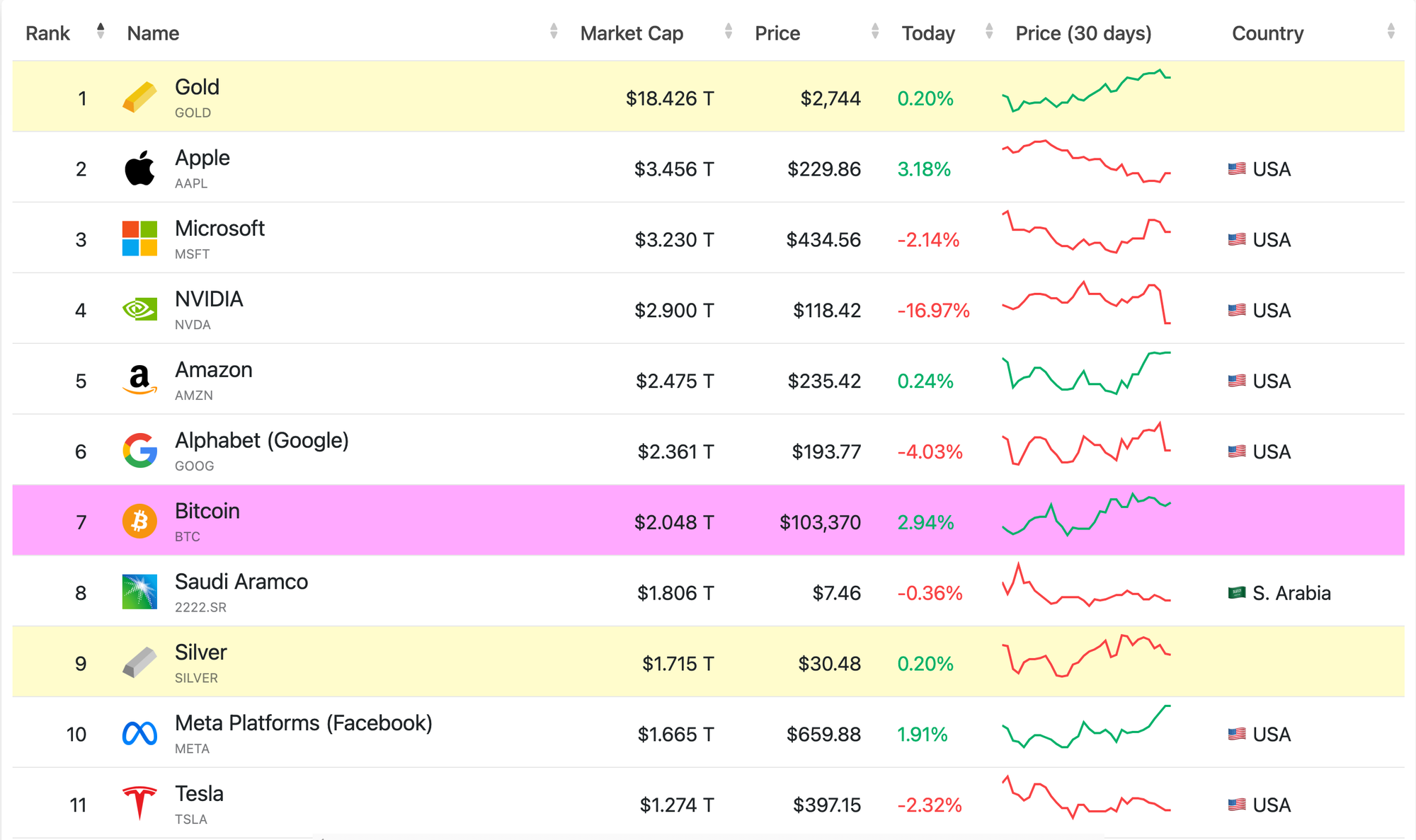

Bitcoin has established itself as a multi-trillion dollar asset. This marks a fundamental shift in the market dynamics.

In a recent conversation with on-chain analyst James Check, we explored compelling evidence of bitcoin's maturation as a major financial asset. Check pointed out that bitcoin has not only proven itself at the $1 trillion market cap level – testing it twice in 2021 before maintaining it for seven months last year – but has now "teleported" to $2 trillion with remarkable stability. This rapid ascension and subsequent consolidation suggests a fundamental shift in market dynamics.

