"Rolling Recession" about to get a lot bigger

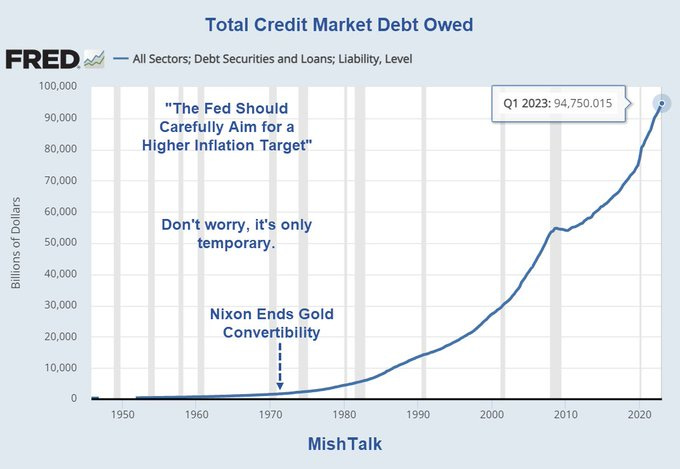

The American economy is being propped up by debt, and now the American consumer is giving up as pandemic-era savings run out, credit card debt hits the trillion mark, and the job market dramatically cools.

In the past couple days we've seen some rough numbers from America’s biggest retailers. I did a video last week on Target missing by 5%, lopping $15 billion off their stock. Bell-weather Foot Locker stumbled with sales down 9%, knocking the stock for 30%. Dick’s was flat, while Macy's and even BJ's lowered guidance — when the warehouse clubs are down it’s bad.

The American consumer is now piling up debt and running down savings at historic rates as incomes lag inflation by almost 8% in just the past 2 years.

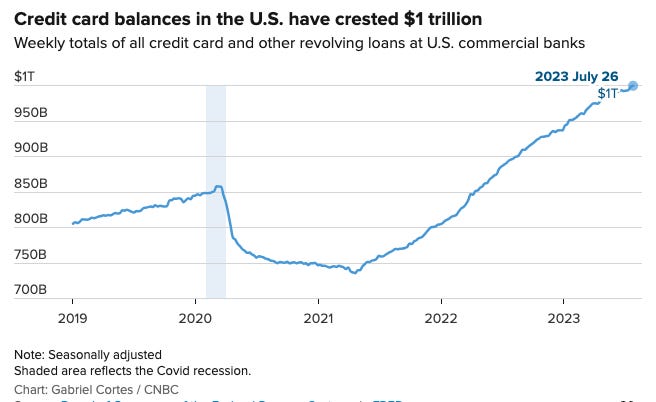

Exhibit A is credit card balances, up almost 40% in 2 years and now crossing the $1 trillion line -- a record high. Considering those balances are running at 24 percent -- yes, the mafia charges less -- that’s a landslide waiting to happen.

Card balances are up almost $300 billion in 2 years from the lows during the pandemic when Americans were paying off their cards with stimulus checks, while lockdowns and supply chains meant there wasn’t much to buy — no vacations, not even going out for dinner.

Keep in mind there's another $3.5 trillion in untapped credit card lines. Meaning this hole can keep digging for awhile, all accruing interest at 24%. Which makes a catastrophe when the recession finally hits full-force and millions lose their jobs.

Meanwhile, we've got the student loans set to resume in October — those loans make up over 9% of all consumer debt in the US. Oxford Economics estimates they’ll knock $100 billion off consumer spending per year, but if we look at how student loan recipients have actually behaved, they’re more likely to keep spending and just run up the credit card.

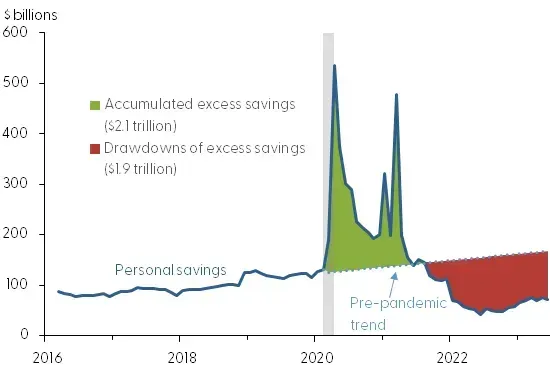

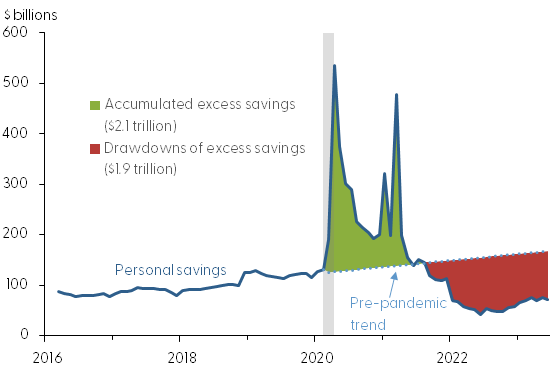

To keep up this spending, Americans are now running down their savings at historic rates, with the personal savings rate now under 5% — about half where it was pre-pandemic.

Put the debt and the spending together, and Americans’ household savings are now plunging — the Federal Reserve just put out a paper arguing Americans have already run though $1.9 trillion of the $2.1 trillion built up during the pandemic, and could run out of excess savings altogether in the next month or two given consumers are running through savings at the pace of $100 billion per month.

For perspective, that’s a $1.2 trillion annual over-spend. Meaning very soon we get to where credit cards are what’s holding it together.

In fact, the Fed now estimates those excess savings could run out next month, taking out one of the things that's been holding up the recession, making it a "rolling" recession -- hitting some people but not others -- rather than an old-fashioned recession.

The excess savings have been one of the main things staving off the full recession, keeping it at a “rolling recession” that hits the middle class but not the wealthy. The next data points to watch are defaults and delinquencies. Both were driven down artificially during the pandemic thanks to trillions in government money, but they've already returned to above pre-pandemic levels, especially auto loans and credit card delinquencies that are now soaring.

Surprisingly, even mortgages delinquencies are now soaring — surprising since most Americans still have a 3-4% mortgage. What’s driving it is new buyers coming in at 7.5% rates. To illustrate, the average existing mortgage payment right now in America is $1,355 -- up 10% in 2 years, but still pretty benign historically. But anybody who buys a house right now is looking at $2,600 a month just for the median house.

In effect, the Fed's interest rate yo-yo is making America into a two-tier economy, where anybody lucky enough to own financial assets or even a house are sitting pretty, while the young and working class are wrecked. So Boomers are fine, everybody else is screwed.

Evaporating savings and booming credit cards mean the “rolling recession” will keep snowballing, as the Fed’s rate hikes infiltrate the entire economy on their traditional 18-month delay. The storm’s not even here yet.

Those who’ve hedged their assets — including with a hard asset like a house — and recession-proofed their livelihoods and their skills will do fine. Those who didn’t will be digging out of a trillion-dollar debt hole.

Sign up to my free email list to get weekly posts on what’s happening in economy and freedom. Choose the $5 option if you’d like to support the content — everything’s audience-supported.

I’ve also got a brand new website at Peterstonge.com with the daily videos, weekly podcast, and all the articles in one spot.

This was originally published on profstonge.com