Bitcoin, emerging as a form of 'non-violent money,' presents a transformative contrast to traditional fiat currencies.

The concept of money has evolved significantly over the centuries, from barter systems to precious metals. One of the most significant developments in recent history is the creation of Bitcoin, a currency that many advocates claim represents a form of non-violent money. This article explores the characteristics of Bitcoin that differentiate it from traditional fiat money and examines the implications of adopting a decentralized currency system.

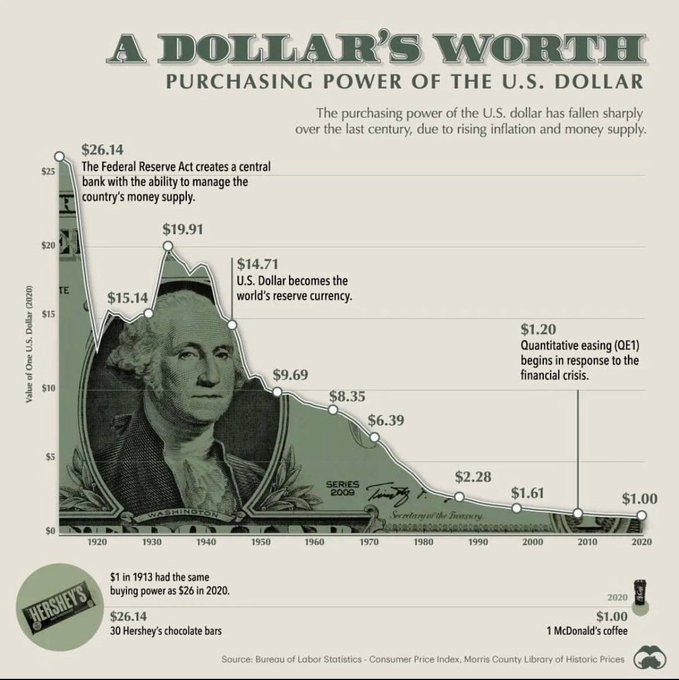

Modern fiat currencies, such as the US dollar, are known for their diminishing purchasing power over time. This can be attributed to monetary inflation, a process where the value of money decreases as more of it is printed. Historical data shows a consistent decline in the purchasing power of fiat currencies, which can significantly erode savings and wealth stored in these forms.

Another critique of fiat money is its role in funding military conflicts. The ability to print money provides governments with a mechanism to finance wars without immediate taxation, which could lead to public discontent. This has been observed in various conflicts where the expenses were not directly covered by taxes but rather through the expansion of the monetary supply.

“You can’t have permanent war without fiat.” @saifedean goes deep with @lexfridman in this 4hr episode. pic.twitter.com/v097auqZOS

— Cory Bates (@corybates1895) May 11, 2022

Fiat currencies are typically enforced by legal tender laws, which require their acceptance for the settlement of debts and payment of taxes. This imposition can be perceived as a form of coercion, as failure to comply with these laws can lead to legal repercussions. In contrast, Bitcoin offers a voluntary system where participation is a choice rather than a mandate.

Bitcoin is “opt-in” money, meaning that individuals can choose whether or not to use it. There is no requirement to participate in the Bitcoin network, and it operates without the need for centralized approval or oversight. This permissionless nature makes Bitcoin an alternative to those who seek a monetary system that aligns with principles of voluntary association.

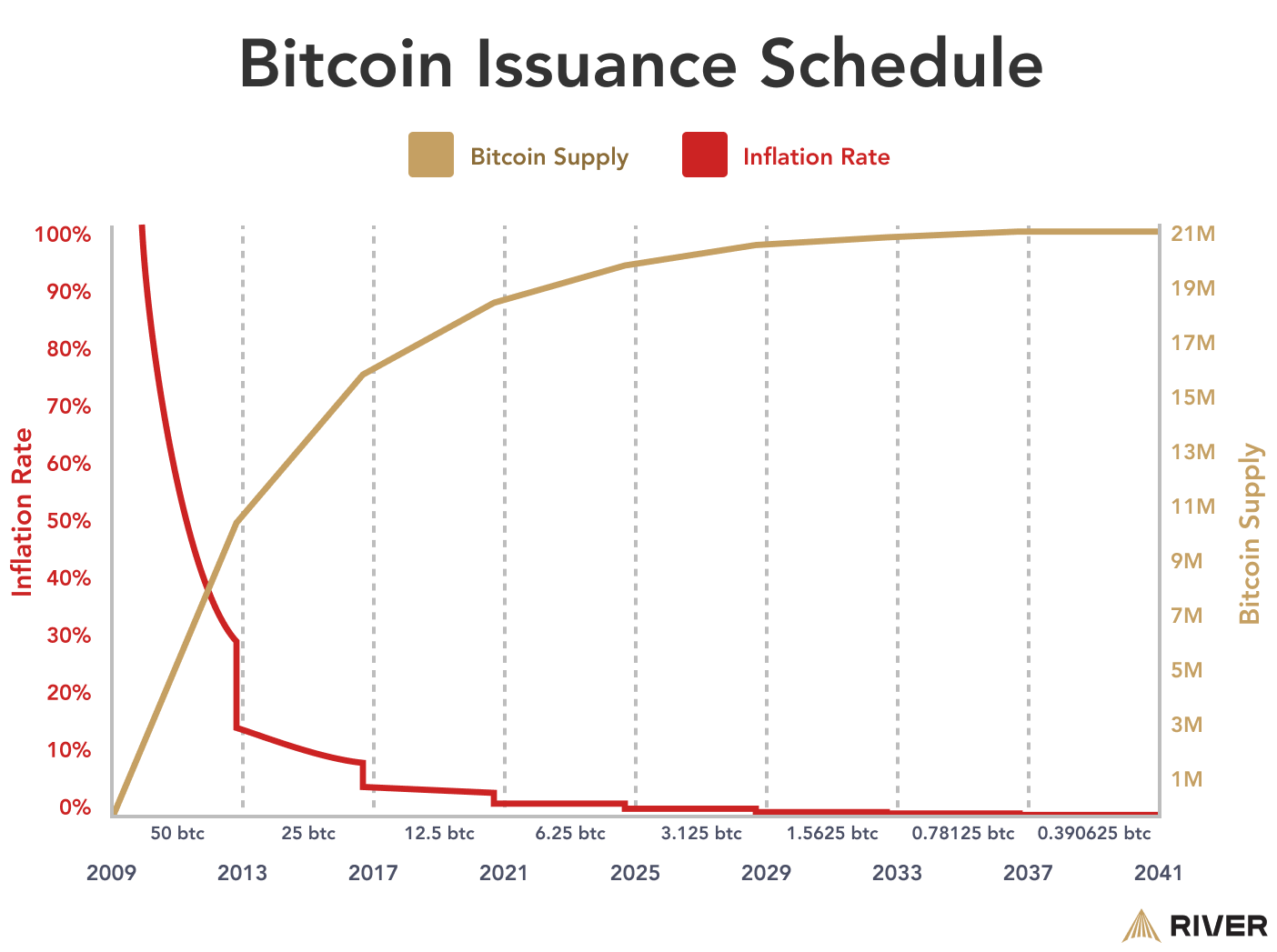

Bitcoin is sound money. Its value is determined by free market forces rather than government decree. The supply of Bitcoin is capped at 21 million, making it a scarce asset similar to precious metals like gold. However, unlike gold, Bitcoin can be easily transferred across the globe via digital communication channels, facilitating fast and final settlement of transactions.

The adoption of Bitcoin is gradually increasing, with individuals and institutions recognizing its potential as a global asset and currency. This trend is not driven by legislation or government endorsement but by a growing consensus among participants who see value in a decentralized, non-violent form of money.

Bitcoin offers a stark contrast to traditional fiat currencies through its decentralized nature, capped supply, and voluntary adoption. Bitcoin’s emergence as a potential form of non-violent money presents an opportunity to reevaluate the principles that underpin our current financial systems. As the world becomes more digitized, the role of Bitcoin in shaping the future of money remains a critical area of discussion and analysis.