The Fed has broken the Financial Matrix.

I recently took an Ayahuasca journey to the edge of consciousness- causing some mind-shattering realizations about myself. But what if our financial markets are the same- and the abstraction has superseded reality?

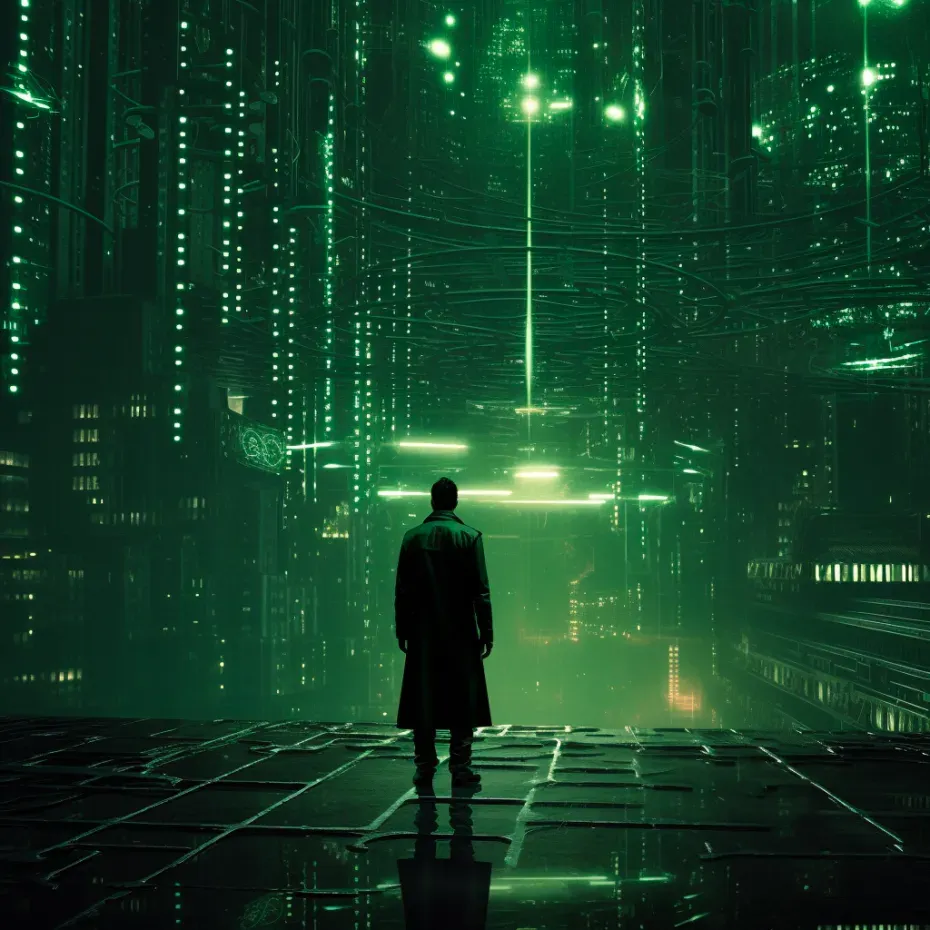

This is the Simulacrum.

Suarez Miranda,Viajes de varones prudentes, Libro IV,Cap. XLV, Lerida, 1658 (The Map)

Jorge Luis Borges' short story "On Exactitude in Science" (often referred to as "The Map") is a thought-provoking fable that explores the philosophical concept of representation and the limits of human knowledge and understanding.

The story presents a fictional world where the rulers decide to create a map that is a perfect, one-to-one representation of their territory, down to the smallest detail. In their pursuit of precision and exactitude, they produce an immense and incredibly detailed map that covers the entire territory perfectly. However, this colossal map becomes so unwieldy that it is abandoned and falls into disrepair, while the actual territory it represents becomes obscured and neglected.

People living in the world after generations forget that the real world even exists, and soon believe that the map IS the land. The abstraction becomes reality.

The Map is a thought-provoking allegory that reminds us that while representations are valuable and necessary for understanding our world, they should never fully replace the richness and complexity of the reality they seek to represent.

I was reminded of this fable on a recent Ayahuasca retreat, up in the Colombian foothills north of Medellin. In the span of two nights, I went through a painful, but necessary transformation that caused me to question my perceptions of the world and of myself- ultimately leading me to a more holistic and healthier place. I recounted the story on Twitter if you would like to read it, but needless to say although it was extremely difficult, I learned a lot.

