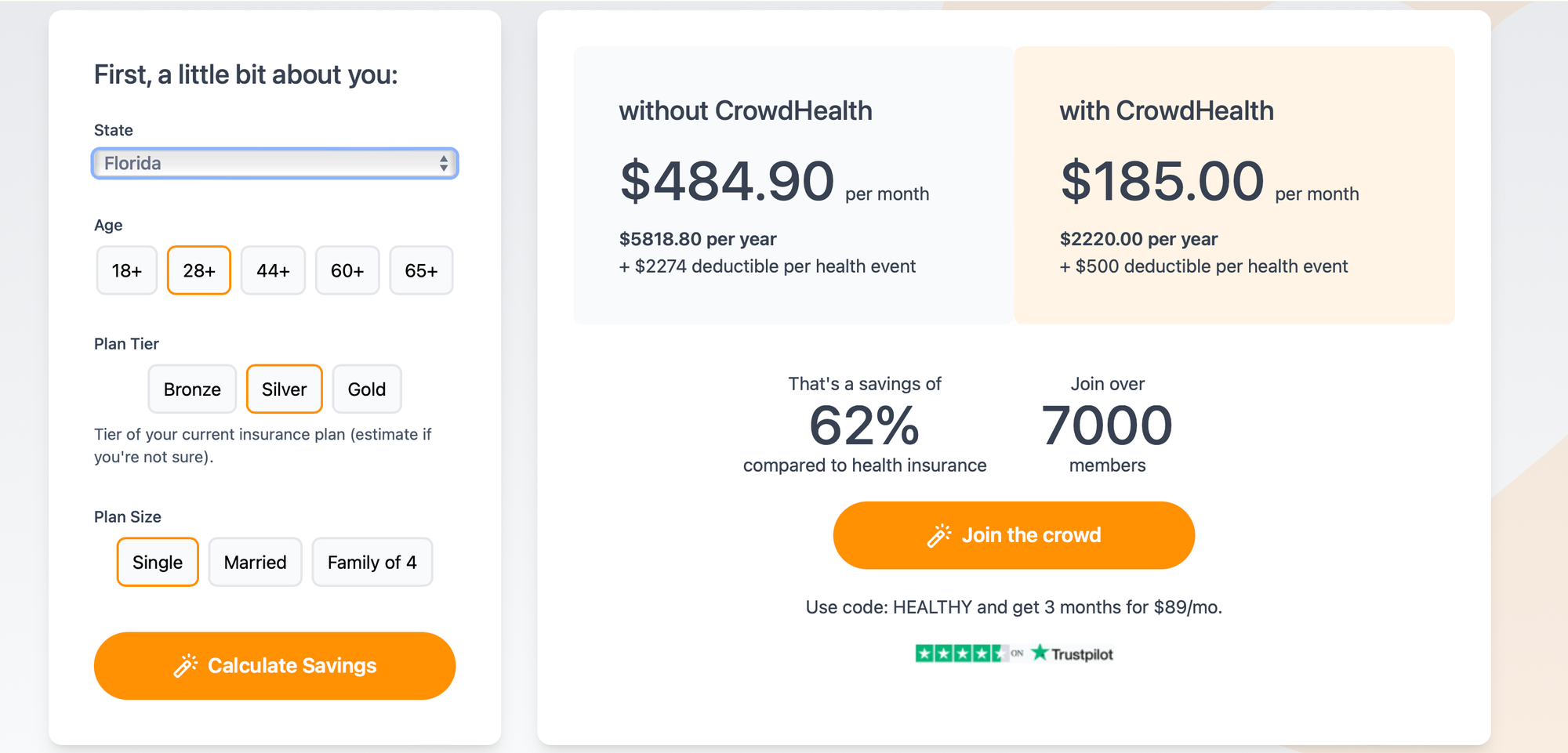

Comparing health insurance costs in Florida to CrowdHealth reveals some significant differences. Traditional health insurance in Florida typically comes with high premiums, deductibles, and co-pays. A family of four, for example, might pay hundreds of dollars per month just to stay covered. CrowdHealth, on the other hand, offers an innovative model for health care that aims to reduce costs through crowdfunding and direct negotiations with medical providers.

CrowdHealth is often more affordable than traditional health insurance, providing a community-driven solution without the expensive premiums. By joining a health-sharing community, you can avoid the middlemen that often drive up prices in traditional insurance. With lower monthly contributions and more personalized coverage options, it's an appealing alternative for many people.

Moreover, CrowdHealth doesn't just save you money; it also simplifies the health care process. There's no need to navigate confusing insurance policies or deal with unexpected charges. From negotiating lower prices with hospitals to ensuring your contributions directly support others in your community, CrowdHealth aims to make health care more transparent and accessible.

