The Swiss National Bank (SNB) has unexpectedly lowered its interest rates for the second time in a row, reflecting growing concerns about the global economy.

The Swiss National Bank (SNB) has unexpectedly lowered its interest rates, marking the second consecutive rate cut by the institution. This decision reflects growing concerns among Swiss officials regarding the global economic landscape which seems to be faltering rather than rebounding as previously hoped. The SNB's move also comes amidst increasing unease about currency market volatility, particularly with respect to the US dollar.

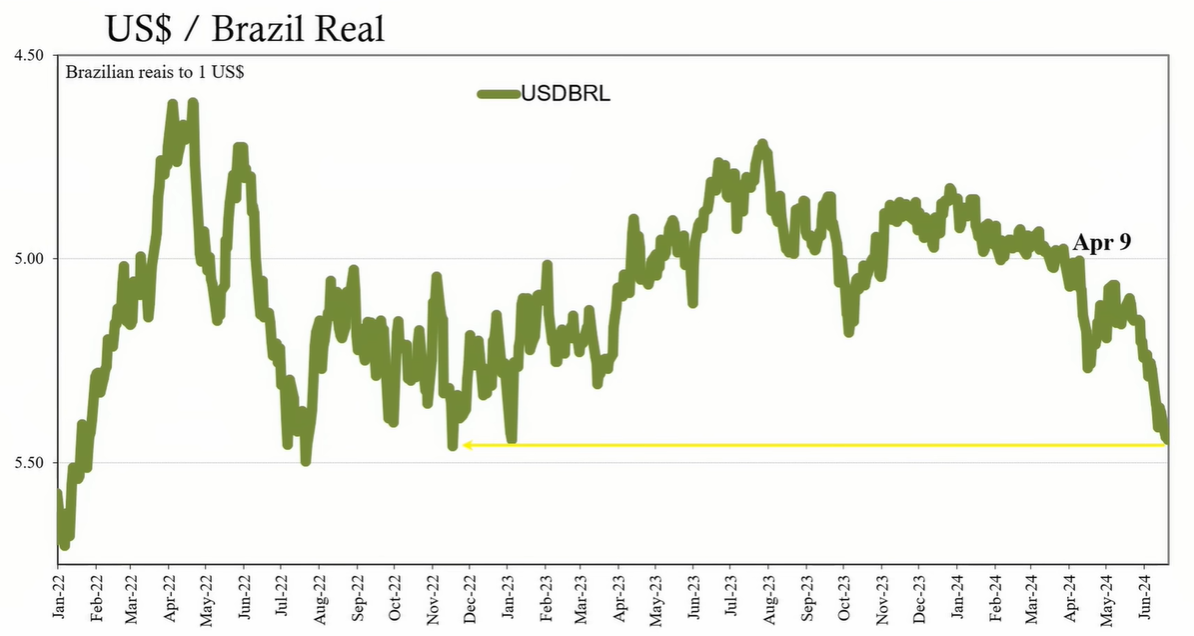

The Swiss franc has been appreciating over recent months, buoyed by its status as a safe haven currency amid a growing rally in government bonds such as US treasuries. This rise in the franc is indicative of the shift towards safer investments, which is usually a response to heightened economic uncertainty. Concurrently, concerning lows have been recorded in the currencies of other major economies, including China's yuan, Japan's yen, and Brazil's real.

The Swiss national bank's actions highlight a broader sense of pessimism about the global economy's trajectory. Despite a mildly positive first quarter, troubling signs persist, suggesting a slow recovery from a low baseline. Europe has been grappling with a recession, and there are few signals that conditions are improving significantly elsewhere.

The Federal Government Expert Group on Business Cycles predicts Switzerland's economic growth in 2024 to be well below average, with an expected GDP growth of 1.2%, adjusted for sporting events. The outlook for 2025 is slightly more optimistic, with growth potentially normalizing to 1.7%, assuming the global economy maintains its recovery trajectory.

The SNB's concerns are echoed in other parts of the world. The US economy has shown notable weakening in the first quarter, and Japan's GDP has contracted. While the UK and China have seen relatively robust GDP growth, there remain questions about the sustainability of China's economic performance.

The eurozone has managed to recover from a weak phase, but expectations are for subdued growth in the coming quarters, which could negatively impact Swiss exports.

The SNB's decision to cut rates is partially a response to significant currency market fluctuations. The rate cut aims to provide some insurance for the Swiss economy against these volatilities and the broader global economic slowdown. However, the rate cuts may have limited impact on both the economy and the Swiss franc's strength, particularly if the global downturn persists and safe haven demand continues to push the franc's value higher.

The Swiss National Bank's latest rate cut signals a deepening concern over the global economic outlook and the associated currency market instability. While the SNB remains hopeful for a European and global recovery, the current economic indicators and currency trends suggest that such optimism may be premature. As the SNB adjusts its monetary policy in response to these challenges, it acknowledges the significant uncertainty that lies ahead for Switzerland and the global economy at large.