Today is a better day than most to put the current problems people are facing into perspective. To do this, let's take a look at what the monetary and debt landscape looking like around the time bitcoin was launched.

Today marks the 15th anniversary of Bitcoin's Genesis Block being mined. Pretty wild to think about for me, personally. This means that bitcoin has been around for almost half of my life and I have been involved in bitcoin for almost a third of my life. So much has happened between January 3rd 2009 and today. And a lot of the coverage I've seen has been around the fact that we currently find ourselves at a time in bitcoin's maturity where a spot Bitcoin ETF seems imminent, the US National Debt has just crossed $34 TRILLION, the annual interest expense on that debt is above $1 TRILLION, and the geopolitical situation around the world seems as tense as it has ever been.

Satoshi gifted the world with the antidote it needs to right the ship sent off its path due to the ills of fiat money at the perfect time; in the pits of the Great Financial Crisis. Anyone who is so motivated now has a mechanism through which they can take control of their money. This is a powerful reality that most - even 15 years in - are oblivious to. However, with the national debt growing by $1 TRILLION a quarter and inflationary pressures increasingly squeezing the Common Man as he attempts to go about his life, more and more people are becoming aware of the problems that bitcoin was created to solve.

Today is a better day than most to put the current problems people are facing into perspective. To do this, let's take a look at what the monetary and debt landscape looking like around the time bitcoin was launched.

