Target's stock drops 10% as missed earnings reflect wider economic pressures from rising inflation and stagnant wages.

In a sobering glimpse into the U.S. consumer market, retail giant Target's latest earnings report has sent shares tumbling 10%, a significant drop for a company not known for volatile stock movements. This substantial decline comes as consumers pull back on purchasing not only discretionary items but also everyday essentials like groceries and paper towels, signaling a broad-based reduction in spending.

Target's fiscal first-quarter earnings missed estimates, with sales falling 3% year-over-year. CEO Brian Cornell acknowledged the ongoing soft trends, with the company responding by slashing prices on everyday items, attempting to position itself as a value leader amidst accelerating consumer price inflation.

This concerning trend echoes reports from other retail behemoths such as Walmart and Home Depot, suggesting a broader economic pattern. Personal stories reflect this hardship, with individuals across the country grappling with inflated costs for essential goods, forcing many to cut back on non-essentials, and in some cases, even the basics.

Persistent inflation, combined with stagnant wages and contracting bank lending, could lead to a weakening economy and further disinflation, with the potential for outright deflation if asset prices crash. This cycle may eventually prompt interventions by central planners, potentially leading to another wave of consumer price inflation due to market distortions reminiscent of the pandemic period.

Amidst this grim outlook, Target's efforts to cut prices on select items are likely a strategic move to attract consumers. However, with already thin margins, these cuts are seen as loss leaders designed to draw customers in, hoping they'll purchase higher-margin goods once inside the store.

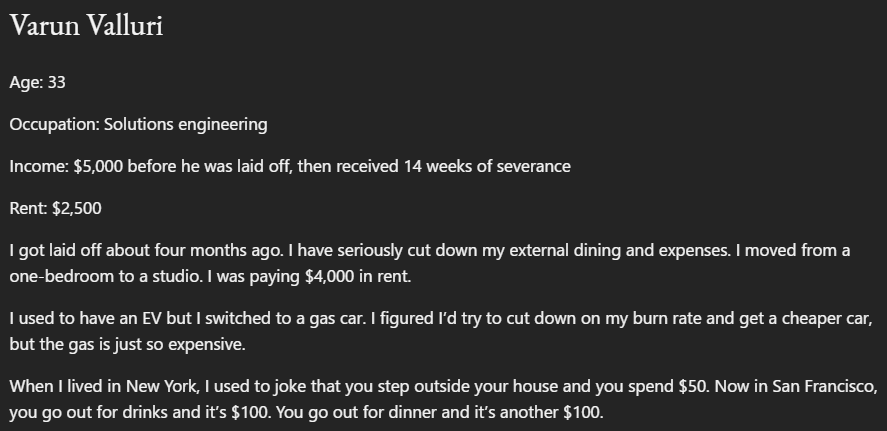

The Wall Street Journal provided anecdotal evidence of the financial strain on everyday Americans, ranging from those struggling to make ends meet to small business owners thriving in niche markets. Particularly striking are the hardships faced by individuals in San Francisco, a city notorious for its high cost of living, where even those making above-average incomes find themselves unable to afford basic necessities or forced to make significant lifestyle adjustments.

These personal accounts and the latest data from Target offer a stark reminder of the challenges facing the U.S. economy. As inflation continues to outpace wage growth, the strain on consumers is becoming increasingly evident.