U.S. hiring rates have plummeted to a six-year low as of March 2024, highlighting significant labor market challenges and discrepancies between official data and actual job availability.

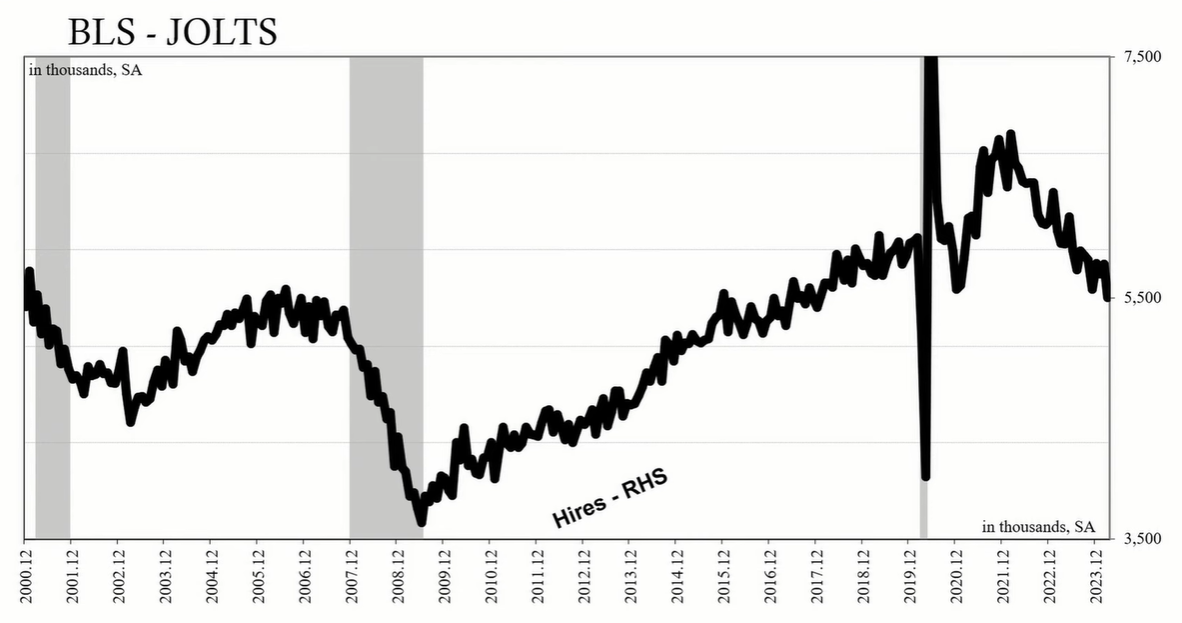

The U.S. economy is facing significant hiring challenges, with the hiring rate dropping to its lowest point in over six and a half years, excluding the initial lockdown period during the COVID-19 pandemic.

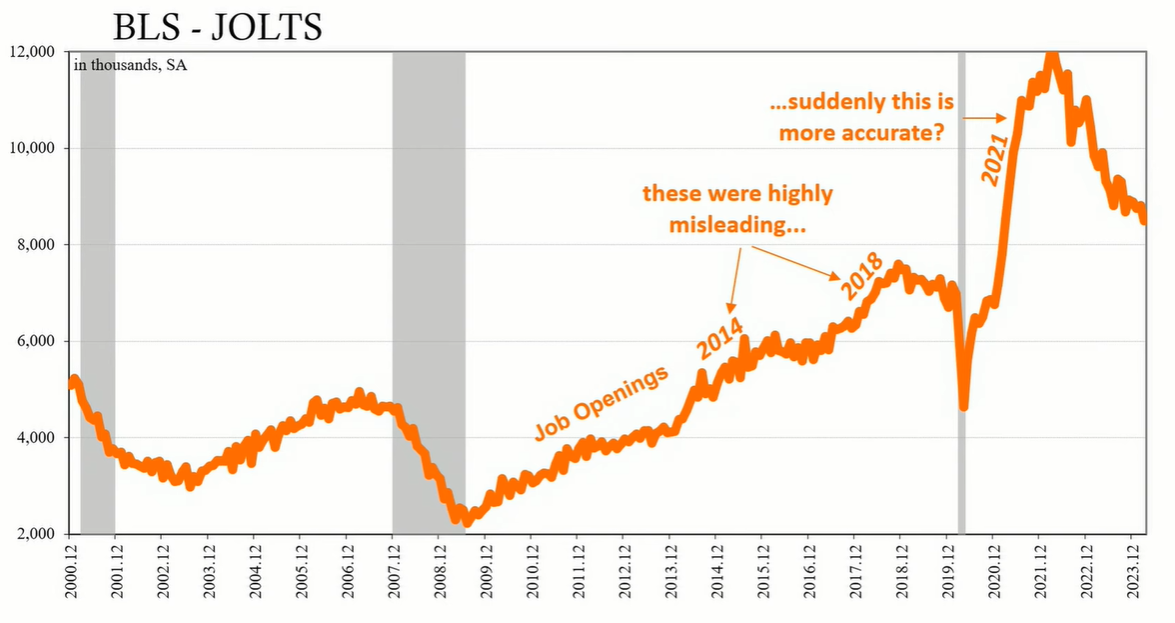

When evaluating the labor market, job openings often receive the most attention. However, the more critical metric to consider is the hiring rate. As of March 2024, the hiring rate fell to the lowest level since December 2017, with only 5.5 million hires recorded, which is even lower than the figures seen in the worst month of 2020, excluding the lockdowns.

