The most important question right now for the economy, aside from Jerome Powell’s metaphors about navigating in the dark, is when the recession hits. All major schools of economics predict it's coming, since all major schools know interest rates cause recessions. But it’s worth breaking down why.

I'm an Austrian economist. Which essentially means a non-government economist – the Austrian school got its name because the Prussian economists were all government-funded and the Austrians were not. It has nothing to do with Austria, it simply means economists who are not paid shills for government.

Instead of shilling, we use 500 years of Classical economic theory running from the Spanish Scholastics to the French (Turgot, Say, Bastiat) and the Austrians (Menger, Mises, and Rothbard). Professor Pete Boettke calls us "mainline" economists – we build on what's already been built. As opposed to the "mainstream" economists who are paid to use statistics to spin whatever lie they’re told to.

So in classical economics, recessions don't happen on their own -- there is no natural "business cycle" of inflation and recession. Rather, governments cause them.

Sometimes by war, which makes spending soar while the economy hunkers down. But in modern times almost always by central banks.

Specifically, central banks push interest rates too low, making money artificially cheap. They do this to print more money via loans -- they are, after all, a counterfeiting cartel. Counterfeiters always prefer to print more — it's the product.

Some of the counterfeiting proceeds go to Wall Street itself, which is why they bought the Federal Reserve in the first place.

But mostly it goes to borrowers. The vast majority of whom are rich, including, of course, the biggest borrower on earth: the federal government.

Those borrowers, above all the government, effectively get free money in the form of cheap loans. They use them to take over hunks of economy and society, while driving the very income inequality that ironically animates the communists to advocate for yet more government control.

The boom-bust cycle comes in because those cheap loans aren't just hand-outs, they spark an economic boom as free credit flows to everybody. Including to crap businesses that never should have gotten loans in the first place.

Perhaps it’s the 25th app selling artisanal DIY bentos. Or selling NFT's of bored apes. These low-quality businesses -- "malinvestments" -- can grow like a weed even if they’re losing billions, fueled by cheap credit. Just replace the losses with new loans paying almost nothing.

Sadly, the boom is a tissue fire -- it burns bright but it burns short.

Because all that activity bids up prices -- there are only so many offices in San Francisco for billion-dollar dot-coms selling artisan DIY bentos or j-pegs of bored apes. More prosaically, there’s only so much steel and construction workers for the bento factories or rebuilding racist overpasses.

As prices rise, the central bank slams on the brakes. Because it knows inflation will trigger the voters, who will make Congress take away the Fed's power. So they panic-hike to stop the inflation.

This chokes off new loans and crushes household spending. Which takes enough spending out that inflation falls — it clears the highway so federal spending can hog what’s left.

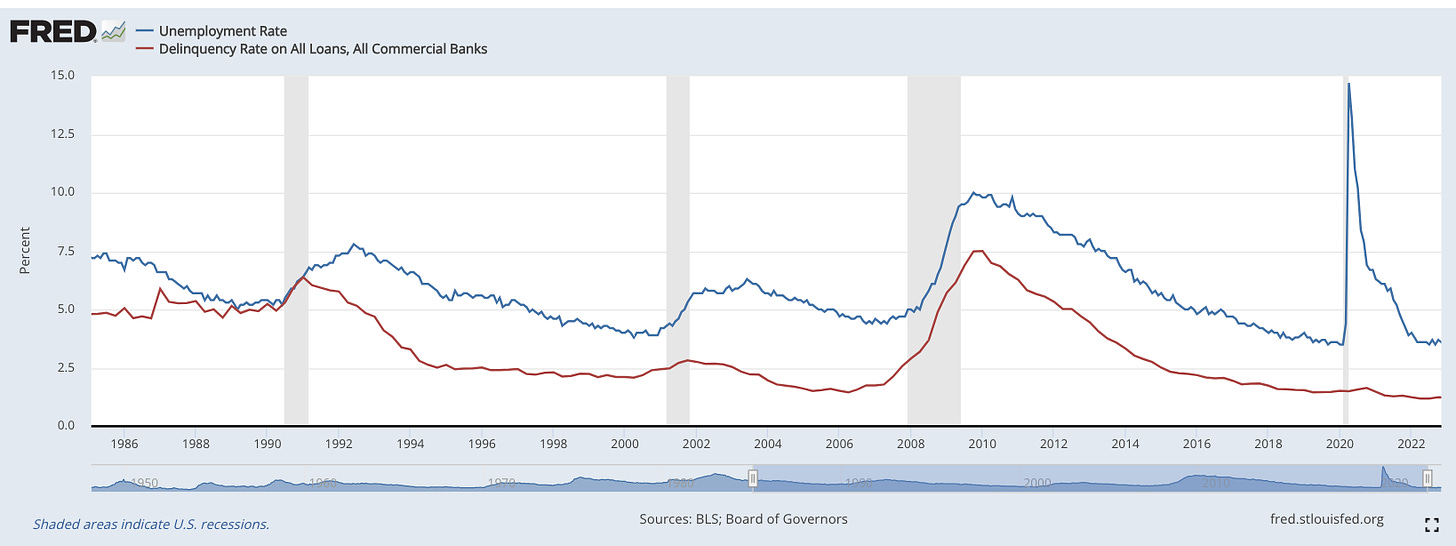

For those malinvestments, higher rates means money suddenly goes from cheap to impossible to find. You get a mass extinction of the marginal firms. Not immediately, of course -- it typically takes about 12 to 18 months to run through the cheap money they already had.

So, rather than dying one by one, as in normal times, the malinvestments fail in clusters by the thousands. As the failures pile up, with hundreds of billions in defaults and millions of lost jobs, it shows up in the statistics as a drop in GDP -- a recession.

The end result is boom-bust cycles, over and over. A few years of cheap money, then 12-18 months of running on fumes. Then a crash.

At which point the Fed yanks rates back to zero, covered by the temporary disinflation that always happens in recession due to credit evaporation. Money goes back to cheap and the cycle begins again.

Government, of course, thrives at every stage of this horror-show.

When the money's cheap they steer investment into politically-favored industries like solar or wind or even into government-funded "non-profits."

Then when the crash hits, governments bail out their donors and fund new trillion dollar welfare schemes using those millions of laid off workers as human shields. Every crisis is an opportunity for the ones who caused the crisis. Even as each cycle destroys trillions in wealth and millions of lives.

All in service to a perpetual ratchet that progressively hands more and more of our economy to the central planners who create the crises then cash them in.

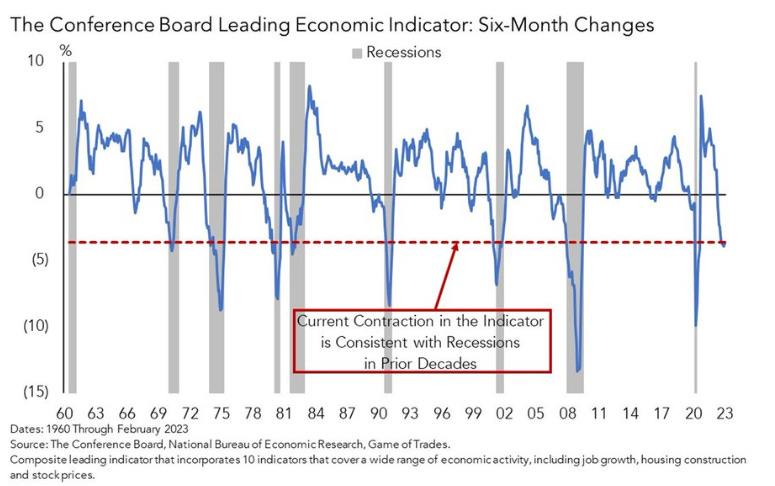

We’re currently smack in that “running on fumes” stage. That 12-18 month delay between panic-hikes and economic devastation.

The Fed kept interest rates artificially low most of the past 15 years, spawning the mother of malinvestment booms. For years the resulting inflation was soaked up by foreigners hoarding dollars, by technological progress, and by cheap Chinese goods.

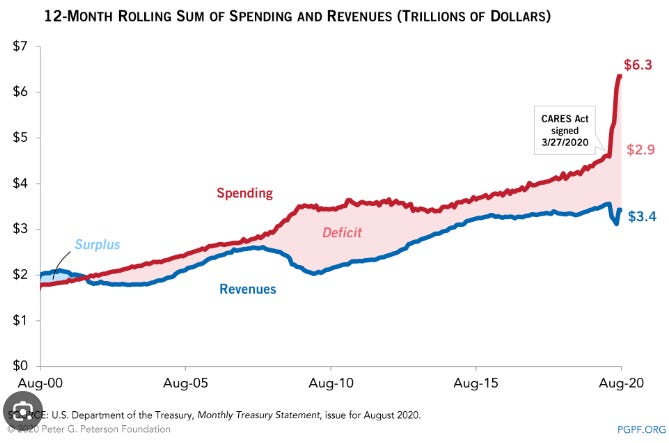

But they broke the bank pumping out $7.5 trillion to buy Covid lockdowns. That was almost 50% of the pre-existing money supply, meaning one in 3 dollars had wet ink on them. Naturally, that drove up inflation: once it hit double digits the Fed panicked and jacked rates early -- in fact at the fastest rate in 50 years.

And that brings us to today. Going by 3 centuries of central bank boom-bust, unless the lockdowns themselves cleared out so much malinvestment that we got a clean slate, we're now living on borrowed time, with 12-18 months until we get to pay for it all with a recession that we’re still praying will only be as bad as 2008.

What could fix it?

Easy: The Fed sells off its $5 trillion horde of Treasury bonds, forcing the federal government to spend less, perhaps even balance its budget. That pulls inflation down to the point the Fed can ease rates back to normal levels.

Of course, it won't happen: the Fed serves federal spending and Wall Street. It does not serve the people. And that will continue so long as it exists.

Sign up to my free email list to get weekly posts on the economy and freedom. Choose the $5 option if you’d like to support the videos and articles.

Also check out the weekly podcast rounding up all the week’s videos in a single 30 minute podcast.

This was originally written on profstonge.com