After some temporary relief, yields on sovereign debt spiked again this week, with the 10-year US Treasury rising nearly 40bps W/W to break 5% for the first time since 2007 before retracing slightly on Friday afternoon.

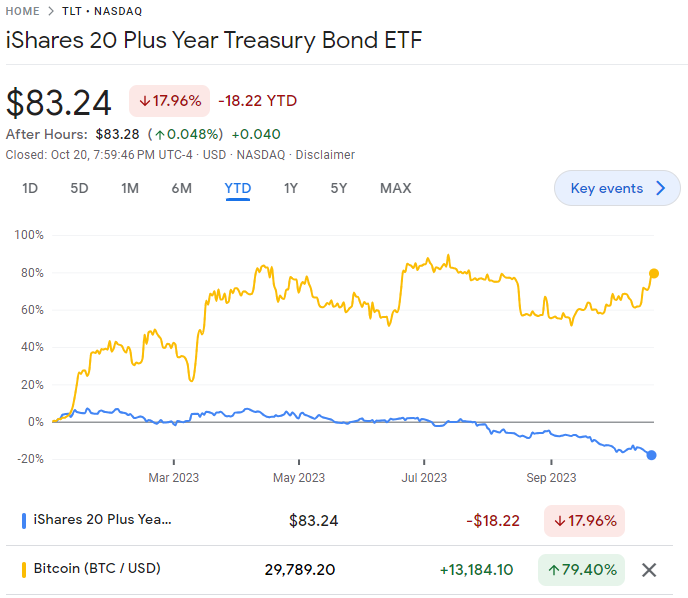

In a volatile week filled with headlines across the macro and regulatory landscape, a notable dichotomy continued to take shape: the simultaneously growing acceptance of and resistance to bitcoin among legacy investors and institutions. The first theme was on display in the divergent price action of bitcoin and US Treasury bonds – while Treasuries took another beating on the week with the 10-year yield spiking ~40bps W/W to nearly 5%, bitcoin held its recent range and took a ~10% leg up on Friday. At the same time, the many financial institutions with spot bitcoin ETF filings noted continued progress toward approval, and BlackRock CEO Larry Fink even went so far as to call bitcoin a “flight to quality” trade. While Ten31’s thesis on the power of bitcoin infrastructure investing is uncorrelated to near-term bitcoin price swings and the progress of ETF filings, we view this week’s divergence between traditional markets and bitcoin as a noteworthy signpost for the way legacy asset managers will ultimately come to view bitcoin and bitcoin technology as the unbroken 40-year bond bull market sputters to a halt.

On the flipside, this week also saw signs of institutional resistance to bitcoin, as the US Treasury Department’s FinCEN arm released new, excessively broad guidance on the treatment of cryptocurrency “mixing” services. Under FinCEN’s proposed guidance – which will now enter a 90-day public comment period – virtually any use of bitcoin could conceivably be categorized as “mixing” and made subject to additional oversight and burdensome, invasive reporting requirements by regulated financial service providers. In the battle between economic incentives and the inertia of sclerotic institutions, we expect the former to ultimately win out (as suggested by the capitulation of long-term bitcoin skeptics like Larry Fink), but this latest proposal from FinCEN serves as a reminder that bitcoin’s path to global monetization still faces hurdles that demand attention and response.

Battery Finance is a credit opportunities asset management firm capitalizing on some of the ways that bitcoin will impact traditional finance. Battery focuses on project finance with unique dual collateralization in the form of both underlying physical assets and bitcoin. Battery seeks to lend to traditional infrastructure ventures at competitive rates while requiring project sponsors to partially re-denominate real asset equity into bitcoin exposure. Upon maturity, borrowers repay principal and a portion of their bitcoin appreciation to Battery, giving Battery exposure to bitcoin’s upside while reducing medium-term volatility via project cash flows and the collateralization of traditional physical assets.

Unchained launched Sound Advisory, a new affiliate registered investment advisory (RIA) firm offering financial planning services tailored to bitcoin holders:

Announcing a new affiliate @mysoundadvisory, a registered investment advisor, to provide optional financial planning and investment advisory services tailored to bitcoin investors like you.

— Unchained (@unchainedcom) October 18, 2023

It’s financial advice for the new era.https://t.co/WzSlXDyyUA

Samourai rolled out an update to its watch-only Sentinel app that introduces many new capabilities and UX improvements:

We're proud to launch Version 5.0.0 of our popular "Watch Only" software, Sentinel, and boy is it a big one.

