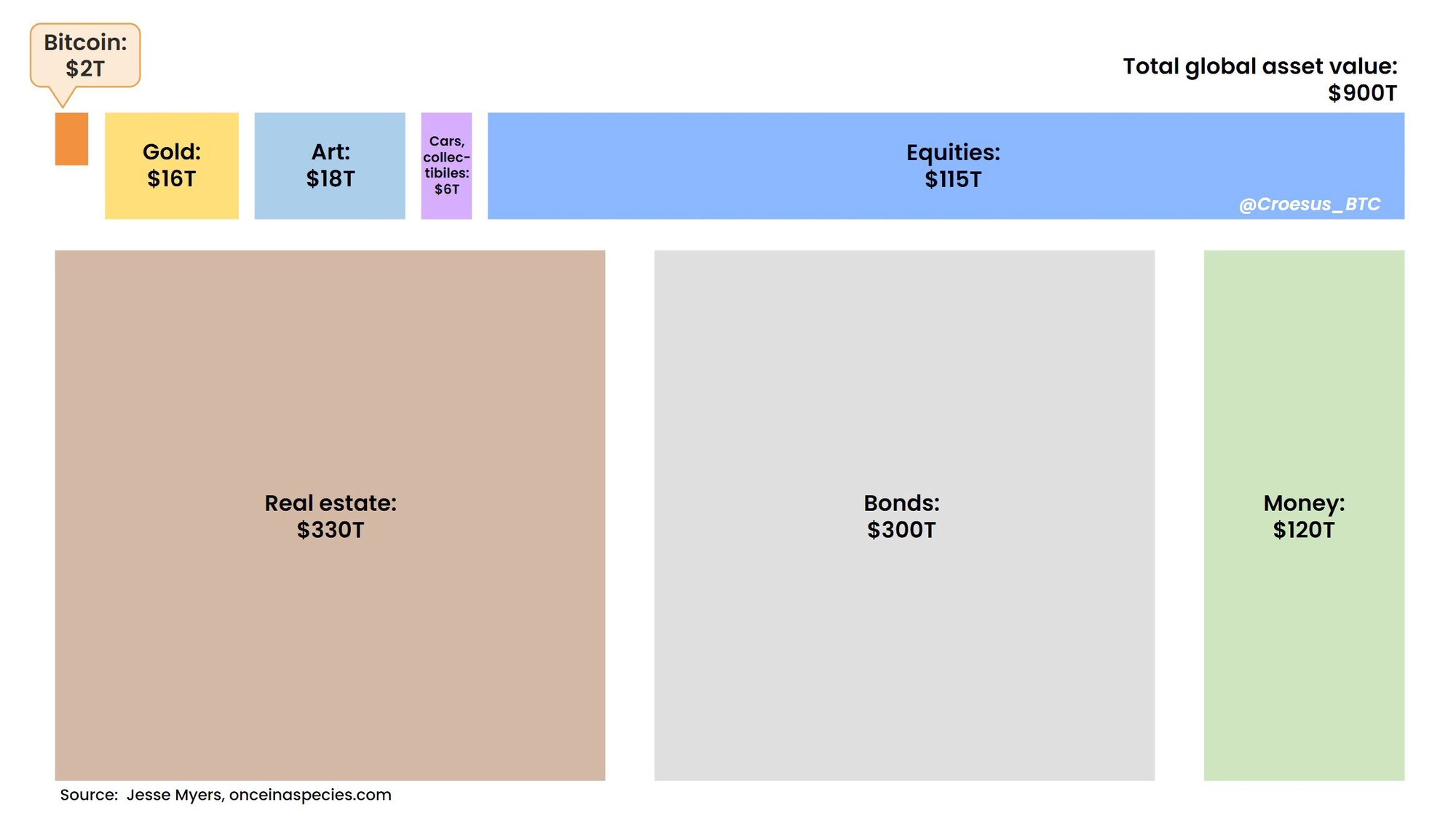

Professional risk managers are waking up to the risk-adjusted return profile of bitcoin.

