Why every business will decide to receive bitcoin payments. Someone-is-going-next logic. If not you, then who.

This article explains the logic of why practically every business will adopt bitcoin as a form of payment and how it will happen at a high level, ordering key decision points and drivers. It also helps build a logical framework for someone new to bitcoin to think about the transition, without getting hung up with everything that must happen between a current state, in which very few business accept bitcoin and the end state in which every business does–tying it all the way back to the individual decision point to first save in bitcoin.

Someone has to go first. And someone always has to go next. If not you, then who.

It's not a mantra. It describes the dilemma of bitcoin adoption–both when it comes to first deciding to store value in bitcoin as a balance sheet asset as well as the decision to receive bitcoin payments. Someone is going next. Fundamental economic facts dictate that. Whether it is you or not is entirely in your control.

Adopting bitcoin as a savings vehicle is psychologically difficult. There is no way around it. Bitcoin is admittedly difficult to understand. It is difficult to see how bitcoin could be money when it seems to be incongruent with the norms of what people know money to be. But once it clicks. Once someone begins to understand why bitcoin reliably stores value over time, the decision to demand bitcoin as payment directly for goods and services becomes very logical. Even if it takes a bit of time to get there, it becomes inevitable.

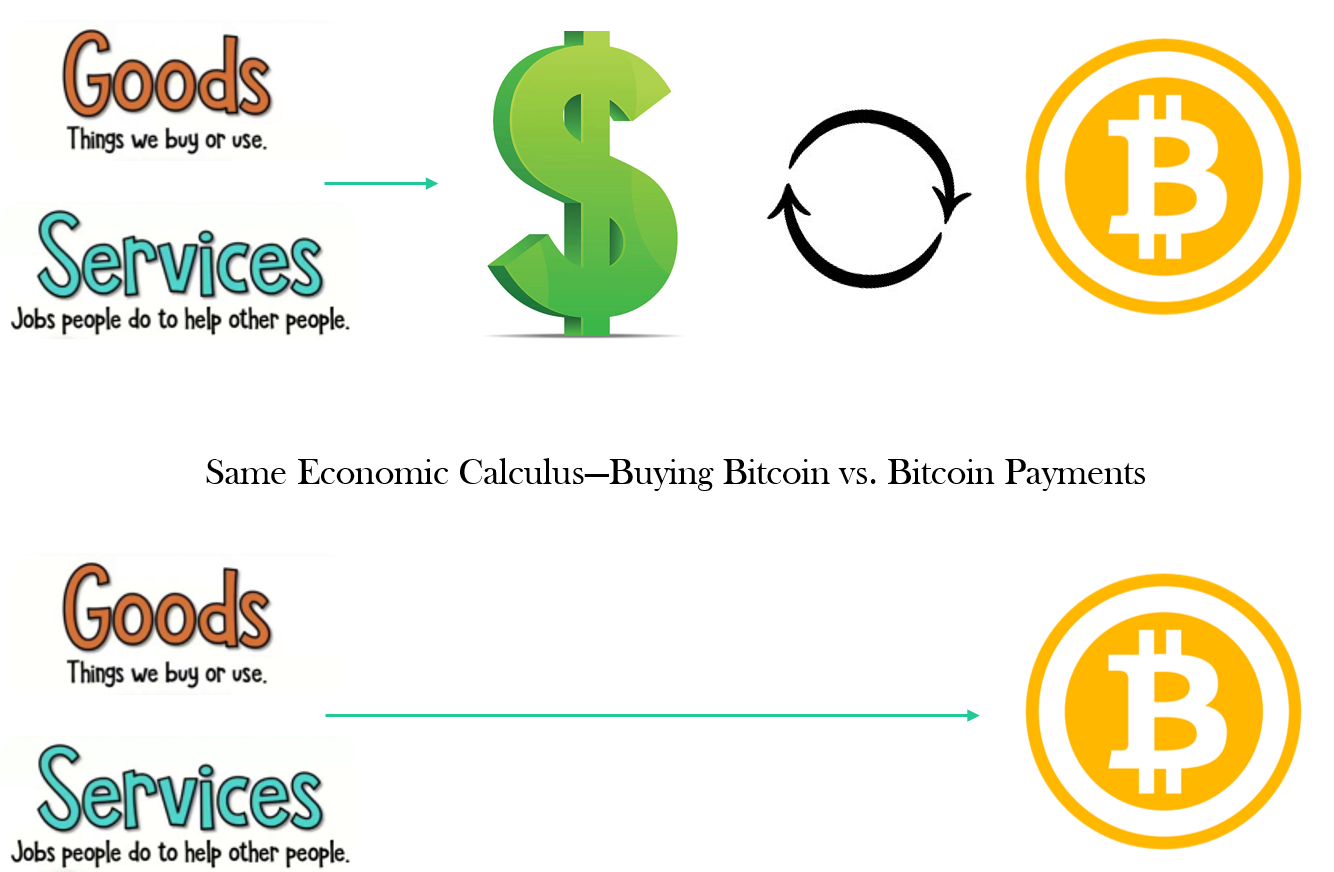