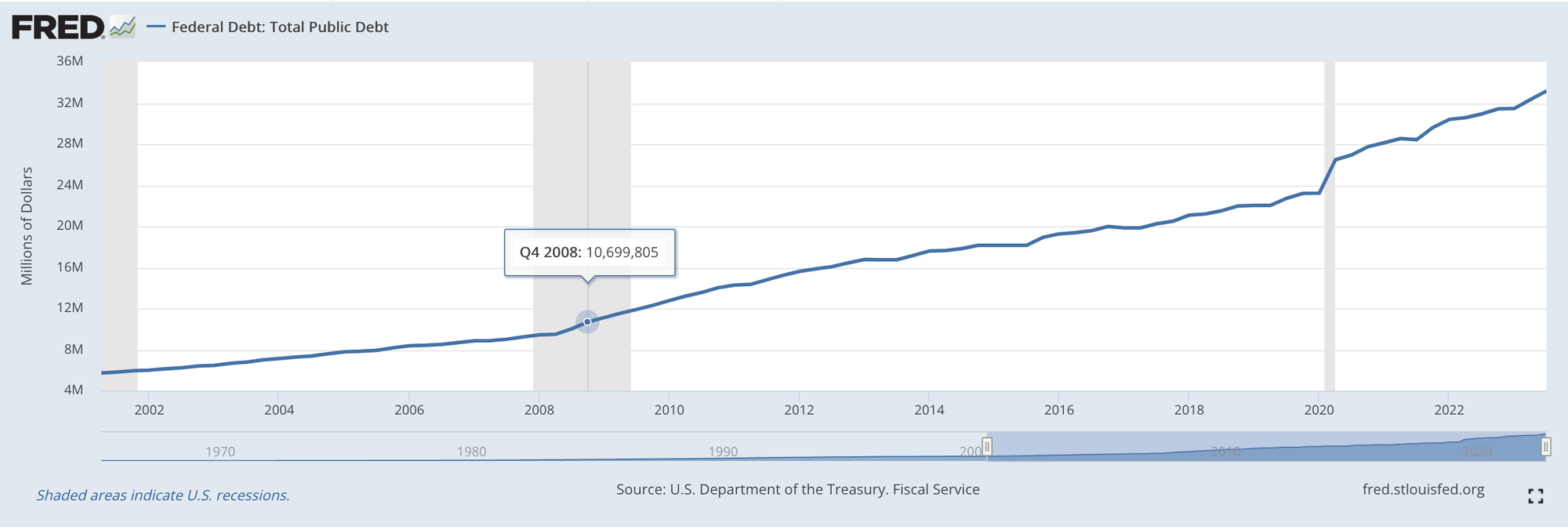

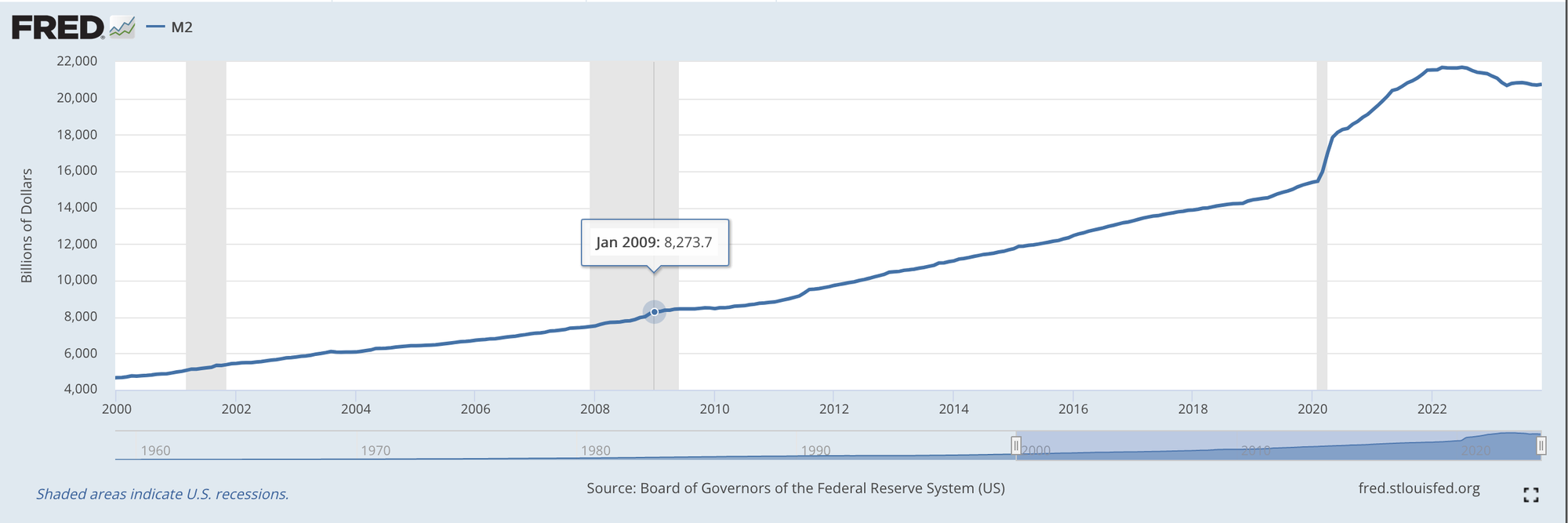

At the end of Q4 2008 the national debt was at ~$10.7 TRILLION. To put this in perspective we'll go backwards and forward in time from this point. The national debt first passed the $5 TRILLION mark in Q1 1996. So it took 220 years to go from 0 to $5 TRILLION and only another 12 years to double, which seems utterly insane. The real insane numbers are after the 2008 crisis. The national debt ballooned to over $20 TRILLION for the first time in Q3 2017, less than nine years after it hit $10 TRILLION. And since Q3 2017, the debt has skyrocketed to well over $34 TRILLION in a little more than six years. All in all, the US national debt is more than 3x what it was when bitcoin launched. Put another way, 68% of the debt that this country has accrued over the last 248 years was added over the last 15 years, or 6% of the country's lifetime. We are firmly in the "acceleration" phase of our national debt addiction. This astronomical debt is ballooning on top of a monetary base that has expanded quite rapidly, yet not at the pace of the debt being thrown on the tab.

In January 2009 the ratio of national debt to the M2 money stock was 1.29 ($10.7T in debt: $8.3T in M2). Today, that ratio has ballooned to 1.63 ($34T in debt: $20.8T in M2). As our friend Parker Lewis likes to say, there is simply too much debt and not enough dollars to service that debt, and this is becoming clearer by the day. Something has to break one way or the other eventually. And when it does, things are not going to work out well for the Common Man. Things either break via overt default and sends the value of people's retirements, which due to target date funds is skewed heavily toward government debt as retirement approaches. Or they break via soft default, which means the Federal Reserve and the Treasury print dollars and more debt at an unfathomable pace. Ultimately leading to the debasement of the dollar. Both ways lead to the same outcome, just on different timelines.

Many are convinced that the expansion of the monetary base and the acceleration of the national debt are not existential threats to the dollar's dominance in the world, but this line of thought is put into the world by people who are either attempting to project strength to keep the music playing, extremely hubristic, or extremely naive. I won't pretend to know exactly when everything breaks down, but I am certain that it is an inevitability. When things do eventually break, bitcoin will be here to help as many people as it can escape the madness.

The first 15 years have brought with it millions of users, trillions in dollar value of transaction settlements, the global geographic distribution of hashrate, and hope for a better future. A future built on a peer-to-peer cash system with a hard capped supply that is infinitely harder to corrupt compared to the incumbent system. The scarcity of bitcoin will bring with it an abundance the likes of which the world has never seen. Unfortunately (or fortunately depending on your outlook on life and the benefits of hardship) we will have to put up with the insanity of the dollar system until it fails.

Final thought...

Feels good to be back in the saddle.