The study suggests that the most affected demographic appears to be first-time homebuyers, who are experiencing significant financial strain.

In a troubling report for the American housing market, property prices are plummeting in numerous major cities across the United States, with the impact being severely felt by new homebuyers, many of whom are purchasing for the first time. According to Newsweek, the value of homes in several key markets has tumbled, some by double-digit percentages. The most notable declines have been observed in cities like Memphis, with a 17% decrease, and even steeper drops in urban centers such as San Francisco, where prices fell by $122,500, and Manhattan, where $70,000 has been lost due to the recent surge in mortgage rates.

The study suggests that the most affected demographic appears to be first-time homebuyers, who are experiencing significant financial strain. This group, often young families or those without substantial savings, are finding themselves in a position of negative equity, where the value of their home is less than the mortgage they owe. This alarming situation has wiped out down payments for many and has left them indebted beyond the value of their property.

Ironically, while nationwide housing prices have remained elevated, largely due to a stagnant mortgage market, local declines are hitting hard. This downturn in property value poses a threat to the financial security of the next generation, which has historically relied on rising home equity as a safeguard against stagnant wages since the year 2000. With the prospect of home ownership diminishing, a growing portion of the population may be forced to rent indefinitely, missing out on the traditional wealth accumulation associated with property investment.

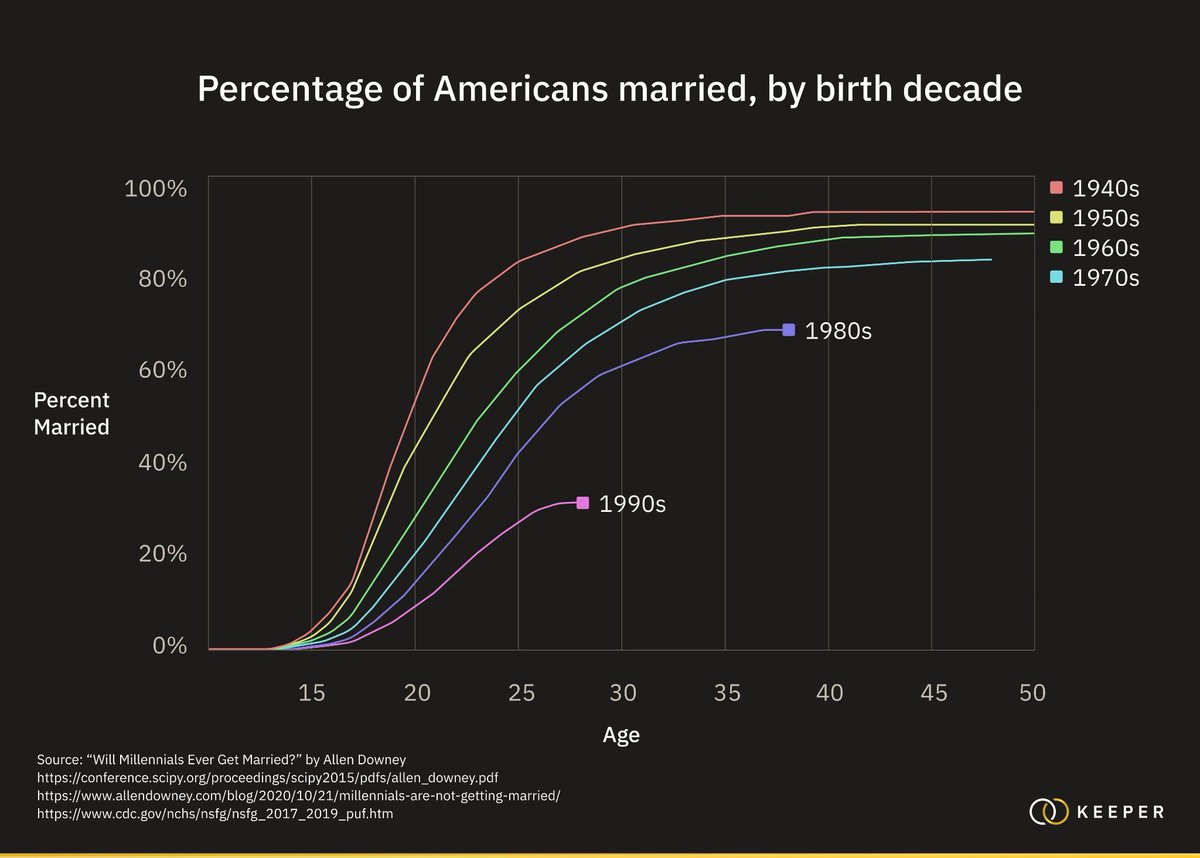

The National Association of Realtors (NAR) reports that first-time homebuyers now represent a mere 26% of the market, a significant drop from 50% just five years prior. Furthermore, the average age of first-time homebuyers has increased to 36, reflecting a broader trend of delayed property acquisition among younger generations. This shift has profound implications, as only 60% of older millennials (now in their 40s) own a home, compared to higher ownership percentages in previous generations at the same age.

The broader economic implications are dire. With the Federal Reserve's aggressive actions to curb inflation potentially exacerbating the situation, the dream of homeownership is drifting further out of reach for millions of Americans. As the central bank continues to navigate the delicate balance of economic policy, the hope of reversing this trend hangs in the balance. The sharp decline in property values in several U.S. cities is not only a short-term financial blow to new homeowners but may also signify a long-term shift in the fabric of American wealth accumulation and the potential reshaping of the American Dream into a far more grueling journey.

Newsweek: House prices are in “freefall” in dozens of major US cities, with new buyers — often young families — losing in some between $70,000 and $122,000.

— Peter St Onge, Ph.D. (@profstonge) December 18, 2023

A thousand dollars per week.

The Fed keeps throwing meteor after meteor at young families. Millions will never get a… pic.twitter.com/UzpRNbWq84