Planning for Bitcoin inheritance is vital for ensuring your digital wealth is securely transferred to loved ones. This guide covers the key aspects of Bitcoin inheritance, from security measures to tax implications, aiding in making informed decisions for the future of your Bitcoin.

Bitcoin has become a significant part of many investors' portfolios. As more people hold Bitcoin for the long term, the importance of planning for its inheritance becomes crucial. Due to the decentralized nature of Bitcoin, proper measures must be taken to ensure the wealth can be passed on to loved ones. Otherwise, the assets could be lost forever.

In the realm of Bitcoin, access to the private keys is tantamount to ownership. If an individual holds Bitcoin in self-custody and passes away without a clear inheritance plan, the likelihood of the Bitcoin being inaccessible and ultimately lost is high. It is essential to have a clear and secure process so that beneficiaries can inherit without putting the funds at risk or causing family disputes.

There are numerous risks associated with prematurely sharing access to Bitcoin:

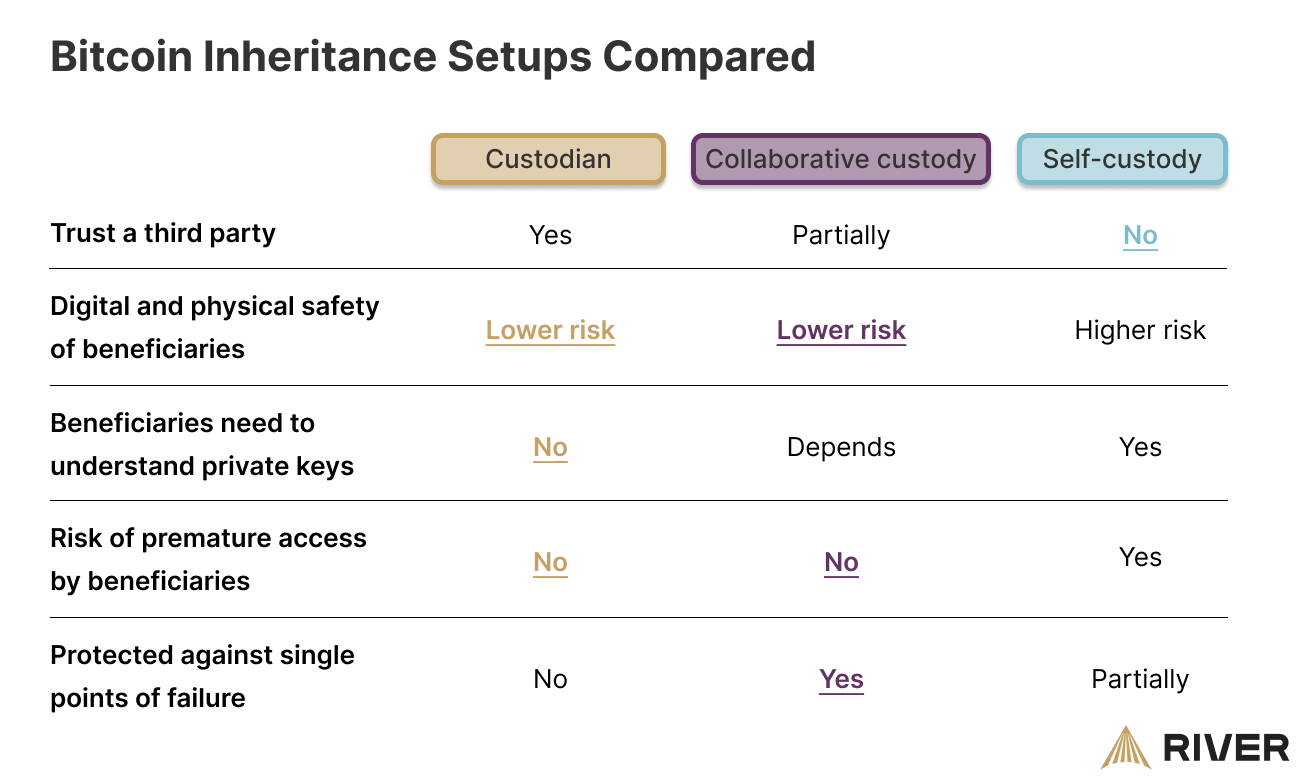

We'll cover three options for setting up a Bitcoin inheritance: custodian with beneficiaries, multisig with third-party service, and self-custody without trusted third parties.

One can store Bitcoin with a custodial service that allows setting up beneficiaries. This requires trust in the company's ability to secure the assets and honor the inheritance process. For instance, River offers a Bitcoin Beneficiary plan, subject to their terms and the limitation that it only applies to Bitcoin held on their platform.

This arrangement's key advantage is that it frees beneficiaries from the obligation to safeguard a private key. Instead, they only need to reach out to the firm, demonstrate the individual's passing, and rightfully claim the bitcoin inheritance.

A multisig setup involves multiple keys to authorize transactions. A common configuration is 2 out of 3 keys, where the owner, beneficiary, and a third-party service each hold one key. This setup ensures the Bitcoin can only be moved after the owner's death and with the collaboration of the beneficiary and service provider, adding layers of security and preventing unauthorized access.

This triple-signature inheritance framework offers multiple protections:

This option removes intermediaries but introduces the highest risk of loss. It relies heavily on the beneficiaries' understanding of Bitcoin and the ability to access it securely. Various methods, such as creating a multisig setup or using Bitcoin's timelock feature, can mitigate risks but require technical knowledge and can still be prone to errors or obsolescence.

These setups may depend on particular software that could become unsupported or obsolete. To ensure safety, beneficiaries must be equipped to replicate the process with alternative software. This might lead them to seek external assistance, potentially exposing them to similar risks previously mentioned.

Efforts to improve self-custodial inheritance include technical proposals like Bitcoin Vaults, which aim to integrate additional security features directly into the Bitcoin protocol. However, these solutions still require a significant level of technical understanding from the beneficiaries.

Inheritance tax must be considered when planning for Bitcoin inheritance. The tax treatment varies by jurisdiction and depends on whether Bitcoin is classified as property and the applicable tax thresholds. In the U.S., for instance, taxes might be imposed at both federal and state levels, necessitating consultation with a tax professional.

Selecting the right Bitcoin inheritance setup requires careful consideration of access methods, security, and legal enforceability. It is advisable to establish a will to complement the chosen method and prevent disputes. Each option has distinct advantages and risks, and Bitcoin holders should evaluate these against their personal circumstances and preferences.