The crude oil market is showing signs of weakness, with potential to weaken further amid economic slowdowns across the US and Europe and geopolitical tensions.

The crude oil market is showing signs of weakness, with potential to weaken further amid economic slowdowns across the US and Europe and geopolitical tensions. This shift comes after a brief resurgence in prices due to conflict in the Red Sea region, which has now been overshadowed by prevailing market fundamentals.

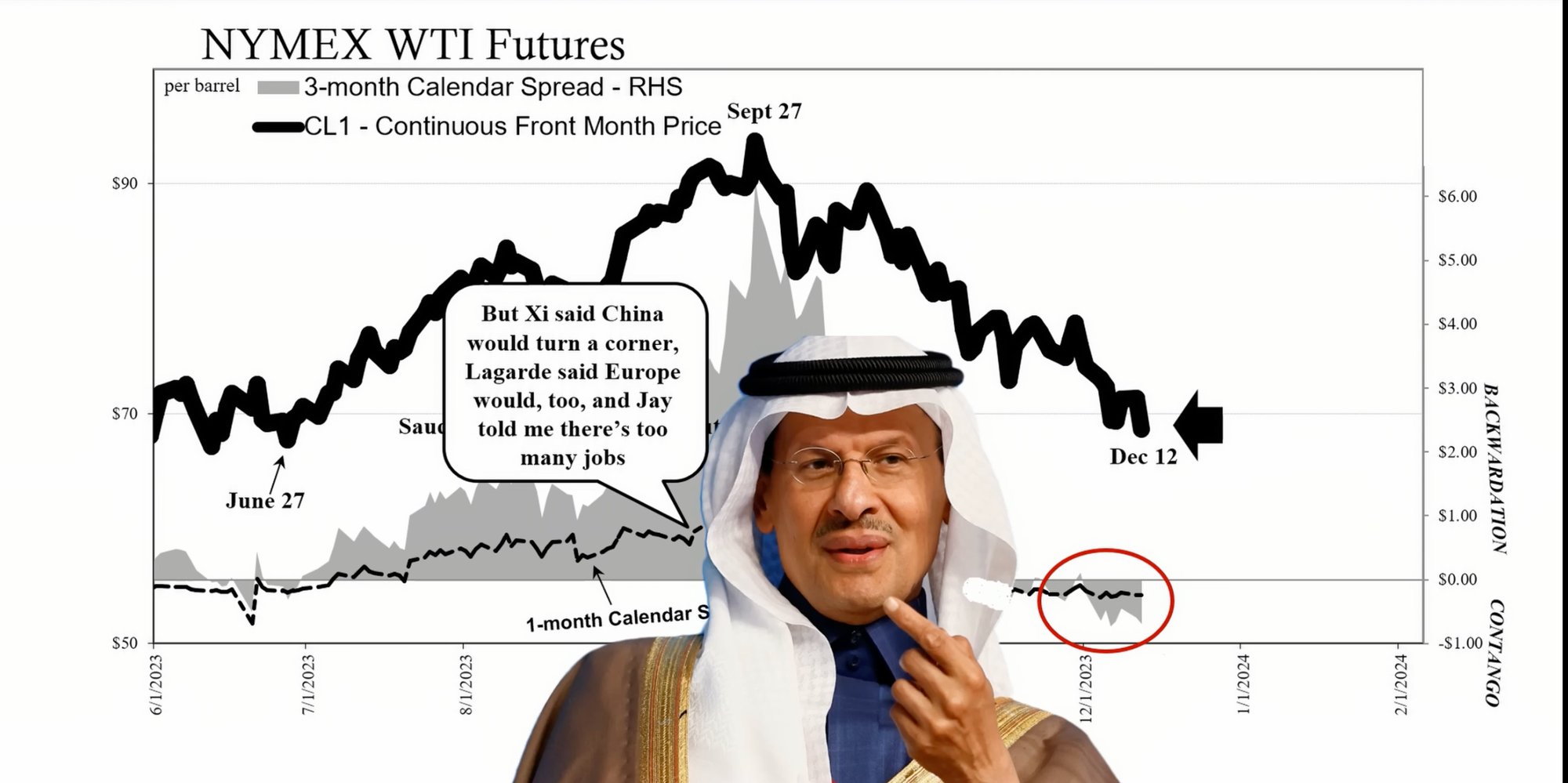

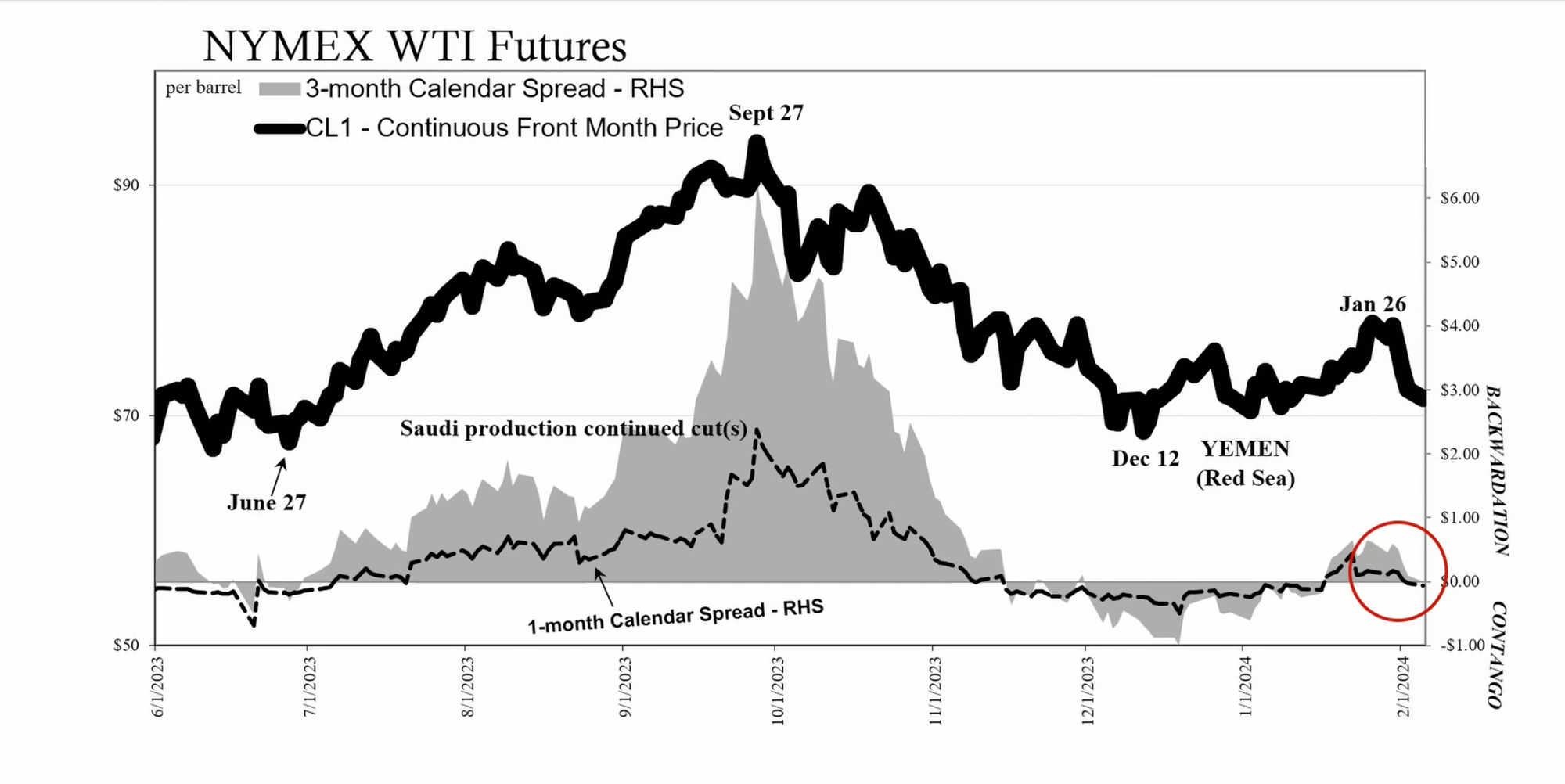

In the latter months of 2023, crude oil prices experienced a significant sell-off, aligning with a surge in bond yields. WTI futures prices reached a low of $68.80 on December 12th, and the market structure shifted into a contango state, despite OPEC's production cuts. By December 19, the WTI futures curve indicated a contango of $1 at the crucial three-month spread.

The International Energy Agency (IEA) acknowledged a demand problem in its December report, noting a slowdown in oil demand growth from 2.8 million barrels per day year-over-year in Q3 2023 to 1.9 million barrels per day in Q4. The downward revision was attributed to deteriorating macroeconomic conditions, affecting Europe, Russia, and the Middle East.