It is inevitable because the logic that leads one to the rational decision to save in bitcoin is fundamentally the same as accepting payments in bitcoin. If you can explain to yourself why any single person would save in bitcoin–namely why bitcoin will store value–that logic applies to yourself as much as it does to any other individual in the world. The logic that leads to your own decision to save in bitcoin is identical to what anyone would have to accept to make a similar decision.

Will bitcoin store value over time or not? If you can rationally explain to yourself why it will, you will save in bitcoin. If you can't, you won't–at least not in any rational way. But if bitcoin reliably stores value, would it store value any better or worse whether you acquired it by converting dollars for bitcoin or directly in exchange for goods and services? No. That is why accepting bitcoin as payment is fundamentally a balance sheet decision. It is functionally the same. Receiving bitcoin as payment is just a different–arguably more efficient–way to acquire it.

When explaining why bitcoin will store value, I rely on the logic that informs my own decisions. I typically explain it as follows. All fundamental value in bitcoin derives from the fact that there will only ever be 21 million. Bitcoin will store value better than any other form of money for the reason that it is finitely scarce (and permissionless). It is controlled by no one and can't be printed by anyone.

If bitcoin credibly enforces its fixed supply of 21 million, it logically follows that bitcoin will be adopted by the entire world and emerge as the global reserve currency–due to the reason that it will store value better than any other form of money and economic systems converge on a single form of money. In that case, it will become the unit of account as a result, and it will facilitate practically all of the world's trade in direct exchange for goods and services for the same reason.

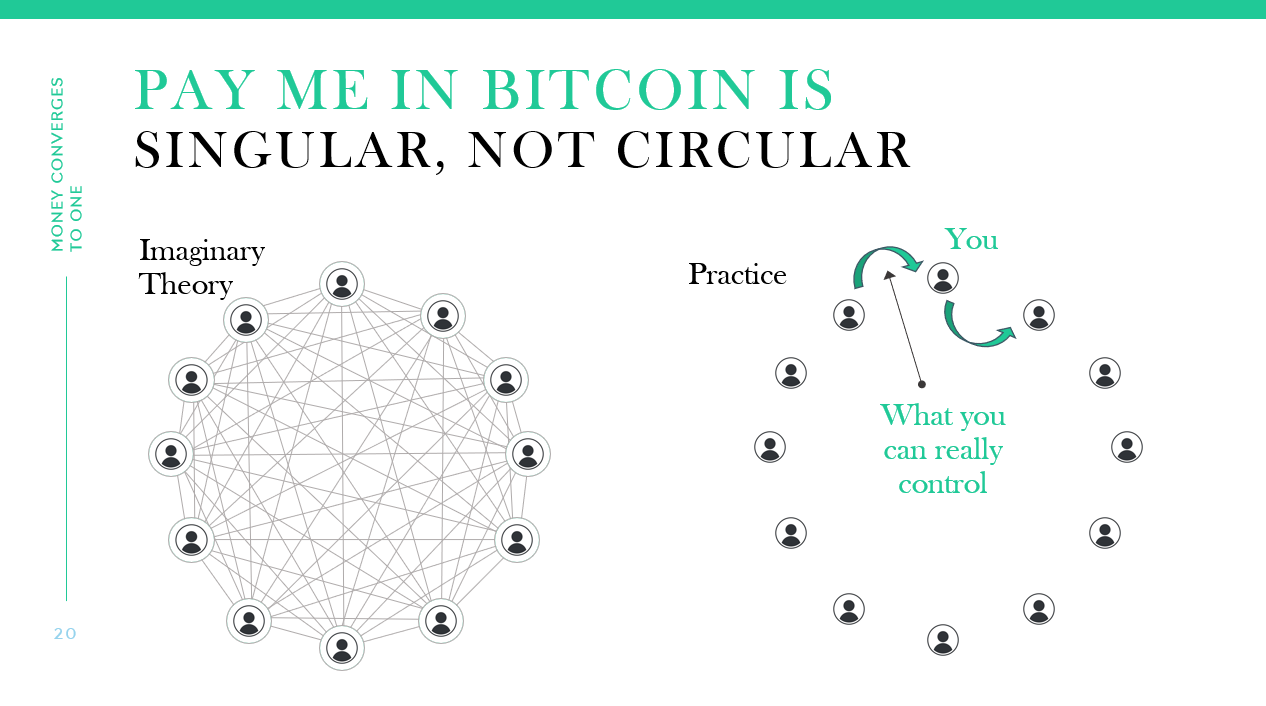

As I explain this to folks new to bitcoin, I can see people tracking the logic, but then a mental circuit typically breaks. How does the world go from where it is today to that future state? The logic makes sense to them, but in my experience, many individuals struggle with two bookends–what causes the next person to adopt bitcoin and can it really play out that everyone adopts bitcoin? They can't see how the end state plays out because they can't reconcile why anyone would adopt bitcoin if the individual rationale seems dependent on the future decisions of others. Almost like a chicken or egg–which comes first–dilemma. The end state where everyone in the world adopts bitcoin is typically an overwhelming and impossible outcome to forecast or wrap one's mind around.

Who goes first? And why would anyone go first or next if you don't know whether everyone (or anyone) else will follow. It seems too far fetched that the entire world will adopt bitcoin, which makes it difficult to rationalize the individual decision point. It also feels circular–bitcoin storing value is dependent on others (and more) people adopting it as money–which is where the logical circuitry typically breaks. But, it isn't circular at all. If A, then B. If bitcoin's fixed supply of 21 million is credibly enforced, that is why each individual will adopt it as money. The question–and finite surface area to evaluate–is not whether the entire world will adopt bitcoin. It is whether the 21 million fixed supply is credible. And whether that will cause you to adopt it–the proverbial next person.

People become paralyzed trying to forecast the end state, weighting its probability as incredibly low or trying to create a mental model of all that must happen between now and then, rather than focusing on the next step–the cause and effect that informs tomorrow rather than an undefinable end point. If point A is today and point B is bitcoin as the global reserve currency–something that will only happen if bitcoin credibly enforces its fixed supply–I don't have to forecast everything that happens between then and now to guide my next decision.

I can rationally explain to myself why point B is somewhere in the future (albeit undefinable), and I can inform my present decisions based on that ending guide point, without needing to know exactly what it looks like or how the world gets from here to there. You have to have some vision–vision in the sense of knowing where the world is going and having some rationale as to why. It's about being able to see the future, without feeling the need to know every detail to take action.

Effectively, I don't need to know the precise path of how the world gets from A to B to be able to confidently know which direction to head. Someone is going next and next and next because there will only ever be 21 million bitcoin and because humans are rationale. That is all I need to know.

How the world goes from very few people saving in bitcoin as money to virtually the entire world is the same logical dilemma as businesses accepting bitcoin as payment directly for goods and services–how the world goes from few to practically everyone. Really, it's the same.

If you try to focus on–and forecast–everything that must happen for bitcoin to be adopted globally as a reserve currency rather than the inputs that would cause each next decision leading to that end point, it is an impossible endeavor. Similarly, if you get caught up in trying to understand whether (or how) every business decides to receive bitcoin as payment without first explaining to yourself why a single business would or why the next would, you will be similarly lost.

When it comes to saving in bitcoin as a means to store value, the 21 million fixed supply is paramount. As the next person and the next decide to save in bitcoin, one of those next in line is inevitably a business owner. Once an individual comes to understand why bitcoin will reasonably store value for he or she personally, his or her business is a logical extension. Cash is cash. Money is money. If bitcoin will store value for personal savings, it will store value for a business.

But how could a business accept bitcoin as payment when it is so volatile? That question is no more relevant to a business than an individual, and if the individual has already personally rationalized that very logical dilemma, it is fundamentally no different for their business. Any cash sitting on a business's balance sheet, beyond short term working capital, must store value for the long term otherwise a deficit is created between valued created in the past and the ability to realize that value in the future–the very same dilemma of personal savings. As Michael Saylor explained, he viewed the problem of fiat currency losing purchasing power over time like a melting ice cube.

Businesses deciding to receive bitcoin as payment is predicated on the business owner (or a Board) first coming to the conclusion that bitcoin will store value over time–that is the balance sheet decision. Once that conclusion has been made, it becomes a much more nuts-and-bolts execution question. Do I need bitcoin to solve a savings problem or not? If I do, I'm logically motivated to acquire the bitcoin as efficiently as possible. Can I get it cheaper, more reliably and more securely receiving it directly via trade than buying it through a bitcoin exchange? But importantly, it is not one or the other. It is merely a question of the marginal basis and whether having the ability to do both makes logical sense.

Any business owner, management team or board that logically concludes that bitcoin will store value has already crossed the chasm. There might be operational time and energy required to accept bitcoin as payment–as well as accounting friction. But if you have already identified why a fiat currency is a long-term risk to your business from a savings perspective, the payment rails of that same currency are also a risk. If a person has figured out why bitcoin will store value and wants bitcoin on a business's balance sheet, that person will logically and more easily understand why an entirely different currency system would be a source of friction, certainly more easily than others who haven't reached that same conclusion.

As a business owner, I don't have to be able to explain to myself when Apple, Google, Microsoft, GM, GE, Ford, AT&T, Verizon, Exxon, Chevron or any other business will figure it out. I just have to be able to explain to myself whether bitcoin will store value and if receiving bitcoin as payment for my business is a more efficient way to acquire it. Someone is going next and next and next because there will only ever be 21 million bitcoin and businesses are rational. If a fiat currency is at risk, the currency rails of the fiat system are a risk and receiving bitcoin as payment reduces risk while augmenting the ability to convert fiat.

The decision to go next is always yours. It is not dependent on any other business accepting bitcoin as payment. However, if you can explain to yourself why it solves a problem for you or your business, it logically follows that it solves problems for others. You don't have to be able to forecast how exactly everything plays out to make a rational decision informed by reason and logic. Someone always has to go first. And someone always has to go next. It doesn't necessarily make going first or next easy, but you do it because it is rational and necessary to reduce future uncertainty. If not you, then who?

If you are a contractor or business that wants to be set up to receive bitcoin payments, reach out to us at Zaprite. I'm part of the team and we're here to help.

Originally published on Gradually Then Suddenly