The US economy exhibits a stark divide between its manufacturing and services sectors, raising questions about its overall health and stability.

Recent data releases have presented conflicting narratives about the state of the US economy. On one hand, the manufacturing sector appears to be experiencing a resurgence, while on the other, the services sector indicates a potential downturn. This discrepancy has led to varied interpretations of economic health and inflation risks.

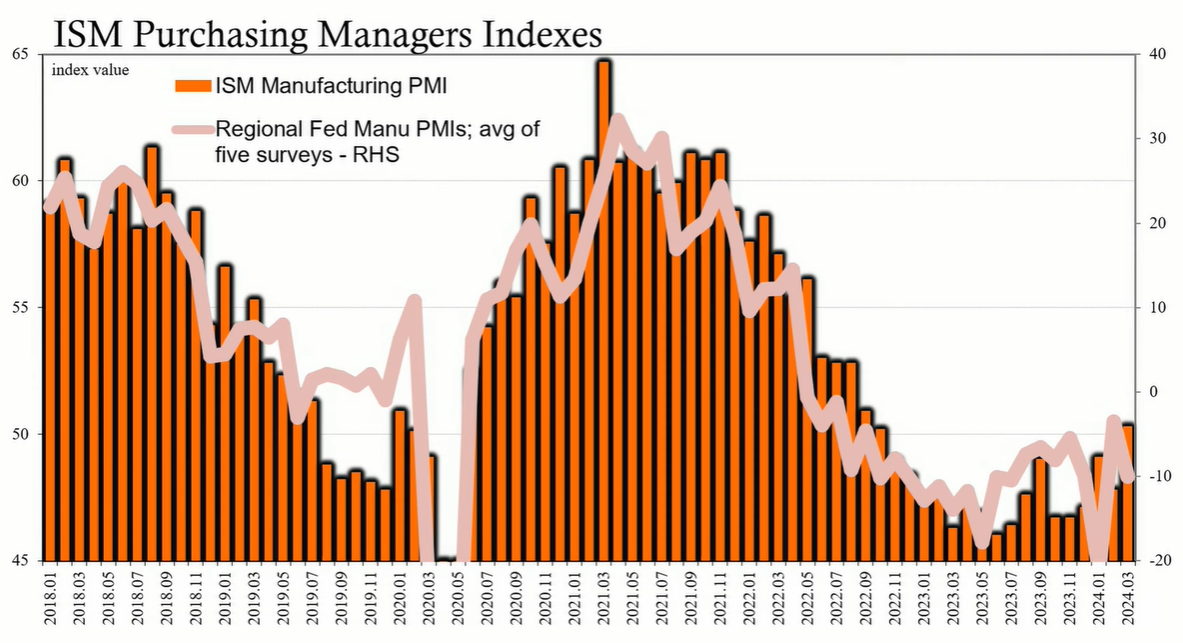

The Institute for Supply Management (ISM) manufacturing index, a key barometer for industrial activity, rose to 50.3, its first time above the neutral 50 mark since October 2022. This uptick suggests that the manufacturing sector may be stabilizing after a prolonged period of contraction. However, the reading is just barely in expansion territory and must be viewed in context with other data.

