Bitcoin is back over $51,775 for the first time since early December 2021 and has surpassed a $1 Trillion market.

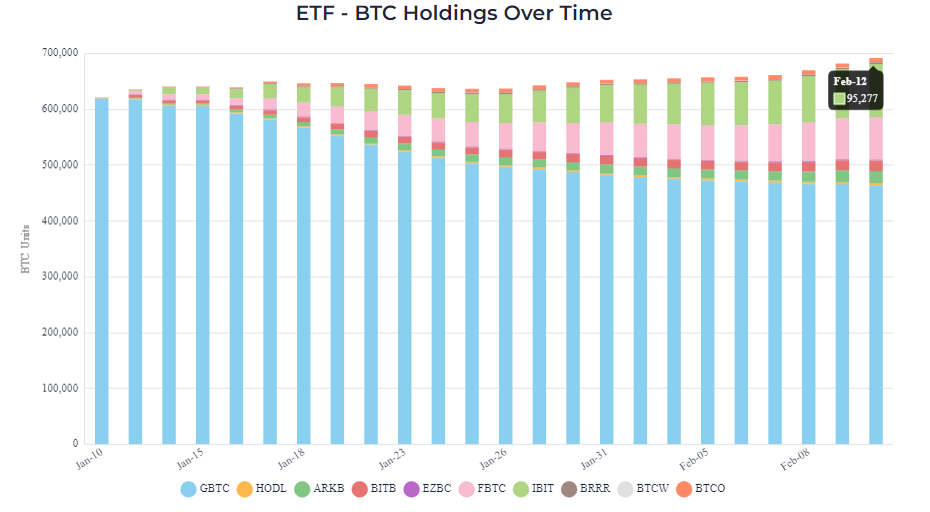

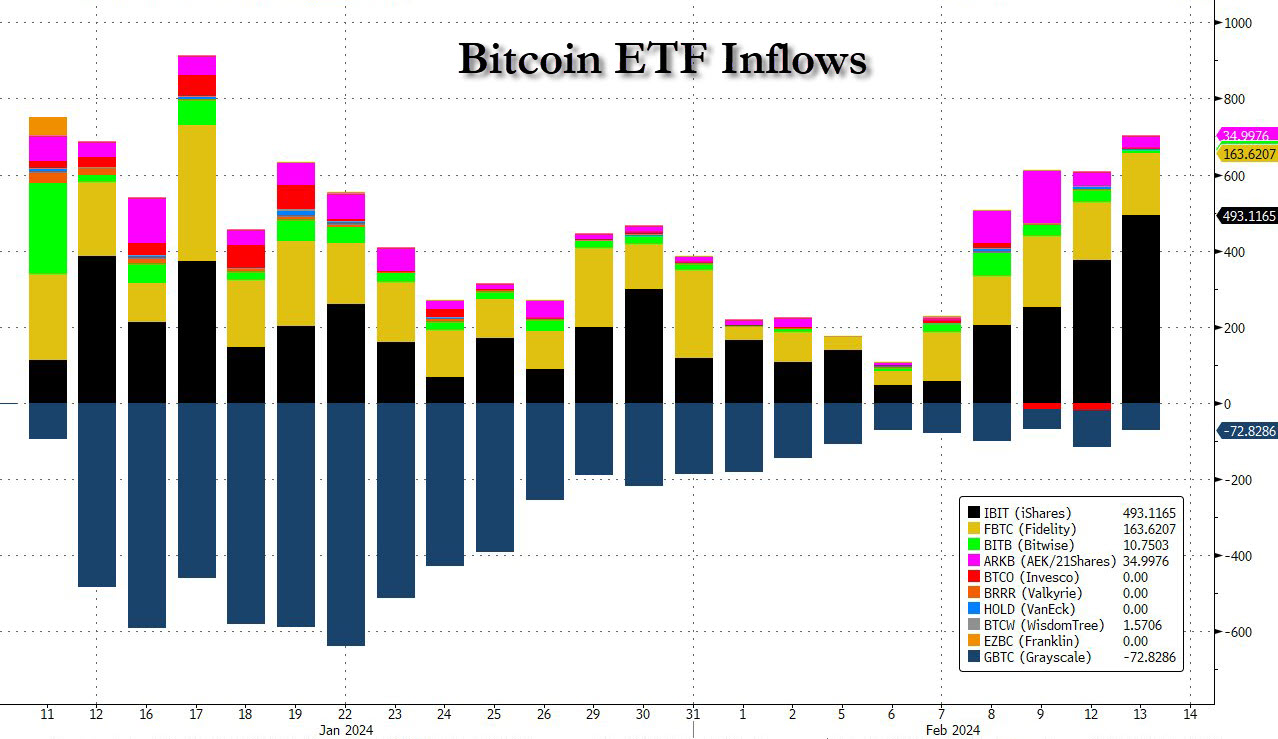

Bitcoin is back over $51,775 for the first time since early December 2021 and has surpassed a $1 Trillion market. The run in price follows another banner day for the bitcoin ETFs, which saw a new all time high in net bitcoin inflows with more than 10,200 flowing into the different vehicles. Blackrock alone added more than 7,500 bitcoin while Fidelity added more than 3,000. There are now more than 692,000 bitcoin held in ETFs.

