The bullish winds are blowing toward the shores. Are you prepared?

The price of bitcoin has been range bound between ~$60,000 to ~$70,000 since mid-March of this year. During this relatively boring period of ten weeks a number of announcements have been made that should have anyone who is paying attention to bitcoin for any period of time as bullish as they can possibly be.

Over the last 70 days there has been a wave of publicly traded companies from around the world who have announced that they have chosen to allocate to bitcoin and use it as their preferred corporate treasury asset. The beauty of these announcements is the diversity of bitcoin acquisition strategies that range from mining it using excess energy to simple dollar cost average strategies.

Nasdaq listed Alliance Resources $ARLP, a $2.8b coal mining company, is mining #bitcoin, and currently holds 425 $BTC on its balance sheet.

— Dylan LeClair 🟠 (@DylanLeClair_) April 30, 2024

The company has additionally adopted the new FASB accounting standards for its holdings. pic.twitter.com/uZomhnuBPz

In late April, due to corporate financial filings that changed because of the new FASB accounting standards, the market became aware that Alliance Resources, a coal mining company, has been mining bitcoin since late 2020 using the excess electricity capacity on their coal mining sites. As of the end of April they had accumulated and hold 425 bitcoin. This is a strategy we have talked about many times in this newsletter throughout the years and one we imagine will become more popular as time moves on. It makes too much sense for any energy producer with cheap excess capacity to monetize it directly on site via bitcoin mining. The fact that this announcement happened so nonchalantly makes it even more impressive. It seems that the team at Alliance Resources internalized the fact that this is a no brainer years ago, deployed the strategy, and felt comfortable disclosing it to shareholders because of the new accounting standards that went into effect at the beginning of this year.

block is DCA'ing bitcoin every month. here's how your company can do it too: https://t.co/xabpCVZdn8

— jack (@jack) May 2, 2024

Block, formerly Square, has been on the cutting edge of implementing a bitcoin strategy within a large publicly traded company since 2017 when they enabled Cash App users to buy and sell bitcoin directly within the app. Over the years they announced a couple lump sum purchases of bitcoin to hold in the corporate treasury, but in early May of this year the company announced that it would be pivoting their bitcoin accumulation strategy towards dollar cost averaging and open sourced their playbook for other corporations to implement. Moving forward, Block will allocate 10% of the profits derived from their bitcoin product lines to bitcoin to be held on their corporate treasury. This is probably the path of least resistance for most companies trying to decide how to get bitcoin on their balance sheet. Keep it simple stupid. Stay humble and stack sats every month in a calculated way.

*Strategic Treasury Transformation and Bitcoin Adoption by Metaplanet* pic.twitter.com/Uz5RxkBV2D

— Metaplanet Inc. (@Metaplanet_JP) May 13, 2024

This is probably the most interesting of the corporate bitcoin accumulation strategies that was announced last month. Metaplanet, a publicly traded small cap company in Japan, announced that they are going to follow in Microstrategy's footsteps and have publicly announced that they are going to exhaust the financing options at their fingertips to stack as much bitcoin as possible on their balance sheet. Word on the street is that this is part of a larger strategy within BTC Inc. (parent company of Bitcoin Magazine) to opportunistically takeover struggling publicly traded companies and turn them around by making it explicit that they plan to mimic Microstrategy's bitcoin strategy.

JUST IN: Semlar Scientific has bought $40m #Bitcoin for its balance sheet and adopted Bitcoin as its primary treasury reserve asset. pic.twitter.com/leGBTIp4qN

— Radar🚨 (@RadarHits) May 28, 2024

Last, but not least (and only the last in terms of the companies we're covering in this particular newsletter), Semler Scientific announced last week that bought $40m worth of bitcoin and have decided that bitcoin will be their preferred corporate treasury asset moving forward. "We believe it has the unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability." That's a powerful statement from a relatively unknown medical technology company. Many have been led to believe that only energy companies, Wall Street institutions and forward thinking FinTech companies were paying attention to bitcoin, but it seems that many different companies with differing specialties are coming to the realization that they need a better store of value to preserve their purchasing power.

I fully expect corporate treasury announcements to be a growing trend for many years to come as everyone wakes up to the fact that we have reached the point where you NEED a bitcoin strategy if you expect to survive and thrive.