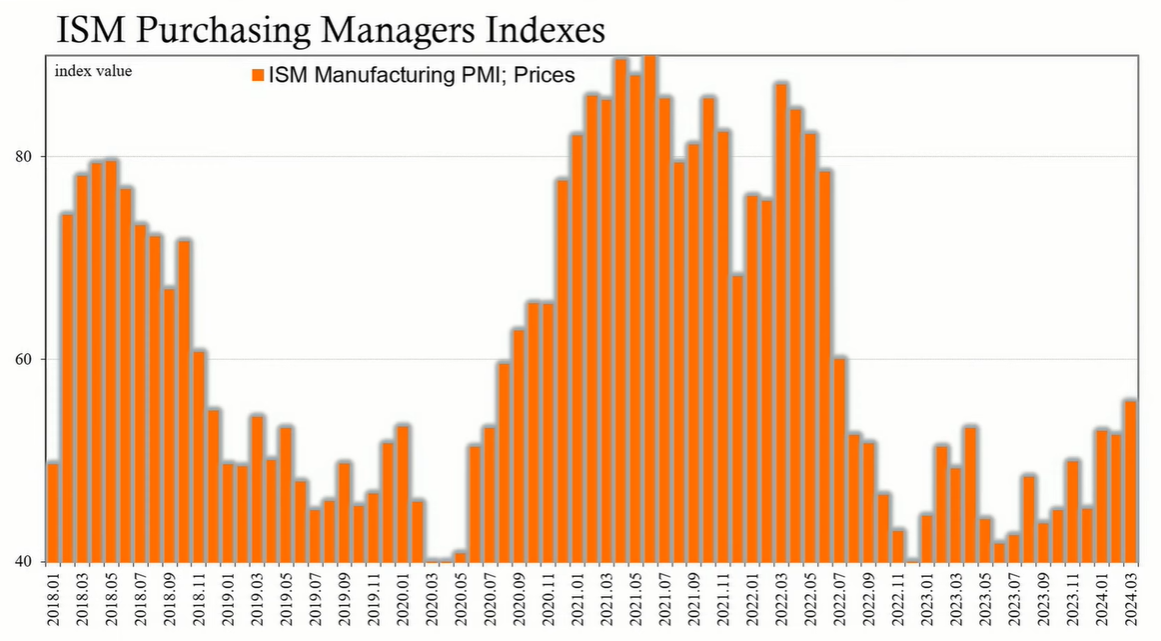

Despite the optimism, the Federal Reserve's regional manufacturing surveys paint a less rosy picture, with continued contraction in several regions. Furthermore, the ISM manufacturing prices index hit 55.8, signaling potential inflationary pressures as prices rise, possibly due to higher energy costs.

