Following its worst year in generations and a bloodbath earlier this fall, the traditional “60/40 portfolio” put up its best November + December performance in nearly 30 years.

The Santa Rally was in full force this week, as the S&P 500 climbed to new YTD highs and is now almost back at its all-time high as investors increasingly price in (correctly or incorrectly) peak restrictive monetary policy.

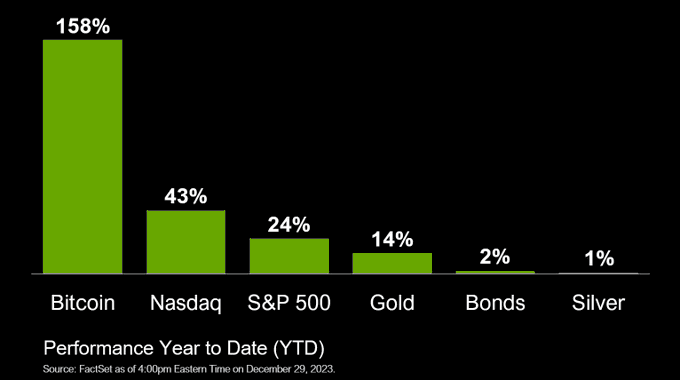

Bitcoin extended its recent run with another +13% gain on the week and is now up over 165% on the year.

Traditional markets generally maintained gains from the past few weeks even as economic indicators continued to look mixed.

The bitcoin network saw its sixth consecutive upward difficulty adjustment this week to another all-time high, as total network hashrate has now jumped by ~100 EH/s in just under three months.

The US economic picture continues to look precarious, as leading indicators extended their record-long streak of sequential declines and existing home sales cratered to new 13-year lows – but as the Wall Street Journal suggests, you can always consider selling your kidney if times get tight.