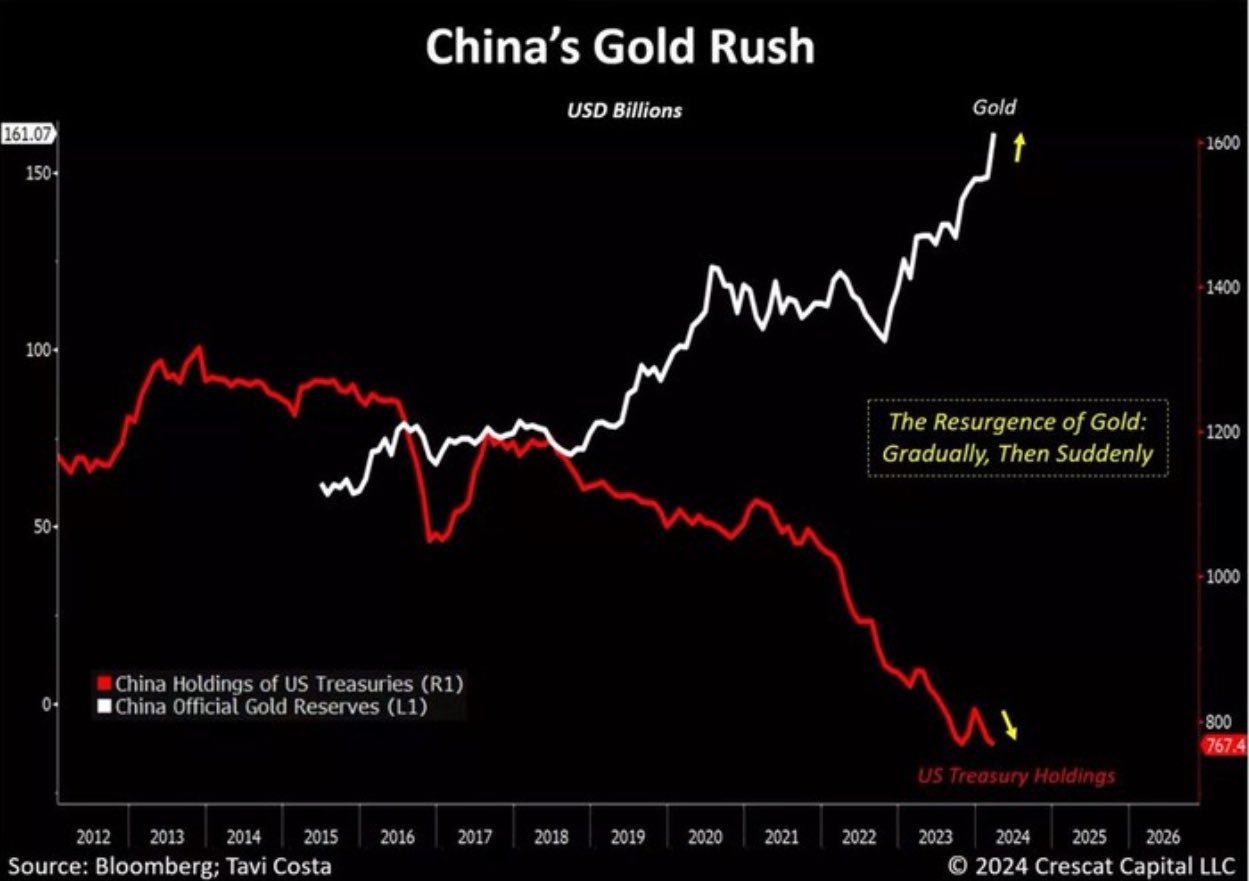

The weaponization of the rails the dollar and US treasuries run on and a federal debt situation that is clearly getting out of hand here in the US is forcing sovereign nations to rethink their reserve assets situation. Nothing makes this clearer than the chart above, which highlights the acceleration of gold purchases and an offloading of US treasuries by the Chinese government since 2020 with a big inflection happening in 2023 as the world began to grapple with the fact that Russia had their US treasury assets seized as the snap of a finger.

While China is accumulating gold and not bitcoin (at least publicly), this should be taken as a massive positive for bitcoin because it signals that there is increasing demand for apolitical hard assets with no third party risks. While gold is the tried and true hard asset that has worked well for countries and individuals alike seeking safety in times of uncertainty, bitcoin is far superior in every aspect. It is scarcer, easier and cheaper to secure, easier and cheaper to verify, more divisible, and exponentially easier to transport. It's only a matter of time before more countries begin to awaken to these facts.

Despite the fact that we don't believe that exposure to bitcoin via ETF products is the best way to accumulate bitcoin because you are just getting exposure to price movements and not actually accumulating the asset, it is impossible to ignore the success that the bitcoin ETFs have had since they launched in January of this year.

The bitcoin ETFs are driving insane flows for the providers that have products on the market. So far this year, $IBIT (BlackRock's bitcoin ETF) has accounted for 26% of it's overall flows into ETFs. And $FBTC (Fidelity's bitcoin ETF) has accounted for 56%(!) of overall flows into Fidelity's ETF products.

To those asking, $IBIT is 26% of BlackRock's flows and 56% of Fidelity's flows, so yes, def having impact on leaderboard.

— Eric Balchunas (@EricBalchunas) June 3, 2024

These are mind numbing numbers, and whether you agree with the bitcoin ETF products or not it is impossible to deny that these type of numbers are sticking out to the providers. They are highly incentivized to position bitcoin as an asset that everyone needs exposure to.

Speaking of the ETFs, the world became aware of the fact that the Wisconsin Pension System allocated $162m dollars across a number of the bitcoin ETF products in the first quarter of this year.

State of Wisconsin revealed it owns $162m #Bitcoin through the BlackRock and Grayscale ETFs.

— Bitcoin Archive (@BTC_Archive) June 3, 2024

"This is a $180 BILLION FUND. I think it's just an entry point. They're using this as a trial run," says Marquette University professor emeritus David Krause

👉 In other words, they're… pic.twitter.com/J4tmdhJAt7

This is massive for many reasons. Obviously a state pension system announcing that they are allocating to bitcoin ETFs is a massive validation that many people have been waiting for. However, I think the fact that this specific state pension was the first mover is massive for bitcoin. Wisconsin is famously what were call a "purple state" here in the US. Meaning that it is made up of many people on both sides of the political aisle and acts as a swing state during election years. Put another way, Wisconsin isn't a hyper-partisan state that can be pointed at and called a loon for allocating to bitcoin. If Texas or Florida were to be the first state pension system to allocate to bitcoin it is easy to imagine the headlines that would come out. "Florida goes rogue again by putting pensioner money in bitcoin." "Texas moves closer to secession by allocating to a monetary good that competes with the dollar." It's much harder to push these headlines out when Wisconsin is the state making the move. The fact that a purple state moved first could be massive for bitcoin adoption within pensions moving forward since it will be extremely hard to paint it as a partisan move.

That wasn't the only piece of institutional adoption news that dropped over the last few months. Three weeks ago the country of Kenya announced a joint partnership with the publicly traded bitcoin miner Marathon Digital. Marathon will be working with the Kenyan government and energy companies within the country to monetize stranded and wasted energy sources via bitcoin mining.

During President @WilliamsRuto’s State Visit to the US, we entered into an agreement with @EnergyMinK to invest over $80 million in establishing green data centers to boost renewable energy utilization and optimization in the Republic of Kenya. 🇺🇸🤝🇰🇪 pic.twitter.com/TfyanEdJwW

— MARA (@MarathonDH) May 24, 2024

The game theory is playing out as prophesied. The mad dash for bitcoins is heating up and everyone is getting into the fray.

It would be remiss of me not to mention the fact that the bitcoin network experienced its fourth block subsidy halving on April 20th. Cutting the predetermined amount of bitcoin issued to miners per block from 6.25 bitcoin to 3.125 bitcoin. We're only one and a half months post-halving and the market is still adjusting to the supply inflation shock. With all of this demand beginning to bubble up coupled with the fact that bitcoin is becoming significantly de-risked in real time by the number of announcements that have been made from corporations, pension funds and nation states alike it is hard to believe that the supply inflation shock won't have a similar, if not more profound, effect on price during this cycle. Moving forward it will be seen as a bigger career risk to not have a bitcoin strategy than it is to have one, which hasn't been the case in bitcoin's short 15-year life.

Bitcoin is becoming more obvious to more people, companies, institutions and countries and it is only going to become more obvious over time.