"Silver didn't even put up a fight. Whatever silver's market cap is, we just rip straight through it. That was the end of it. Didn't even try." - James Check

Most striking is how this maturation is reflected in market behavior. Check emphasized that the likelihood of previous cycle-level drawdowns has diminished significantly, with institutional integration providing a more stable foundation. When we examine bitcoin's recent price action, even its corrections have been notably muted – the worst being a mere 32% drop in August that lasted just three hours. This marks a stark contrast to previous bull markets where 35-50% corrections were regular occurrences, suggesting we've entered a new era of market stability.mn

TLDR: Bitcoin hits $2T, holds strong, and laughs at silver's market cap on the way up.

Check out the full podcast here for more on Trump's meme coins, Ethereum's decline, and the bond market volatility ahead.

Bitcoin mining is like a global competition where computers create cryptographic hashes that are hard to produce but easy to verify.

When a computer produces a hash below the current network difficulty target, it gets to add a block of transactions to the ledger (blockchain) and receives new bitcoins plus the fees attached to the transactions in the block as a reward.

This process makes bitcoin secure by requiring an enormous amount of computing power to change any records, and ensures everyone agrees on who owns what.

Today, successful mining requires specialized machines and (typically) joining mining pools to reduce payout variance.

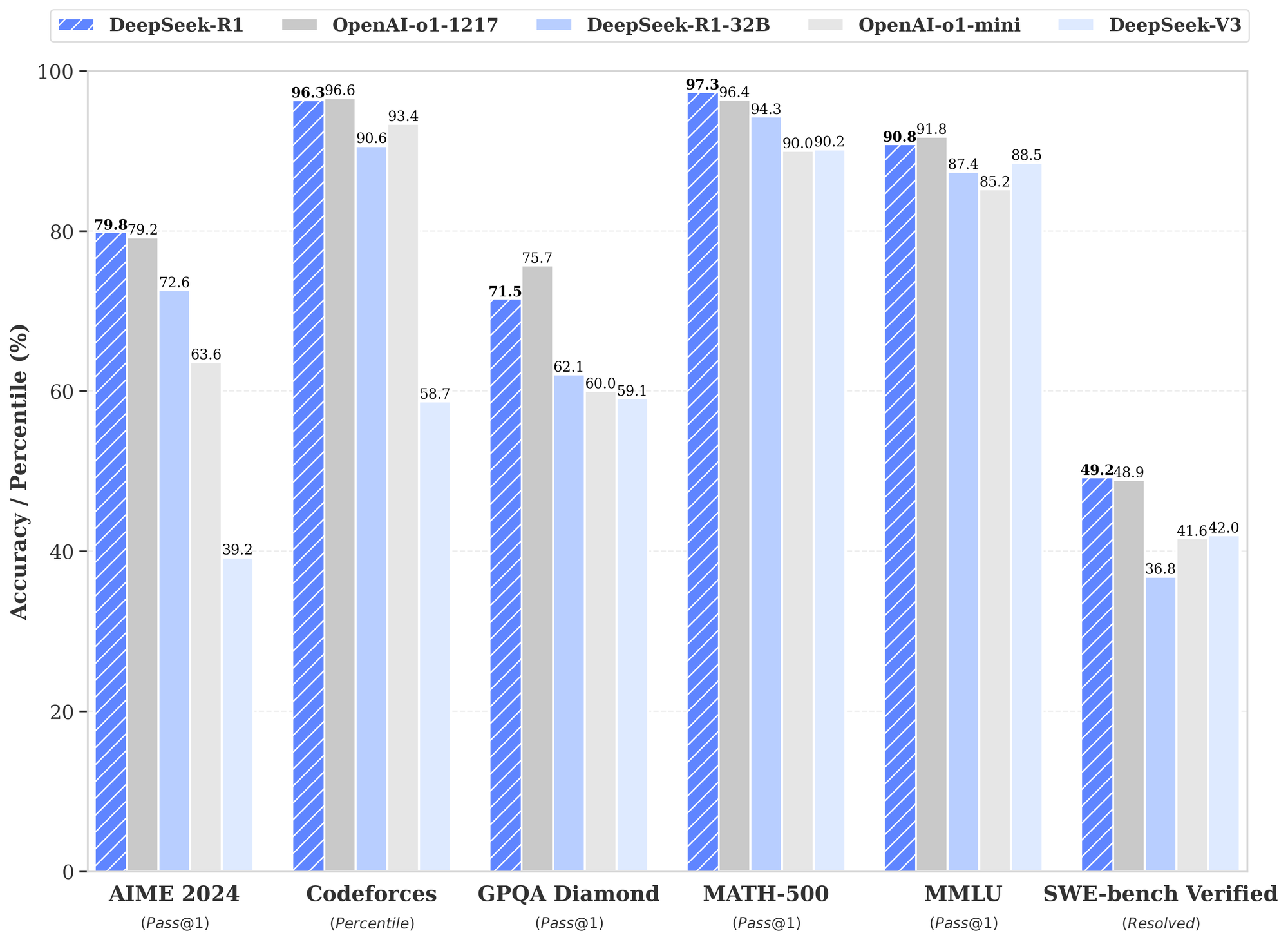

As many of you are probably aware of already, the AI world had a wrench thrown into its engine last week when DeepSeek, a Chinese AI company spun out of a hedge fund, released its open source model that is comparable with all the top Silicon Valley-backed behemoths in the West. DeepSeek's team is claiming that they trained their models using $6m dollars worth of computers.

While the claims of the cost of the computers they used to train their models is being called into question as many speculate the claim is a misdirection to disguise the likelihood that they acquired NVIDIA GPUs (despite the US's sanctions on China relating to chip sales) via Singapore, one thing is very clear; the cat is out of the bag and upstarts are now going to be able to compete with the OpenAI's of the world leveraging DeepSeek's open sourced model.

This fact calls into question the true value of OpenAI, Anthropic, xAI and others who have raised tens of billions of dollars at insanely high valuations. The NASDAQ tanked today as markets attempted to grapple with the ramifications of DeepSeek's entry into the market. Time will tell how disruptive DeepSeek is from a valuation perspective. It will take time to see if their new performant open sourced models mean that it will take significantly less hardware to produce better results or if Jevons Paradox will come into play via commoditized compute that leads to an explosion of use cases and, therefore, skyrocketing demand for GPUs.

One thing is for sure, the certainty of bitcoin's finite supply, the dynamics of its proof of work consensus model with a difficulty adjustment, and the lack of formidable competitors in the landscape of monetary goods makes it the only place I would feel comfortable storing value for the long-term.

NFL's Saquon Barkley is a bitcoin holder - via X

President Trump Alludes to the Elimination of the Income Tax - via X

MicroStrategy Unveils New Preferred Stock Offering - via X

Zaprite Launches BTCPay Server Integration - via nobsbitcoin.com

Arizona Could Pioneer State Bitcoin Reserves with New Bill - via X

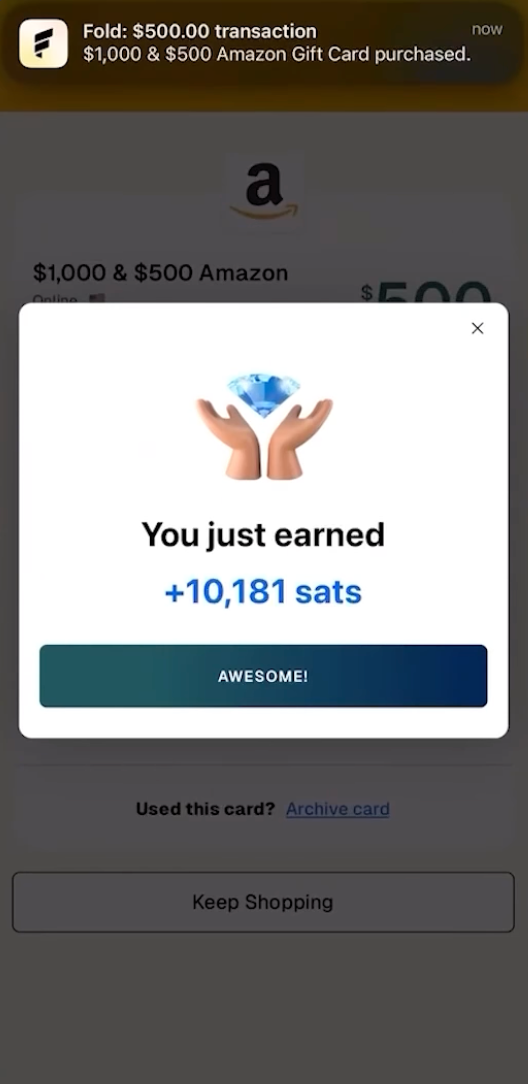

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: