Historically, America held a positive net international investment position until the dissolution of the gold standard under President Nixon's administration. Now, the nation faces a negative $18 trillion position that continues to deteriorate.

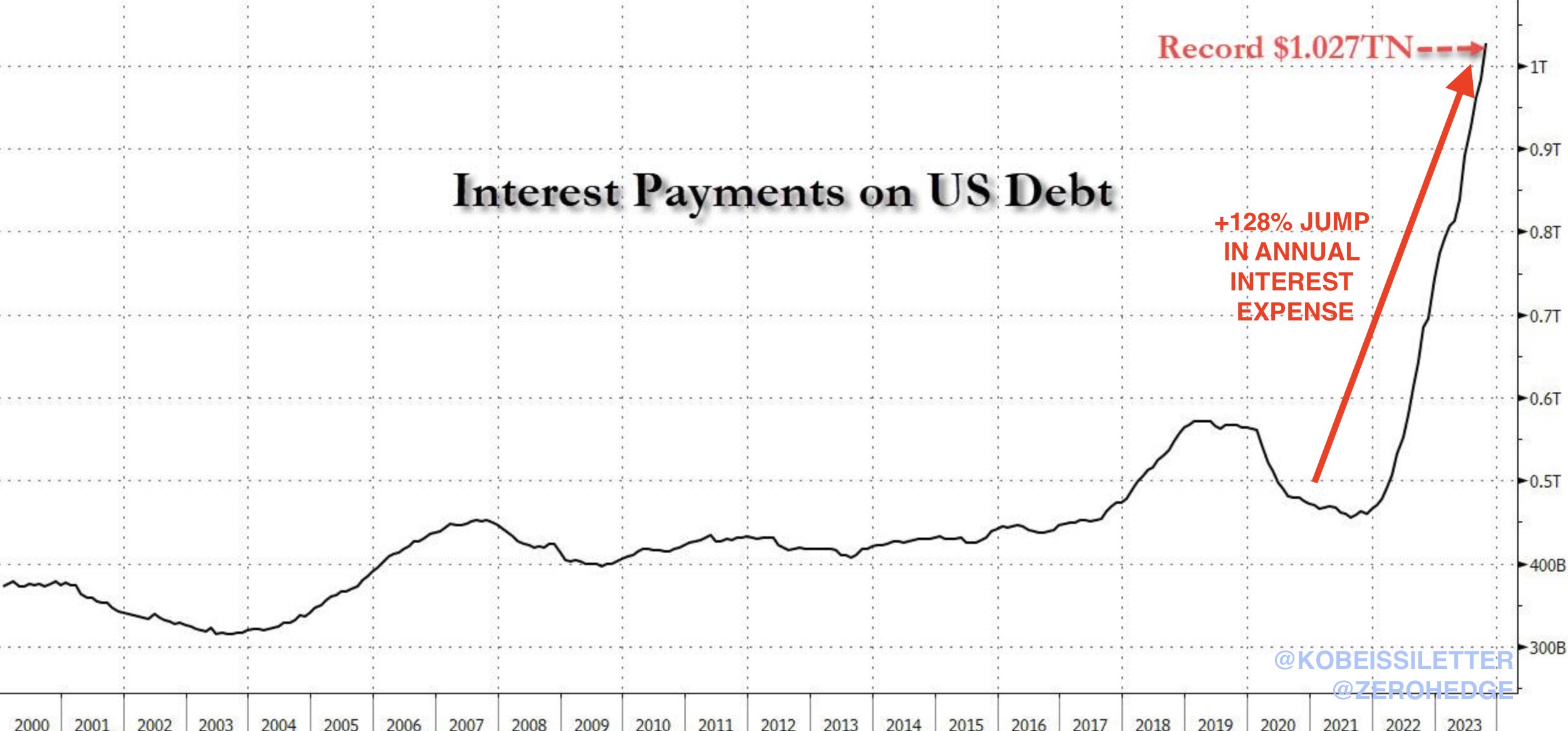

As the American public grapples with escalating living costs, a startling economic development has emerged from the shadows of fiscal management: the United States now expends more on servicing its national debt than on its formidable military apparatus. This revelation, drawn from the Department of Treasury's latest monthly financial statement, signals a concerning trend in federal spending priorities.

According to the data, the past two months have seen an expenditure of nearly $170 billion in interest—approximately $3 billion per day, a staggering increase from the $1 billion per day seen just two years prior. This trajectory, described by financial analysts as 'parabolic', indicates that interest on the national debt is poised to become the largest category of federal spending, surpassing even Social Security and Medicare, both of which are facing their own fiscal challenges.

Further scrutiny reveals that the U.S. military, despite its colossal budget—exemplified by the $200 million monthly operating cost of each of the nation's eleven aircraft carrier strike groups—no longer constitutes the primary financial outlay in Washington. This shift is emphasized by the recent $20 billion excess in debt interest payments over military spending in a mere two-month period.

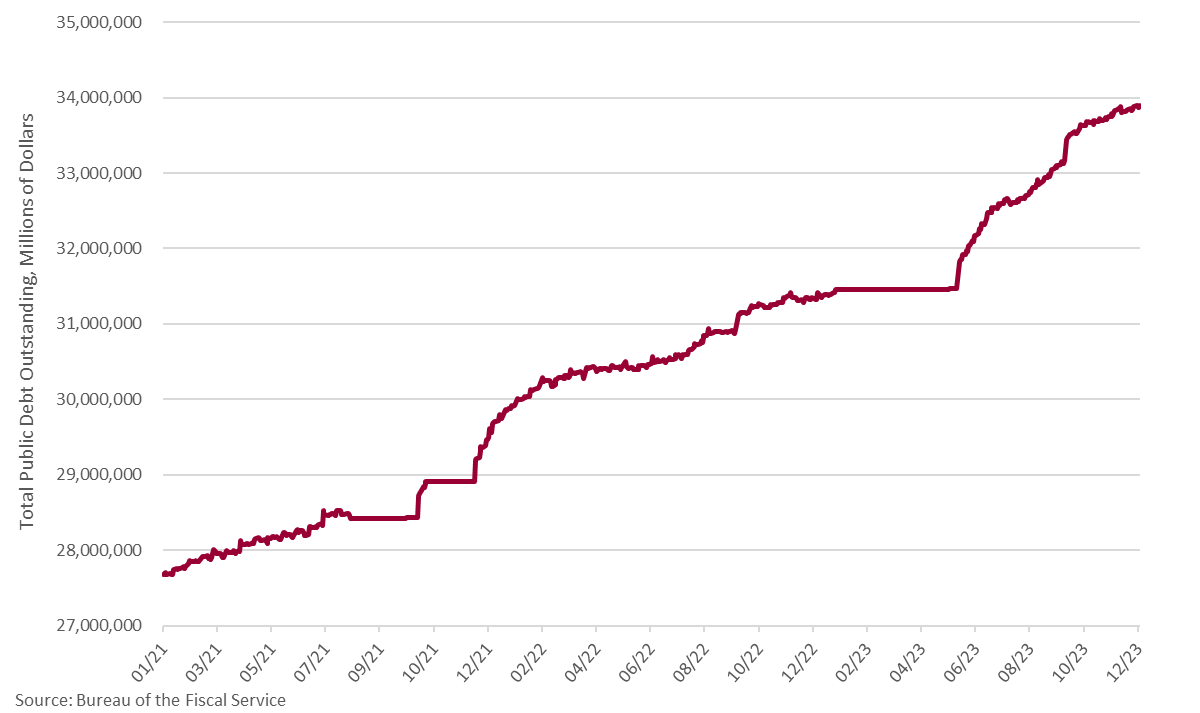

The composition of the debt holders adds layers to the complexity of the issue. Of the approximate $33 trillion national debt, $7 trillion is intragovernmental, including the Social Security funds that, contrary to popular belief, lack a 'lockbox' due to congressional spending. The Federal Reserve holds another 20%, while half of the remaining debt is domestically owned—from banks to individual investors. Notably, foreign entities possess around 30%, equating to roughly $10 trillion, a figure that is half the total of all bank accounts in the United States.

Historically, America held a positive net international investment position until the dissolution of the gold standard under President Nixon's administration. Now, the nation faces a negative $18 trillion position that continues to deteriorate.

With projections pointing to a $2 trillion-plus deficit for the current year, and a potential $50 trillion debt by 2030, the urgency for solutions intensifies. High interest rates, which may persist for years, will only exacerbate the burden of interest payments. Analysts speculate on potential outcomes: a 'hard default' akin to Greece's financial crisis in 2009, or a more likely 'soft default' where inflation is permitted to escalate, eroding the value of the dollar while preserving the interests of foreign and plutocratic debt holders.

As America stands at the precipice of a financial precipice, the path forward remains uncertain, with the potential for significant economic and political ramifications. As a nation, the United States must confront the reality of its fiscal trajectory, and the decisions made today will undoubtedly shape the economic landscape for generations to come.

For continued in-depth analysis and reporting on this and other economic developments, stay tuned to Peter St. Onge's coverage.