Bitcoin won't be a safe haven until more people are piped into the infrastructure.

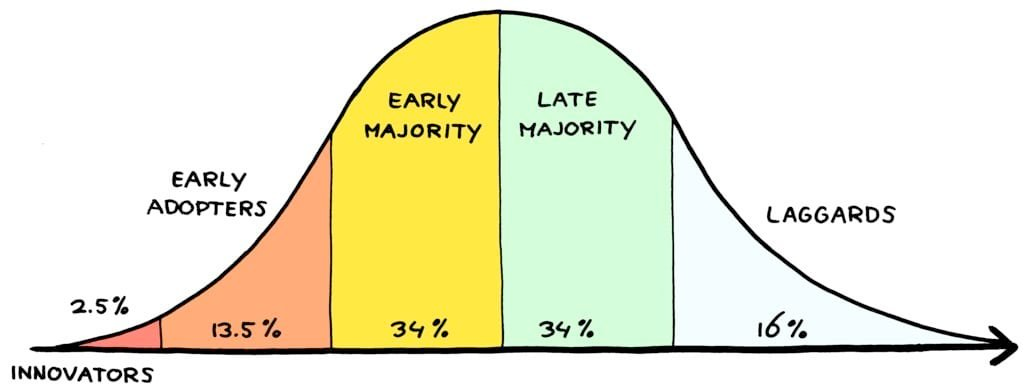

During a recent conversation with Parker Lewis, he presented compelling evidence for bitcoin's nascent adoption state. As he pointed out, fewer than 1% of S&P 500 companies currently hold Bitcoin on their balance sheets - with only notable examples being Block, Tesla, and MicroStrategy. Even more striking was his observation that likely less than 1% of the general population has meaningful bitcoin exposure. This reality fundamentally prevents bitcoin from functioning as a traditional safe haven asset, regardless of its inherent properties.

"The idea of something being a safe haven - I think about it as people already being piped in to this asset. When something happens, they shift their allocations to the more conservative thing, and they're already piped in to that." - Parker Lewis

Parker's analysis suggests that quadrupling adoption from 0.5% to just 2% would represent a massive shift in bitcoin's trajectory. The fact that we're still in such early innings of adoption is incredibly bullish for bitcoin's long-term potential. While the current low adoption rate means bitcoin can't yet serve as a traditional flight-to-safety asset, it also indicates enormous headroom for growth as more individuals and institutions begin to understand and acquire bitcoin. The infrastructure and understanding required for widespread institutional adoption is still being built, setting the stage for bitcoin's next major leap forward.

TLDR: Bitcoin is still sub-1% adoption. Too early for "safe haven" status.

Check out the full podcast here for more on Fed liquidity crunches, Trump's Bitcoin stance, and Silicon Valley's crypto blind spots.

A bitcoin node is a computer running Bitcoin software that connects to other nodes to form the network.

Each node has three key jobs: enforcing bitcoin's rules by validating transactions, sharing transaction data with other nodes, and maintaining a copy of the blockchain (the permanent record of all confirmed transactions).

You don't need to run a node to use bitcoin, but if you want to verify incoming transactions without any third parties running a node is the best way to reap the assurances of bitcoin's permissionless nature.

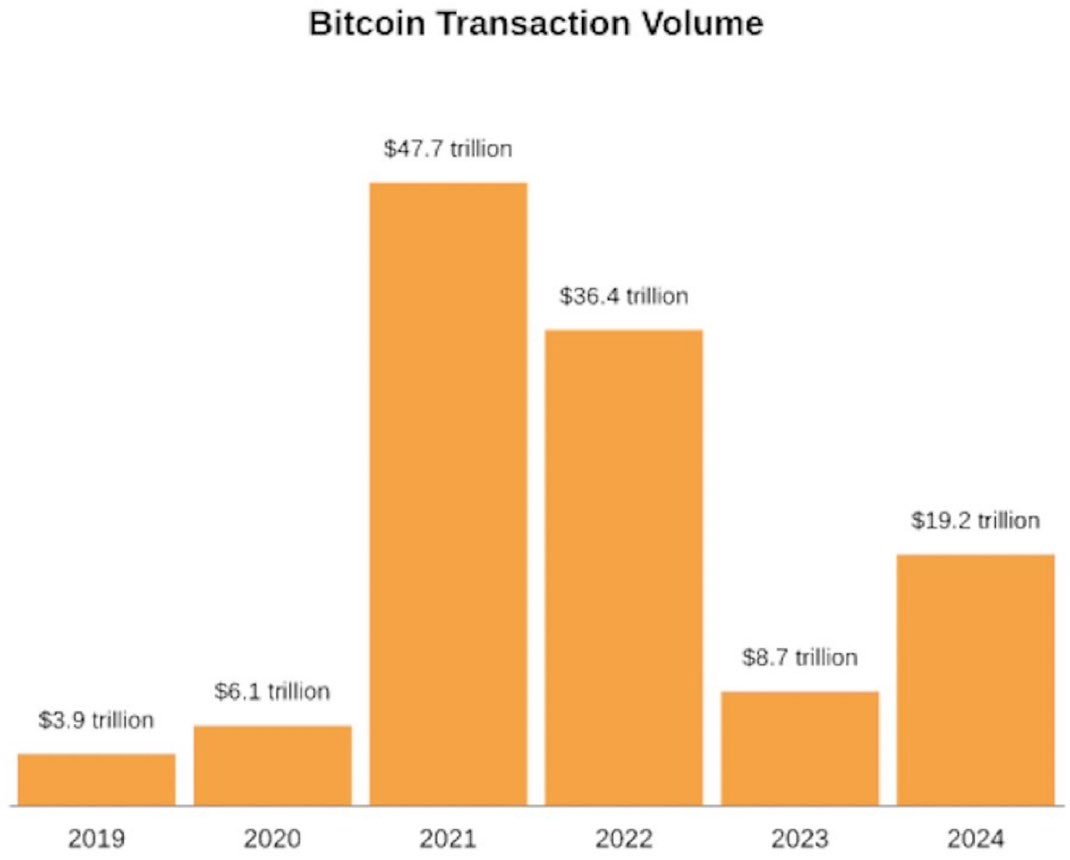

In 2024 the bitcoin network settled $19.2T. Sometimes you may hear some opine that "bitcoin can't scale!" Would a network that can't scale have been able to settle $19.2T in value in 2024 and $47.7T in 2021? I don't think so. Bitcoin is scaling wonderfully efficiently and it is only getting more efficient over time as people learn how to transact in smarter ways, as second layer protocols come to market and mature and as hundreds of billions of dollars worth of value flow into the network. This chart is pure signal.

U.S. District Court Officially Reverses Sanctions on Tornado Cash Mixer - via nobsbitcoin.com

Bull Bitcoin Expands to Europe - via nobsbitcoin.com

Larry Fink says bitcoin could hit $700,000 and pensions and sovereign wealth funds are looking to allocate 2-5% - via TFTC

Goldman Sachs CEO Solomon says, “I do not see bitcoin as a threat to the US dollar.” - via CNBC

Abdel, a developer from StarkWare, debuts zero-knowledge proofs on the Cashu ecash protocol - via X

Jack Dorsey explains why Nostr is the only "decentralized" social media protocol that isn't captured - via Citadel Dispatch

If you’re not passively stacking sats as you spend cuck bucks you’re doing it wrong.

— Marty Bent (@MartyBent) January 20, 2025

Just stacked 10,181 sats buying an Amazon gift card. All made possible by @fold_app. pic.twitter.com/seqefkwSEX

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: