The bitcoin network's fundamentals are strong.

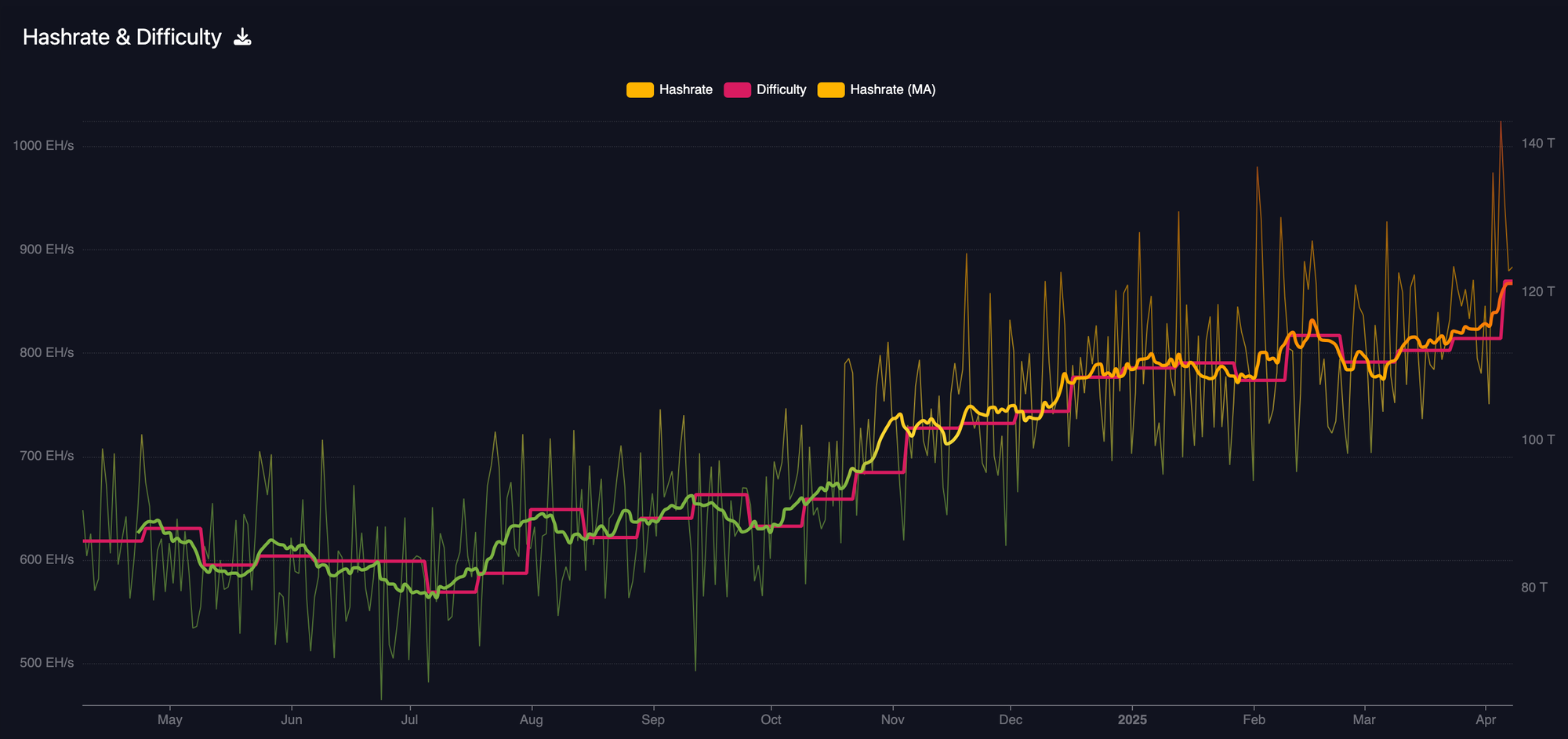

While the world has been distracted by tariff talk, Bill Ackman's crocodile tears, asset price corrections and bitcoin's "recoupling" with equities the bitcoin network surpassed a significant milestone; it crossed the 1 zetahash level for the first time ever.

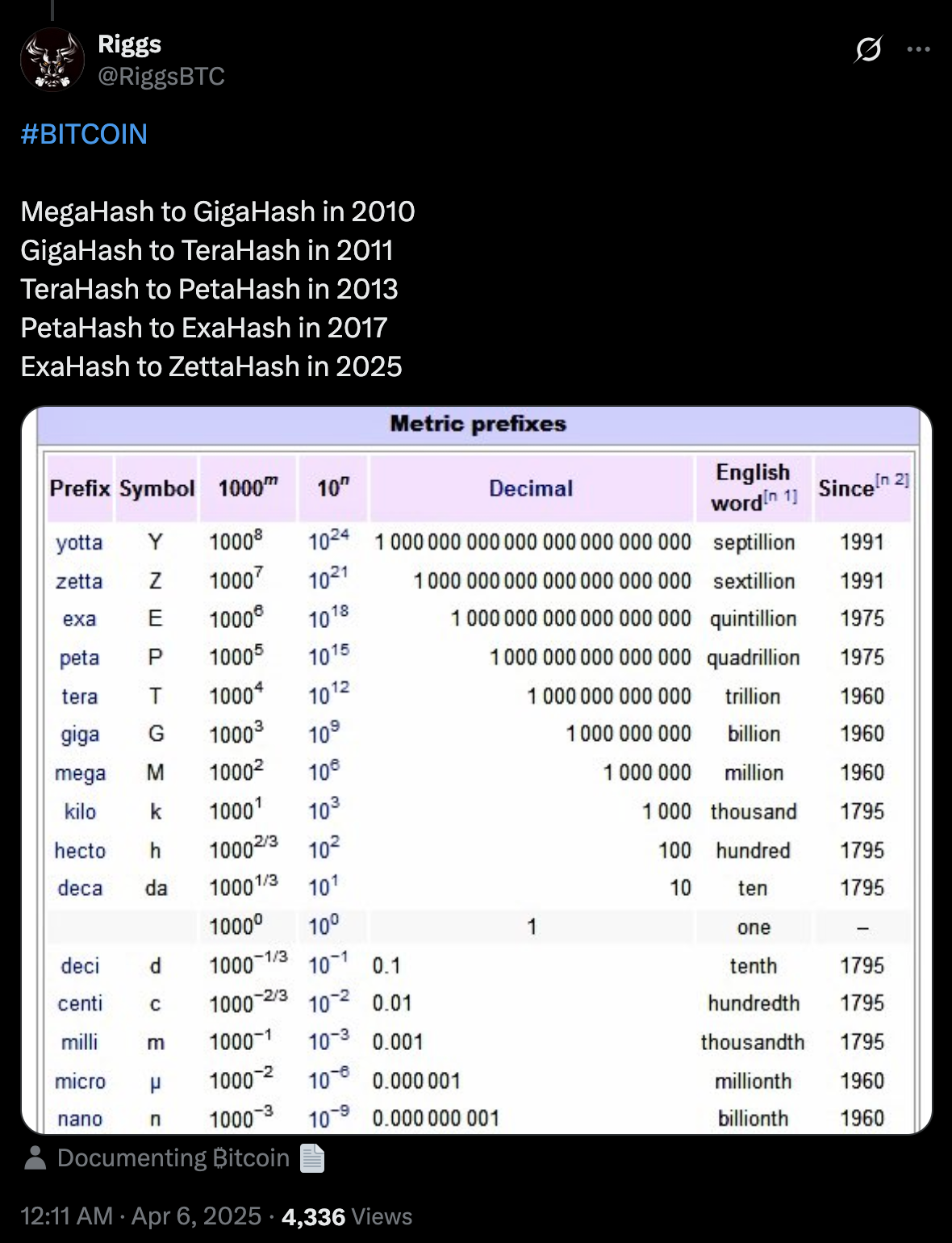

This means that, in aggregate, miners around the world produced 10^21 hashes per second for a period of time.

1 sextillion hashes.

1,000,000,000,000,000,000,000 hashes per second.

That is an insane amount of computational power. It would take an individual 31.7 TRILLION years to count from 1 to 1 sextillion. Absolutely mind boggling. And that amount of hashes was being produced on a second-by-second basis earlier this week, and will presumably pass the threshold for good at some point in the next year or two.

Pretty wild when you sit back and think about it. To put this in the historical perspective of hashrate milestones let's take a look at this tweet + chart:

It looks like order of magnitude hashrate jumps are happening via an exponential function with a doubling time. The first took 1 year, the next took 2, the third took 4 years, and the leap from exahash to zetahash took 8 years. If this trend continues the network will reach 1 yottahash 16 years from now, or 2041.

The amount of electricity dedicated to finding hashes that enable miners to add blocks of transactions to the ledger so that they can be rewarded in bitcoin is awe inspiring. It is particularly awe inspiring when you consider how low hashprice currently is at $0.042/TH/day. This tells me a few things:

There's signal here. Hashrate levels are telling you something. It's a beautiful thing to see.

In my recent conversation with Tom Luongo, a fascinating dynamic emerged regarding Bitcoin's role in the global financial chess match. When Treasury Secretary Scott Bessent mentioned Bitcoin alongside gold as a store of value on Tucker Carlson's show, he wasn't just legitimizing digital assets - he was sending a direct message to the European Union. As Tom pointed out, this single statement represents a "direct attack upon the European Union" whose leadership has demonstrated consistent hostility toward Bitcoin.

"They're all uniquely hostile to Bitcoin. Anytime they say anything nice about it, no one's gonna believe them because we all know what their plans are." - Tom Luongo

The contrast couldn't be clearer: while the U.S. administration appears increasingly accommodative to Bitcoin, European officials like Von der Leyen, Macron, and Lagarde continue their resistance. The ECB has gone so far as to publish papers specifically criticizing Bitcoin (one even cited my newsletter). This Bitcoin-friendly positioning by the Treasury Secretary signals that digital assets are becoming an integral component of America's strategy in what Bessent himself has called a "grand economic reordering" on the global stage.

Check out the full podcast here for more on Trump's tariff strategy, Jerome Powell's monetary policy stance, and the potential collapse of the European financial system. All under 150 characters.

Trump's Tariff Threat Sparks "Fight to the End" Vow From China - via X

Jack Mallers Claims Dollar Reserve Status Ending, Cites WH - via X

River Claims Limited Bitcoin Supply Outpaces Growing Millionaires - via X

Pierre Rochard Launches Bitcoin Bond Co For Institutional Users - via X

OpenSats Announces 10th Wave of Nostr Grants - via nobsbitcoin.com

China Let's Begins to Devalue, Yuan Falls Below 7.20 - via X

The first months of the new administration have sparked an unprecedented push for cost- cutting and efficiency within the federal government—but DOGE Can't Fix The Dollar. Join us on April 16th to hear PhD economist Peter St. Onge explain how bitcoin brings true efficiency to governments while protecting your generational wealth. With macro uncertainty driving a dip in bitcoin prices, now is the time to understand the fundamentals driving the global shift to sound money.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/invest.

Final thought...

Ants can carry 27 times their body weight.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: