Bitcoin's enters the "then they fight you" phase.

It's been one hell of a week for bitcoin. It seems that the US government has become motivated to deploy a chilling effect across the industry. The honeymoon period between the US government and bitcoin seems to have ended, the page has turned to the next chapter and we have entered a new era that will define whether or not bitcoin's road to success as a peer-to-peer distributed cash system is relatively painless or painful. The US government, at least this current administration, and many other governments around the world seem keen on making it as hard as possible for software developers to build tools that enable individuals to access the bitcoin network and control their wealth in a permissionless fashion.

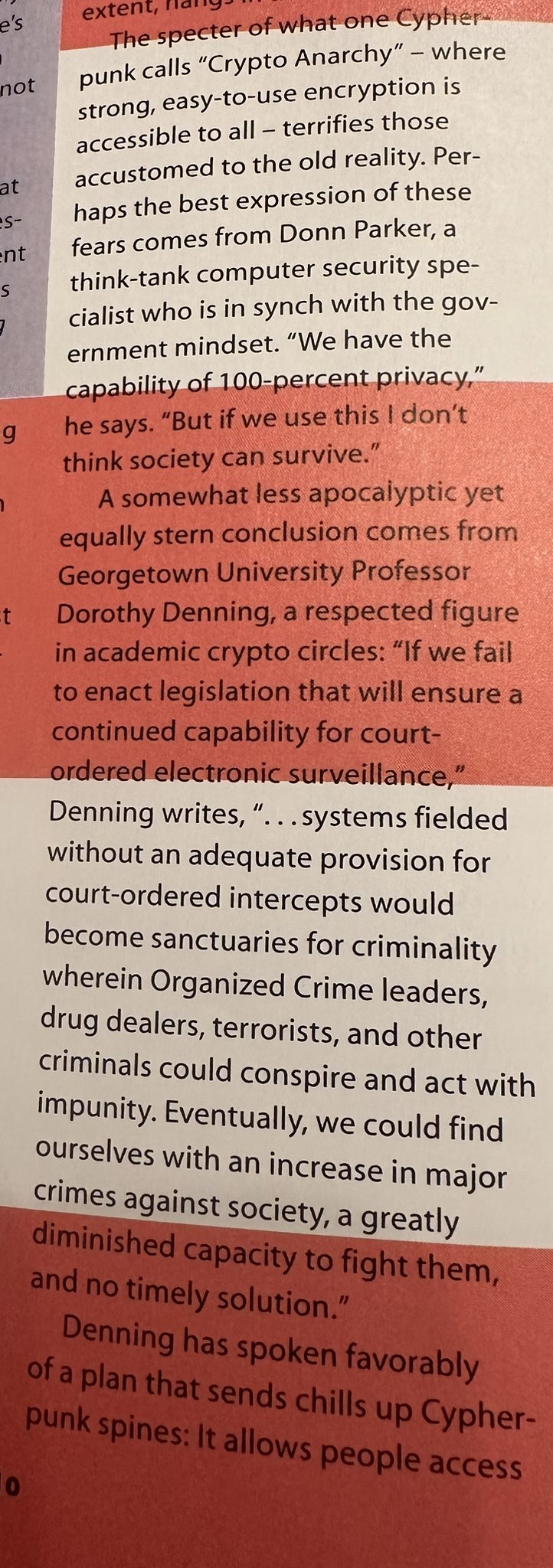

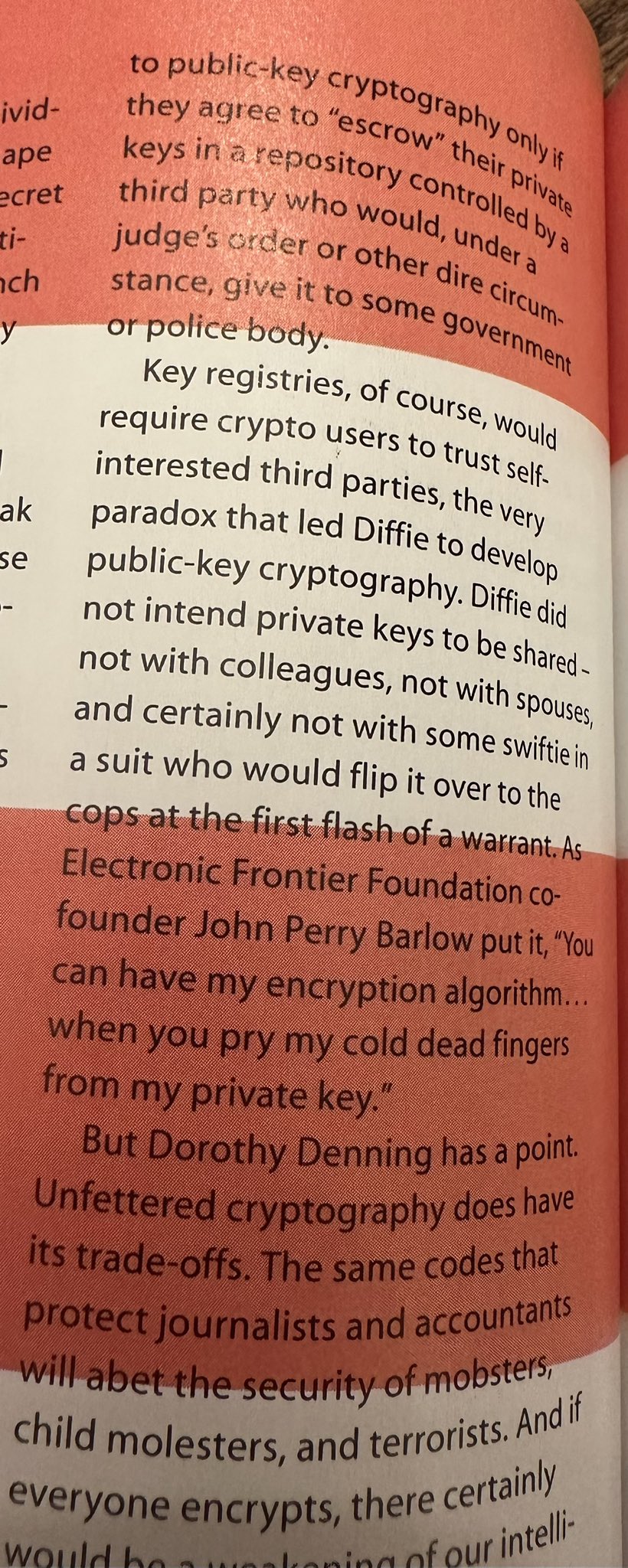

Bitcoin could be at the beginning stages of its very own version of the Crypto Wars of the early 1990s, which centered around Phil Zimmerman and his PGP (Pretty Good Privacy) project. The US government claimed that by allowing PGP to be exported to countries outside the US Zimmerman was breaking US laws around the exporting of munitions to foreign countries. At the time, privacy preserving cryptography was considered military grade technology that was too dangerous to allow to proliferate lest it found itself in the hands of enemies of the US who could leverage the privacy preserving technology to evade snooping from intelligence agencies.

Phil Zimmerman and the cypherpunks who worked alongside him to ensure that the public had access to public key cryptography tools that enhanced privacy saw things a bit differently. Mainly, that the benefits created by public key cryptography tools far outweighed the drawbacks. Yes, nefarious individuals could leverage these tools to communicate in private since anyone had the ability to leverage them once they were open sourced. But the added security that the masses would benefit from; inability for criminals to intercept messages and use the information against those sending and receiving the messages, keeping private matters private on the internet, and preventing nefarious state actors from accessing information.

