Do we need inflation? Should we be thanking the Fed for everything they steal? One of the biggest barriers people have to replacing paper money with gold or Bitcoin is the idea that inflation is necessary. Central banks, and the academic economists they pay, have been very successful at convincing

Do we need inflation? Should we be thanking the Fed for everything they steal?

One of the biggest barriers people have to replacing paper money with gold or Bitcoin is the idea that inflation is necessary.

Central banks, and the academic economists they pay, have been very successful at convincing the public that inflation is a good thing. That we'd be impoverished, perhaps society would collapse, if we didn't pay them to siphon our wealth and hand it to bankers and governments.

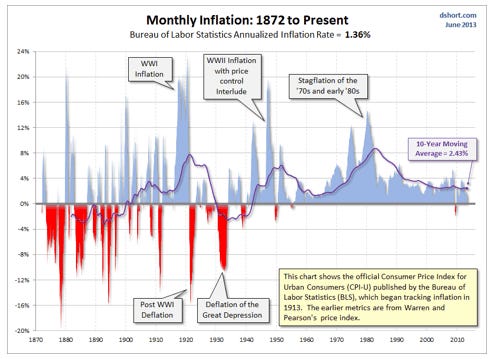

Of course, the opposite is true: Golden Ages in history are deflationary, not inflationary. Because deflation happens when the stuff grows faster than the money. All else equal, if your economy is making 10% more than last year and the money hasn't changed, each dollar is worth 10% more. It cost 10 bucks last year now it only costs 9 because we’re richer.

So why do central banks get away with trash-talking deflation?

Because there’s another kind of deflation, the bad kind, where you’re not making 10% more stuff, instead it was the number of dollars that suddenly plunged. Fewer dollars chasing stuff will also give you deflation.

The problem is why exactly money suddenly shrink. Historically, it could be some cataclysm -- war, say -- that made people save and stop spending, taking money out of circulation.

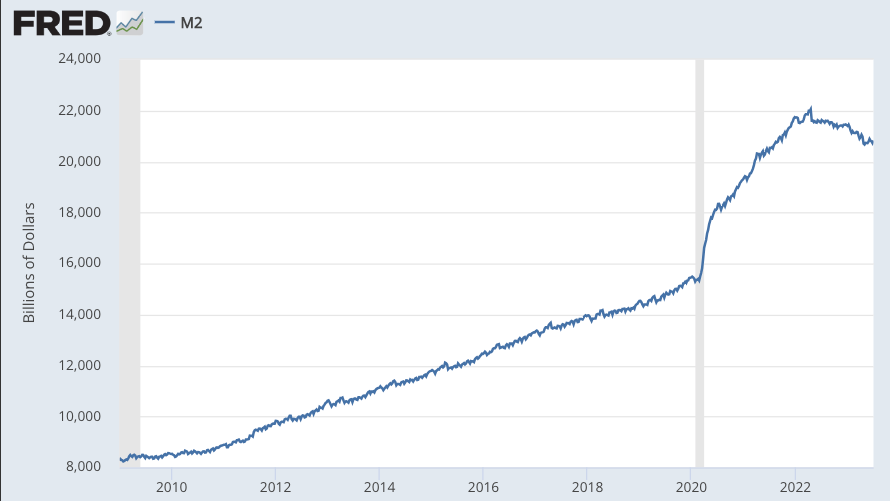

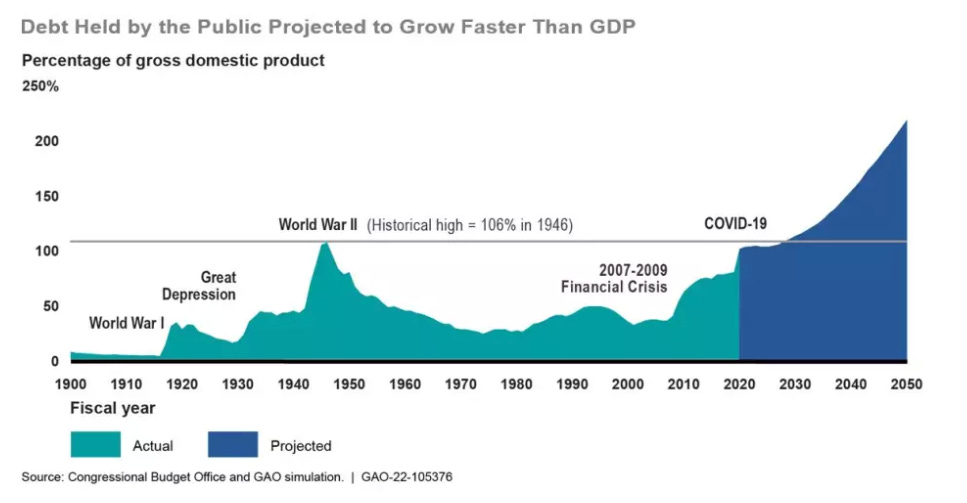

Of course, it’s been a long time since the Napoleonic Wars. Nowadays, money supply only crashes because a central bank artificially pumped out cheap money which then evaporated. That is, the money was lent to reckless companies or banks, and when they failed their debts evaporated.

Since debts act like money to the lender — they think of it as an asset — this also makes them set aside money just like savings. If it’s a big crash, it can look like war.

This happens in every central bank bust — in 1929, in the 1970’s, in 2008. And that kind of deflation is very bad.

In other words, central banks use the exact deflation they themselves create to argue all deflation is bad. So they poison us, then they hold up the poison as the reason to keep poisoning us.

Good work if you can get it.

Of course, they do this because by attacking all deflation, they have their excuse to counterfeit up those trillions. They are saving us from ourselves.

So what happens if we go to a hard money like gold or Bitcoin?

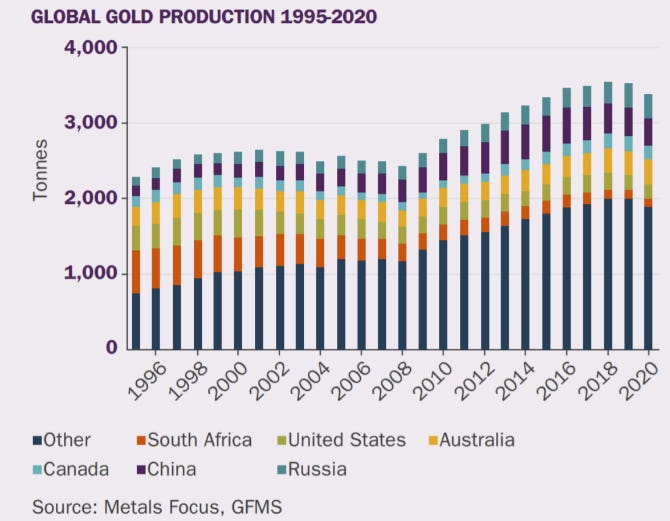

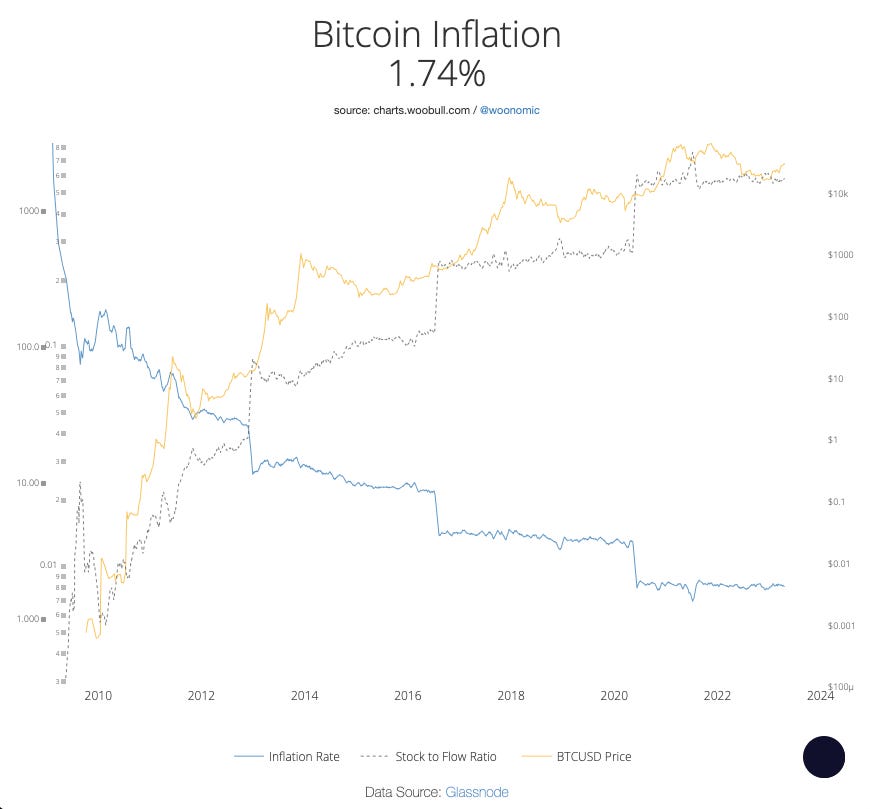

In that case money would grow a lot slower than paper, which has grown by 6.5% per year since 2008. How much? If we go with gold, about 1.2% of the gold in existence is mined each year. If we go with Bitcoin, about 1.7% of the supply is created each year, dropping to 0.9% next year due to Bitcoin’s pre-scheduled “halving.” And then dropping in half every 4 years after that — 0.4% in 2028, 0.2% in 2032, and so on.

So now we can just run through the math:

Under today’s paper dollar, 6.5% is printed per year since 2008, while the economy grew by 2% over that time. And we had 2.5% official inflation over that period. The final 2% was saved — it’s locked away in somebody’s bank account.

Now, what happens if we go to gold?

Assuming economic growth, savings, and mining don’t change — more on that in a moment — we’d be “printing” 1.2% of of gold supply each year, with a 2% economy and 2% savings. So we’d have about 2.8% deflation — 1.2% change supply minus 4% change in demand. What cost $100 today would only cost $97.20 in a year.

You’d still have lending, in fact you’d still have the entire financial system, just as we did under gold in the 1950’s. The most important change, aside from the end of inflation, would be a dramatic reduction in the boom-bust cycle, the inflation-recession cycle of paper money.

Meanwhile, we’d have a much smaller government since they couldn’t print up trillions to blow on foreign wars or Covid lockdowns.

For Bitcoin, the math’s identical: 1.7% supply growth vs 4% in economic growth and savings comes to 2.3% annual deflation. What costs $100 now would cost $97.70 in a year. Starting in 2024 it would be 3.2% annual deflation and so on, approaching 4% as the “halvings” proceed.

Now, all this gets more interesting because a hard money world is so different than today. So we probably get higher economic growth, higher savings, higher mining if we went with gold. These would largely be capitalized in the gold or Bitcoin price — they’d go up a lot.

Conclusion

Hard money, whether gold or Bitcoin, is arguably the most important reform to fix the world.

It returns us to the healthy deflation that built the United States -- that built the entire West -- into the richest societies mankind had ever seen. We would invent things we can't imagine -- in fact our greatest golden age, the Victorian Era, was literally known as the “long deflation.”

We would reduce the boom-bust cycles of inflation and recession, reduce the cancer of government, the endless wars and endless bureaucracies who dream up new straitjackets from climate mandates to CBDC’s.

It won't happen tomorrow – historically, fiat regimes don't go quietly. But if we get back to hard money, to our golden age of deflation, we'll be handing our children a world we can be proud of.

Sign up to my free email list to get weekly posts on what’s happening in economy and freedom. Choose the $5 option if you’d like to support the content — everything’s audience-supported.

I’ve also got a brand new website at Peterstonge.com with the daily videos, weekly podcast, and all the articles in one spot.

This was originally written on profstonge.com