Recent shifts into contango in the gasoline market and falling oil prices signal significant weaknesses in the U.S. economy.

Recent indicators and market signals have raised concerns about the health of the U.S. economy. These warning signs span across various economic sectors, from the gasoline market to oil prices, and have implications for consumer behavior and overall economic performance.

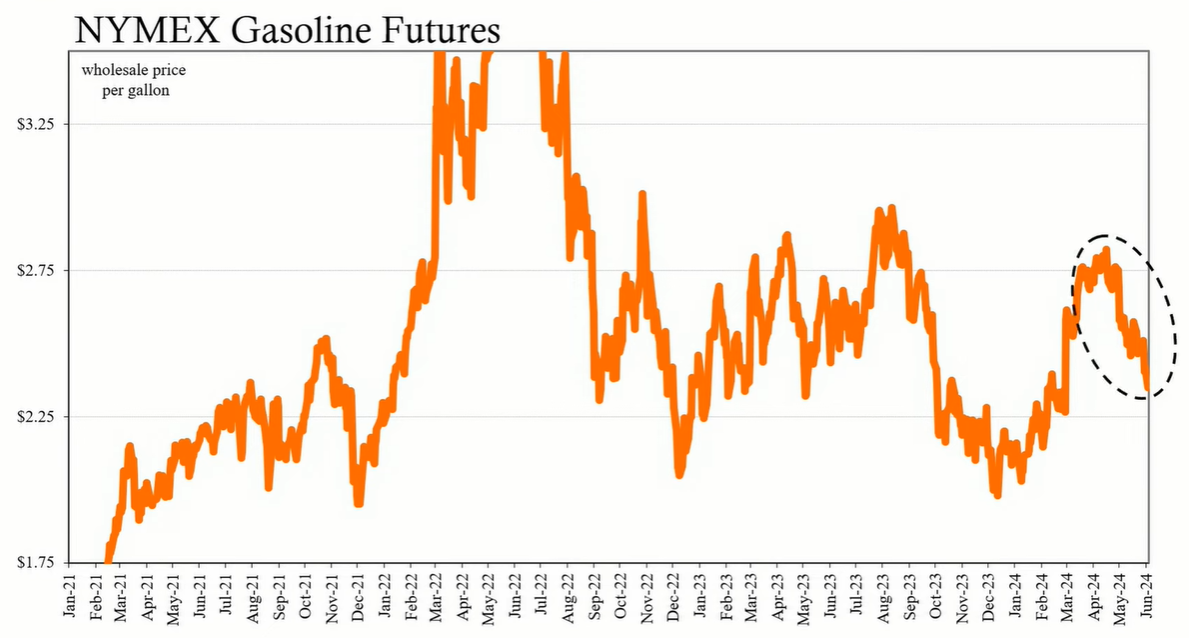

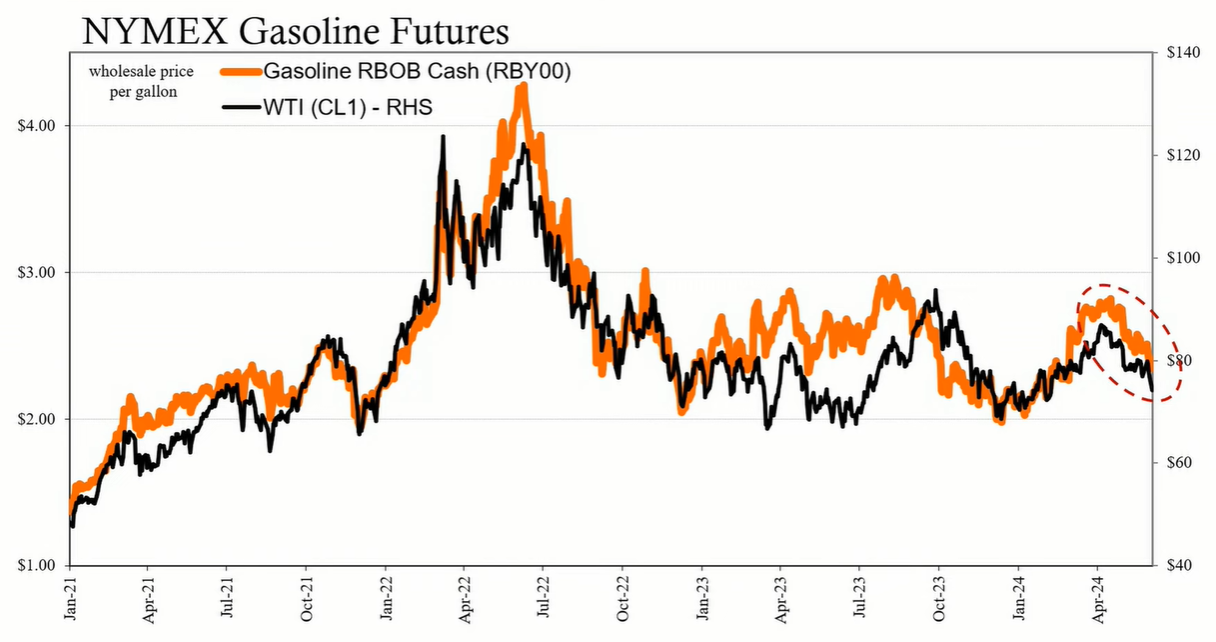

A notable event occurred in the U.S. gasoline market, where futures briefly entered contango for the first time in three years. This market condition suggests an excess of supply over demand, prompting storage of the commodity and signaling potential economic weakness. Despite lower gasoline and oil prices, demand has not rebounded as expected.

The Organization of the Petroleum Exporting Countries (OPEC) plus Russia has acknowledged global economic challenges. Surprisingly, the group has decided to extend production cuts into 2025, aiming to support oil prices amid sluggish demand growth. This move is contrary to expectations that lower oil prices would accompany a weakening economy.

Income data released on Friday showed concerning trends, with U.S. gasoline usage—a significant portion of global oil consumption—indicating reduced demand. This decrease may reflect broader economic issues such as reduced employment or the inability of consumers to afford gasoline.

Despite geopolitical tensions and production cuts, oil prices are declining. West Texas Intermediate (WTI) futures reached their lowest point since February, moving closer to contango, which reflects the weakening demand overriding supply-side factors.

High oil prices in a weak economy are not inherently inflationary; instead, they can be disinflationary, leading to a redistribution of resources from productive sectors to cover increased energy costs. Persistent high energy prices without inflationary pressures can contribute to a recessionary environment.

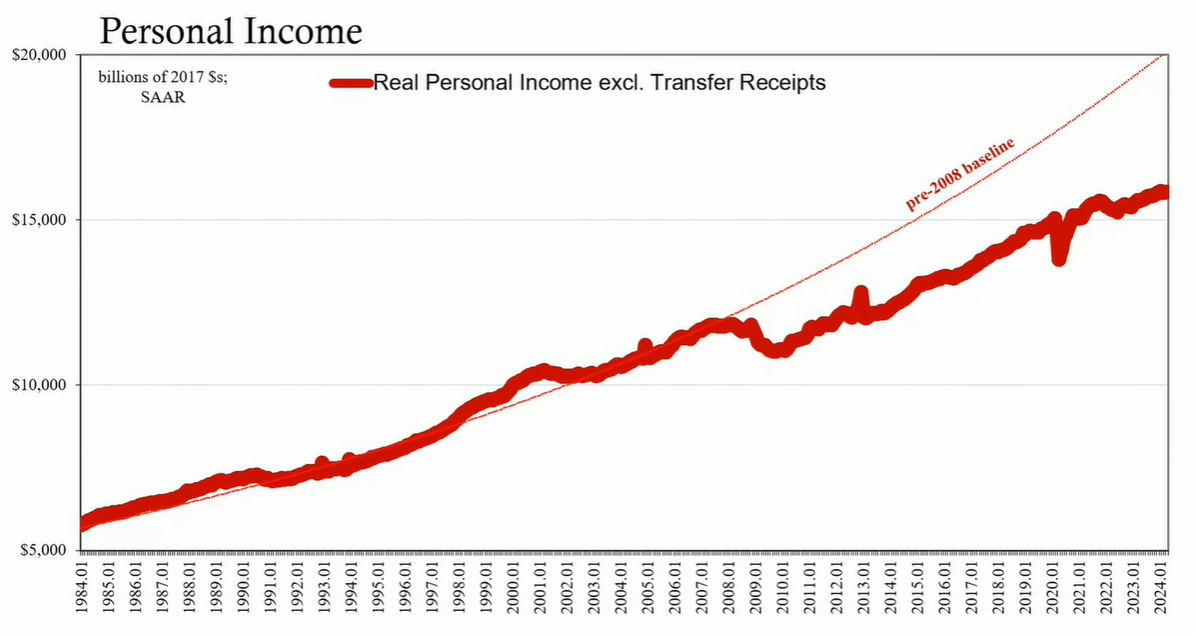

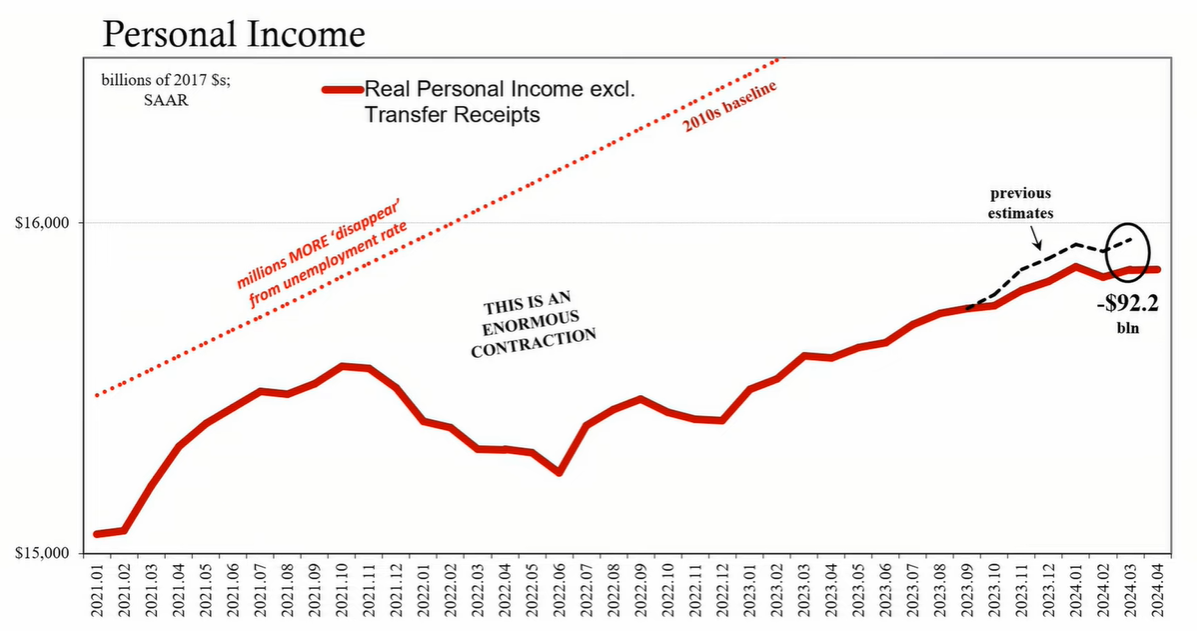

Government statistics revealed a prolonged slump in real personal income excluding transfer receipts, a key indicator for economic health. April's figures showed little to no growth, with substantial downward revisions for previous months. Consumer spending also declined, indicating a strained labor market and a lack of economic momentum.

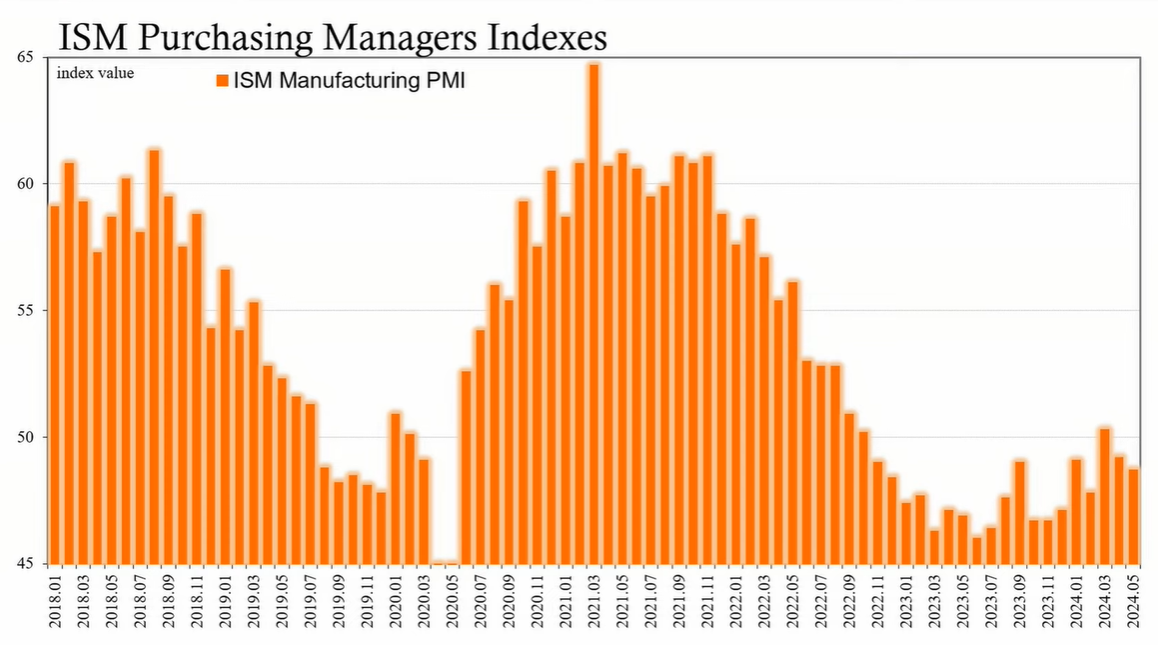

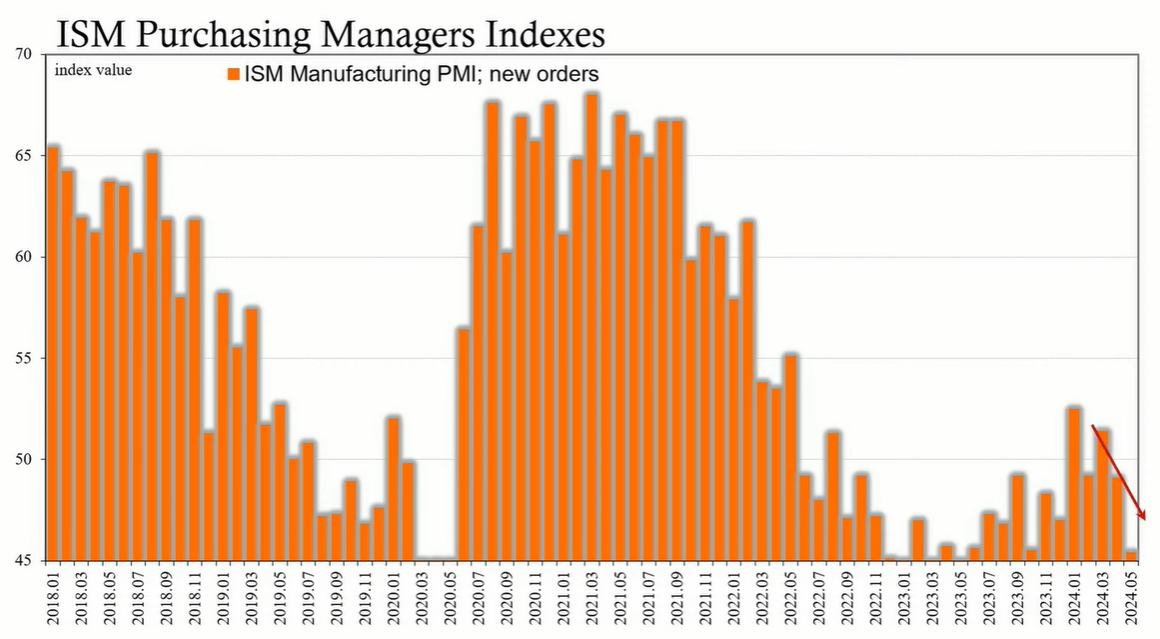

The Institute for Supply Management (ISM) Manufacturing Index and the Chicago Business Barometer have both shown contractions, with new orders, backlog orders, and customer inventories indicating a diminishing demand for production.

The U.S. economy is exhibiting signs of weakness across multiple indicators. The gasoline market's rare shift into contango, OPEC's decision to maintain production cuts, declining oil prices, and concerning economic data all suggest underlying challenges. As consumer spending falters and manufacturing contracts, the outlook for economic resilience seems uncertain.