Michael Howell explains how 77% of global lending depends on fragile collateral, making repo disruptions a crisis trigger.

The global financial system has shifted from capital formation to debt refinancing, leaving it highly vulnerable to liquidity shocks, particularly as 77% of global lending is now collateral-based. Michael Howell warns that disruptions in the repo market can trigger widespread refinancing crises, a recurring pattern over the past three decades due to rising debt burdens outpacing liquidity. He argues that the debt-to-liquidity ratio, not debt-to-GDP, is the key metric to watch, with a ratio above 2:1 signaling systemic risk. Central banks are increasingly constrained in responding, especially as shadow banking expands beyond their control. Howell sees assets like gold and Bitcoin as critical hedges against ongoing monetary inflation, noting both the explosion of U.S. debt and China’s strategic gold accumulation. While a global monetary reset may be inevitable, Howell emphasizes that in the meantime, private sector innovation and hard-asset strategies will be essential to weather the instability.

Michael Howell’s analysis reveals a financial system increasingly defined by collateral dependency and an unsustainable debt burden, where liquidity, not inflation or GDP, emerges as the true pressure point. He warns of an inevitable reckoning marked by strained debt refinancing, renewed central bank intervention, and a revaluation of what counts as reliable collateral. In this environment, assets like Bitcoin and gold take on strategic importance, not as speculation but as safeguards against systemic fragility. The podcast urges a shift in focus, from surface metrics to structural vulnerabilities, because the collateral crisis isn’t looming; it’s already underway.

0:00 - Intro

0:39 - Is liquidity crunch incoming

6:16 - Explaining the crisis

16:15 - Fold & Bitkey

17:57 - The Fed’s ineffective measures

20:47 - Powell/Trump standoff and China selling

28:20 - Unchained Evernt

29:45 - Digging out with better assets

34:52 - Bessent's reset & BitBonds

40:04 - Weimar & gold

45:29 - Cutting red tape

50:01 - Clear skies beyond the storm

(00:00) something like 77% of all lending globally is now collateralbased If you get disruptions in the repo market you're going to get disruptions in the whole of global liquidity If there's no global liquidity you get a refinancing crisis Inevitably these crises keep reappearing and it's all because of this whole burden of debt in the world economy is just getting bigger and bigger and bigger What investors need to think about is hedging things like gold or in the long-term Bitcoin The stock of treasuries is going to double in the

(00:29) next 10 years That means the gold price should double I mean Bitcoin may do exactly the same at least Michael How welcome to the show Hi Monty Good to be here Lots lots going on I think Lots going on And like I was mentioning before we hit record I think the timing is perfect I reached out to you after watching your interview with Jack Farley on the Monetary Matters podcast exactly a month ago And at the time you two were discussing discuss excuse me discussing liquidity challenges um in the market that you were foreseeing that began in Q4 of last

(01:06) year and obviously a lot has happened since then most particularly in the last uh 8 days with the liberation day Rose Garden speech with tariffs we've seen disruptions in the bond market with bond yields screaming Tuesday night many people wondering if that was people uh engaged in a basis trade getting offside Um and I I I think that's the big question right now is the are we on the precipice of a big liquidity crunch that is going to force the hands of these governments and central banks I think the short answer is in the in the very

(01:42) short term no Um but I think in the longer term there are clearly big issues that we got to we've got to face And the the essence of the of the whole issue is that if you look at the evolution of the global financial system since the GFC back in 2008 2009 effectively the the market has be is very dependent now on collateral and something like 77% of all lending globally is now collateralbased and what that means is that you know obviously there's the clear example of mortgage lending against your real estate but actually more pertinently

(02:17) Most of the transactions in financial markets now involve some security on the other side In other words uh people are probably depositing or posting treasury bonds uh and they're borrowing against that They're repoing those or using the repo market to do that And this is a big deal Um and if you get disruptions in the repo market uh you're going to get disruptions in the whole of uh global liquidity the world of global liquidity and hence in financial markets because this means the funding disappears and you can't have that situation u arise

(02:51) Now the reason that this is again a big big deal is that what we got to understand here is the financial markets have changed their their whole complexion really um in the last couple of decades I mean no longer uh is is the market is the capital market street or whatever really used to finance new capital spending Uh those days are long gone That's the textbook model where you know uh a business came to the market uh interest rates or the cost of capital and um effectively capital raising in the market uh fueled the business cycle

(03:24) That world is gone We're not in that world We're in a world that's dominated by debt and in particular debt refinancing um something like 3/4 of all transactions that go through financial markets today involve a debt refinancing transaction in some form So if you're refinancing debt in other words rolling over debt what you need is balance sheet capacity to do that And balance sheet capacity is what we think of is as liquidity or given the fact that liquidity has a international dimension global liquidity So that's why it really

(03:54) matters If there's no global liquidity you get a refinancing crisis And I would venture that every financial crisis we've experienced in the last 30 years has ultimately been a refinancing crisis It's been the inability to roll over debt in some form Uh there's been a lack of liquidity So central banks have come back after the event poured in liquidity uh rewrited the trucks and away we go again But you know inevitably these crises keep reappearing And it's all because of this whole burden of debt in the world economy is just getting bigger

(04:27) and bigger and bigger Uh and we need liquidity to to uh balance that And the liquidity is not always forthcoming Yeah This reminds me of many conversations I've had with my good friend Parker Lewis on the show He wrote a paper in 2017 called Enders Game that basically went back and dissected the Fed minutes that were um that were made public years after meetings that were happening from 2005 all the way through 2012 He basically pinpointed that this is this is the problem uh with the Fed specifically is that they have these

(05:02) prognostications and these models and these predictions they that they make and they inevitably never come true and we just live in a system where there's too much debt not enough dollars You can go to ZERP do QE try to unwind that but ultimately once you unwind it enough that that liquidity crunch comes in And I think that's the big question on everybody's mind particularly here in the United States is how how close are we to that potential liquidity crisis with QT sort of um having been been uh engaged by the

(05:37) Fed for the last two years Uh you can look at the the overindexing on the front end of the yield curve is not QEQE but it seems like reposs are getting drained and that's a big topic of conversation right now Everybody's saying Trump and Bent are maniacally focused on bringing down the 10-year yield so that they can roll over the this trillion dollars in debt that we have at the Treasury at more reasonable rates to bring down the interest expense Uh and then on top of that there's discussions that aren't as loud

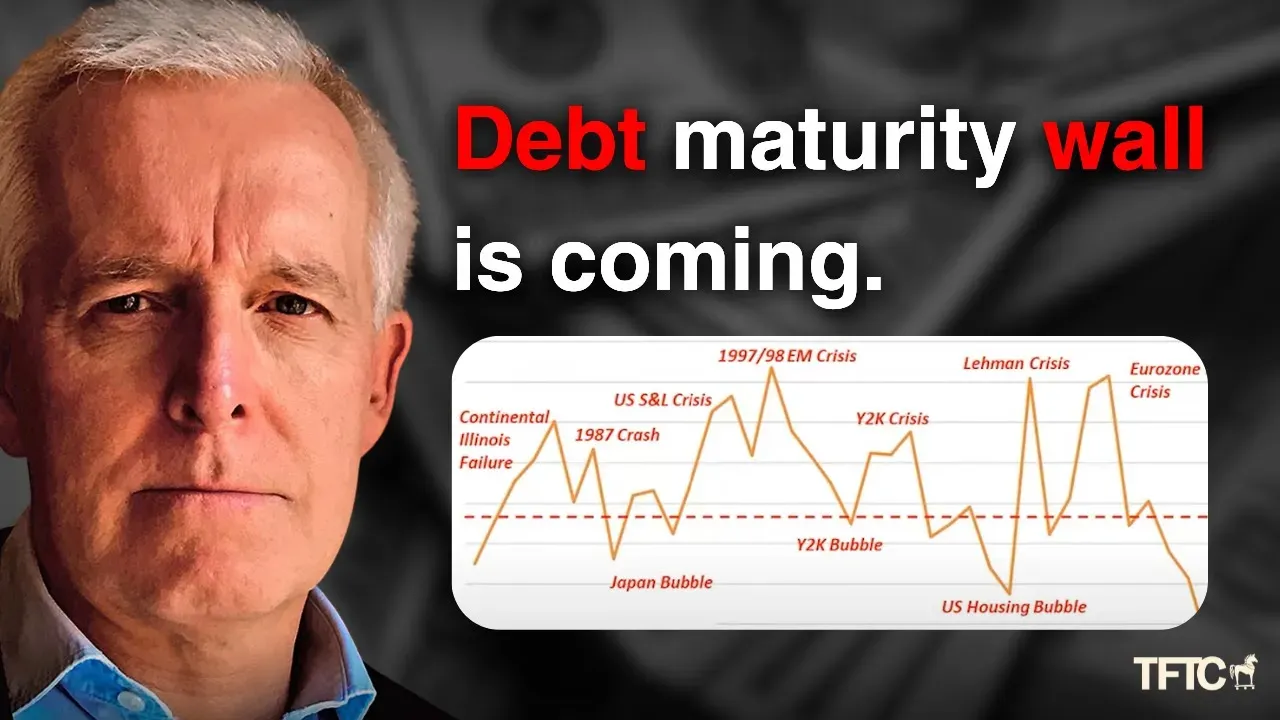

(06:07) happening about the the corporate debt situation and a lot of refinancing that needs to happen there So you said you don't think we're on the precipice we're getting What you can hopefully see here is a slide that is looking at uh it's entitled advanced economies debt as a percentage of the domestic liquidity stock worldwide And what this basically says is that the thing to look at is not uh debt to GDP which is what all economists are telling us that we need to be monitoring but actually the debt to liquidity ratio which is what you see

(06:41) here for the world Now that statistic that ratio over time kind of flatlines but it cycles and there's a dotted line that you can see drawn through the middle of that chart at about circa 200% And what's that that's saying is the volume of debt to the volume of liquidity is about 2:1 If it gets seriously above 2:1 and we annotate on the chart where that's happened you typically get a financial crisis And as that chart says with the annotation that's when you get refinancing tensions in the world So if there's too much debt

(07:16) relative to liquidity bang you get a crisis If you've gone the other way so there's a lot of liquidity relative to your debt What typically happens is you get um an asset bubble There's just too much cash around That cash has to find its vent somewhere So it goes into asset prices So things like the Japanese bubble in the late 1980s the Y2K bubble the US housing bubble in the early 2000s the cryptocurrency boom that we're now seeing All these things have come about because there's been too much liquidity in the system Now if you look at the

(07:49) projection that we've made which goes into the end of uh 25 into the end of 26 what that's saying is that that ratio between debt and liquidity looks like it starts to move appreciably higher It gets back it mean reverts back to its level Now the reason for that is that number one we've uh we believe that the pool of liquidity that's out there is not growing fast enough So that's one factor but the other thing is that the amount of debt that needs refinancing is starting to escalate because of something called the debt maturity wall

(08:22) Now the debt maturity wall basically is all about um the debt that was termed out during the COVID crisis coming back into the system And that debt that was termed out in 2020 2021 at nearly zero interest rates is now coming back to be refinanced in 25 26 2027 at much higher interest rates And that's going to be a big burden on financial markets Essentially uh issuers need liquidity and that liquidity will be uh taken out of the market and so there's less liquidity around to drive other asset prices up like Bitcoin or uh the S&P or

(08:58) whatever it may be And that's where the problem is uh the fact that we've had abundant liquidity through this period of the last decade is really courtesy of the fact that after the GFC central banks threw liquidity at the system to revive it and then during COVID there was another big dose of liquidity So all these factors uh COVID GFC have distorted uh the debt liquidity ratio appreciably but now it's coming back to bite users and that really is one of the questions Now if you kind of hold that thought and let me just show you another

(09:30) uh another chart This chart here is looking at the world financial system a schematic diagram that we put together Now that looks a little bit complicated but let me dis distill that a little bit by saying that global liquidity what we're really talking about is this key metric is at the bottom of that chart in the middle And global liquidity rests on a collateral base or a collateral pool And as I said something like 77% of all lending in the world economy now is collateral based And you can see around that collateral pool actually uh

(10:05) intermediating between collateral and liquidity is the repo market So we need to understand the repo market uh critically It's it's a major major point to watch Now the problem the system has got just to understand this is that stability is if we lean more to the left hand side and that is that that collateral is really resting more on safe assets like public debt Now there may be a question in that going forward but let's say for the moment uh let's accept the fact that treasuries are pretty much pristine collateral

(10:40) What I've shown there is that the system also has a right hand wing which we've called private debt instruments You can see that bubble on the top right And there's an arrow going from uh the public debt instruments to the private debt called regulatory arbitrage And that is because the banking system's been so super regulated in the wake of the GFC that actually to do business to lend or to to make money you've got to go outside of your balance sheet if you're a bank and you've got to start operating as a shadow bank And the

(11:12) shadow banks are operating obviously in the in the shadows the murky shadows of the financial system They're not regulated that tightly And what's more they tend to focus on uh two aspects One is private debt instruments things like collateralized loan obligations which clearly have a big credit risk in them And secondly there's a lot of leverage going on because hedge funds uh you know are sort of squeezing all the juice out of the treasury market through these basis trades which may be up to 100 times leveraged or whatever you may get

(11:41) So effectively the system is leaning more and more onto this shadow bank type environment and what that means it's a lot more unstable and hence you need central banks to come in and effectively corral the system or manage the system much much more actively Now this is an issue because mainly because of this chart here which which we cite This is looking at the repo market and it's looking at collateral shortages so-called In other words it's looking at the tension in the repo market where there's an inability of borrowers to

(12:18) post uh appropriate levels of collateral uh to borrow In other words the system is breaking down This chart is is monitoring the spread between uh sofa rates which is the system uh um the system overnight financing rate and Fed funds And what this is saying is when you start to get spikes such as we're seeing on the right hand side of the chart what that's telling us is that there are liquidity uh problems tensions financing tensions in the repo market right at the heart of the system It's beginning to shutter And this is a big

(12:53) problem Now if you look at that graph what you can say uh convincingly or compellingly is that 90% of uh since the end of 2023 90% of those spikes in the repo system have occurred since last July More worryingly uh of those 90% 90% of those have occurred since December So what you can see here is a trend and that trend is a worrying trend because it's basically telling us that there's a lack of liquidity emerging in the system Now the Federal Reserve is confident it can deal with this Uh they said they do not want to experience obviously another

(13:34) 2019- like repo crisis and they're they're on the case Uh they may well be but this is what bothers us and this is the prospective growth of Fed liquidity through the back end of the year Now Fed liquidity is effectively the active part of the Fed's balance sheet the liquidity creating parts of the balance sheet And essentially it comes down to let's say three major ones that we can we can think of One of those is what is uh called the SR account which is basically um the treasury and agency holdings that the Federal Reserve has the government

(14:12) securities that it buys or sells uh that is either operates under a QT quantitive tightening regime or a QE quantitive uh you know um quantitive easing when they're buying uh treasuries Uh when they're selling treasuries into the market you're into QT That's what they're doing right now So they're shrinking their liquidity injections through that conduit The other two are the Treasury General account which tends to be cyclical but at the moment it's in draw down because of the debt ceiling So there's been a lot of liquidity drawn

(14:44) out of the Treasury General account to pay for government spending that's gone into the money markets and that's clearly been a positive Uh and the other is the re the reverse repo facility was a bit of a wonkish thing but it's another big pool of liquidity that the Fed has basically drawn down from over 2 trillion to about uh 100 billion uh in the course of the last 18 months That drawdown of the reverse repo facility has been a major plank behind the bull market It's put a lot of liquidity into the money markets So what you're seeing

(15:16) going forward is number one they're still doing QT Number two the TGA the Treasury General Accounts been drawn down but it's going to be rebuilt by definition once the debt ceiling is solved So that will suck money back out of the system And then thirdly what you've got uh is the reverse repo facility has already been spent So bottom line is that if you look at that graph the projection uh going to the end of the year you see a lot of volatility but the trend is downwards because that reflects largely the TGA rebuild plus

(15:46) some seasonality Um and you know those ups and downs that you see are connected with the uh tax season the taxpaying season from uh April 15th etc So you got volatility there's maybe more liquidity coming in the short term uh as the as the TGA gets drawn down maybe a bit more but it ain't good news looking forward and that's really the issue that we've all got to face So that that's the issue in a nutshell and um um you know over to you What's up freaks do you have a credit card are you getting cash back or

(16:20) airline points or points for some other service guess what those are shitcoins you want to be stacking Bitcoin I have some groundbreaking news for you The team at Fold has finally released the Bitcoin Rewards credit card They have a wait list Going to be distributing the cards later this year So you want to get on the wait list Full Plus members are going to get unlimited 2% Bitcoin back on this credit card If you get on the wait list there are up to $200,000 in prizes they're going to be given out So get on it as quickly as possible Go to

(16:54) tftc.io/ io/fold and get on the wait list there If you're on the wait list you have the potential to win some of the prizes Check it out Stuff freaks This RIP TFTC was brought to you by our good friends at BitKey Bit Key makes Bitcoin easy to use and hard to lose It is a hardware wallet that natively embeds into a 23 multisig You have one key on the hardware wallet one key on your mobile device and Block stores a key in the cloud for you This is an incredible hardware device for your friends and family or maybe yourself who have

(17:26) Bitcoin on exchanges and have for a long time but haven't taken a step to self-custody because they're worried about the complications of setting up a private public key pair Securing that seed phrase setting up a PIN setting up a passphrase Again Bit Key makes it easy to use hard to lose It's the easiest zero to one step your first step to self-custody If you have friends and family on the exchanges who haven't moved it off tell them to pick up a big key Go to bit.

(17:52) world Use the key TFTC20 at checkout for 20% off your order That's bit.world code TFTC20 You mentioned that the Fed is hypercognizant of what happened in September uh September 2019 with repo markets and wants to make sure that doesn't happen again If I recall correctly uh the reaction to that overnight rate spasm uh back in the fall of 2019 was to create new facilities that essentially give primary dealers access to the Fed window Correct Is it your intention or is your belief that that's what they think is going to prevent a spasm from reemerging

(18:28) in the repo market or are they going to have to create new facilities that are specific to this particular point in time it it it's a bit like saying look the the system is not is not a stable system It's a fragile system I think we all accept that and it's a fragile system largely because uh just be just simply because the regulators are uh are overregulating in inverted commas the banks there's a lot of shadow banking activity and nobody really knows what goes on there uh I mean you can do a lot of research but at the end of the day

(19:00) you know in practice one just praise that the system holds together and if you're shaking the tree enough and clearly we've had a lot of shakes in the last few weeks and you know u Mr Trump is shaking the the system furiously as we speak right now We don't really know how it's going to hold up Now we hope that the system works but effectively a lot of these measures that the Fed is putting is announcing or has announced a kind of sticking plaster on the cracks and we just hope it works but it's not necessarily guaranteed It didn't work

(19:30) for example in the case of SVB that managed to default even though these things still existed So although you could say in theory SVB had complete access to the discount window uh they didn't use it So you know accidents happen and what you really need is a system which acknowledges the fact that in a debt driven world you need liquidity uh you know all this thing about the sort of hair shirt philosophy that the Fed has to say well okay the balance sheet's so bloated now we got to go back to what it was in uh I don't

(20:02) know 19 uh you know not 19 20 sorry 2007 or we got to go back to uh what it was you know 5 years ago or we got to do it relative to GDP is madness I mean let's just accept the fact that we're in a debt driven world Debt is a bad thing we know but we got to accept we're here you've got to have uh liquidity sufficient to roll the debt over and that liquidity provision is really in the gift of the Fed Uh and there's nothing there no way around that They've got to go back to some QT uh arrangement Now I know that they won't call it QE Um

(20:36) they'll think of some there'll be the acronym department of the Fed would be working overnight to think of something else like QS or quantitive support or whatever they call it But it's got to come Balance sheets's got to expand again Yeah Yeah I think we could return the monetary base to 2007 levels which I believe were around 800 billion Yeah I mean it's insane It's insane And I guess that begs the question what do you think Jerome Pal is thinking right now because it seems like he's in somewhat of a standoff with

(21:06) President Trump President Trump I believe earlier this morning tried to send something up the Supreme Court to figure out if he could officially fire Jerome Pal It seems very obvious that President Trump would like Chairman Pal to uh cut rates as soon as possible And I think Jerome Pal is in a position where for years he's been trying to really um bring back the the belief that the Fed is apolitical and it's going to do what it needs to do Uh despite what any uh administration wants them to do And it it seems like he's trying to hold

(21:42) a hard line there to to put out to the public that the Fed is a political we're a private institution We're going to do what we believe is right and not be pressured by any particular administration But then you also have uh something like Tuesday night where I mean there was like you said this it's a shadow banking system but Zero Hedge wrote a piece pointing at the multistrat funds and how levered they are in this basis trade and we don't know for sure but many people were speculating that the Citadel's 72s millenniums were

(22:13) getting off sides and that's what led to that spike in the 10 and 30year yield curves on Tuesday night Um and so the meme that Zero Hedge had is Jerome Pal over the two buttons Do I uh do I let the hedge funds fail or do I um come in and and and save the situation but it seems like I'm I'm appeasing President Trump politically Yeah Well I think the I mean at the end of the day look first of all it's a it's a it's it's a noble thought to say look we we want an independent Fed I mean clearly that that's that's that's that's essential Uh

(22:50) but on the other hand one's got to be realistic here and realism tells you that the balance sheet of the Fed has to expand during these times of crisis If you starve the markets of liquidity you have a big problem and this is the issue that we're really facing now Now I don't think this thing is going to crack in the you know the next few days I don't think it's a problem that shorter term But I think as you go through the year uh more and more these tensions build and there's likely more and more of a problem particularly if our data or our

(23:20) projections about what the Fed is intending to do uh you work out Um this is this is an issue and uh it's an issue not just for the US but it's an issue for the global economy as well Well curious to get your thoughts on like and I I think the the recently introduced variable of the unpredictability of President Trump and his economic policies has to pull that that liquidity crisis forward just just just the embedded uncertainty that that has been introduced with how Trump is going about these tariff negotiations as

(23:55) one example has to uh again create uncertainty that that forces people to to think about their allocations to treasuries specifically and act accordingly which could pull that that liquidity crisis forward Yeah I think you know there's there's there there's clearly a big issue here that what what you've got is um is is a situation in the treasury market where you know what we what we know is that Scott Bessant um has been put in a very difficult position because he has 30% of the outstanding stock of treasuries to

(24:25) refinance this year Now that's a challenge for anyone in normal times but in a difficult market environment clearly it's a much much bigger challenge and he's got to face that So you know I think given the funding problems that he's inherited um you know what one has to say is that Trump 2 is much much more about focusing on the bond market than the stock market If Trump one was about stocks Trump 2 has got to be about bonds and trying to draw a line in the sand about how high the yield goes Now I think we kind of saw a

(24:53) little bit maybe last night that there is a line in the sand and they don't like yields uh pushing up much above 4.5% and then maybe there is a there's a change of tag but you know that could tell us something but effectively what they like would like is the yield to come down the problem you've got there is that you know the enemy number one enemy is China that's clear right um the Chinese Ministry of Finance has uh a big uh you know a big sign uh in their um you know in their headquarters which says $9 trillion uh which is the amount

(25:28) that um um you know Besson has to refinance this year China is holding the the the the ACE cards in many cases because they're sitting on their holdings of what is it 750 odd billion of US treasuries uh and if they start to sell those and an inopportune moment they could spoil the auctions uh for best upcoming uh and this is clearly an issue This is a challenge Uh and what you don't want is a disruptive market or failed auctions And we saw a little bit of a hint of that you know in the uh in the last 24 hours Uh this is dangerous

(26:03) stuff Now the other the other problem that you've got which is why a lot of pressure is going to be heaped on J Pal uh over the next few weeks is that if you look at the structure of the bond market now without getting caught in the weeds here uh bonds really comprise two moving parts uh one is uh an interest rate expectation element In other words what you think the Fed is going to do in terms of policy rates and the other bit is something called a term premium which is definitely wonkish Now a term premier

(26:34) is really the extra bit that investors demand to hold a bond to cover interest rate risk in the future And if you look worldwide term premier in bond markets are rising Why are they rising because number one Germany has taken off the debt break Okay so what we know is that the world is going to be a wash with boons in the future or European debt Number two Japan has an inflation problem that's emerging that's starting to make JGBs look a less attractive And we know that China uh viz announced overnight but we know it's coming anyway

(27:08) is going to engage in a major fiscal uh spending program So effectively the long end of bond markets in other words the 10 10-year benchmark bonds globally are being elevated yields are being elevated by these fiscal spending demands Now that ain't a great environment for Scott Besson to start raising money uh or trying to refinance US debt because there's this upward pressure coming internationally Now the point is that if you go back 5 or 10 years the US was largely a price maker in international bond markets In other words global bonds

(27:42) followed the US Treasury market increasingly It's the other way around The US is more and more a price taker And that is because you cannot guarantee the international bid for treasuries anymore because the Japanese are sitting on their hands The Chinese are more likely sellers than buyers And all the other buyers as you rightly say Marty are hedge funds uh which we know are you know are basically short-term So there there is a problem which means that the only way you're going to get funding costs down is to put an awful lot of

(28:11) pressure on JPAL to start c cutting front-end rates and I think that's going to come Uh but I think he should be doing it anyway because the economy is starting to skid badly as we speak The new administration is pushing hard for government efficiency But can Elon Musk and Doge fix the dollar on April 16th PhD economist Peter Sange explains why Bitcoin is the most important tool for government efficiency and how the principles underlying the global shift toward sound money can help you protect and grow your generational wealth

(28:38) Register now at unchained.com/rhr That's unchained.com/rhr These conversations often get frustrating because it feels like we have to have them too often particularly post 2008 And I think to touch on the core of the problem which is the collateral in the system being these these bonds how sustainable is that in the long term particularly taking into consideration the the nature of the geopolitical landscape right now and this push towards a multi-olar world like are we entering an era where markets more broadly begin to recognize

(29:17) that this isn't the ideal form of collateral for a financial system yes absolutely Let let me give you let me evidence that since year 2000 the stock of US treasuries has increased by 9.6 times almost 10 times So in 25 years the stock of US debt has almost grown by 10 times I mean that is an eyewatering amount but the US is not unique here Other countries are in exactly the same situation The gold price has gone up over that same period by 9.

(29:49) 65 times So gold has absolutely matched the increase in in treasury supply Now what that's telling us is that effectively uh the increase in debt is part of a monetary inflation process and gold throughout history has been the best hedge against monetary inflation Now if you're going to tell me that debt here doesn't grow anymore okay please may it be but it's not going to be the case because there's so much mandatory spending that we know is is out there Trump has said he's not going to stop social security Medicare payments or anything like that Uh

(30:23) they're going to keep running So ultimately what you've got is a big and growing debt burden So what you know is that the gold price is going to match over the long term that increase in debt Debt is growing at at least 8% peranom So that's going to give you some indication of what the trend in gold is likely to be Now if you know can you sell that debt at stable yields well I think that's extremely difficult and therefore they're going to have to start moving more and more towards monetization which is exactly what Janet

(30:52) Yellen did because she basically skewed uh Treasury issuance uh something like 2/3 towards bills and shortdated bonds Now that's left Scott Besson with a big problem but he can't really get out of it now He's kind of he's been painted into a corner So he probably liked to issue more coupon debt but can't So they're going to have to lean more and more back on shortdated issuance or even bills And what that means is monetization which is devaluing ultimately paper monies and the gold market is going up So this is the

(31:25) reality that you've got What investors need to think about is hedging uh or getting monetary inflation hedges in their portfolio Things like gold or in the long-term Bitcoin You know Bitcoin is volatile for sure but in the long term it's likely to outperform um and it's going to match or at least match what's happening to the gold market Now if you're not if you you know you're not satisfied with that explanation for the US think China Okay the problem that China's got China has got a whopping debt burden right now If America is

(31:58) relatively stable here and I'm saying relatively China is relatively unstable because the debt liquidity ratio in China is completely out of line because they've taken on so much debt And in m in many of the last few years they haven't created liquidity because they've been absolutely focused on maintaining the stability of the yuan the currency the remmbb against the US dollar which means they've had to tighten monetary policy So that's why China is in a debt deflation But the answer is they're digging their way out

(32:30) And one of the things that we said um a couple of years ago is that the way that China has to get out of its debt deflation is to massively increase liquidity and devalue the yuan uh currency Now they're devaluing the currency but they're not devaluing the currency against uh against the US dollar The US dollar I mean the yuan has weakened against the dollar for sure but not dramatically What it's weakened against is the gold price Um two and a half years ago the yuan gold price was 11,000 yuan uh per ounce of gold What is

(33:04) it today as we speak is 22,500 It's doubled right now Our view back then was that they had to get up to over 26,000 yuan to actually dig themselves out of their debt crisis And why does that matter because ultimately uh what you want to do to get out of debt is to devalue your paper money but to devalue against real assets and gold is a real asset Okay so if you start to think about this if China is driving the gold price and you know why shouldn't that be the case i mean we've been grown up to think that it's the London gold

(33:39) market that is really the is the call on gold but actually it's no longer the case The Shanghai gold exchange is really driving things Uh there's a premium on Shanghai gold a persistent premium uh because they're bidding for it There's an Asian bid going on Uh China is printing money And what's more the People's Bank of China is buying bullion in the open market They bought again in March So they're lifting the gold price So if you start to think about how this works if you're taking a 26,000 uh yuan per ounce

(34:10) target at least and you take a 7 what 735 yuan US cross rate um you triangulate back at $3,500 $3,600 an ounce for gold And that's where we've been moving I mean that that's probably minimum target So you can see how the whole world is starting to evolve and China is in a much stronger position certainly financially uh or in terms of financial markets than it is probably in the in the trade arena Uh and that's what we got to remember It's it's going to be difficult for the US to fund itself at low interest rates going

(34:48) forward Yeah And with all this with all this in mind you mentioned Scott Asent He's been painted into a corner but it seems like he specifically asked to be placed in this corner Uh he was on a press tour leading up to the election last year I mean famously the clip's been going around the last couple weeks of his conversation at the Manhattan Institute last June where he uh expressed that he believes there's going to be a monetary restructuring on on uh on par with Breton Woods or the Plaza Accords And that's a pretty big discussion right now

(35:27) is that the this Mara Lago accords that may be on the horizon And based off of everything you just described our problem here in the United States what China may be trying to do by uh fixing the yuan to gold do you think there is a potential for something like a Mara Lago accords or something of another name where everybody recognizes this is untenimal it's getting out of control We need to meet at the table and negotiate how we we settle this debt situation Well I think the the in an ideal world chill Marty That's that that would be

(36:01) great if they did something like that I mean good good luck with that with that progress on that because I think we you know there's a lot of traveling before we get there Um and it'll be wonderful to get a deal and that you know obviously uh you know President Trump would like to oversee such a deal I'm sure and so would Scott Besson but you know that that deal if it comes will have to involve gold in some form uh because gold is fast becoming the sort of pristine asset or pristine collateral worldwide because effectively you know

(36:30) if you look at western financials or more more particularly western fiscal systems they're effectively bust aren't they i mean the commitments that have that have been made um in an environment of aging uh societies are just are just untenable I mean how can how can we afford how can younger generations afford this it's it really is it's it's crazy So you've either got to reague somehow on those promises or you've got to somehow devalue paper money uh which means ultimately reorganizing the whole international financial system Um and

(37:02) that's what we've got to do But it's a big big ask and it's not not going to happen overnight But I think gold has to play a much bigger role in that somewhere down the line Yeah agreed It's funny I was at a a lecture last night where the birth rate crisis came up and it's like we're dealing with these problems now um with this debt issue but there is many more issues down the line with this global uh birth rate uh birth rate crisis that it's probably advantageous to get ahead of it whether that's resettling around a sound money

(37:34) standard or introducing pristine collateral But I think that's one thing that's being floated here And so this my beat and my uh my passion is Bitcoin and um taking the the situation that Scott Bent has found himself in needing to roll over all this debt Curious to get your thoughts on we live in insane times and it may demand creative uh bold thinking And one idea that has been floated in recent months the Bitcoin Policy Institute wrote a paper about this concept of bit bonds where the Treasury could issue 10-year 10-year

(38:14) bonds and take 10% of the proceeds from a portion uh of the offering buy Bitcoin have it sit in the bond over the duration uh of 10 years uh and essentially provide the market with a dual collateralized sort of bond product that is offered at a lower rate but has more potential upside on the back end when when that bond comes to term Is this something that you think is possible is it is it something that would be appeasing to to bond investors uh could it could it actually work in your mind well I think there's you know there's

(38:53) scope for all this sort of financial engineering for sure Innovation is really the the name of the game in the financial sector So I wouldn't rule that out But I don't think necessarily that's going to be the the panacea That's not going to solve the problem I mean ultimately what what we've got to do I mean the only way to solve the problem ultimately is not necessarily finding new financing instruments It's basically to devalue the the debt that we've got uh so we can find innovative ways of actually selling debt for sure but

(39:19) ultimately it's better to actually devalue that debt uh you know on mass through uh through printing liquidity And that's I think the path of least resistance that the politicians and the central bankers will ultimately come to because you know hey isn't that what they've always done um you know look at the value of the dollar in 1900 versus where it is now the purchasing power I mean you know this is this is the fact paper money is um is paper money It's just ultimately the value is destroyed What you need to do is to hold your

(39:49) wealth in in other forms of uh other forms of collateral Something that holds its value And that's why I think it's very interesting that the younger generations basically go into things like Bitcoin because they can realize that this monetary inflation process is a real real risk And I think that you know it's a very interesting analogy and one ought not to push this too far for obvious reasons but if you go back to Vimar Germany in the 1920s and you look at the hyperinflation there one of the things that the hyperinflation did is it

(40:18) basically caused a massive red redistribution of wealth from the older generations to the younger generations and that was because the older generations basically were wedded to fixed income and they had all their wealth held in German government bonds So when you got the hyperinflation they kind of lost everything The younger generations uh basically went into the stock market because they could see that the stock market was a monetary inflation hedge Now all their parents and their peers were saying you are

(40:46) crazy What are you buying these stocks for uh you're going to lose your shirt These are speculations Okay Now they are the ones that actually got out of the 1920s 1930s with a big wealth transfer Okay Now the consequences of that and their particular political aspirations clearly didn't work out very well to put it mildly but effectively there was that generational shift If you look at what's happening now maybe the same thing is going on with Bitcoin is that the younger generations are realizing that actually these are the instruments that

(41:17) are going to hold their worth in the long term Their parents okay and older generations are saying you must be crazy Uh Bitcoin is is is completely you know is is there's nothing in it Okay um you know keep your money in uh in stocks or bonds or whatever keep the 6040 portfolio The younger generation saying no we think that this is the this is the way forward Maybe they're right but there's an interesting historical parallel there Yeah there really I can't stop thinking of when money dies the um some of the stories that are told in

(41:48) there Yeah walking the street and the paper boy is talking about this his stock picks and the parallels are uncanny um in terms of the speculative fervor that's going on I mean and there's there's layer layers of the spectrum um in terms of like where people find themselves on on the risk curve I think Bitcoin um within this uh within the spectrum of risk assets the younger people are playing it is actually like one of the least risky but we're seeing manifestation of meme stocks meme coins cryptocurrencies outside of Bitcoin and you just see a

(42:26) bunch of people reaching out further on the risk curve to get y an attempt to get yield so that they can sustain their lives and that's one thing I worry about with the the route which I we both agree is going to be taken and probably needs to be taken which is just you debase the currency to to solve the debt problem And I just wonder how you manage that politically considering where public sentiment is and how uh how stressed financially stressed the middle and lower classes are around the world Well I think that yeah I think you rais

(43:03) you rais a very good point but I think the the issue is that what one has to do is you know let's say you continue as is because that's what politicians have always done And the way that they do it is they they basically decry gold So they always say you know it's a barbarous relic All these things we've heard before uh you know gold is there has no meaning no intrinsic value nothing like this You know don't hold gold uh you read it in the media the Financial Times the Wall Street Journal all these media outlets are telling us

(43:31) that gold is you know a spoof asset But they've been doing that for decades after all You know that's that's the story And they get everyone to focus on paper money units Now if everyone devalues at the same pace in other words if the British pound uh the US dollar the euro uh the yen etc the Chinese yuan all devalue at the same pace The paper money cross rates don't change particularly but everybody inflates against gold and you know the other way to think about it is that actually gold is not moving although everyone says the

(44:01) gold price goes up actually gold is like the pole star in the sky that navigators use to actually get their bearing Gold doesn't really move actually it's everything else falls against it and what you want to do is to fall at a lesser rate um what's happening with paper money devaluation is everyone is devaluing dramatically against gold and you know we you see that in the example I give with um the with US treasury debt outstanding if US treasury debt is growing at 8% peranom that means it doubles every 10 years right so the

(44:32) stock of treasuries is going to double in the next 10 years just by looking at the growth rate we currently got that means the gold price should double um there not going to be many investments you could think of off the top of your hat that will do will do that I mean Bitcoin may do exactly the same at least So these are the sort of monetary inflation hedges we need uh in my view but the way that you the way that you restore the system is to get everybody to do the same thing Everybody devalues um and the you know the issue in the

(45:00) 1930s or 1920s for Germany was it was only Germany in 1922 that was in that boat uh and they chose to print money uh to get out of their reparations problem Uh but that was a that was a skew Now the whole world is indebted So there's more chance of everybody doing it together And that maybe is ultimately why Scott Bessent is cor is correct to say we need to reform the global monetary system but they'll reform it after they've devalued That's definitely for sure Yeah And and it has been encouraging um in the last 24 hours

(45:34) to see I think Trump recognizes this problem that exists and you mentioned the red tape that regulatory um burdens have have created for the banking system but I I think you've got it's got to be a multi- angle a front on on this problem and I think regulation is a big one to Trump basically defanging the um Department of Energy the EPA and others last night I think it's very clear that energy if we're going to get out of this like we need to bolster up the energy sector and make sure that we have robust and reliable and relatively cheap energy

(46:11) And so I think that's at least here in the United States something a positive that's happened uh recently that that could help create a conditions where you can sort of manage the the debasement of the currency because you don't have the regulatory compliance burdens on top of you and so you're able to save cost as a business pass on that that that savings in the form of wages to your workers and right let them succeed as um this debasement is going on Yeah I mean that this is the issue if you look at periods where monetary

(46:44) inflation has been rife I mean good example is in the last decade or so in the wake of the GFC uh you disenfranchise most of uh most of the non-asset owners in the economy uh because monetary inflation is not high street inflation monetary inflation means your asset values go up significantly and you get a tremendous wealth divide opening up and that's that's what we've been seeing but the problem is that that is uh you know that's uh that comes with increasing debt burden So the more and more debt that's taken on and you know this was

(47:15) the errant policy that most policy makers fell into is cutting interest rates to such low levels uh low interest rates incentivized the take up of debt and that was the madness that was uh you know that has taken place in the last 20 years and that increase or that increase in debt has been funded by monetary inflation and that monetary inflation has disenfranchised most of the uh you know workforces of the western world Yeah And so we we've had a heavy focus on the Fed and the governments solving this problem How do you think actors in

(47:48) the private sector can can move to solve their own problems and so with that in mind I one example I've said this many times in recent months but my mind's stuck on it Like we're beginning to see um in the Bitcoin world um people recognize that it is this pristine form of collateral It's very divisible Uh trades 24/7 You can send it anywhere It doesn't come with maintenance costs whatever that So you're beginning to see Bitcoin introduced in private credit products as part of the collateral package And so in my mind I look at

(48:20) something like this beginning to develop And I think if you're somebody who doesn't want to be holding to the whims of any individual government or central bank or the collection of them all globally we need to figure out ways to get creative in the private sector in something like this really piques my interest because uh it gives you agency and the ability to move and begin solving the problems without needing to worry about what the Fed or the Treasury is doing Yeah I quite agree I think that you know Bitcoin is going to be a major

(48:50) uh corner of the world financial markets I think stable coin as well I think those are those are instruments which are going to be essential in the modern world So I think the private sector is there already I think there's a lot of innovation uh on one seen in the last few decades that financial innovation actually has been immense u and the problem is that financial innovation moves a lot faster than the regulators do and that's part of the you know the issue when it comes to financial crisis u the regulators just too slow in

(49:17) understanding how the system has evolved u but private sector is there and I think it's coming up with these initiatives and you you start to extrapolate into the future and you say well okay you know how are we going to afford these burdens of mandatory spending higher defense higher social security uh higher Medicare Um you know without tax either taxing people more heavily or printing money Uh and both of those both of those solutions if you like taxation and printing money come back to saying well okay I'd rather be

(49:49) holding Bitcoin and some of these uh crypto units because a it's more difficult for governments to actually get hold of me and secondly are they going to hold their value in a monetary inflation anyway Yeah And so I can't tell are you off to like is this a good thing that all this is coming bear i mean obviously there's going to be a lot of It's a good It's a Marty it's a good thing in the for the long term I think the short term we've got to get through uh you know the current storm Um and I think that you know I'm optimistic we will because we

(50:18) always do Uh is there going to be volatility in markets for sure but you know um it's like the old Warren Buffett adage isn't it um when people are fearful start to be greedy And when people are greedy start to be cautious And I think if you look at where investors are positioned right now particularly US investors and what we see uh they've become they've turned uh remarkably cautious remarkably pessimistic and in a very very short time And if we look at we do a lot of monitoring of investor portfolios um and

(50:48) in fact I can I can show you a chart if you let me stick another one up So what you see in front of you is a is a chart of investor exposure This chart basically comes from this time series and this time series is looking at what we call the world risk cycle Now this is showing how investors globally and in the US So the world investors are shown in red US investors in orange change their asset allocation over time This is beginning in the late '7s and the cycle is basically a 9 to 10 year cycle as it happens But it shows their shifts into

(51:23) risk assets um things like equities corporate debt uh cryptocurrencies uh etc versus their movements into safe assets So the zero line is the long-term average If you're below the zero line basically it's telling you that investors are moving more and more defensive And what you can see is that that line has gone right down Now it's not at the lows yet but it's actually getting down quite quite low And if you look at this following chart what we've shown is a distribution of that data since 1978 And what it illustrates is

(51:58) effectively the ranges of risk on and risk off So most of the time people on average are bunched around the middle as you'd expect but you do see extremes extremes on the right where investors are really heavily risk on And you can see right out there on the far right there was June 2007 before the GFC where investors were very bullish And then if you go right to the other side um March the 9th 2009 uh where you can see you know that was where US markets bottomed and that was when investors were up there most pessimistic in their asset

(52:32) allocations So this is actual asset allocations of investors Look at the evolution of what's happened since November 6th uh 2024 uh just after the election So US investors were bullish uh they were they had investment uh you know on that right side of the uh bar chart then uh by the end of February they had moved to neutral and the latest reading is that sort of minus40 area uh which is telling us that there's only 3% of occasions 3 and a half% in reality of occasions uh since 1978 where investor portfolios have actually been more uh

(53:08) more uh defensively only more defensively uh um um aligned allocated than they are today So there's a big big riskoff move going on on the US which basically says that there should be a bounce in markets I think that's likely Uh but I think one's got to be you know realistic here that there are clearly other risks out there with liquidity and I'm not for sure saying that liquidity is going to rebound heavily in the next 6 to 12 months I hope it does but that really is in the gift of the Federal Reserve They need to but let's see Mhm

(53:42) Yeah We'll see the to be interesting to see if uh I I think the Supreme Court's going to come back and say "Donald uh the Fed is an independent entity You cannot fire the Federal Reserve chairman." But it seems Well let's hope that's right Yeah it seems that's what is very interesting particularly right now that Trump is posturing this way considering the uh liquidity conditions that you've you've laid out over the course of the last hour It's like why not just this you you should understand that pal probably

(54:18) understands this liquidity issue is just waiting for the right time for him I would imagine because well I I hope that's right because it the only thing I'd say is the history shows that the Federal Reserve is always behind the curve when it comes to these things That's true And that's what makes me sort of somewhat nervous Yeah But the the adding the like to think that you would just try to replace him get a new fed chair in uh and then have him act immediately that seems farfetched to me It seems like you're what I guess what

(54:47) I'm trying to say is like your your wagon sort of been hitched to this So you got to figure out a way to to I think the I think international markets would be very very skeptical if uh you know I mean the the you know the obvious candidate is Kevin Walsh uh to come in but I think you know even though he has extremely good credentials I think international markets would be very wary about accepting that given the fact they would see it as a direct Trump appointee Yeah Fascinating times Are you having fun yeah Lots of fun It's always good

(55:19) when you get volatility in markets but it's you know it's you can see it's turned my hair white So I'm only you know only 35 years old and look this is what happened Ah we graduated high school around the same time Um Michael thank you for for doing this This is incredible I I really appreciate uh your work and coming to uh explain everything that's going on to our audience It's uh it's very important I think understanding the the plumbing behind the scenes and how all these things interface with each other is very

(55:52) important because I think it's obvious we live in chaotic times Volatility is on the rise and it's important as somebody listening out there to realize that this is just a natural consequence of a debt based system Uh it's all about liquidity and um this too shall pass And I think being equipped with the knowledge uh that you just provided us is is very important So thank you That's a great pleasure If you want to know more about what we do Capital Wall Substack is where we write We'll link to that in the show notes I hope you enjoy

(56:25) your night and uh hopefully we can do this again at some point Yeah I look forward to it Marty Enjoyed it enormously Thanks so much Thank you Peace and love freaks Okay