Explore the mechanics and impact of Bitcoin halving events, where miner rewards halve every four years, shaping Bitcoin's scarcity and price dynamics.

Bitcoin has introduced a novel approach to creating and distributing digital money. Central to this system is the process of mining, wherein miners are rewarded with newly minted bitcoins for validating transactions and securing the network. However, an event known as the Bitcoin halving plays a critical role in the long-term viability and value of Bitcoin. This essay provides an objective exploration of the Bitcoin halving, its purpose, mechanics, and the implications it has on the economics of Bitcoin and the broader financial landscape.

To understand the concept of Bitcoin halving, one must first comprehend the process of Bitcoin mining. Miners use powerful computers to solve complex cryptographic puzzles, which in turn validates transactions and adds them to the blockchain. As a reward for this service, miners receive block rewards, consisting of newly created bitcoins and transaction fees.

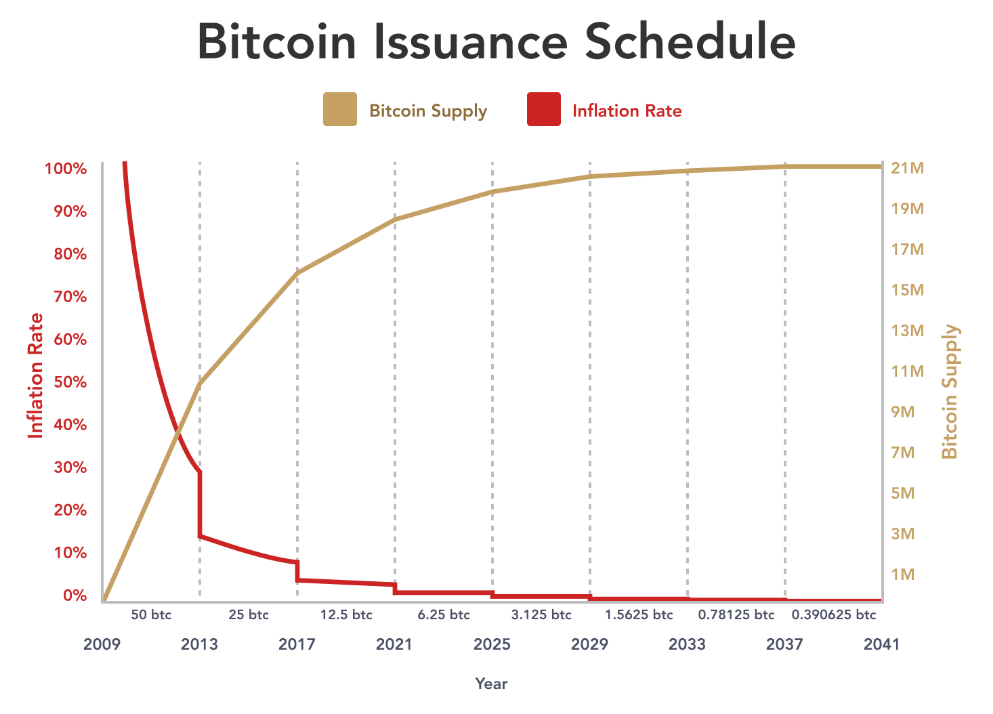

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, designed the protocol with a hard cap of 21 million coins to ensure scarcity. The halving event, hardcoded into the Bitcoin protocol, slashes the block reward by 50% after every 210,000 blocks mined, approximately every four years. This mechanism ensures that the issuance of new bitcoins slows down over time, positioning Bitcoin as a deflationary asset.

Block rewards serve as a critical incentive for miners to participate in the network. By receiving bitcoins for their efforts, miners are motivated to contribute computational power to maintain and secure the blockchain. This incentive is crucial, particularly in the early years of Bitcoin's existence, when the network requires robust fortification against potential attacks. However, the block reward also represents a significant financial burden for miners, who often have to sell a portion of their rewards to cover operational and electricity costs.

The timing of Bitcoin halving is predictable, with the event occurring every 210,000 blocks. Given the average block time of 10 minutes, a halving transpires roughly every four years. Since its inception, Bitcoin has undergone several halvings, with the first in 2012, the second in 2016, and the third in 2020. The fourth is scheduled for April 20, 2024, after which the mining reward will decrease from 6.25 to 3.125 BTC per block. This process is set to continue until around the year 2140, when the 34th halving will effectively reduce the block reward to zero, capping the total supply just shy of 21 million BTC.

The halving event is often cited as a significant factor influencing Bitcoin's price. Proponents of the "Stock-to-flow" (S2F) model argue that reduced inflation and subsequent supply squeeze will have a bullish effect on price. This theory posits that if demand remains constant while the flow of new bitcoins to the market halves, the price should theoretically rise.

However, there are dissenting opinions. Some analysts argue that the halving does not intrinsically create demand and that the overall market selling pressure might not be substantially reduced post-halving. Others suggest that the halving events are already "priced in" given their predictability, and should not inherently lead to price increases.

The correlation between Bitcoin's price movements and the broader credit cycle has been a topic of discussion among market analysts. The credit cycle, which consists of periods of expansion and contraction in the availability of credit, seems to align with Bitcoin's halving events. Some argue that Bitcoin's price is more a reflection of market liquidity than the direct result of supply constraints imposed by halving.

As the block reward diminishes over time, transaction fees are expected to become the primary source of revenue for miners. This transition has sparked debate, with some expressing concerns about the economic sustainability of mining. Proponents counter by highlighting advancements in transaction batching and layer-two technologies, which could mitigate the impact of reduced block rewards.

The Bitcoin halving is a critical aspect of Bitcoin's economic model, serving to control inflation and preserve scarcity. While it is clear that halvings have historically coincided with increases in Bitcoin's price, the exact relationship between these events and market behavior remains a subject of debate. As the Bitcoin ecosystem evolves and the final bitcoins are mined, the industry will continue to adapt to the changing dynamics of miner incentives and market demand.