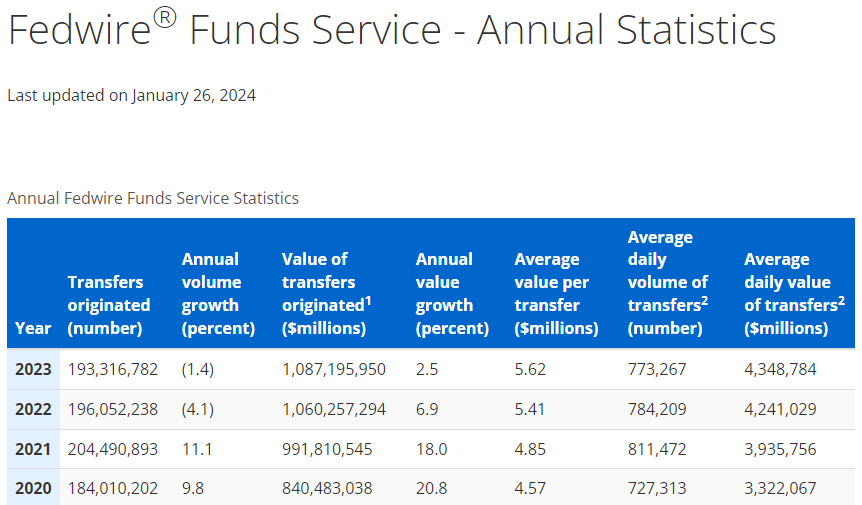

When compared to Fedwire, a global financial settlement network, Bitcoin's TPS is similar. Fedwire processed around 193 million transactions in 2023, averaging about 8.6 TPS. This suggests that Bitcoin's base layer is capable of functioning as a global settlement system similar to Fedwire.

Monetary systems traditionally scale in layers, and Bitcoin is no exception.

Credit cards represent a third-layer solution on top of fiat currency. Transactions on this layer can be reversed or canceled, whereas settlement occurs later through methods like Fedwire or ACH transfers.

Bitcoin employs a similar strategy through layer two solutions such as the Lightning Network, which allows for the batching and netting of transactions. These transactions are eventually settled on Bitcoin's base layer, providing finality.

For minor transactions, such as buying a cup of coffee, it is more efficient to use higher layers of the network, which could be facilitated by custodial wallets or the Lightning Network, to avoid cluttering the blockchain with small transactions.

Bitcoin's decentralized network, secured by proof of work, contrasts with Fedwire's centralized system. Bitcoin's network consists of tens of thousands of nodes, while Fedwire operates with a primary node controlled by the Federal Reserve. This decentralization enhances security and accessibility, enabling anyone to run a node and verify transactions.

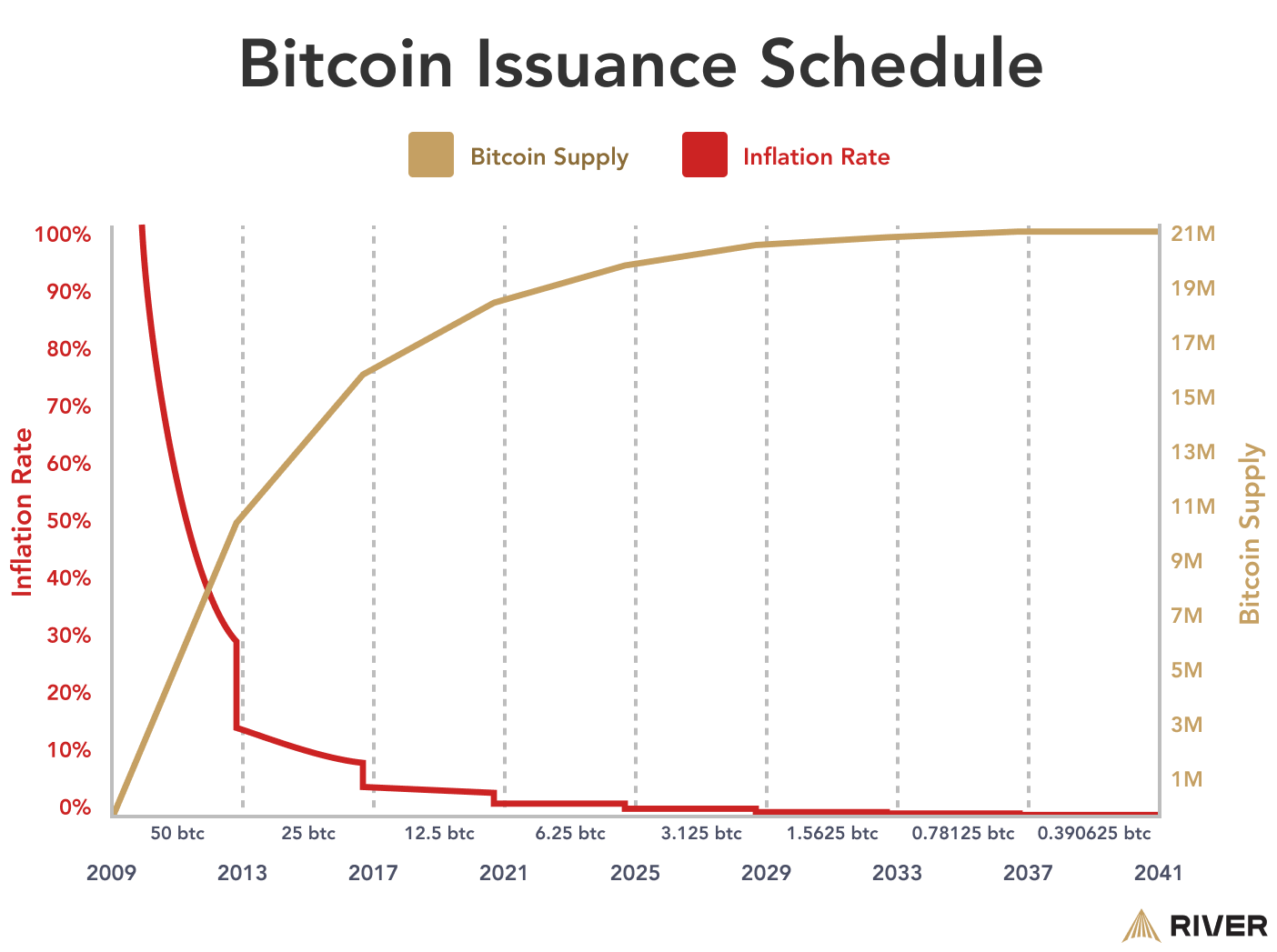

Bitcoin's capped supply of 21 million coins positions it as a strong store of value, unlike fiat currencies, which can suffer from inflation due to unlimited supply potential.

The critique that Bitcoin is "too slow" is typically voiced by promoters of alternative cryptocurrencies. Despite BSV's higher theoretical transaction speed, the market has shown a clear preference for Bitcoin's properties, which include decentralization and neutrality.

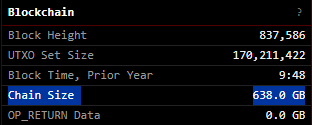

The manageability of Bitcoin's blockchain size, currently at roughly 638GB, is more practical compared to BSV's 10.92TB, which poses a challenge for individuals wishing to run their own nodes.

Bitcoin's transaction speed, although not the highest in the cryptocurrency space, is aligned with its role as a secure, decentralized, and neutral global settlement layer. The design of layered scaling solutions ensures efficiency for everyday transactions while preserving the integrity and trustlessness of the base layer. The market's preference for Bitcoin over other cryptocurrencies, including BSV, is a testament to its robustness and potential as a global decentralized money.