The end of 2023 saw record U.S. credit card delinquencies, signaling mounting financial pressures on consumers amid high inflation and escalating costs.

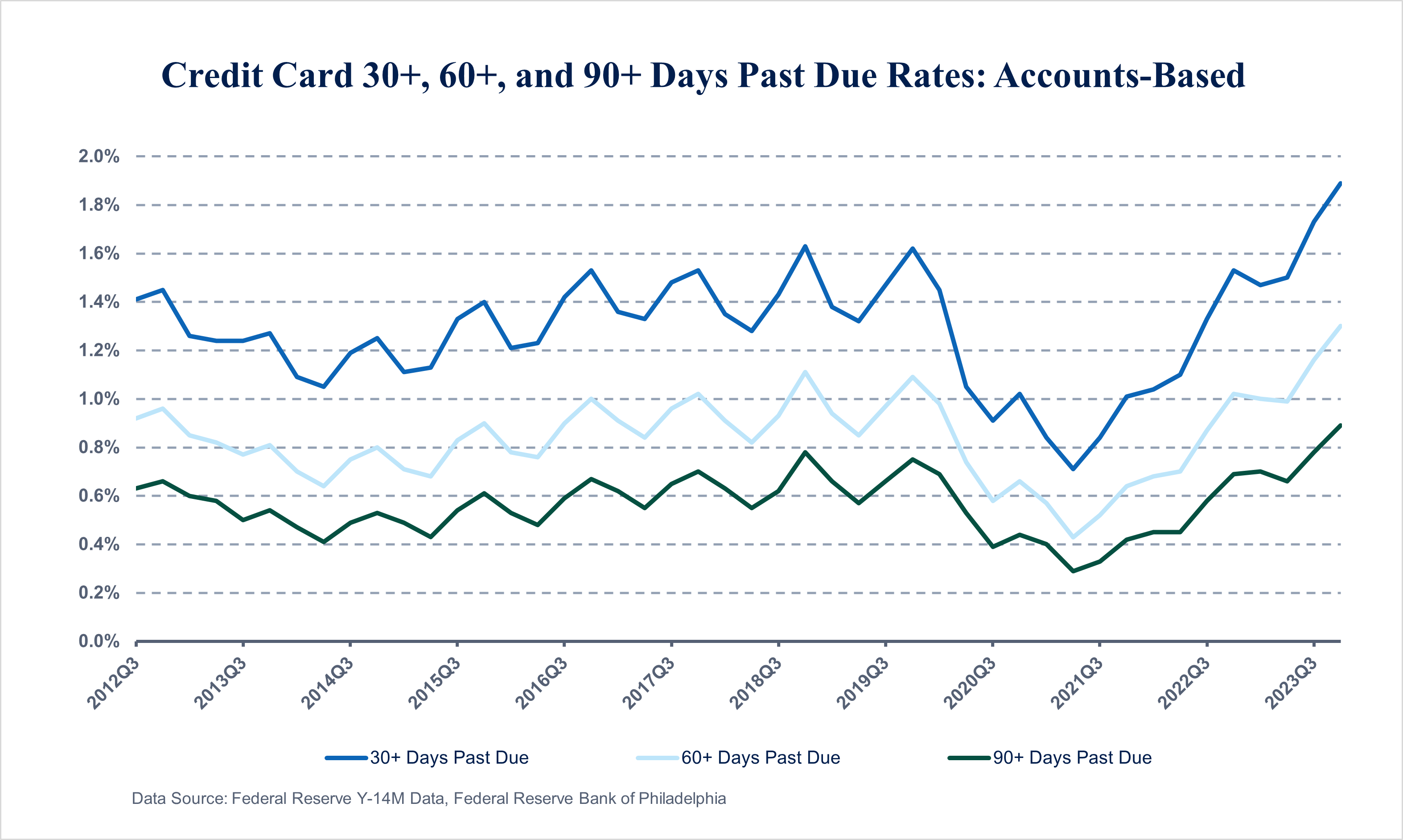

A new report from the Federal Reserve Bank of Philadelphia has revealed a concerning trend among American consumers: credit card delinquencies have surged to a record high. The fourth-quarter 2023 data, released on April 10, indicates that the share of credit card accounts with past-due debt payments has reached unprecedented levels at every time horizon—30, 60, and 90 days.

The report highlights the financial stress cardholders are facing, as evidenced by the rising share of accounts making only minimum payments, which increased by 34 basis points from the previous quarter and also hit a record high. Concurrently, nominal credit card balances escalated to their highest level on record, suggesting that Americans are increasingly dependent on credit to finance their consumption.

High inflation, which saw a resurgence in March, continues to impact household budgets, particularly for essential items like groceries. Over the past four years, food price inflation has officially risen by 24.9 percent, according to U.S. government figures. However, a Wall Street Journal analysis of commonly purchased supermarket goods estimates the real increase at 36.5 percent.

Despite the overall inflation rate decreasing from its peak of 9 percent in June 2022, recent data indicates that price pressures remain elevated, with little sign of immediate relief for households struggling with the increased cost of living. Consequently, the likelihood of missing a minimum debt payment has grown, particularly among those aged 40–60 and individuals earning less than $50,000 a year.

The New York Federal Reserve's March survey revealed that consumers' average perceived probability of missing a minimum debt payment over the next three months has jumped to 12.9 percent, the highest since the onset of the COVID-19 pandemic. Additionally, consumers have grown more pessimistic about future credit access, expecting tighter lending conditions in the coming year.

Job security is also a concern, with the New York Fed survey showing that the mean perceived probability of losing one's job in the next year has increased to 15.7 percent, the highest since 2020. The likelihood of finding a job if one were to lose their current position has also decreased, reaching a near three-year low.

The labor market reflects these anxieties, with job-cut announcements in the first quarter of the year surging by 120 percent compared to the last quarter of 2023, according to Challenger, Gray & Christmas. Inflation data continues to show high price pressures, with the Consumer Price Index (CPI) increasing to 3.5 percent in February.

The Federal Reserve has responded to inflation by raising interest rates to a range of 5.25–5.5 percent, with market predictions leaning towards cuts this year. The U.S. economy's growth rate was solid at 3.4 percent in the fourth quarter of 2023, and the Federal Reserve Bank of Atlanta's GDP estimate for the first quarter of this year stands at 2.4 percent as of April 10.

Federal Reserve Bank of Philadelphia Report