The numbers are telling us something.

Every once in awhile it's nice to zoom out and put things in perspective. Bitcoin is 22.4% below its all time high of $109,300 which was hit in January of this year, equities markets have taken a hit in recent months and gold is hitting new all time highs every week. This has led to a number of pundits, analysts and general skeptics to come out of the woodwork to proclaim that bitcoin "isn't a store of value". It is merely an asset that trades alongside the Nasdaq with some beta when times are good.

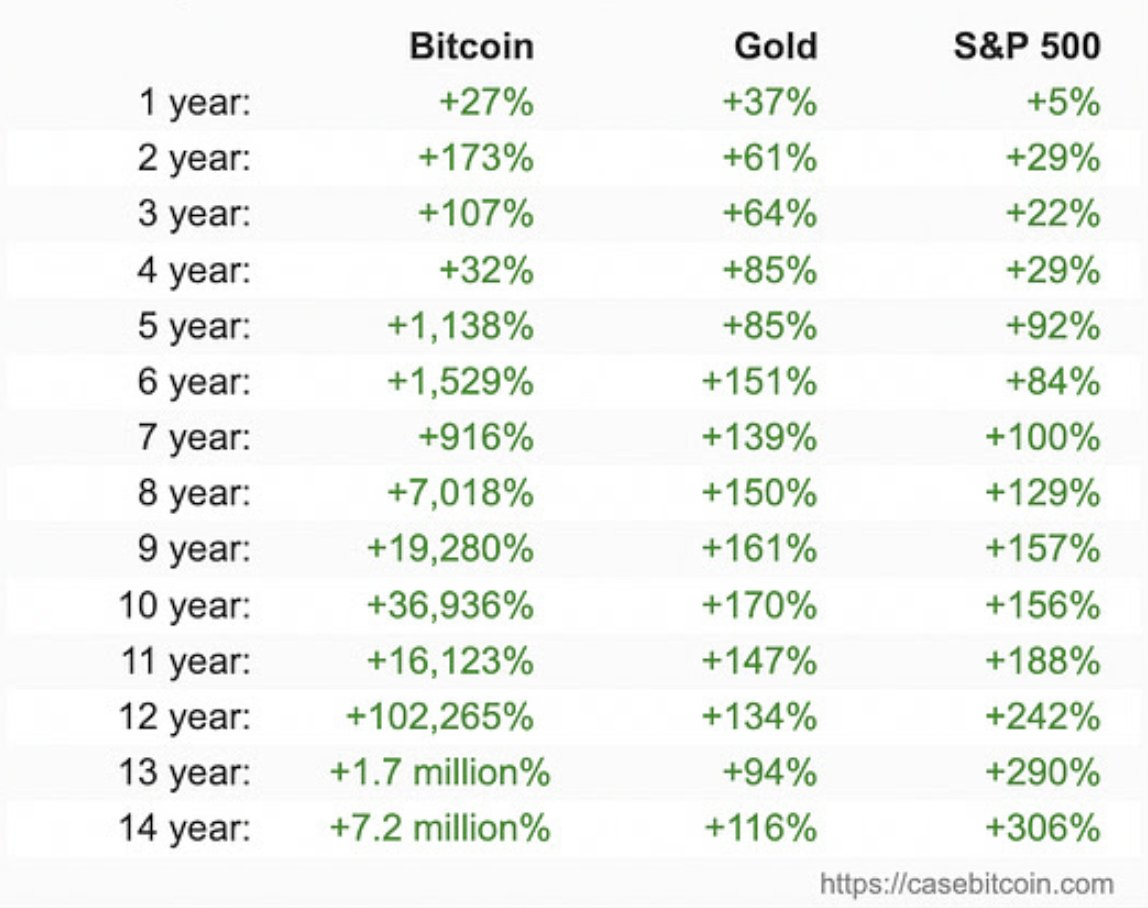

This is objectively false. Bitcoin has been the best performing asset since a price was first attached to it 14 years ago outside of some temporary out performance by gold on cherry picked time frames. Equities indices even out perform on certain time scales, but the signal is clear when you zoom out; bitcoin is monetizing in real time and if you hold it long enough you are going to outperform every other tradeable asset out there. Individuals, businesses and governments alike are slowly but surely pricing in the fact that a truly scarce asset has been introduced to the market.

If you are an outside observer looking at bitcoin, or a holder of bitcoin who is easily manipulated by the loud narratives it is imperative that you internalize the message being articulated in the return comparison chart of bitcoin, gold and the S&P 500 over the last 14 years. The message is, "There's a 'there' there and it probably makes sense to try to understand what the 'there' is."

Bitcoin is the apex predator of money and only a very small fraction of the global population has recognized this. Those who have recognized this, acquired bitcoin and held on have been rewarded handsomely as more of their counterparts come to the same realization; in a world of perpetual and increasing fiat monetary debasement, a money that cannot be printed is invaluable. A money that cannot be controlled gives you an incredible amount of control over your financial well being. A money that cannot be printed or controlled is simply a superior product in a world run by governments and central banks who are losing control of the Frankenstein monetary systems they've created.

If you take the time to zoom out you can see this in the data. It's staring you right in the face.

James Check identifies $65K as a critical psychological level for Bitcoin, calling it the "true market mean" - the average cost basis for active investors. This price would put many 5-year Bitcoin holders underwater, creating what Check describes as a "really, really sensitive" point for the market. Check notes his own strategy's cost basis sits at $67K, suggesting this zone represents significant investor sensitivity.

"That's a level where if you wanna have a full-scale capitulation, it's probably going to happen somewhere in there."- James Check

While Check sees $65K as a potential capitulation zone that could trigger "Bitcoin obituaries" across financial media, he remains optimistic about Bitcoin's resilience. He "struggles to see the market going down to $40K," arguing this would undo both ETF momentum and Bitcoin's hard-won trillion-dollar market cap milestone. Despite the current correction, Check's analysis suggests Bitcoin's foundational support remains intact above these levels.

Check out the full podcast here for more on the bond market crisis, Triffin's dilemma, and Trump's tariff strategy. James also explores what "soft landing" options might exist for Bitcoin.

Trump Says No One "Off the Hook" for Unfair Trade Practices - via X

Economic Order Breakdown More Dire Than Recession—Dalio - via X

US May Use Gold Reserves to Buy Bitcoin, Official Says - via X

China Halts Rare Earth Exports to U.S. - via X

The first months of the new administration have sparked an unprecedented push for cost- cutting and efficiency within the federal government—but DOGE Can't Fix The Dollar. Join us on April 16th to hear PhD economist Peter St. Onge explain how bitcoin brings true efficiency to governments while protecting your generational wealth. With macro uncertainty driving a dip in bitcoin prices, now is the time to understand the fundamentals driving the global shift to sound money.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

I'm happy for Rory McIlroy. We should all celebrate greatness when others achieve it.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: