The U.S. GDP revision to 1.3% signals an economic slowdown, prompting a potential reassessment of Federal Reserve policies amid recession fears.

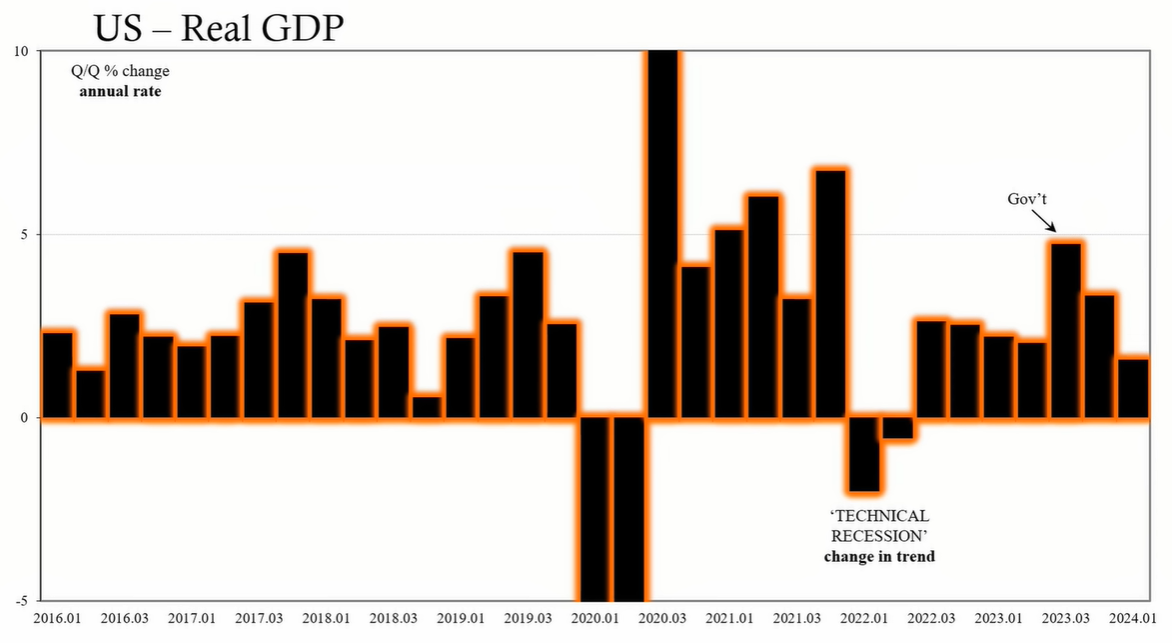

The US economy has experienced a notable slowdown in the first quarter, as revealed by the most recent GDP data. The Bureau of Economic Analysis (BEA) has revised its initial 1.6% GDP growth estimate down to 1.3%. This significant deceleration from a robust 5% growth rate in the previous year has raised concerns and posed critical questions about the future trajectory of the economy.

The initial GDP growth estimate of 1.6%, already the lowest in two years, has been further downgraded to 1.3%, indicating a more pronounced deceleration than initially forecasted. This downturn has led to speculations about the sustainability of the economic momentum and whether the slowdown itself will continue to worsen. The reduction in GDP growth aligns with other economic data that suggests a persistent softening of the US economy.

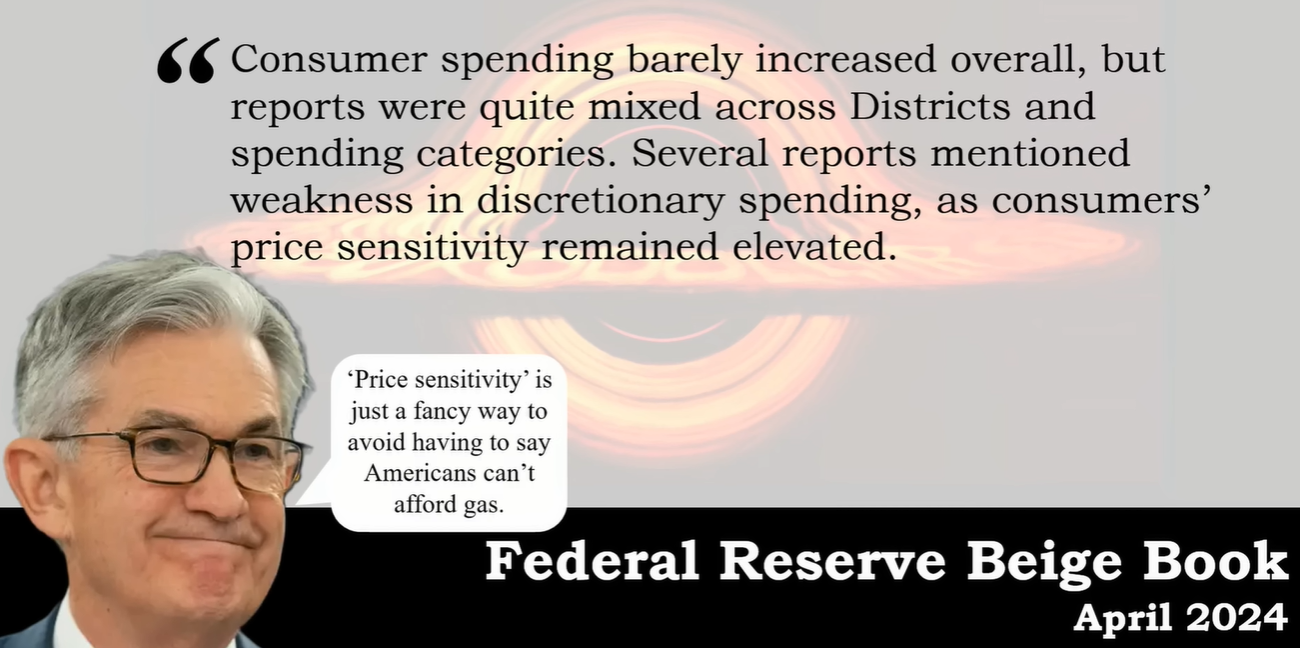

The Federal Reserve (Fed), which has been primarily focused on inflation control, may need to reassess its policy direction in light of the weaker GDP figures. Historically, the Fed has been reactive to consumer price indices and inflationary pressures. However, the softening economy could prompt a policy shift towards stimulating economic growth. Federal Reserve Bank of Atlanta President Raphael Bostic has indicated a potential change in stance, leaning towards a target range that may bring rate cuts into consideration sooner than previously expected.

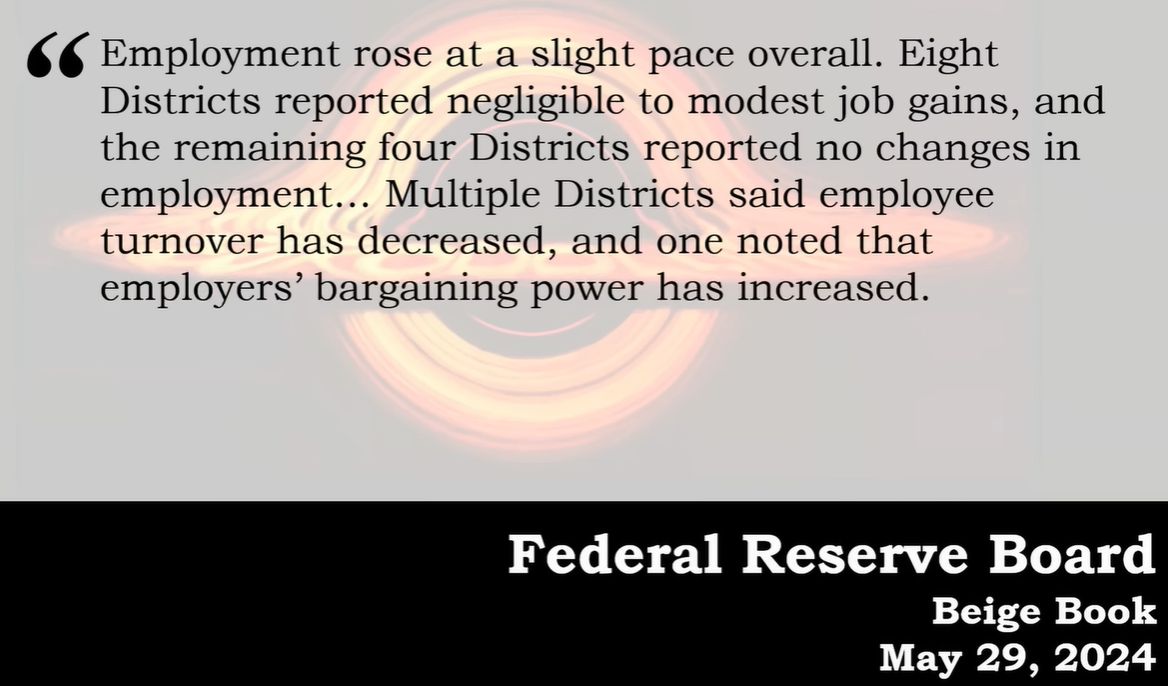

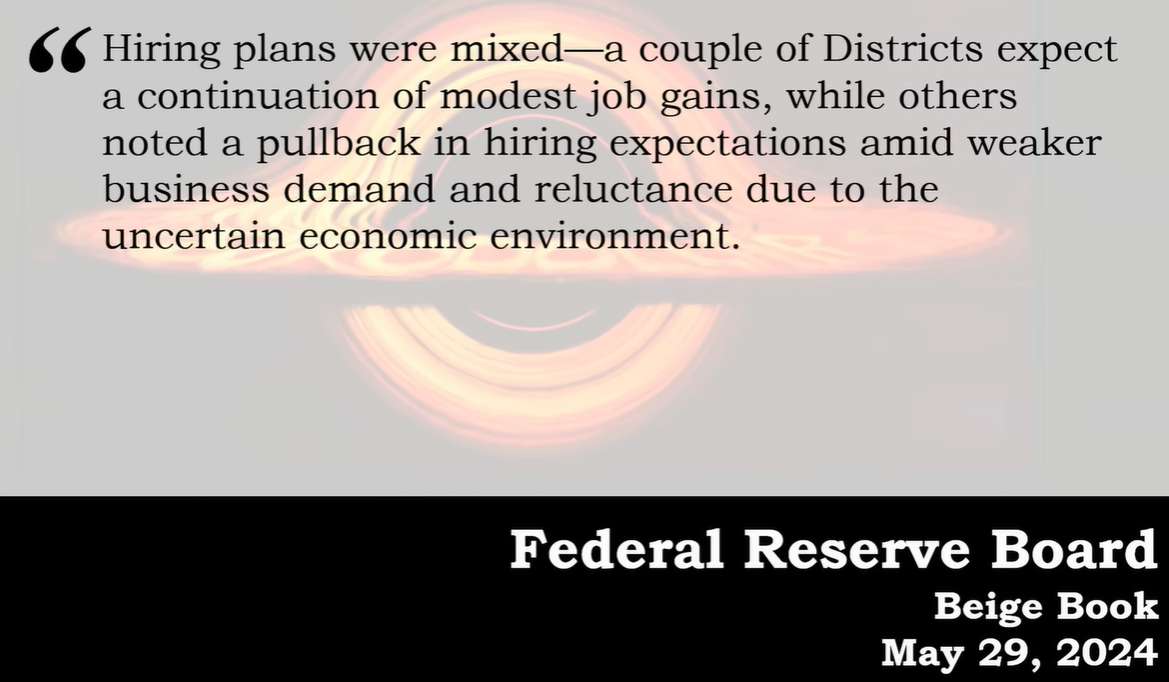

The labor market is another crucial area under scrutiny. The Fed's Beige Book reports only slight employment growth, with eight districts experiencing negligible to modest job gains. Moreover, employee turnover has decreased, suggesting a less robust labor market than before. This change could affect consumer spending, particularly on discretionary items, which is already showing signs of decline.

With the deceleration of GDP growth and concerns over the labor market, the risk of recession looms. Businesses reliant on consumer spending, particularly those in the services sector, may face challenges if the expected summer revenue surge fails to materialize. Employment warnings are at levels not seen since the last economic cycle, indicating apprehension about the trajectory of the economy.

The Fed's potential response to the economic slowdown could involve interest rate cuts. However, there is skepticism about the efficacy of such measures. Previous reliance on monetary policy to stimulate the economy might not yield the same results, especially when the slowdown is driven by deep-rooted structural issues rather than cyclical fluctuations.

The downward revision of GDP growth, coupled with a cooling labor market and reduced consumer spending, paints a bleak picture of the US economy's immediate future. The Federal Reserve may need to pivot from its inflation-centric policy to address the broader economic challenges. Although rate cuts are a traditional tool to combat economic slowdowns, their effectiveness in the current context is uncertain.