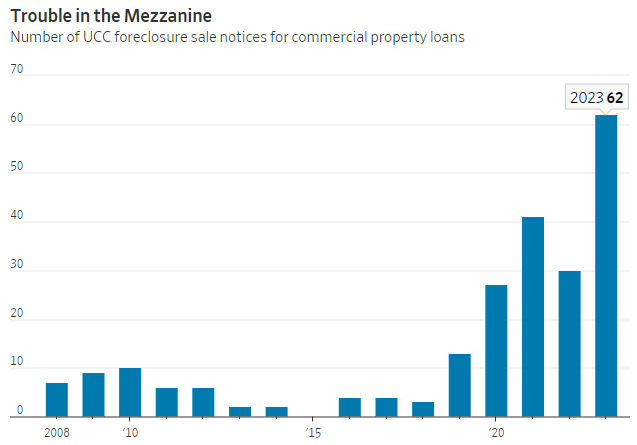

The US economic picture continues to look precarious, as leading indicators extended their record-long streak of sequential declines and existing home sales cratered to new 13-year lows – but as the Wall Street Journal suggests, you can always consider selling your kidney if times get tight.

Markets decisively reversed course from mid-October woes this week, as the latest CPI reading ignited a short squeeze that sent stock indices back near YTD highs.

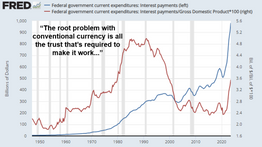

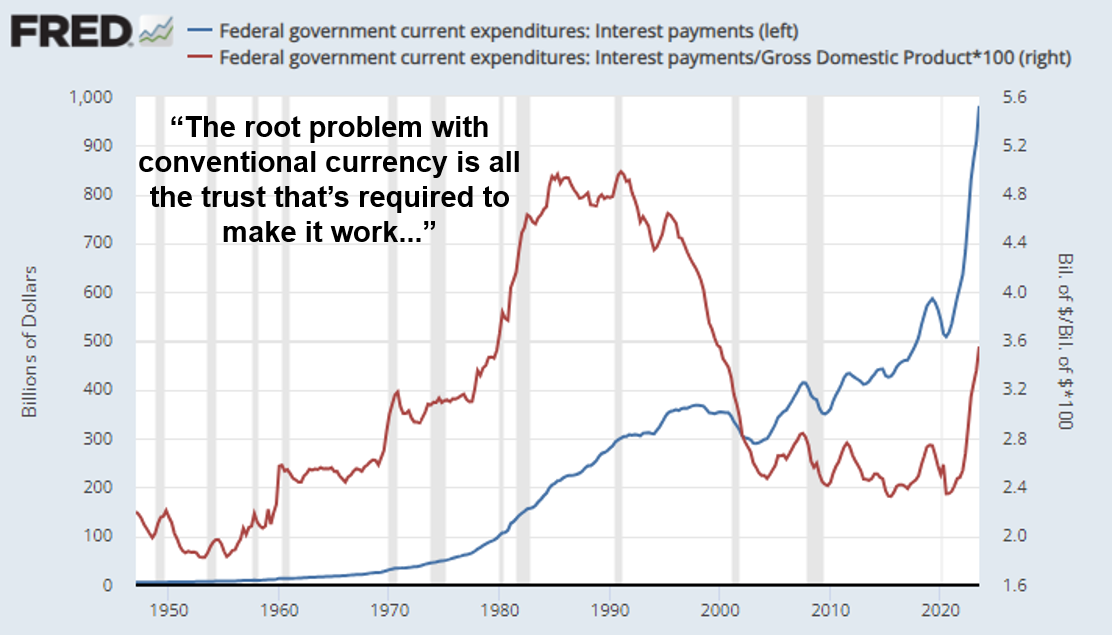

The capstone for the week came late Friday, when ratings agency Moody’s downgraded its outlook for US sovereign debt to negative.

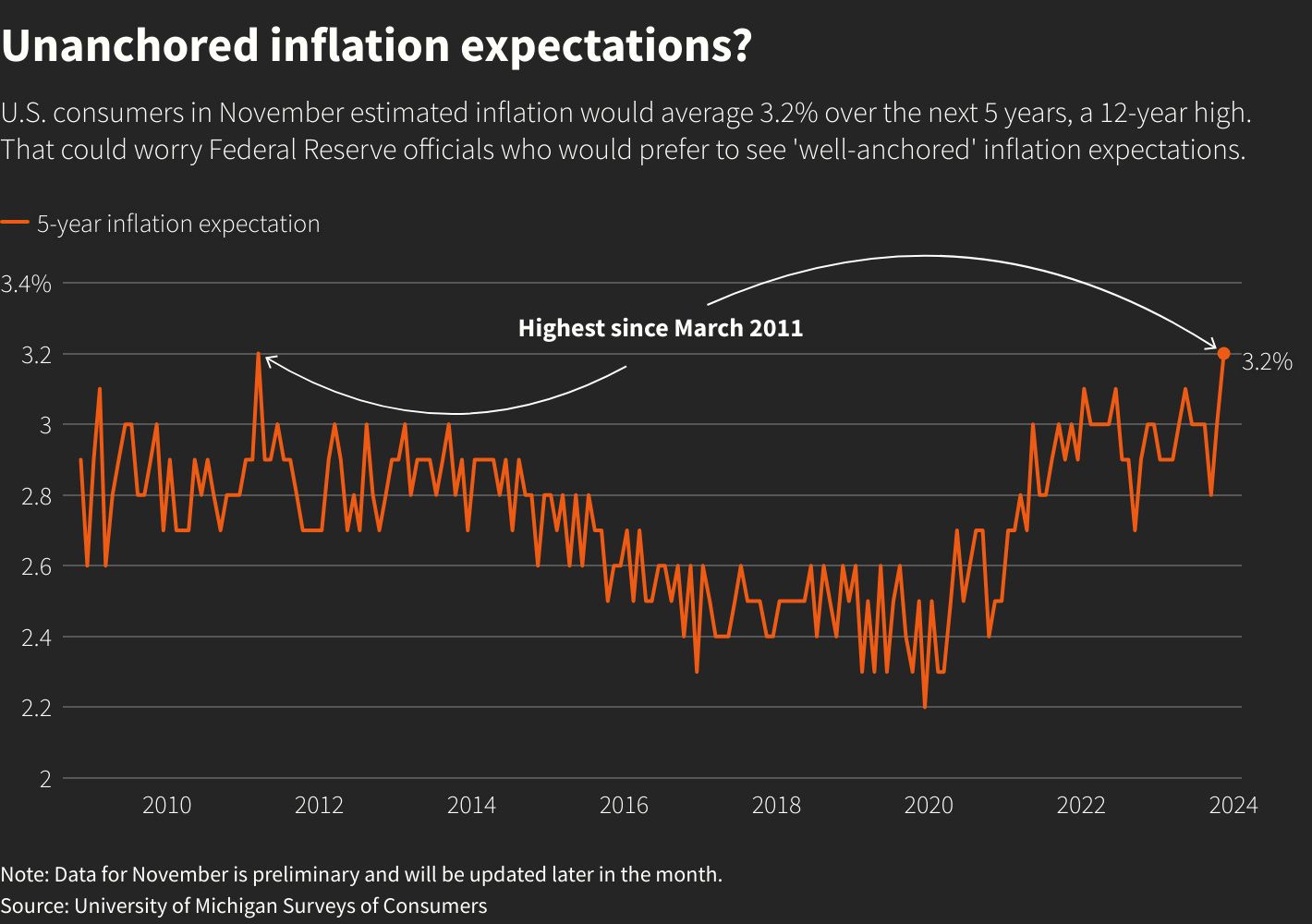

We fully expect the excesses and fragilities of late-stage fiat to compound further over the coming decade.

Meanwhile, bitcoin put up another strong showing, gaining another ~15% after last week’s +10% move (which also coincided with a broad selloff in traditional markets).

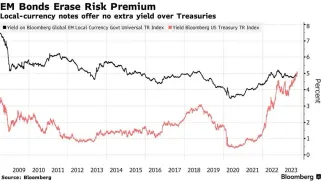

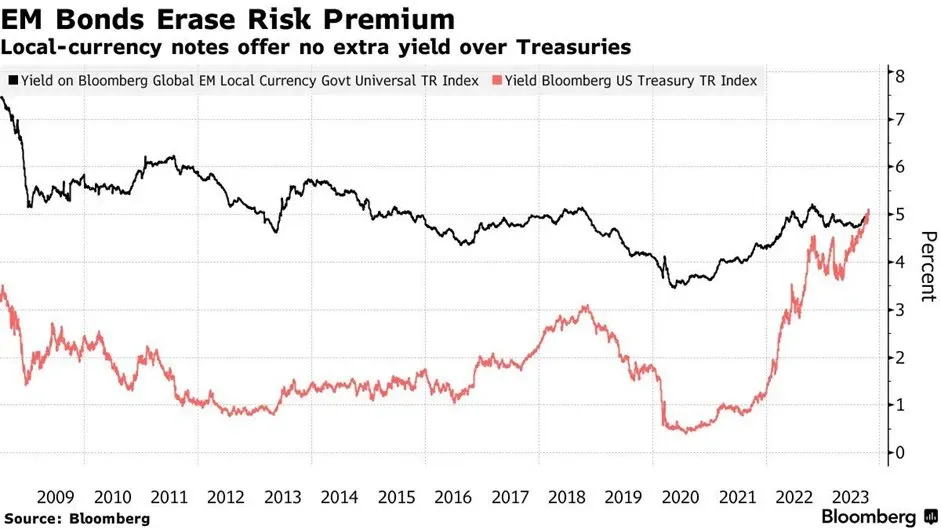

After some temporary relief, yields on sovereign debt spiked again this week, with the 10-year US Treasury rising nearly 40bps W/W to break 5% for the first time since 2007 before retracing slightly on Friday afternoon.