Bitcoin and the insurance industry are perfect for each other.

The insurance industry faces a critical challenge with long-term liability matching, as Jeff Walton explained during our conversation. Insurance companies must estimate and set aside capital for claims that could pay out over decades, like workers' compensation cases that might span 25 years. If their inflation assumptions are wrong, the entire long-tail insurance market could be eviscerated. This is particularly concerning given the rising costs in healthcare, property values, and general inflation trends that make accurate long-term forecasting nearly impossible.

"Bitcoin's effectively eating TradFi from the inside out and nobody really knows about it." - Jeff Walton

With approximately $7-8 trillion in capital between insurance and reinsurance markets, we're seeing early moves from major players like Allianz, who participated in MicroStrategy's convertible note offering. While regulatory constraints currently prevent direct Bitcoin holdings, insurance companies are finding creative ways to gain exposure through various financial vehicles. The companies that understand this shift early and position themselves accordingly will have significant advantages as Bitcoin becomes an essential tool for matching long-term liabilities and hedging against inflation risk in their portfolios. Jeff's insights from his reinsurance background suggest this trend is just beginning, with potential for entirely new insurance company designs built around Bitcoin treasury strategies. The market remains largely blind to this transformation, creating a massive opportunity for first movers in the space.

TLDR: Insurance giants need Bitcoin to hedge against decades of future payouts.

Check out the full podcast here for more on MicroStrategy's preferred stock offering, DeepSeek's AI disruption, and how Bitcoin could break its 4-year cycle.

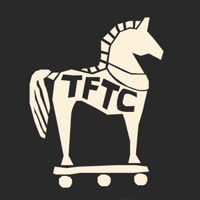

What you are looking at is a table of individual Solana addresses, the number of memecoin tokens they've created, how many of those memecoins are currently active, how many of them are currently inactive, and the ratio of active:inactive coins created by each individual. This chart perfectly describes the complete degeneracy and, more importantly, worthlessness of altcoins. Particularly, memecoins. Even more importantly, the dynamic currently unfolding in the memecoin space highlights just how differentiated bitcoin is and why "alt season" will never be the same.

The snake oil salesmen over in altcoin land have speed run their scams to their purest form; unfettered and unapologetic overt degeneracy. Long gone are the days of feigning "I'm here for the tech. Bitcoin is cool, it can be improved, and we're here to do that with [insert half baked 'blockchain']." No one is even pretending that anything marketed like this has any chance at supplanting bitcoin. It's the year of Our Lord 2025 and we've finally reached the point where this is generally accepted by anyone with two brain cells operating outside of Wall Street chop shops, which are four years late to the trend and completely oblivious that they sound like bumbling idiots.

The smart hoards of Gen Z'ers on Discord have caught on to the fact that competing with bitcoin is a fool's errand, decided to rip the band aid off, and embrace what has always been the true ethos of altcoins; degenerate gambling. Why waste the time and money LARPing about building a bitcoin competitor when you can simply make it clear that you have no intention of ever competing with bitcoin and simply want to gamble in the most frictionless way possible?

"I'm going to hop on Pump.Fun, create a memecoin, try to make it somewhat popular, have other people buy it, rug them, and get rich!"

This is the state of the altcoin world today. And, if I'm being honest, I kind of respect it. This crop of shitcoiners has the intestinal fortitude to own what they are; degenerate scammers looking to find a hoard of suckers to dump their bags on.

However, even though I respect their game, I don't think this gaggle of scammers truly understands the dynamics of the market they're operating in. Since it is trivial for a 12 year old with a parentally advised Discord account to spin up a memecoin, the market for memecoins is being saturated at a pace that would make the ICO scammers of the 2017 cycle blush. This dynamic creates a massive problem for the memecoiners; completely fractured liquidity and an increased incentive to hop from coin to coin.