Florida has a diverse health insurance market with many factors impacting costs. Key differences exist between plan types and the companies offering them. Understanding these elements helps make informed decisions.

Several key factors affect the cost of health insurance in Florida. Age is a significant factor, as older individuals typically face higher premiums. Your health status and medical history can also influence costs.

Geographic location within Florida can determine how much you'll pay, as costs can vary from one county to another. Smoking status may increase premiums, while your income level can affect eligibility for subsidies, lowering the overall cost.

Average premiums in Florida can vary based on plan choice—Florida's most common types of plans and coverage level. For instance, standard plans fall into Bronze, Silver, Gold, and Platinum categories, which cover 60%, 70%, 80%, and 90% of costs, respectively.

Bronze plans are often the least expensive in terms of premiums but have higher out-of-pocket costs. Silver, Gold, and Platinum plans have higher premiums but offer lower costs when you seek care. Average full-price premiums in Florida are approximately $623 per month. However, most people get subsidies that significantly lower this cost.

Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are Florida's most common types of plans. Major providers include Florida Blue, Aetna, and Cigna, among others. Each offers various plans catering to different health needs and budgets.

In 2023, about 14 insurance companies participated in Florida’s Marketplace, providing a wide range of options. Notably, almost all (97%) people who enrolled in these plans received subsidies, making health insurance more affordable. Large players like Florida Blue dominate the market due to their extensive network and plan variety.

CrowdHealth offers a unique way to manage healthcare costs through a community-oriented model and transparent pricing structure. This approach provides an alternative to traditional health insurance with potential cost savings and personalized service.

CrowdHealth operates differently from traditional health insurance. Instead of paying premiums to an insurance company, members contribute monthly to a community fund. This fund is used to cover medical expenses as they arise.

Knocked this one out of the park…if we do say so ourselves. pic.twitter.com/9EDMlHt8P6

— CrowdHealth (@JoinCrowdHealth) February 12, 2023

CrowdHealth negotiates directly with healthcare providers to secure lower prices, significantly reducing overall costs. Members pay a small initial amount, and the community covers the rest. This peer-to-peer support system is designed to minimize overhead and streamline payments, making healthcare more affordable.

This model is built on trust and accountability within the community. Members support each other, and the administrative team ensures transparency and efficiency. This system's success hinges on a large and active member base committed to the collective well-being.

CrowdHealth's pricing is straightforward and transparent. Monthly contributions are typically lower than traditional health insurance premiums, appealing to those seeking affordability. For instance, a family of four pays a maximum of $400 per month to support other members' medical needs.

Each member's contribution depends on their age and health status but remains competitive compared to standard insurance plans. The model eliminates the need for co-pays, deductibles, or surprise bills, providing predictable costs.

CrowdHealth uses a crowdfunding approach where all members share in each other’s expenses, ensuring that costs are distributed evenly. This method helps keep healthcare accessible and affordable while promoting a sense of community and mutual support.

We are done crowdfunding for the year.

— CrowdHealth (@JoinCrowdHealth) December 28, 2023

3,506 submitted to the community for crowdfunding

3,506 funded by the community

We had some doozies. Brain surgery, cancer cases, motor vehicle accidents, NICU babies, a whole bunch of MSK surgeries, and a host of other large events.… pic.twitter.com/isPNN9ue9O

In this section, you'll find a detailed comparison focusing on the costs, benefits, and coverage scope of traditional health insurance in Florida versus CrowdHealth. This analysis aims to help you understand which option might be better suited for your needs.

Traditional health insurance in Florida often involves monthly premiums, copayments, and deductibles. These costs can add up, especially for single-member LLC owners. For instance, monthly premiums for a family of four can be substantial, sometimes up to $1,200 or more.

In contrast, CrowdHealth uses a monthly membership model that can be more budget-friendly. Members contribute a fixed amount, which is pooled to cover medical expenses. This contribution might cost around $400 per month for a family of four, potentially saving you hundreds of dollars compared to traditional insurance.

Traditional Insurance Costs:

CrowdHealth Costs:

Traditional health insurance offers many benefits, including access to an extensive network of doctors and hospitals. It also provides comprehensive coverage for various medical services, from routine checkups to emergency care.

CrowdHealth, on the other hand, focuses on shared medical expenses. While it doesn't offer traditional insurance benefits, it does ensure that members' medical bills are covered through community contributions. This model can lead to lower out-of-pocket costs for major health events.

Traditional Insurance Benefits:

CrowdHealth Benefits:

Traditional health insurance covers various medical needs, including preventive care, surgeries, and specialist visits. However, it often involves out-of-pocket expenses like deductibles and copayments.

CrowdHealth is not traditional insurance but rather a healthcare-sharing community. It covers large medical expenses through pooled funds and helps you negotiate the bills.

Traditional Insurance Coverage:

CrowdHealth Coverage:

CrowdHealth offers a modern approach to healthcare funding that emphasizes flexibility, community support, and transparency. Here are the key advantages you can benefit from as a member of CrowdHealth.

CrowdHealth provides flexible healthcare solutions that are not tied to rigid insurance policies. With traditional health insurance in Florida, you often face high premiums and limited options.

CrowdHealth, on the other hand, allows you to choose your doctors and treatments without network restrictions. This innovation means you can access the care you need without unnecessary roadblocks.

Additionally, CrowdHealth negotiates with healthcare providers to lower costs before bills reach members. This unique approach ensures you're not overpaying for medical services and that savings are passed on to the community.

The community aspect of CrowdHealth is a significant advantage. Instead of relying on a for-profit company, CrowdHealth uses a crowdfunding model to cover medical expenses. This peer-to-peer funding approach helps create a supportive network where members contribute to each other’s healthcare costs.

A family of four, for example, may pay around $400 a month to help other members. This fosters a sense of community and shared responsibility, creating a safety net where members are invested in each other's well-being.

CrowdHealth also boasts a large member base, ensuring that contributions are distributed efficiently and fairly among the community.

Transparency is another standout feature of CrowdHealth. Traditional health insurance policies can be notoriously opaque, often leaving you guessing about what you'll pay out-of-pocket. CrowdHealth offers clear and upfront pricing, so you know exactly where your money is going.

This transparency extends to the way CrowdHealth operates. The platform is straightforward about its fees and how funds are used to pay medical bills. By being open about costs and operations, CrowdHealth builds trust with its members, ensuring they feel confident in the system.

Crowdfunding for May. pic.twitter.com/zhPLjlF2QM

— CrowdHealth (@JoinCrowdHealth) May 29, 2024

CrowdHealth’s commitment to transparency helps eliminate surprise medical bills, providing peace of mind and financial predictability for its members.

Florida residents need to navigate state-specific regulations and consider alternatives like CrowdHealth when choosing health insurance options.

In Florida, health insurance is subject to regulations that can impact your coverage choices and costs. Nearly all individuals enrolled in the Florida Marketplace are eligible for subsidies, which help cover the average monthly premium of $623. These subsidies often significantly reduce the cost, sometimes covering as much as $565 per month.

The available plans include HMOs, EPOs, PPOs, and POS plans. Each type offers different choices in terms of network size, referral requirements, and cost-sharing. Understanding these differences is crucial. Additionally, Florida regulations allow for short-term and catastrophic plans, which provide limited coverage for emergencies.

When comparing traditional health insurance to alternatives like CrowdHealth, consider the financial impact and scope of coverage. Traditional insurance may offer more comprehensive coverage, with tiers such as bronze, silver, gold, and platinum that cover 60% to 90% of costs.

CrowdHealth, on the other hand, offers an alternative model where members contribute to a community fund. This fund helps pay for medical expenses, but it may not cover all types of care. The benefit here is often lower premiums and more flexibility. Evaluate how often you need medical services and check if the flexibility of CrowdHealth suits your needs better than the structured coverage of traditional insurance plans.

Choosing the right plan involves weighing these factors against your healthcare needs and financial situation. Understanding these points will help you make an informed decision.

Florida's health insurance costs vary significantly due to multiple factors, while CrowdHealth presents a different model aiming to reduce costs for its members. This section addresses common questions about these costs and how CrowdHealth compares.

Health insurance in Florida is more expensive largely due to higher medical costs and a larger uninsured population. Additionally, the demand for health services often exceeds the supply, causing prices to rise.

CrowdHealth operates on a community-powered model. Instead of paying premiums to an insurance company, you contribute to a community fund. This approach removes insurance middlemen, potentially lowering your healthcare costs.

Yes, CrowdHealth can often be more affordable. Many members report saving hundreds or even thousands of dollars each year. This is due to its unique cost-sharing model and efforts to negotiate lower prices with healthcare providers.

While both are alternatives to traditional insurance, CrowdHealth is not faith-based and focuses on transparency and direct cost reductions. Health-sharing ministries like MediShare often have faith-based membership requirements and may include certain religious obligations.

Common concerns about CrowdHealth include the limitations of its new model and the reliance on community contributions. Some users worry about the scalability and long-term sustainability of this approach compared to established insurance plans.

CrowdHealth typically offers lower costs due to its community-powered funding and direct negotiations with providers. Compared to traditional insurance and other alternatives, CrowdHealth members often pay less while receiving similar or better care.