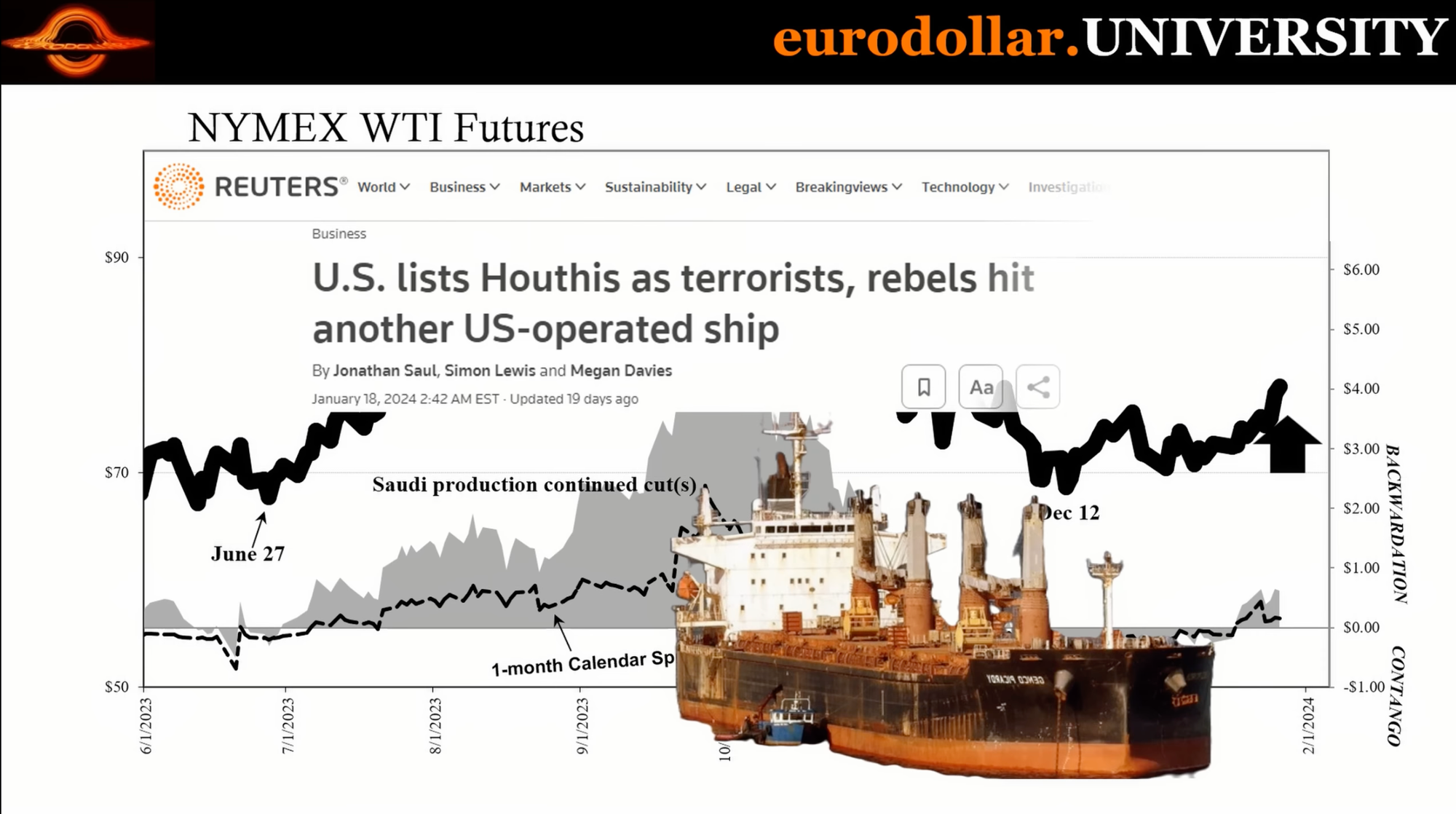

The attack on the Norwegian tanker Strinda by Yemeni rebels on December 12th drew the oil market's attention back to geopolitical risks. This event, followed by the missile strike on the Genco Picardy, a US ship, heightened concerns about supply disruptions through the strategic Red Sea shipping lane, causing fluctuations in oil prices.

Despite temporary backwardation in January 2024, the IEA reported a further slowdown in global oil demand growth to 1.7 million barrels per day year-over-year in Q4 2023. As of early 2024, WTI futures have declined to $71.50 and returned to a contango state, suggesting a focus on economic fundamentals over geopolitical tensions.

The relative strength of the US economy has not been sufficient to counterbalance the weaknesses observed in the global market, raising questions about the true state of economic health and its impact on oil demand.

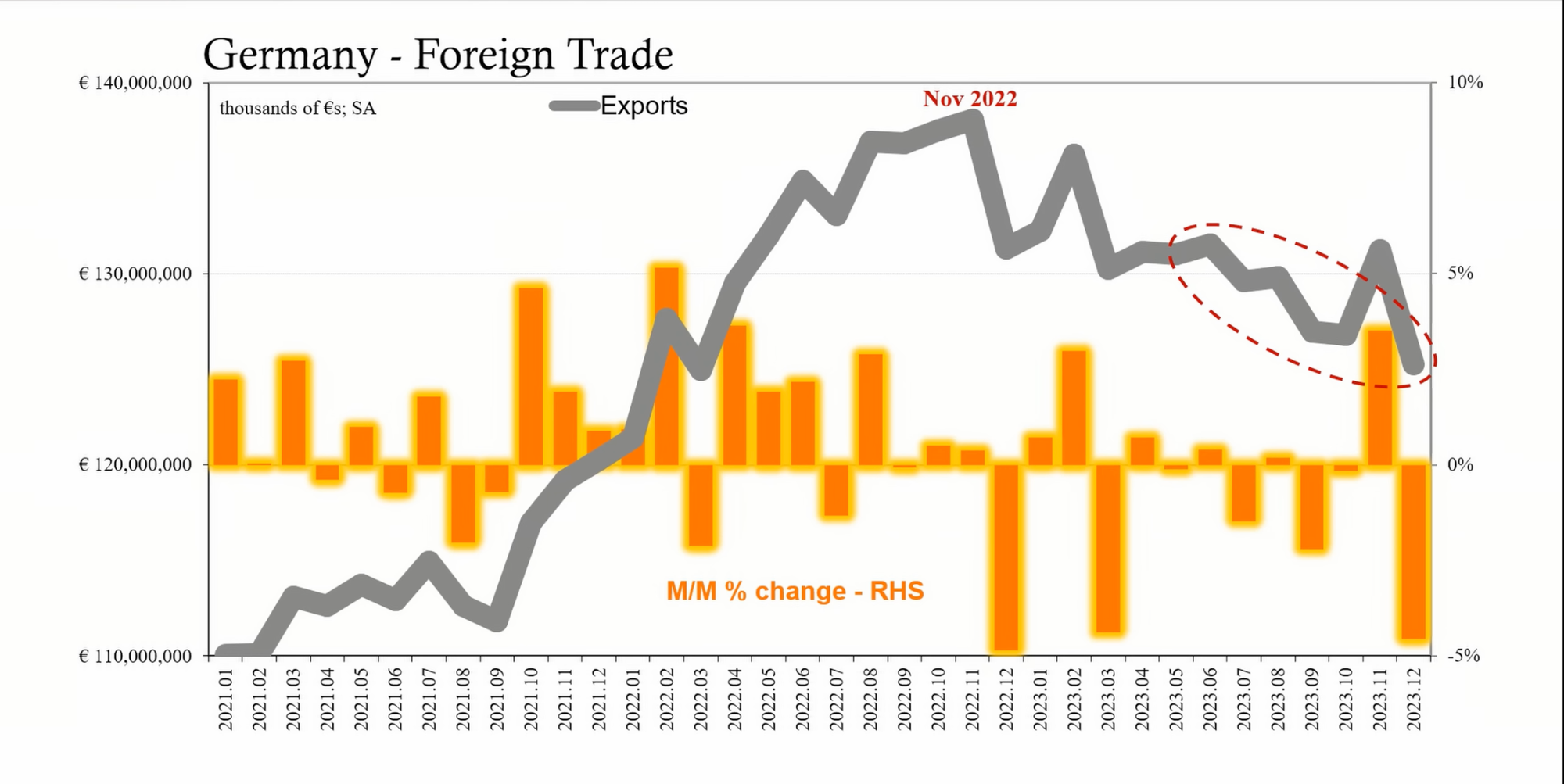

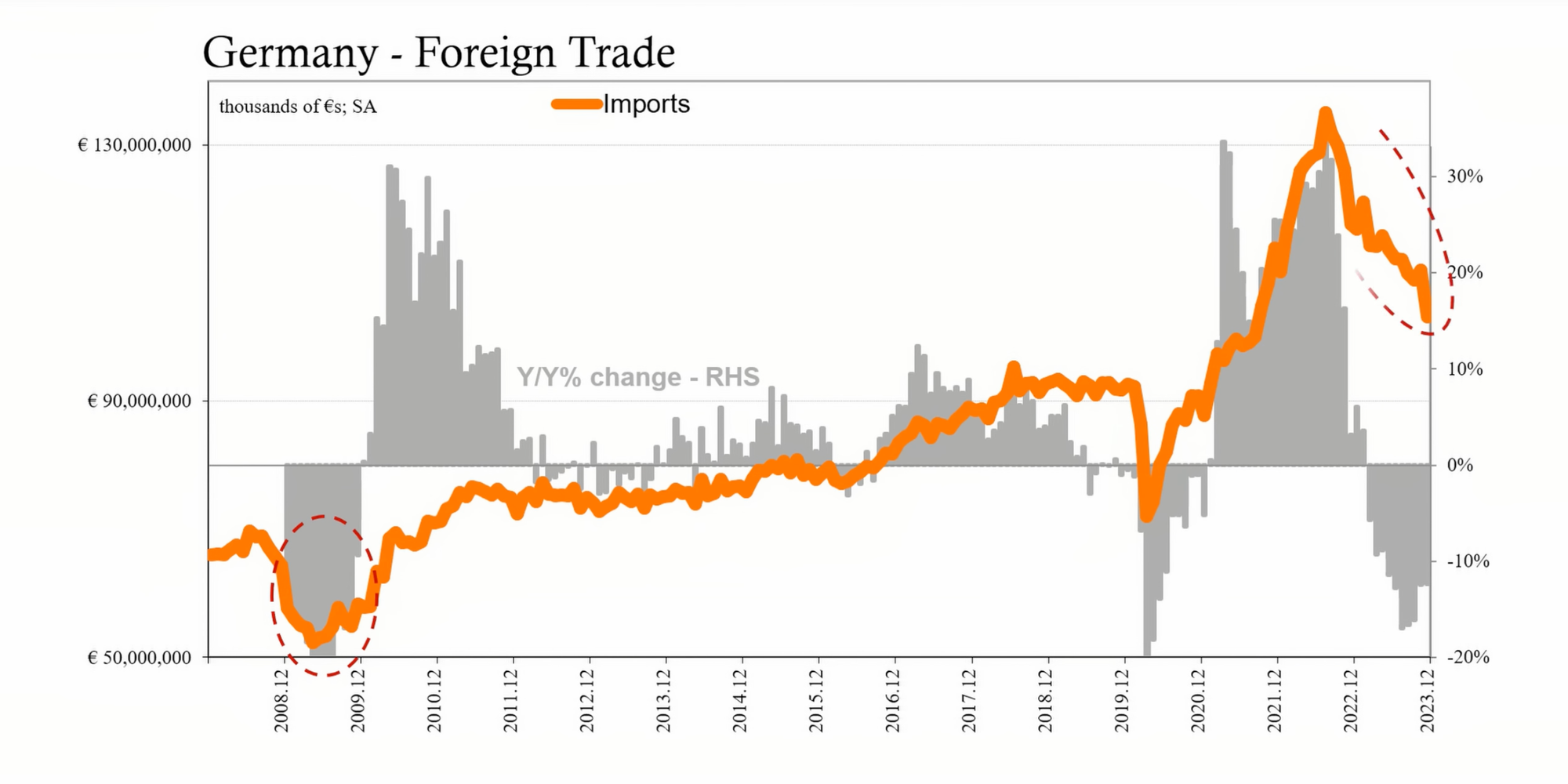

Germany's trade statistics for December 2023 indicated a sharp decline in exports by 4.6% and an even more alarming drop in imports by 6.7%. This downturn is indicative of a broader global trade recession, with Germany's economic performance serving as a key indicator of global economic health.

The weak trajectory of oil prices, coupled with poor economic indicators from Germany and a lackluster demand outlook, signals an ongoing global economic challenge. The german trade data and the state of the crude oil market collectively reflect a broader systemic issue affecting the global economy. Despite geopolitical events that temporarily influence prices, market fundamentals continue to assert their influence, suggesting that the global economy may be far from a robust recovery.