Psychedelics can be a powerful tool for self-transformation. They bend and distort our consciousness, challenging our ego and displaying new viewpoints. For example, one of the most prominent theories regarding the impact of psilocybin on the ego involves the modulation of the default mode network (DMN). The DMN is a network of brain regions that are active when the mind is at rest and engaged in self-referential, introspective, and autobiographical thinking. It is often associated with the sense of self and the ego. Psilocybin and other psychedelics are thought to disrupt the normal functioning of the DMN, leading to decreased activity and connectivity within this network. The ego dissolves, as the boundaries between the self and the external world become less distinct.

This allows for a window for change, for adaptation of our beliefs about ourselves. Oftentimes, these beliefs may not even be true or real- but we have so much faith in them that they become valid.

Borges’ fable is touched on in Jean Baudrillard's "Simulacra and Simulation," a book published in 1981, that delves into the concept of simulation, hyperreality, and the blurring of the boundaries between reality and representation. It has had a significant impact on fields such as philosophy, sociology, and cultural studies - this work was the major inspiration for the Matrix franchise.

The book begins with the assertion that contemporary society is characterized by a precession of simulacra, where copies of reality (simulacra) have become more prominent and influential than the original reality itself. Baudrillard argues that we now live in a world dominated by signs and symbols, where reality has been replaced by hyperreality, a state in which the distinction between what is real and what is a simulation becomes increasingly blurred.

Derivatives are financial contracts that derive their value from an underlying security, and have existed for as long as markets have. A futures contract, for example, is a legal agreement to buy or sell a particular commodity asset, or security at a predetermined price at a specified time in the future. The buyer of a futures contract is taking on the obligation to buy and receive the underlying asset when the futures contract expires, and the seller of the futures contract is taking on the obligation to deliver the underlying asset at the expiration date. These contracts have been around for millenia, with the earliest recorded contract dated to 1750 BC in Mesopotamia, or modern-day Iraq.

Everything in the financial economy is a derivative of the real world. Equities are a derivative of a real company. Bonds are a derivative of the underlying money paid over time. The dollar itself is a derivative of real money, gold. Abstractions are necessary for complex civilizations.

But what happens when the abstraction overtakes reality?

Stock markets evolved to serve the need for corporations to ratably share equity with the public, and have existed for hundreds of years. In fact, the Dutch East India Company was formed in 1602, and the first stock exchange in the world was founded in Amsterdam in 1604, largely as a venue for trading the shares of VOC (Dutch East India Corp). Stock exchanges began to pop up all over Europe, but none were as sophisticated as the Dutch system during this time.

In the United States, the New York Stock Exchange (NYSE) was founded on May 17, 1792, when 24 stockbrokers signed the Buttonwood Agreement under a buttonwood tree on Wall Street in New York City. This agreement marked the beginning of organized securities trading in the United States, and the NYSE has since become one of the world's largest and most influential stock exchanges.

In his seminal work "The General Theory of Employment, Interest, and Money" published in 1936, John Maynard Keynes discussed how changes in people's wealth and their perceptions of it can influence their spending behavior and, by extension, overall economic activity.

Keynes argued that variations in the level of wealth or asset values could affect aggregate demand and, consequently, employment and output in an economy. This became the basis for the wealth effect- the idea that as asset values grew, it would stimulate the real economy. Therefore, manipulating financial markets to go higher was an economic good, allowing the Fed free intellectual justification for any large scale monetization of debt securities.

QE was now righteous.

Any program, of whatever size or complexity, was therefore deemed good. If it saved millions from losing jobs, corporations from going bankrupt, banks from collapsing, then it had to be morally warranted, right?

Thus, in 2008, officials at the Federal Reserve and Treasury saw themselves as heroic knights attempting to save the kingdom; brilliant strategists rescuing the system from itself. The Fed thus entered into a new relational paradigm with markets: they would use the threat of the balance sheet to convince the participants to make moves.

As the rulers of the monetary system began to incorporate this mindset into every fiber of their being, they became more and more carefree with their Excalibur.

Equities market collapsing in 2018? Stop the taper.

Repo blows up in 2019? Emergency lending programs.

COVID-19? Liquidity flood.

Every move exacerbates the next, as the central bank ends up owning more and more of the market. We can see this developing during the most recent QE, as open market operations bumped up the percentage of the Treasury market owned by the Fed in a sawtooth pattern.

As the ownership of the market grows, so does the market’s dependence on the Fed itself. The larger it grows the balance sheet, the more it will need to in the future in order to influence the market. This is because the system itself is growing.

The constant liquidity injections also encourage higher order derivatives, because now the collapse of the underlying is all but impossible. The Bernanke Put has become the Fed Put- no central bank will allow severe contraction of the base layer financial assets, so therefore the superordinate abstractions (think options, CDS, equity swaps, etc) will be safe. Growth in the derivatives market explodes.

The BIS (Bank of International Settlements) reported that as of end of June 2022, the notional value of the OTC derivatives market grew to $632T.

The market grows, and with it the need for the Fed’s liquidity programs. Of course, these programs can be halted for a time- the balance sheet can taper, the interest rates hiked. But the sheer size of this behemoth means it needs to be satiated eventually.

All along the way, the central bank supplies the markets with whatever they want. Falsely believing that the market IS the economy, the monetary planners stuff more and more cash into the coffers of the system.

The market dies a strange and slow death.

We can see this in the ratio of S&P 500 Index to the Fed’s Balance Sheet. Pre-2008, there was strong fundamental growth in equities with occasional small drawdowns- normal for a stock market operating in a booming economy funded by a credit bubble (that the Fed had helped create). However, after the Financial Crisis, the ratio flatlines- showing that there has essentially been almost NO REAL growth in equity prices. The rallies are now financed by the Fed itself.

The correlation coefficient between central bank liquidity and stock markets is nearly 1. The full picture of liquidity is quite a bit more complex than just the balance sheet, as new Fed programs and the growth of the TGA means that reserves can be added/subtracted from the financial system without a direct increase in balance sheet size. But regardless, risk assets need their monthly fix from Papa Powell.

The system becomes more and more dependent on fake money, and the underlying economy is forgotten. Despite equities remaining only 10% from highs, labor force participation is at the same level as March 1978. Nvidia rallies to all time highs, while Fentanyl overdoses climb in tandem.

All basic logic flies out the window. A lackluster jobs report? Equities rally. Low unemployment print? Massive selloff in SPY futures. Bad news becomes good, and good news is bad, as now the major variable on everyone’s mind is what will the Fed do?

This is the Upside Down. All traditional behavioral economics is thrown out- with the new paradigm only relying on central bank actions. We rally whenever jobs numbers are bad, because this means the economy is doing poorly, unemployment could rise, which would give Powell a justification for more QE.

The Abstraction has become the Reality.

Central bankers now plan every move on equity indexes, every bond-buy on repo markets. They become completely tied to the financial matrix; unable to disentangle themselves from the monster they have helped create. Once Silicon Valley Bank collapsed, they wasted no time in creating new programs, new rules, new loans, anything to back up the system. Paper over the wounds and pray for the best.

In 2021, I noted that on virtually every metric available, the markets were on the extreme end of the curve. Price to Earnings, Price to Book, Quarterly Equity Offerings, Forward EBITDA, and more were all in excess of the 90th percentile, historically. The Fed had been successful in pushing markets to the right tail of the distribution; in fomenting irrational exuberance in virtually every asset class.

They viewed this as an indicator of success, rather than one of concern. Federal Tax Receipts ballooned, and Fed governors praised this development in spite of the fact that the Treasury itself was now extremely dependent on capital gains tax. If the market contracts, so too will Federal Tax Income.

The tool of “forward guidance” allowed Powell to communicate the moves of future policy decisions, pushing the market to change without ever actually enacting the programs. This is the epitome of devious controlling behavior. The goal is no longer to mold real economic variables but to manipulate the psychology of market participants so they themselves make the changes.

This cannot continue forever. Equities, derivatives, bonds- all are representations of the world, but not reality itself. Worsening base layer conditions will eventually force their hand, and the only programmatic response known by the central bankers is QE. This will only exacerbate the problems for the rest of us and eventually hasten the demise of the system itself. This is what they do not understand.

If people have to decide between keeping their Apple stocks or feeding their family- we all know what choice they will make. Unfortunately, it might take austerity on this scale to force the Simulation to break. Or the introduction of a new system.

The Simulation is powerful. It is ubiquitous. It is deeply ingrained in the minds of those tortured souls who believe in it. But it holds a flaw- it is no longer tied to the base reality.

This was originally posted on The Dollar End Game