This week's signal in bitcoin and markets.

Hi all,

This is Dylan LeClair, presenting this week's Onramp Weekly Roundup.

Before we get started... If you're a HNWI or Institution looking for the best way to get exposure to bitcoin, Onramp Bitcoin could be the right fit for you - schedule a chat with us to discuss your situation & needs.

And now, here's the weekly roundup...

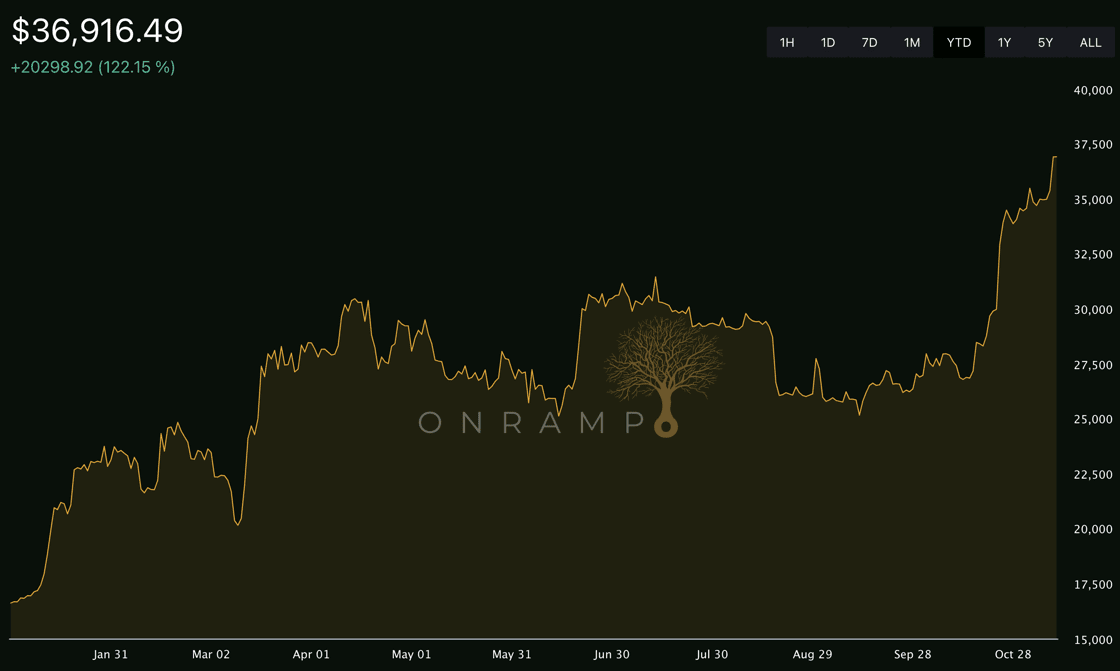

Bitcoin continued its upward ascent this week, flirting with new year to date highs at the time of writing, at around $37,000, +122% year to date so far in 2023. The move comes amidst flurries of optimism by market participants of an ETF approval. While this may be the case, we believe the causation is viewed backwards. Bitcoin's improving fundamentals aren't a result of a potential ETF approval, but an ETF approval is a result of bitcoin's inherent fundamentals, which continue to strengthen against any and all circumstances.

With bitcoin's extreme strength in focus, let's turn to how it compares to other asset classes in the investment landscape. In absolute returns, there isn't really a close comparison, blowing U.S. equities and gold out of the water, while bonds are incredibly negative year to date...

In risk adjusted terms, the Nasdaq is still having an incredibly strong year, closely followed by bitcoin as well.

While we're on the topic of comparing bitcoin to other asset classes, let's revist the performance of passive accumulation strategies into various asset classes.

Starting from the day of the November 2021 $69,000 bitcoin all time high, a daily dollar cost averaging strategy has yielded returns of +40% for bitcoin, +15% for the Nasdaq, +5% for the S&P 500 and gold, and -14% for U.S. long duration bonds.

While the caveat with bitcoin investment by naysayers is always the wild volatility, almost never is that same fact highlighted in it's favor. The wild volatility is actually on your side for long-term oriented investors.

Turning our attention to the economy, Jeff Weniger, Head of Equities for WisdomTree published quite a staggering indicator, showing 18 consecutive declines in reports from the Conference Board's leading economic indicators.

On a similar note, the Eurozone Composite PMI has fallen to it's lowest level in 35-months at 46.5, signaling a persistent slump in the EU's economic activity. With a PMI reading below the neutral 50 mark displaying month-over-month contraction, there are plenty of signs that economic conditions continue to deteriorate globally.

The Chief Economist at Hamburg Commercial Bank remarked on the current economic anomaly of rising prices amidst falling demand, labeling the situation as 'stagflation'. Inflationary pressures, albeit moderating slightly, remain worrisome, and present quite the challenge for the ECB with a EU economy up to it's eyeballs in sovereign debt.

Stephane Deo from Eleva Capital points out a recent pivot in global monetary policies. In October, the count of rate hikes by central banks worldwide dropped to six, the lowest since July 2021, while rate reductions climbed to five, a peak not seen since July 2020. This trend, especially the Federal Reserve's pause at what seems to be the peak rate of this tightening cycle, suggests that central banks are now pausing to evaluate the impact of previous hikes amid a slowdown in global economic growth and the past year's disinflationary patterns.

It's quite fascinating to note, even on an empirical basis, that historically asset prices have fallen and unemployment rates have increased following the Federal Reserve's initial rate cuts. This trend reflects the full absorption of prior tight monetary policies into the economy. A complete reversal of these effects typically awaits a full dovish pivot by the Fed, often coupled with supportive fiscal stimulus measures.

E024: Market Forces & Fed Reactions with Nik Bhatia

Nik Bhatia joined the show for this week's episode of The Last Trade to dive deep into the intricate dance between market signals and Federal policies. Bhatia unpacks the subtle hints of recession from sluggish industry growth, discusses the implications of an inverted yield curve, and examines the Fed's reserves framework. Bhatia doesn't shy away from the hard truths of market leverage effects and the reactive nature of the Fed's policy decisions. The episode concludes with Bhatia's analysis of bitcoin's unique potential as an investable asset in today's economic climate, highlighting its asymmetric nature.

Check out the full episode here.

Wrapping up this week's digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp's offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair

Originally published to Onramp's weekly newsletter