The asymmetric opportunity in Bitcoin was powerfully articulated by a recent guest of the TFTC podcast, Joe Bryan - a former derivatives trader who spent his career managing risk at firms like Goldman Sachs and Morgan Stanley. Drawing from his extensive background in risk assessment, he emphasized that bitcoin "blows everything out of the water" as an asymmetric bet, particularly because its risk-reward profile is fundamentally misunderstood by traditional financial markets.

"I go to bed at night worrying I don't have enough. Not that I have too much." - Joe Bryan

What makes bitcoin unique, and what the markets haven't grasped, is that once people truly understand it, their relationship with the asset fundamentally changes. Bryan highlighted how this creates an unprecedented dynamic where holder conviction only strengthens over time – a complete inversion of traditional market psychology where people tend to reduce exposure as prices rise. This psychological shift, combined with bitcoin's fixed supply and growing adoption, creates what may be the largest asymmetric opportunity in financial history.

TLDR: Bitcoin's risk/reward profile creates unprecedented holder conviction.

Check out the full podcast here for more on educating newcomers, Bitcoin's impact on families, and the evolution of Bitcoin financial products.

Bitcoin Network: A peer-to-peer system where users run bitcoin client software to connect as network nodes.

Nodes communicate by sharing transaction information, keeping the network synchronized. Anyone with an internet connection can join by downloading a client and becoming a node.

The network is decentralized (all peers are equal) and maintains the blockchain, a shared record of all verified transactions.