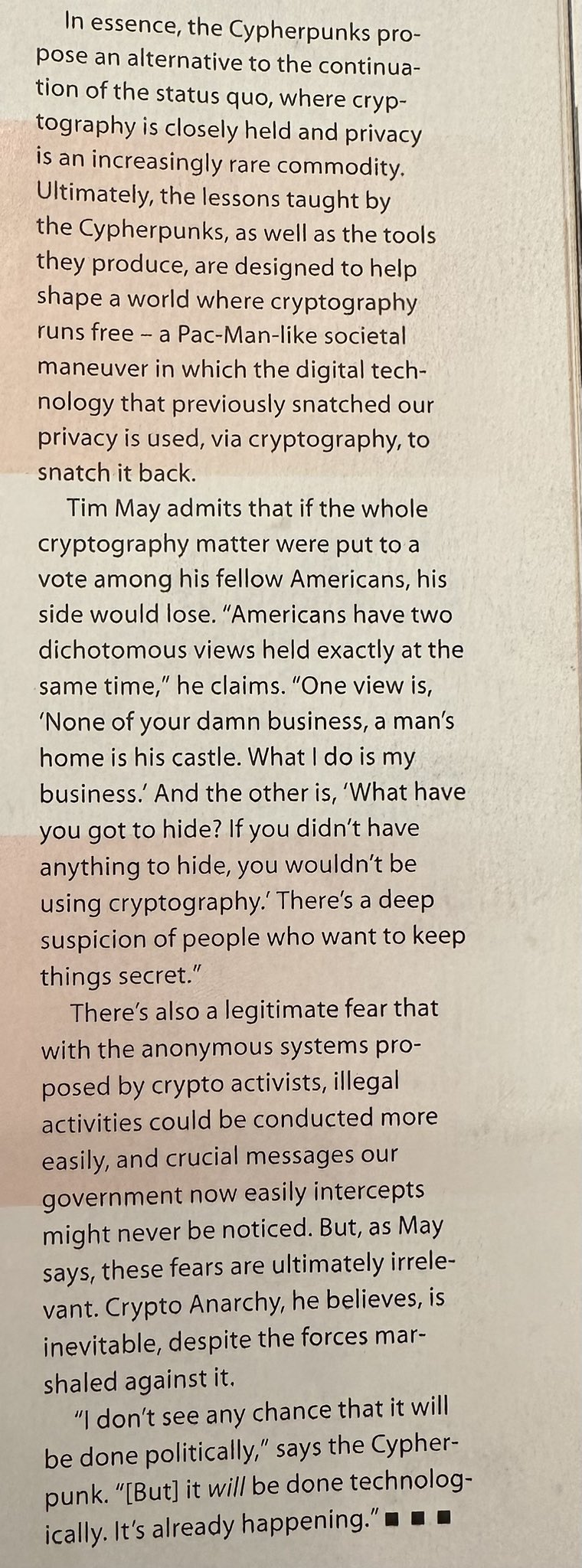

What's striking about the PGP wars and the recent attack on the bitcoin industry is not how similar they are, but how they are exactly the same. Last night, after seeing Bull Bitcoin's founder Francis Pouilot tweet about owning an original version of Wired Magazine's May 1993 issue titled Rebels With A Cause (Your Privacy), which included a feature story on the cypherpunks, how they came to be, what they were working on, the philosophy that drove them, and the ongoing battle they were engaged in with the US government and some private companies - I remembered that I also own an original copy of that issue and decided to re-read the article.

I think it's important for you freaks to understand that the fight that is coming to bitcoin is nothing new. The government doesn't want to lose control of tools that enable them to garner control over their subjects by being out competed by open source software projects despite the fact that they are an overwhelming net positive for society overall. The arguments they used against PGP are the same they're using against bitcoin now. "If we don't have oversight and control criminals will use them and it will be a natural security disaster!" Their proposed "solutions" and guardrails for PGP were exactly the same today with bitcoin. "We recognize that this technology is powerful and individuals should leverage it to attain better security in the digital age. However, to ensure the criminals don't run rampant, we're going to need every users to store their key with a trusted third party that we can tap on the shoulder to gain access to their communications when we deem it necessary."

It was a surreal experience reading the 1993 article on the cypherpunks last night. Time is a flat circle. What's old is new again. Governments don't like technology that gives people more privacy and freedom.

Read some snippets from the article for yourself.

Read the full archived article online here.

Final thought...

Try to enjoy the ride.