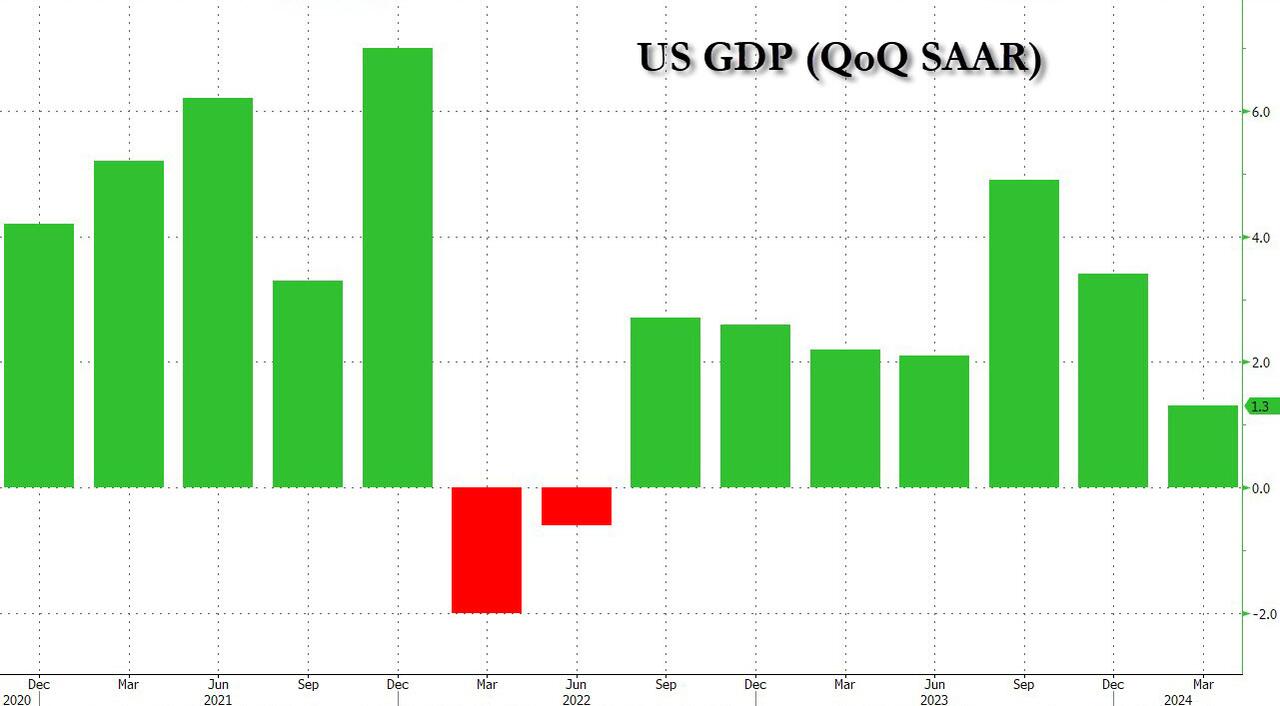

U.S. Q1 GDP revised down to 1.3%, signaling a sharp economic slowdown driven by decreased consumer spending.

The latest gross domestic product (GDP) data reveals a significant slowdown in the U.S. economy, with the annual growth rate for the first quarter of 2022 revised downward to 1.3%, the lowest since the second quarter of the previous year when the economy experienced a contraction for two consecutive quarters. This revision comes from the Bureau of Economic Analysis (BEA) under President Biden's administration and underscores a stark deceleration from the 4.9% and 3.4% annual growth rates reported in the third and fourth quarters of 2024, respectively.

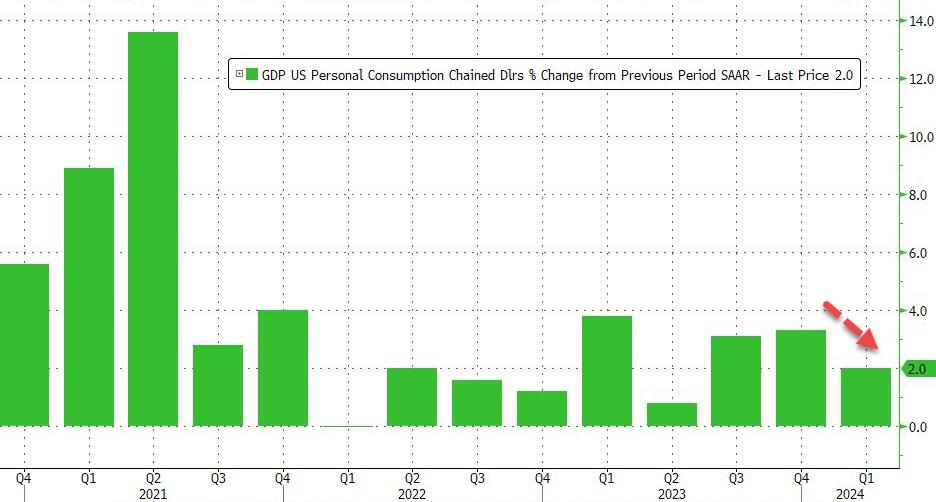

The revised GDP growth rate, initially reported at 1.6%, has been adjusted to 1.3% after a closer examination of consumer spending, which is now indicated to have risen by 2.0% on an annualized basis, a decrease from the previously estimated 2.5% and below the 2.2% forecasted figure. The change in private inventories, which subtracted 0.45% from GDP, and net trade, which detracted 0.89%, were significant factors in the downward revision.

An analysis of the components shows that personal consumption accounted for most of the GDP increase, while fixed investment and government contributions added 1.02% and 0.23%, respectively. Housing investment showed positive trends, particularly in brokers’ commissions, ownership transfer costs, and new single-family housing construction. However, decreases in wholesale trade and manufacturing led to a reduction in inventory investment.

The BEA report also highlighted that purchase prices for U.S. residents increased by 3.0% in Q1 after a 1.9% increase in Q4 of the previous year. The core Personal Consumption Expenditures (PCE) price index, which excludes food and energy, rose by 3.6%, indicating persistent inflationary pressures.

"The GDP number confirms that the US economy is slowing rapidly," according to the revised data, which suggests that consumer challenges, such as high credit usage and wages not keeping pace with inflation, are influencing economic trends.

Despite the sluggish economic performance, market futures responded positively to the report, with investors seemingly optimistic about the potential for future policy adjustments. Analysts are now looking ahead to the PCE report, which will provide further insight into inflation and consumer spending trends.

The revised figures present a challenge for the Biden administration, as it seeks to demonstrate effective economic management amid voter concerns over the president's handling of the economy.