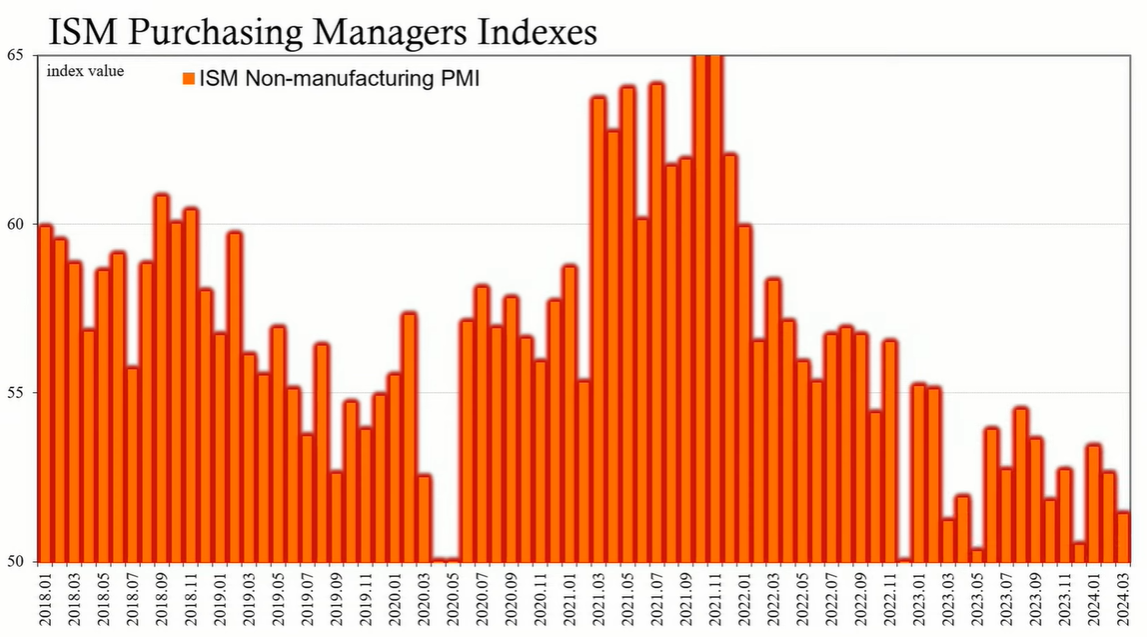

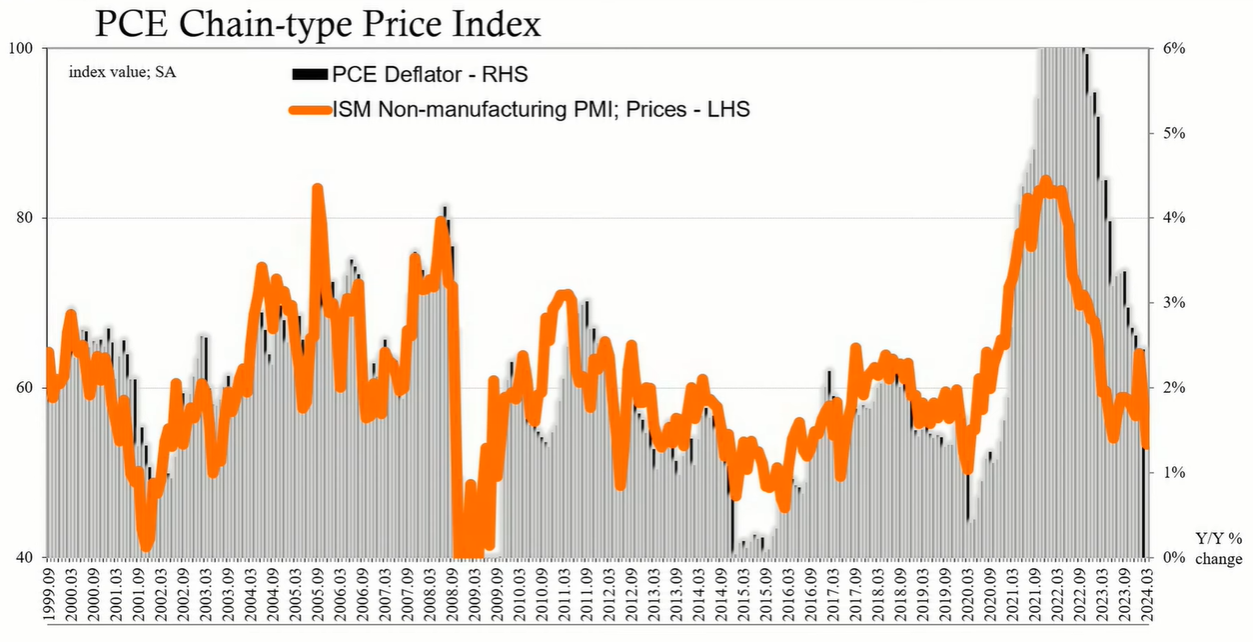

In contrast, the ISM non-manufacturing index, which represents the larger services sector, fell to 51.4, its lowest point since December. The services prices index also decreased, dropping to 53.4, the lowest in four years. Historical analysis suggests that an ISM non-manufacturing index below 53 often correlates with economic recessions or near-recession conditions.

The services index's downward trend is supported by other indicators, including the Personal Consumption Expenditures (PCE) deflator, which tracks closely with the ISM prices index for services. This correlation implies that services sector disinflation is real and ongoing, potentially contradicting the narrative of a booming economy.

The divergence between manufacturing and services data highlights the complexities of economic analysis. While the media may emphasize the positive manufacturing data, the broader and more significant services sector data suggests economic difficulties are present.

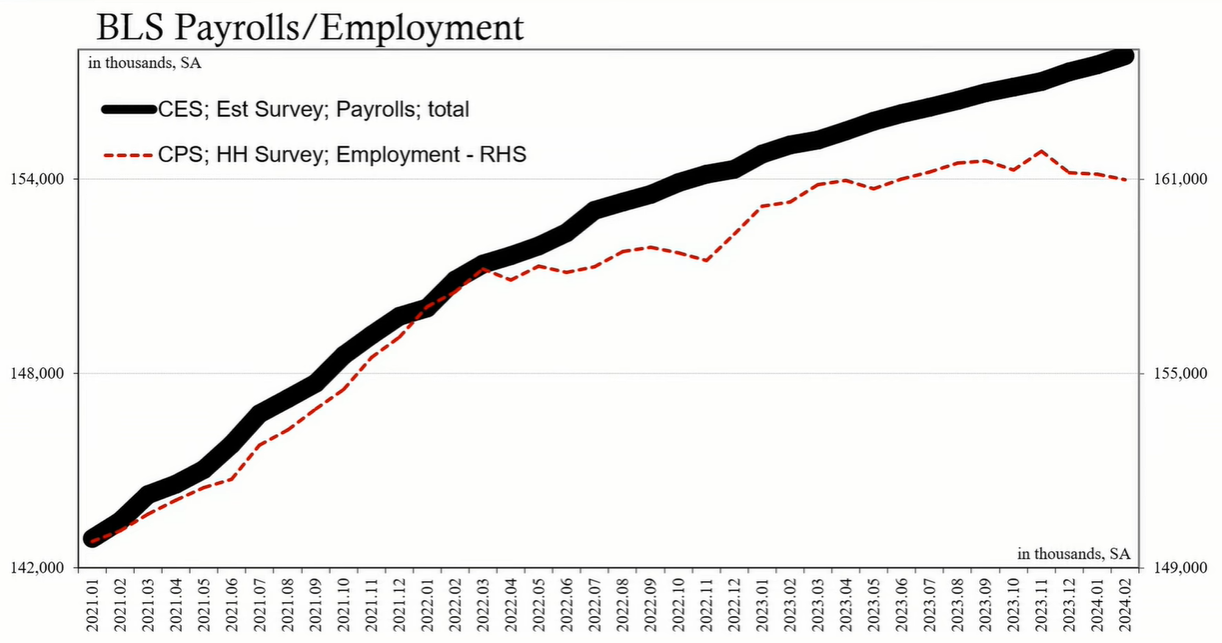

The conflicting signals from the ISM indexes and other economic surveys, like the household and establishment surveys or the Gross Domestic Product (GDP) versus Gross Domestic Income (GDI), reflect the uncertain state of the economy. It is essential to consider the balance of evidence, which currently indicates that the US may not be experiencing a robust economic boom as some reports suggest.

Analyzing the full spectrum of economic data reveals a somewhat confusing picture, one where manufacturing shows tentative signs of stabilization, but the larger services sector continues to struggle with disinflationary pressures. This contrast underscores the need for a cautious interpretation of economic health and inflation risks. Understanding the underlying trends in both manufacturing and services will be crucial for assessing the economy's actual trajectory.