It's akin to the problem Gen Z and Millennials have run into with the dating apps; the increased optionality increases the likelihood of refusing to settle on one person (or memecoin) and to test the market. Hopping from one hookup to the next without ever making a long-term commitment. Ultimately waking up one day regretting every past decision made and longing for the timeline in which you never downloaded Tinder (or Phantom Wallet) and stayed true to your purest self by making it work with your high school sweetheart (bitcoin). Quality years that could have been spent building a family (accumulating whole bitcoins) were instead wasted on sleeping around hoping that you would find the perfect 10 out of 10. Each new partner contributing to the erosion of your best years and the decay of your sense of purpose and pride.

The dating apps are a black hole. The pool of potential mates are limited by the amount of people who are 18-years old. As each day passes and birthdays are celebrated, the optionality increases and you reluctantly try to convince yourself, "this is the one". In reality, it's more likely than not that no one on the app is "the one" for you. The incentives of the app make it such that the desire to "test the market" is always there. A new crop of lasses turn 18 every day alongside a new crop of memecoins.

Markets of souless dilution.

Keep it simple, stupid. Meet someone via your family and friends group, buy bitcoin, avoid the apps and avoid the memecoin traps. The latter are literally designed to ensure pain and misery.

Banks Can Serve Crypto Customers, Fed Chair Powell Says - via X

Trump Media Stock Soars on Crypto, ETF Financial Services Push - via CNBC

Texas Plans State Bitcoin Reserve as 2025 Legislative Priority, Lt. Gov. Says - via X

There is an Ongoing Run On Physical Gold at the Bank of England - via X

The 256 Foundation Mined a Solo Block - via X

The Central Bank of the Czech Republic Votes on a Bitcoin Allocation Today - via X

Bitcoin transactions use a system of locks and keys to prevent theft. Every output in a transaction has a lock (written in a programming language called Script) that specifies requirements for spending those bitcoins, typically requiring proof of ownership of a specific Bitcoin address.

When spending bitcoins, users don't actually reveal their private keys; instead, they create digital signatures using their private keys to prove ownership. The blockchain serves as a storage unit for these locked outputs, and when someone wants to send bitcoins, they select outputs they can unlock and create new locked outputs for the recipient.

This system of programmable locks allows for various conditions beyond simple ownership, such as time-based locks or requiring multiple signatures.

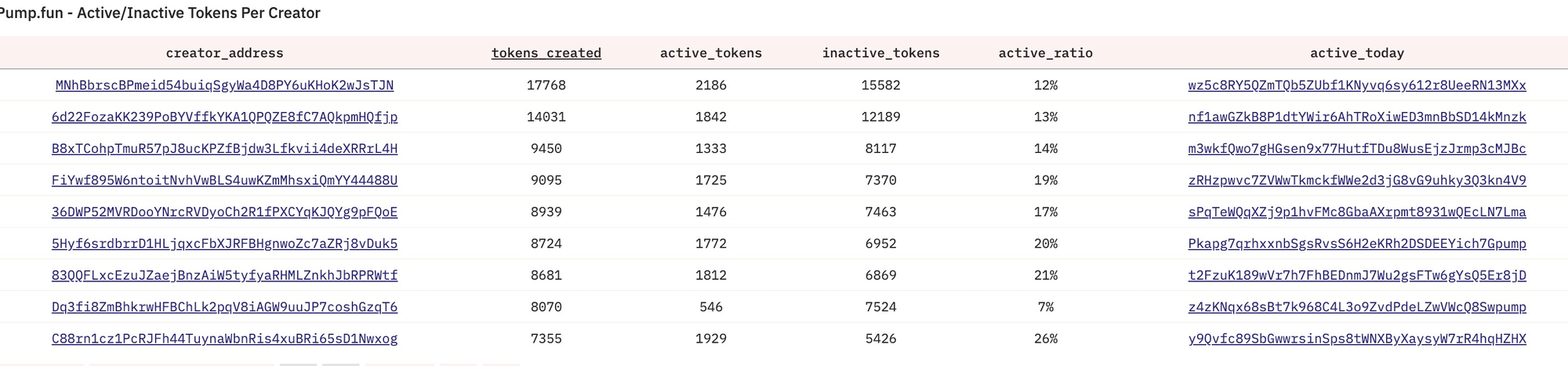

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: