Onramp Weekly Roundup - 11/2/23

The existence of contango in bitcoin futures markets underscores the need for better suited institutional products, with many excited about the potential for a potential spot ETF approval.

The existence of contango in bitcoin futures markets underscores the need for better suited institutional products, with many excited about the potential for a potential spot ETF approval.

2023 has been the year of the Great Bitcoin Decoupling and it may be driven by the fact that more and more individuals are beginning to understand how much counterparty risk they are exposed to in the banking system.

In short, the productive economy was whipsawed during the boom-bust, and now in the recession it's starved.

Meanwhile, bitcoin put up another strong showing, gaining another ~15% after last week’s +10% move (which also coincided with a broad selloff in traditional markets).

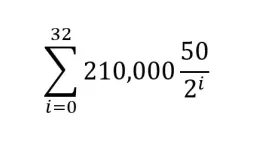

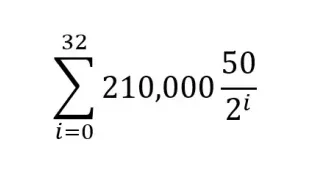

To get ready for April 2024, here are the 6 keys to understanding the Bitcoin halving & why it’s a huge deal

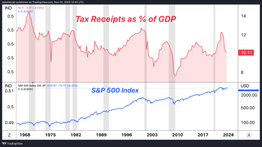

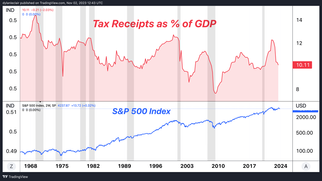

Putting the debt increase in context & examining the four drivers causing it

The inflation-is-prosperity fallacy has been internalized by the ruling class.

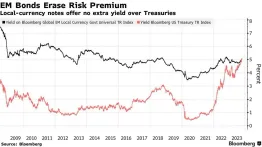

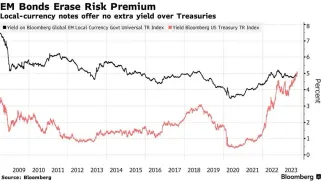

The 10yr US Treasury yield has climbed from 0.66% in April 2020 to 4.7% this week.

The existence of contango in bitcoin futures markets underscores the need for better suited institutional products, with many excited about the potential for a potential spot ETF approval.

2023 has been the year of the Great Bitcoin Decoupling and it may be driven by the fact that more and more individuals are beginning to understand how much counterparty risk they are exposed to in the banking system.

In short, the productive economy was whipsawed during the boom-bust, and now in the recession it's starved.

Meanwhile, bitcoin put up another strong showing, gaining another ~15% after last week’s +10% move (which also coincided with a broad selloff in traditional markets).

To get ready for April 2024, here are the 6 keys to understanding the Bitcoin halving & why it’s a huge deal

Putting the debt increase in context & examining the four drivers causing it

The inflation-is-prosperity fallacy has been internalized by the ruling class.

The 10yr US Treasury yield has climbed from 0.66% in April 2020 to 4.7% this week.

The move to a central bank digital currency regime is official upon us, freaks.

It was simply ledger entries on internal books at the reserve bank- it didn’t exist anywhere else.

What would America look like it we return to the gold standard? Would we return to the stone age, would innovation end as Wall Street bankers and government’s paid economists claim? It's easy to talk about the catastrophes unleashed on humanity by paper money. The permanent inflation,

How to protect against a total loss of your bulk meat purchase “What happens if my freezer breaks or the power goes out?” This is a very common question that comes up in conversations about buying beef in bulk, and is absolutely a consideration that needs to be taken into

With the appropriations fight in Washington in overdrive, and a barely avoided government shutdown behind it—for now—Congress should be paying attention to the latest economic data now more than ever. Recent revisions show things are actually worse than previously estimated. In fact, both the American consumer and the