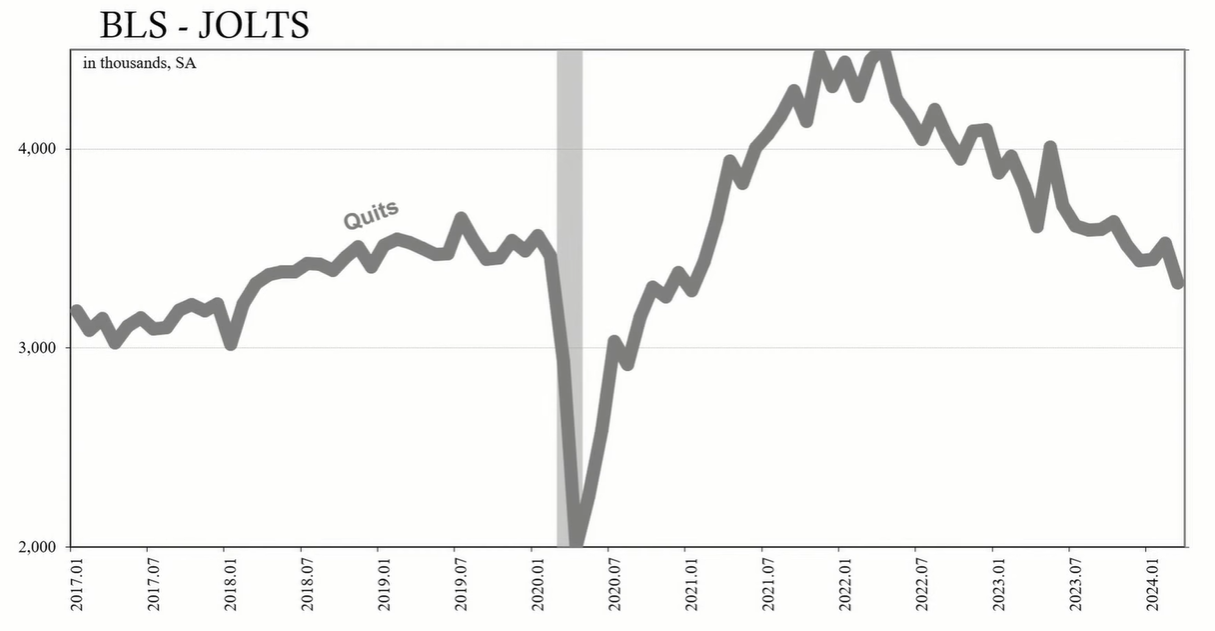

Another crucial piece of data is the 'quits' rate. In March 2024, the quits figure dropped to 3.33 million from 3.53 million in February. This decline suggests that American workers are increasingly aware of the limited job opportunities available and are consequently less inclined to voluntarily leave their jobs.

Despite seemingly positive employment statistics, the reality experienced by job seekers tells a different story. For instance, reports reveal that even highly qualified new graduates are struggling to find employment. Anecdotes from job seekers indicate a disconnect between the reported employment data and the actual ease of obtaining a job.

Various economic indicators and company reports corroborate a weakening labor market. For example, S&P Global reported a reduction in employment for the first time since June 2020, particularly in the services sector. In addition, consumer confidence has declined sharply, with concerns about future business conditions and job availability.

The hiring freeze is not limited to the U.S. but reflects a globally synchronized downturn. Companies are exercising cost control measures, contributing to the hiring freeze and exacerbating consumer pressures. Reports from major restaurant chains like Starbucks and Yum Brands reveal a decrease in sales and transactions, further highlighting the economic challenges.

While the labor market and economy face these difficulties, the Federal Reserve's focus remains on consumer price estimates influenced by factors such as supply issues, geopolitics, and insurance premiums. This focus may overlook the broader economic weakness and contribute to policy decisions that do not align with the labor market realities.

The U.S. labor market is exhibiting signs of significant strain, with hiring rates at multi-year lows and quits declining. Despite positive employment statistics, the lived experiences of job seekers and the reports from various sectors point towards a challenging economic environment. The Federal Reserve's policy decisions, driven by consumer price estimates, may not adequately address the underlying issues in the labor market. As such, the U.S. economy faces the risk of a continued downturn, synchronized with global economic weaknesses.