Here's what these flows look like in dollar terms, which also reached a new all time high in net inflows:

This is what happens when a flood of demand come for the scarcest asset on the planet. The number of people who want to acquire bitcoin could raise to 8 billion and the network would only distribute the amount that is dictated by the protocol at each block. Right now that is 6.25 bitcoin per block, but in 9,573 blocks (at block height 840,000) that will get cut in half to 3.125 bitcoin per block. As of right now, it is estimated that block 840,000 will be mined on April 20th.

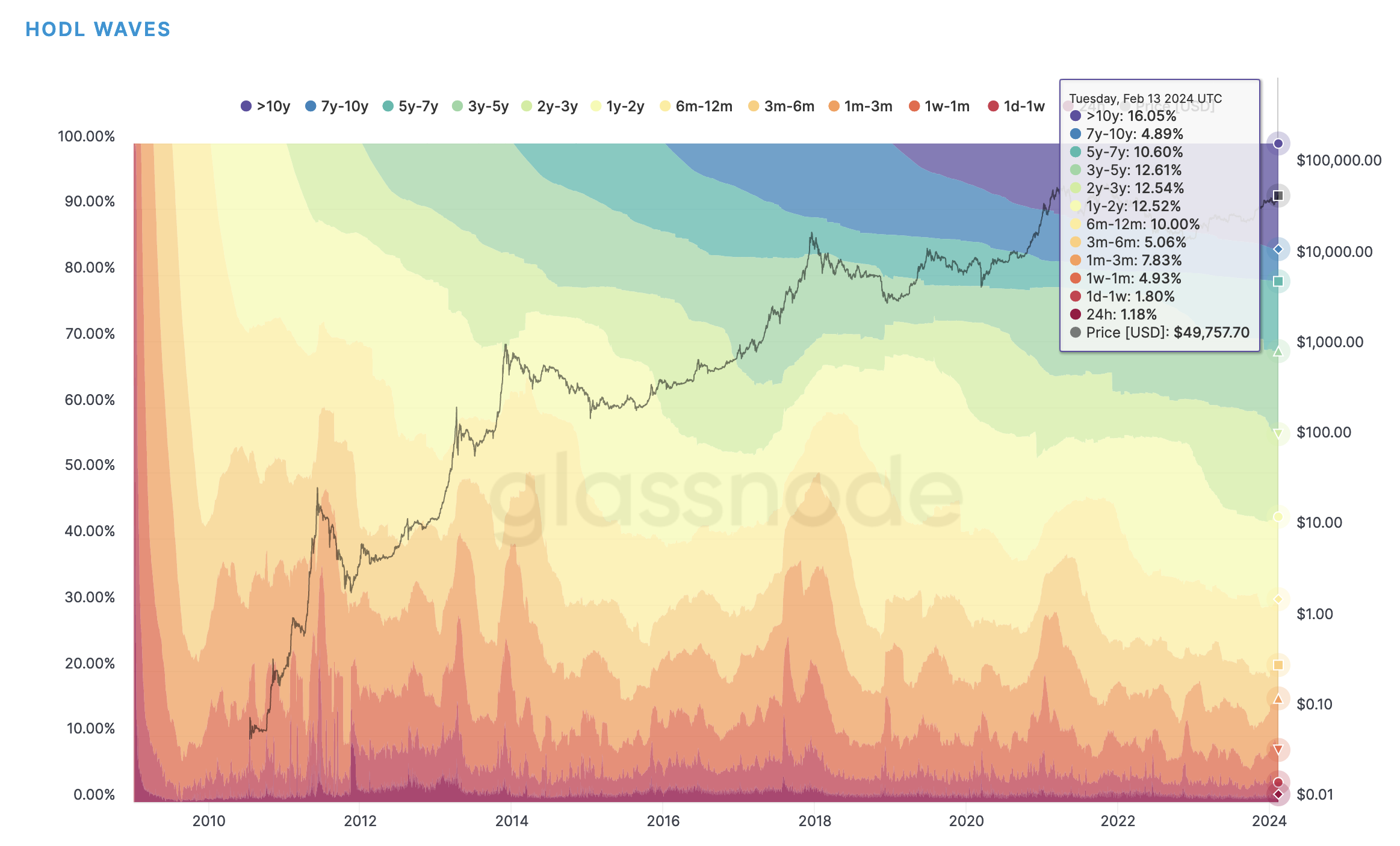

Put another way, all of the money flowing into ETFs and into direct (proper) bitcoin exposure will be find it increasingly hard to source newly distributed bitcoin. They will have to hope that people already holding bitcoin decide to part ways with their holdings. Unfortunately for them, more than 70% of bitcoin hasn't moved in more than one year with ~45% remaining dormant for more than 3 years.