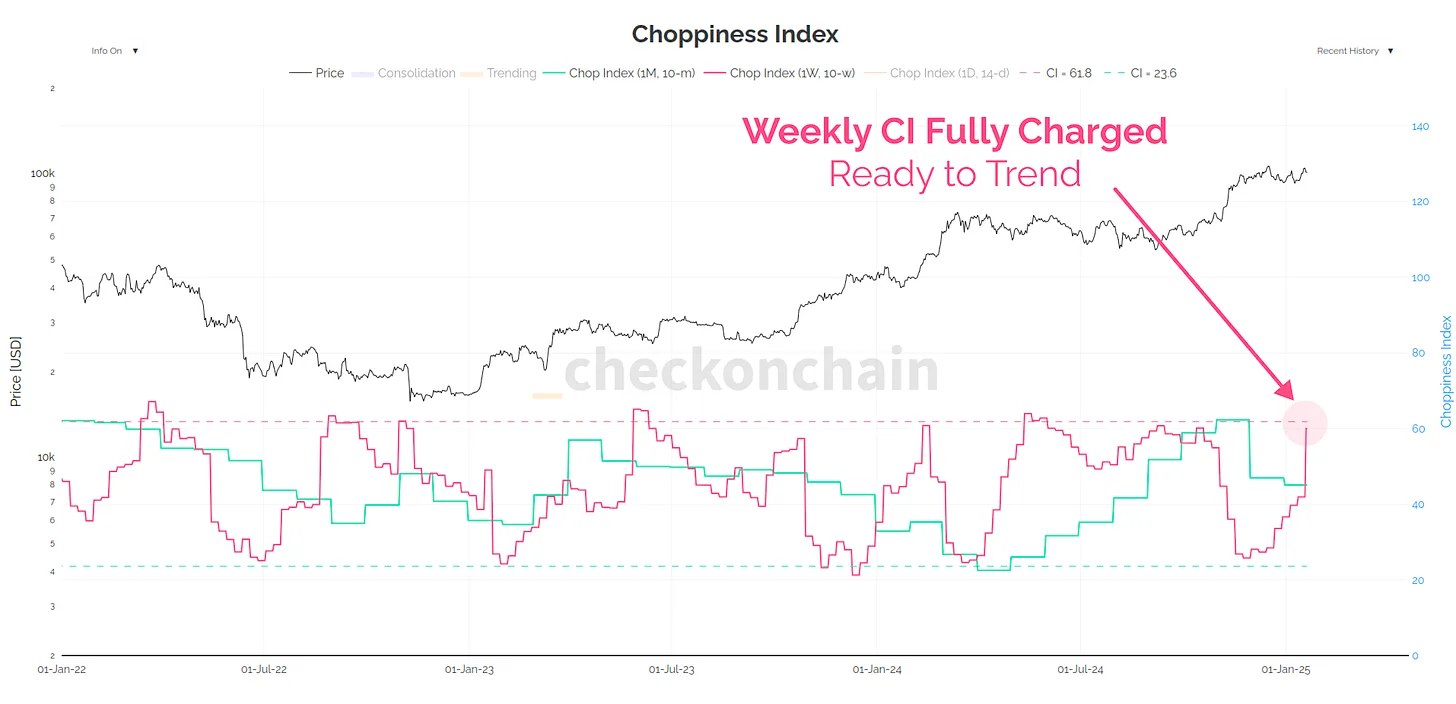

According to onchain analyst James Check, bitcoin seems primed to move out of the consolidation phase it's been in over the last month and move back into "trending" mode. Whether that trend is up or down is yet to be determined, but the Choppiness Index is nearing levels that typically signal that volatility in either direction is on the horizon. Take from that what you will.

Ross Ulbricht makes his first comments after being released from prison - via X

President Trump signs an Executive Order pertaining to bitcoin titled STRENGTHENING AMERICAN LEADERSHIP IN DIGITAL FINANCIAL TECHNOLOGY - via the White House

The SEC Rescinds SAB 121 and issues SAB 122, paving the way for banks to custody bitcoin - via the SEC

Ledger Co-Founder Freed After Ransom Kidnapping - via nobsbitcoin.com

SEC declares effective Fold’s Registration Statement— clearing the path for public listing - via Businesswire

Pierre Rochard considers attempting to do a full supply audit of Ripple's XRP ledger - via X

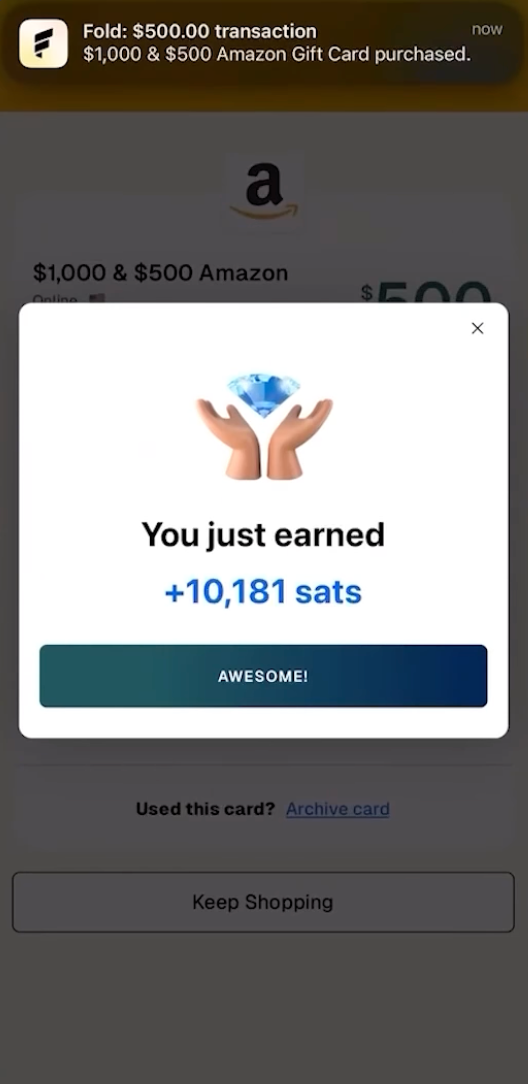

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: