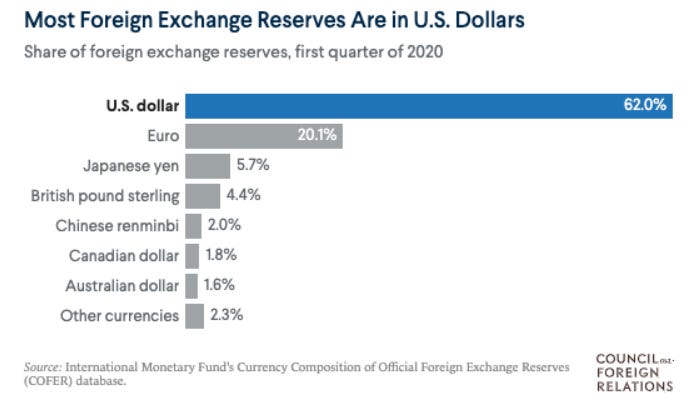

As the Fed begins their journey into a deflationary blizzard, they are beginning to break markets across the globe. As the World Reserve Currency, over 60% of all international trade is done in Dollars, and USDs are the largest Foreign Exchange (Forex) holdings by far for global central banks. Now many foreign currencies are crashing against the Dollar as the vicious feedback loops of Triffin’s Dilemma come home to roost. The Dollar Milkshake has begun.

The Fed, knowingly or not, has walked into this trap- and now they find themselves caught underneath the Sword of Damocles, with no way out…

“The famed “sword of Damocles” dates back to an ancient moral parable popularized by the Roman philosopher Cicero in his 45 B.C. book “Tusculan Disputations.” Cicero’s version of the tale centers on Dionysius II, a tyrannical king who once ruled over the Sicilian city of Syracuse during the fourth and fifth centuries B.C.

Though rich and powerful, Dionysius was supremely unhappy. His iron-fisted rule had made him many enemies, and he was tormented by fears of assassination—so much so that he slept in a bedchamber surrounded by a moat and only trusted his daughters to shave his beard with a razor.

As Cicero tells it, the king’s dissatisfaction came to a head one day after a court flatterer named Damocles showered him with compliments and remarked how blissful his life must be. “Since this life delights you,” an annoyed Dionysius replied, “do you wish to taste it yourself and make a trial of my good fortune?” When Damocles agreed, Dionysius seated him on a golden couch and ordered a host of servants wait on him. He was treated to succulent cuts of meat and lavished with scented perfumes and ointments.

Damocles couldn’t believe his luck, but just as he was starting to enjoy the life of a king, he noticed that Dionysius had also hung a razor-sharp sword from the ceiling. It was positioned over Damocles’ head, suspended only by a single strand of horsehair.

From then on, the courtier’s fear for his life made it impossible for him to savor the opulence of the feast or enjoy the servants. After casting several nervous glances at the blade dangling above him, he asked to be excused, saying he no longer wished to be so fortunate.”

—---------------

Damocles’ story is a cautionary tale of being careful of what you wish for- Those who strive for power often unknowingly create the very systems that lead to their own eventual downfall. The Sword is often used as a metaphor for a looming danger; a hidden trap that can obliterate those unaware of the great risk that hegemony brings.

Heavy lies the head which wears the crown.

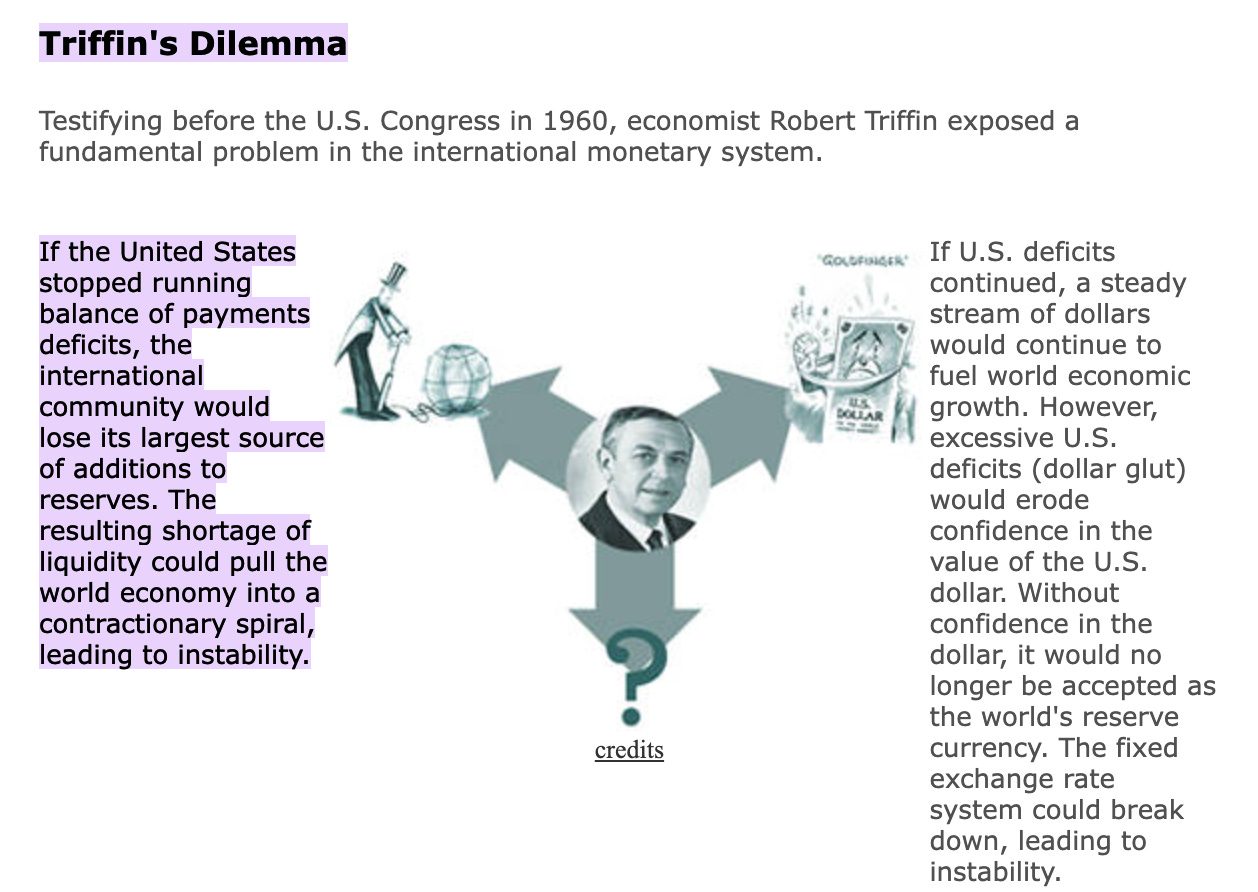

There are several Swords of Damocles hanging over the world today, but the one least understood and least believed until now is Triffin’s Dilemma, which lays the bedrock for the Dollar Milkshake Theory. I’ve already written extensively about Triffin’s Dilemma around a year ago in Part 1.5 and Part 4.3 of my Dollar Endgame Series, but let’s recap again.

Here’s a great summary- read both sides of the dilemma:

Essentially, Triffin noted that there was a fundamental flaw in the system: by virtue of the fact that the United States is a World Reserve Currency holder, the global financial system has built in GLOBAL demand for Dollars. No other fiat currency has this.

How is this demand remedied? With supply of course! The United States thus is forced to run current account deficits - meaning it must send more dollars out into the world than it receives on a net basis. This has several implications, which again, I already outlined- but I will list in summary format below:

The example I gave in Dollar Endgame was that of Liberia, a small West African Nation looking to enter global trade. Needing to hold dollars as part of their exchange reserves, the Liberian Central Bank begins buying USDs on the open market. The process works in a similar fashion for large Liberian export companies.

Essentially, they print their own currency to buy Dollars. Wanting to earn interest on this massive cash hoard when it isn’t being used, they buy Treasuries and other US debt securities to get a yield.

As their domestic economy grows, their need and dependence on the Dollar grows as well. Their Central Bank builds up larger and larger hoards of Treasuries and Dollars. The entire thesis is that during times of crisis, they can sell the Treasuries for USD, and use the USDs to buy back their own currency on the market- supporting its value and therefore defending the peg.

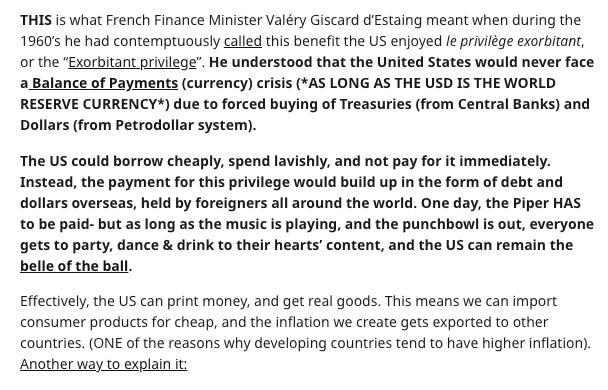

This buying pressure on USDs and Treasuries brings a massive benefit to the United States-

This buildup of excess dollars ends up circulating overseas in banks, trade brokers, central banks, governments and companies. These overseas dollars are called the Eurodollar system- a 2016 research paper estimated the size to be around $13.8 Trillion USD. This system is not under official Federal Reserve jurisdiction so it is difficult to get accurate numbers on its size.

This means the Dollar is always artificially stronger than it should be- and during financial calamity, the dollar is a safe haven as there are guaranteed bidders.

All this dollar denominated debt paired with the global need for dollars in trade creates strong and persistent dollar demand. Demand that MUST be satisfied.

This creates systemic risk on a worldwide scale- an unforeseen Sword of Damocles that hangs above the global financial system. I’ve been trying to foreshadow this in my Dollar Endgame Series.

Triffin’s Dilemma is the basis for the Dollar Milkshake Theory posited by Brent Johnson.

I should note that Brent has had this theory for years, dating back to 2017/2018, when he first came on podcasts and interviews and laid out his theory (like this video, for example).

Here’s the summary:

A giant milkshake of liquidity has been created by global central banks with the dollar as its key ingredient - but if the dollar moves higher this milkshake will be sucked into the US creating a vicious spiral that could quickly destabilize financial markets.

The US dollar is the bedrock of the world's financial system. It greases the wheels of global commerce and exchange- the availability of dollars, cost of dollars, and the level of the dollar itself each can have an outsized impact on economies and investment opportunities.

But more important than the absolute level or availability of dollars is the rate of change in the level of the dollar. If the level of the dollar moves too quickly and particularly if the level rises too fast then problems start popping up all over the place (foreign countries begin defaulting).

Today however many people are convinced that both the role of the Dollar is diminishing and the level of the dollar will only decline. People think that the US is printing so many dollars that the world will be awash with the greenback causing the value of the dollar to fall.

Now it's true that the US is printing a lot of dollars – but other countries are also printing their own currencies in similar amounts so in theory it should even out in terms of value.

But the hidden issue is the difference in demand. Remember the global financial system is built on the US dollar which means even if they don't want them everybody still needs them and if you need something you don't really have much choice. (See DXY Index):

Although many countries like China are trying to reduce their reliance on dollar transactions this will be a very slow transition. In the meantime the risks of a currency or sovereign debt crisis continue to rise.

But now countries like China and Japan need dollars to buy copper from Australia so the Chinese and the Japanese owe dollars and Australia is getting paid in dollars.

Europe and Asia currently doing very limited amount of non-dollar transactions for oil so they still need dollars to buy oil from saudi and again dollars get hoovered up on both sides

Asia and Europe need dollars to buy soybeans from Brazil. This pulls in yet more dollars - everybody needs dollars for trade invoices, central bank currency reserves and servicing massive cross-border dollar denominated debts of governments and corporations outside the USA.

And the dollar-denominated debt is key- if they don't service their debts or walk away from their dollar debts their funding costs rise putting great financial pressure on their domestic economies. Not only that, it can lead to a credit contraction and a rapid tightening of dollar supply.

The US is happy with the reliance on the greenback- they own the settlement system which benefits the US banks who process all the dollars and act as gatekeepers to the Dollar system.

They police and control the access to the system, which benefits the US military machine where defense spending is in excess of any other country- so naturally the US benefits from the massive volumes of dollar usage.

Other countries have naturally been grumbling about being held hostage to the situation but the choices are limited.

What it does mean is that dollars need to be constantly sucked out of the USA because other countries all over the world need them to do business and of course the more people there are who need and want those dollars, the more is the pressure on the price of dollars to go up.

In fact, global demand is so high that the supply of dollars is just not enough to keep up, even with the US continually printing money. This is why we haven't seen consistently rising US inflation despite so many QE and stimulus programs since the global financial crisis in 2008.

But, the real risk comes when other economies start to slow down or when the US starts to grow relative to the other economies. If there is relatively less economic activity elsewhere in the world then there are fewer dollars in global circulation for others to use in their daily business and of course if there are fewer in circulation then the price goes up as people chase that dwindling source of dollars.

Which is terrible for countries that are slowing down because just when they are suffering economically they still need to pay for many goods in dollars and they still need to service their debts which of course are often in dollars too.

….

So the vortex begins, or as we like to say the dollar milkshake- As the level of the dollar rises the rest of the world needs to print more and more of its own currency to then convert to dollars to pay for goods and to service its dollar debt.

This means the dollar just keeps on rising, and in response many countries will be forced to devalue their own currencies- so of course the dollar rises again, and this puts a huge strain on the global system.

(see the charts below:)

To make matters worse in this environment the US looks like an attractive safe haven so the US ends up sucking in the capital from the rest of the world-the dollar rises again. Pretty soon you have a full-scale sovereign bond and currency crisis.

We're now into that final napalm run that sees the dollar and dollar assets accelerate even higher and this completely undermines global markets. Central banks try to prevent disorderly moves, but the global markets are bigger and the momentum unstoppable once it takes hold.

And that is the risk that very few people see coming but that everyone should have a hedge against - when the US sucks up the dollar milkshake, bad things are going to happen.

Worst of all there's no alternatives- what are you going to use-- Chinese Yuan? Japanese Yen? the Euro??

Now, like it or not we're stuck with a dollar underpinning the global financial system.

—-------------

Why is it playing out now, in real time?? It all leads back to a tweet I made in a thread on September 16th, 2022.

The Fed, rushing to avoid a financial crisis in March 2020, printed trillions. This spurred inflation, which they then swore to fight. Thus they began hiking interest rates on March 16th, and began Quantitative Tightening this summer.

QE had stopped- No new dollars were flowing out into a system which has a constant demand for them. Worse yet, they were hiking completely blind-

Although the Fed is very far behind the curve, (meaning they are hiking far too late to really combat inflation)- other countries are even farther behind!

Japan has rates currently at 0.00- 0.25%, and the Eurozone is at 1.25%. These central banks have barely begun hiking, and some even swear to keep them at the zero-bound. By hiking domestic interest rates above foreign ones, the Fed is incentivizing what are called carry trades.

Since there is a spread between the Yen and the Dollar in terms of interest rates, it thus is profitable for traders to borrow in Yen (shorting it essentially) and buy Dollars, which can earn 2.25% interest. The spread would be around 2%.

USD rises, and the Yen falls, in a vicious feedback loop.

Thus capital flows out of Japan, and into the US. The US sucks up the Dollar Milkshake, draining global liquidity. As I’ve stated before, this has seriously dangerous implications for the global financial system.

For those of you who don’t believe this could be foreseen, check out the ending paragraphs of Dollar Endgame Part 4.3 - “Economic Warfare and the End of Bretton Woods” published February 16, 2022:

What I’ve been attempting to do in my work is restate Triffins’ Dilemma, and by extension the Dollar Milkshake, in other terms- to come at the issue from different angles.

Currently the Fed is not printing money. Which is thus causing havoc in global trade (seen in the currency markets) because not enough dollars are flowing out to satisfy demand.

The Fed must therefore restart QE unless it wants to spur a collapse on a global scale. Remember, all these foreign countries NEED to buy, borrow and trade in a currency that THEY CANNOT PRINT!

We do not have enough time here to go in depth on the Yen, Yuan, Pound or the Euro- all these currencies have different macro factors and trade factors which affect their currencies to a large degree. But the largest factor by FAR is Triffin’s Dilemma + the Dollar Milkshake, and their desperate need for dollars. That is why basically every fiat currency is collapsing versus the Dollar.

The Fed, knowingly or not, is basically in charge of the global financial system. They may shout, “We raise rates in the US to fight inflation, global consequences be damned!!” - But that’s a hell of a lot more difficult to follow when large G7 countries are in the early stages of a full blown currency crisis.

The most serious implication is that the Fed is responsible for supplying dollars to everyone. When they raise rates, they trigger a margin call on the entire world. They need to bail them out by supplying them with fresh dollars to stabilize their currencies.

In other words, the Fed has to run the loosest and most accommodative monetary policy worldwide- they must keep rates as low as possible, and print as much as possible, in order to keep the global financial system running. If they don’t do that, sovereigns begin to blow up, like Japan did last week and like England did on Wednesday.

And if the world’s financial system implodes, they must bail out not only the United States, but virtually every global central bank. This is the Sword of Damocles. The money needed for this would be well in the dozens of trillions.

Originally written on Dollar End Game