In the short term, the U.S. economy could experience a brief period of deflation, which might stem from a severe external shock. However, this scenario is considered unlikely due to the existing fiscal framework and the U.S. status as a reserve currency issuer.

In the short term, the U.S. economy could experience a brief period of deflation, which might stem from a severe external shock. However, this scenario is considered unlikely due to the existing fiscal framework and the U.S. status as a reserve currency issuer.

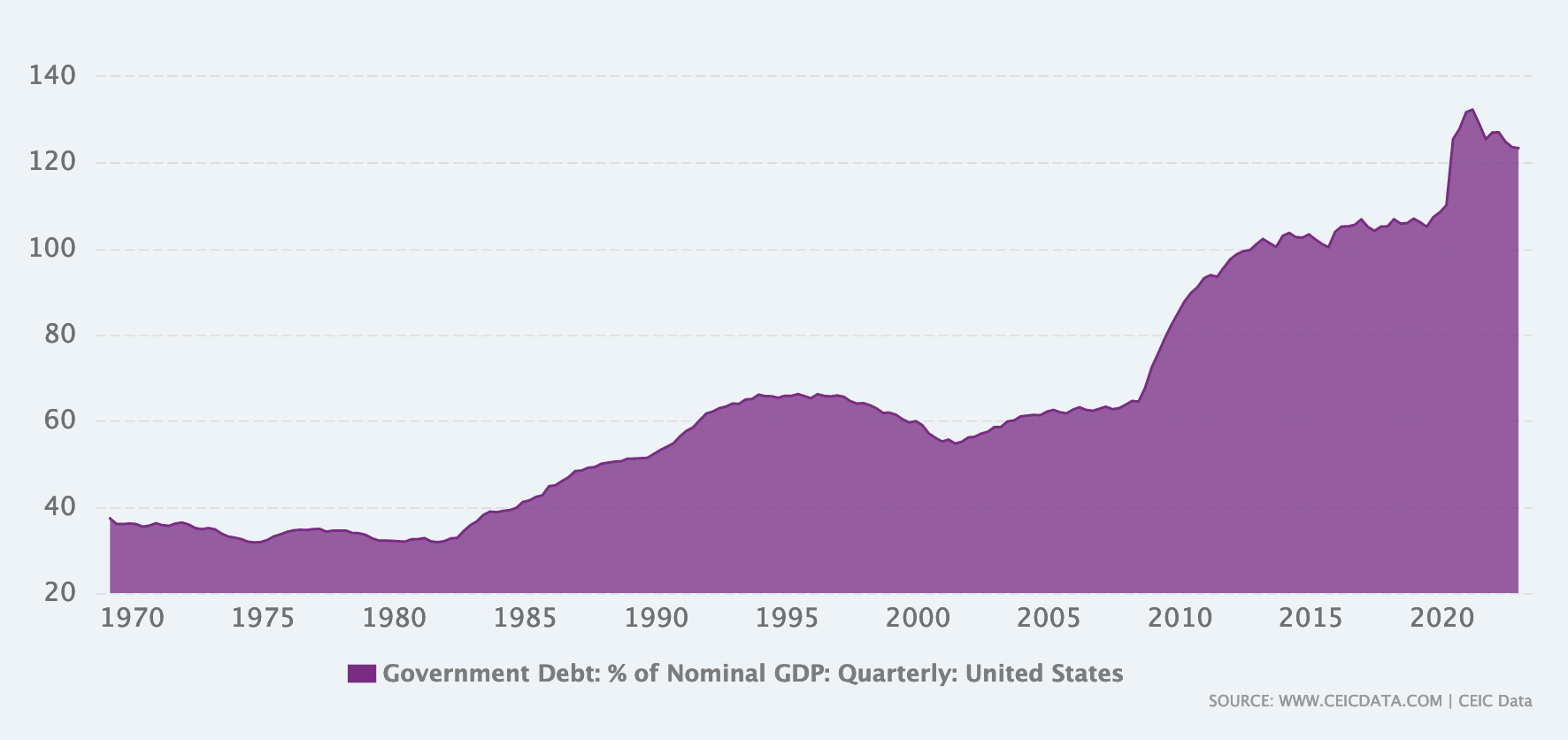

The United States' debt-to-GDP ratio stands at 120%, coupled with a deficit of 7 to 8% of GDP. With unemployment rates hovering around 3%, and a net international investment position at negative 65%, these factors create a concerning fiscal landscape. This situation is compounded by the $13 trillion in U.S. dollar-denominated debt held by foreign entities.

Should deflation occur and not be immediately countered with increased dollar liquidity, the U.S. could face Treasury market dysfunctions, potentially leading to auction failures. Historical precedence suggests that the Federal Reserve and Treasury would intervene to prevent such outcomes, as they have during past instances of market stress in September 2019, March 2020, and several occasions in 2022 and 2023.

In the event of deflation, assets that typically benefit from currency debasement, such as stocks, real estate, bitcoin, and gold, would likely retain value. These assets could perform well even if the Fed and Treasury allowed a Treasury auction to fail, which remains a highly hypothetical scenario.

The current fiscal situation, characterized by true interest expenses consuming all tax receipts, indicates an urgent need for additional dollar liquidity. Without intervention, the U.S. could revert to a regime where the dollar strengthens while other asset classes decline, a pattern observed in the third quarter of 2023.

Market behaviors suggest a shift towards fiscal dominance, where Treasury market functioning takes precedence over traditional Federal Reserve mandates concerning employment and inflation. This shift is evident in the performance of debasement trades and asset pairings like GLD over TLT, bitcoin over TLT, and S&P 500 over TLT.

Interest payments on U.S. debt now exceed national defense spending, with gross interest spending reported by the Treasury Borrowing Advisory Committee surpassing other significant budget items. As of early 2023, the 'big three' expenditures (entitlements, defense, and interest) amount to 125% of tax receipts, up from 89% in the second quarter of 2016.

The U.S. government's fiscal position suggests that without a productivity miracle or politically unfeasible spending cuts, the only viable solution is to add more dollar liquidity, possibly through rate cuts or currency devaluation. This informs a macroeconomic view that favors positions in gold, bitcoin, and short-term treasuries, all held without leverage. This strategy accounts for the expected continued volatility in global rates, currencies, and risk assets.

Inflationary pressures may increase as the U.S. fiscal situation compels the Fed and Treasury to intervene in the Treasury market to maintain its functionality. The repo rate spike in September 2019 exemplifies this dynamic, marking a point where fiscal circumstances began to significantly influence inflation trends.

In conclusion, the U.S. fiscal situation, characterized by high debt and deficit levels, poses significant risks to the treasury market and broader economic stability. The Federal Reserve and Treasury are expected to intervene as necessary to prevent dysfunction, potentially leading to increased dollar liquidity and inflationary pressures. This landscape informs investment strategies that emphasize assets likely to benefit from currency debasement and accounts for heightened volatility in financial markets.