— Samourai Wallet (@SamouraiWallet) October 17, 2023

For those not in the know, Sentinel allows you the convenience of managing your UTXOs on mobile, without the risk of taking private keys hot. https://t.co/4gS3nwmzpJ

Strike partnered with Bitrefill to allow users to directly purchase gift cards and other services in-app through their cash or bitcoin balance:

🚨YO🚨

— Strike (@Strike) October 19, 2023

we're excited to partner with @bitrefill to enable users globally to make real-world purchases via the Lightning Network within Strike

you can now use your Cash or #Bitcoin over Lightning to buy your favorite gift cards, top up your phone, and pay for streaming services pic.twitter.com/H6n8kVt9yJ

Peach released its latest app update, which now allows users to connect to their own nodes:

📣🍑📱NEW APP RELEASE!!!

— Peach Bitcoin🇨🇭 (@peachbitcoin) October 13, 2023

this new Peach #bitcoin version is very cool so make sure to update your app! #donttrustverify

Let’s deep dive 🧵👇 pic.twitter.com/4tCE6hJ45z

Bitcoin Magazine published a profile of Coinkite’s upcoming Satslink device.

Unchained launched The Bitcoin Frontier, a new podcast hosted by Joe Burnett.

After some temporary relief, yields on sovereign debt spiked again this week, with the 10-year US Treasury rising nearly 40bps W/W to break 5% for the first time since 2007 before retracing slightly on Friday afternoon.

The overall US Treasury yield curve, meanwhile, continued to rapidly un-invert, historically an indicator of impending recession.

The price action in the bond market continued to challenge bank balance sheets, as total unrealized losses in the banking system increased to ~$1.6 trillion. Notably, Bank of America reported its unrealized losses had grown ~30% Q/Q to $132 billion through the third quarter, before even accounting for the impact of this week’s moves.

Main Street also felt continued pain this week, as interest rates on 30-year fixed mortgages – a pillar of the American homebuying experience – rose past 8% for the first time since 2000. Meanwhile, the Wall Street Journal ran articles on the rapidly rising cost of both entertainment and healthcare.

As part of remarks at a conference in New York, Federal Reserve Chairman Jay Powell commented that inflation is still too high and that slower growth will be needed to bring it down. His speech suggested the Fed will likely extend its rate-hiking pause, though commentary from other Fed officials suggested cuts aren’t expected until late 2024.

The Bank of Japan continued fighting an uphill battle as worldwide yields soared this week, including yet another round of unscheduled bond buying as the 10-year yield topped 0.85%, inching closer to the 1% high end of the bank’s yield curve control range.

Amid the turbulence across financial markets, BlackRock CEO Larry Fink – who just a few years ago dismissed bitcoin as an “index of money laundering” – took to the airwaves to call buying bitcoin a “flight to quality” trade.

In the background, BlackRock updated their filing for a spot bitcoin ETF (along with most other financial institutions in the hunt), suggesting ongoing progress with the SEC.

FinCEN – the financial crimes enforcement arm of the US Treasury Department – released new, extremely broad proposed guidance that would label any cryptocurrency “mixing” services or activities (including actions as simple as “creating and using single-use addresses”) as “primary money laundering concerns,” a designation that would impose new regulatory and recordkeeping requirements on such transactions. The public will have 90 days to comment on the proposal.

European Central Bank President Christine Lagarde announced that the bank is launching the “preparation phase” for a digital euro.

Senators Jeff Merkley and Steve Daines introduced the SAFER Banking Act, which would seek to prevent regulators from selectively impeding access to financial services for politically out of favor industries like cannabis, a development that could also have positive implications for banking access for bitcoin companies.

California governor Gavin Newsom signed off on the Digital Financial Assets Law, which will lay the groundwork for the state’s version of New York’s BitLicense.

Bitcoin developer Antoine Riard disclosed a potential major vulnerability in the architecture of the lightning network. Several other developers have weighed in with varying opinions on the severity of the vulnerability and potential mitigations available today and longer term.

OpenSats announced its latest wave of grants for Nostr developers and contributors, as well as new long-term support grants for Vasil Dimov and Gleb Naumenko

Lightning Labs released the alpha for its Taproot Assets protocol on bitcoin mainnet.

In the latest example of the dangers and fragility of centrally issued cryptocurrencies, Reddit abruptly ended support for its proprietary crypto tokens, causing prices to swiftly plummet ~90%.

This post was originally published on Ten31 Timestamp