The recent surge in oil prices is raising intricate economic questions, challenging the balance between inflation concerns and the possibility of a disinflationary trend in global markets.

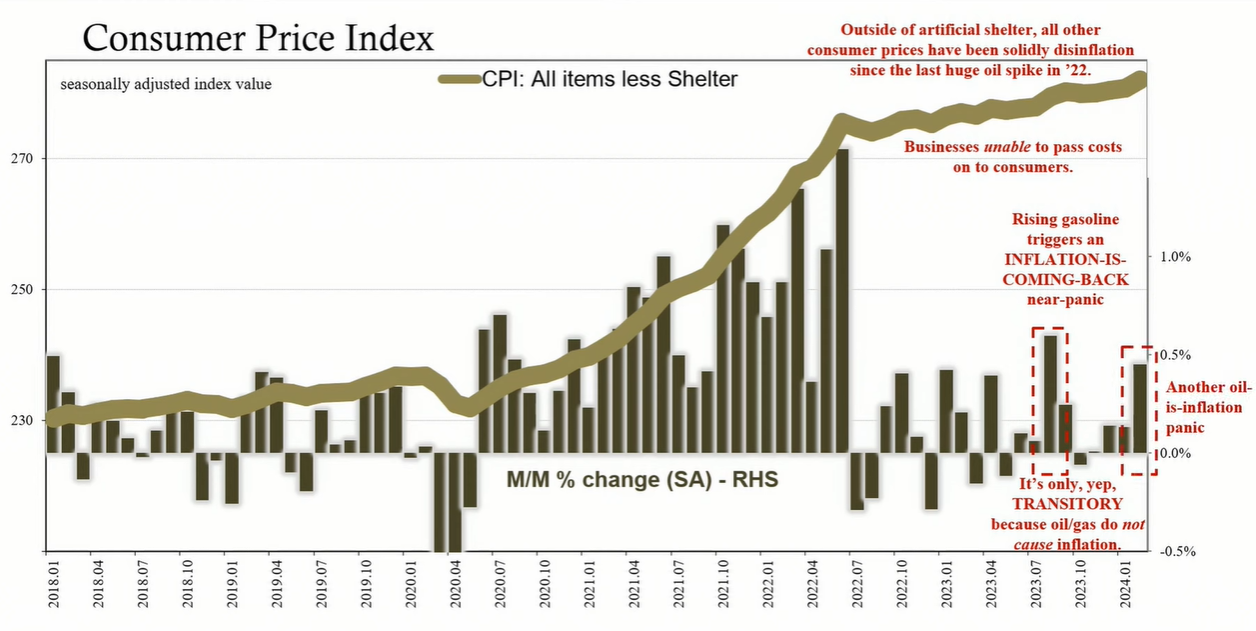

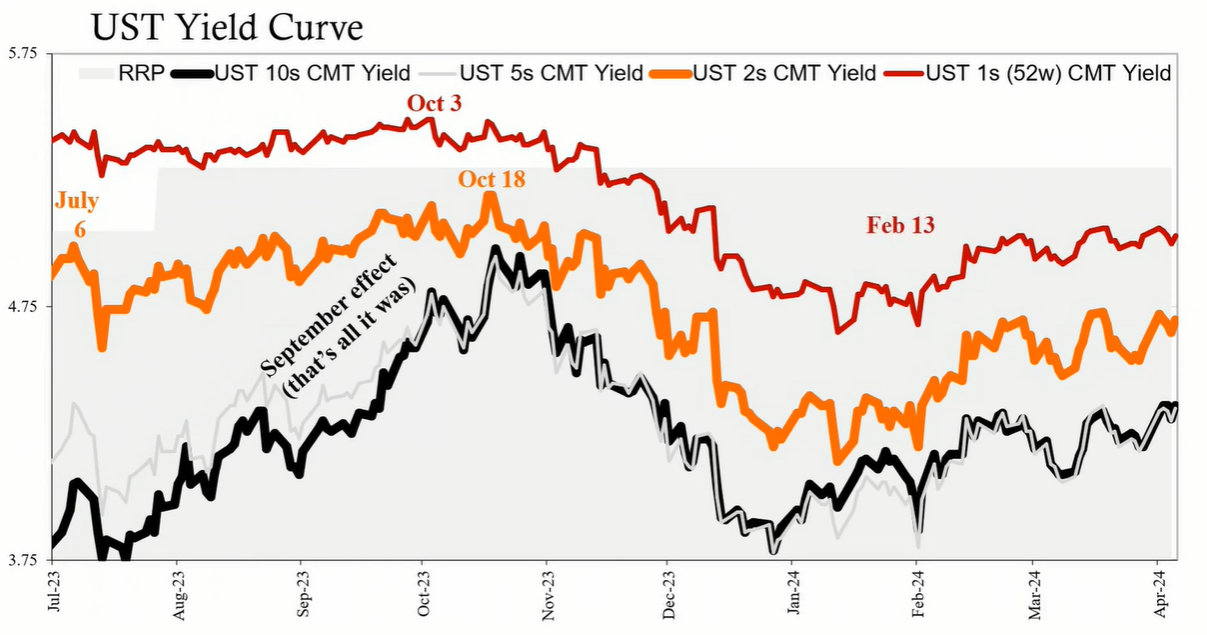

Oil prices are once again on the rise, stoking concerns over potential inflationary pressures. This trend appears reminiscent of the situation from the previous summer, particularly during September and October, when oil prices escalated due to supply factors. Contrary to the inflationary worries that accompanied this increase, the period concluded with disinflation, both in the United States and globally. Additionally, economic indicators, such as retail sales in the U.S., began to show signs of weakness. The financial markets suggested a significant economic shift, but not towards inflation.

As oil prices surge, analysts are tasked with determining whether this is indicative of a global economic uptick, suggesting a demand component, or if it is primarily influenced by geopolitical tensions, such as those in the Middle East and Ukraine. The distinction between these scenarios is crucial, as the former could signal a return to conditions similar to the 1970s, while the latter might point to a repeat of last year's events, where non-economic drivers of oil prices led to disinflation and a negative impact on the real economy.

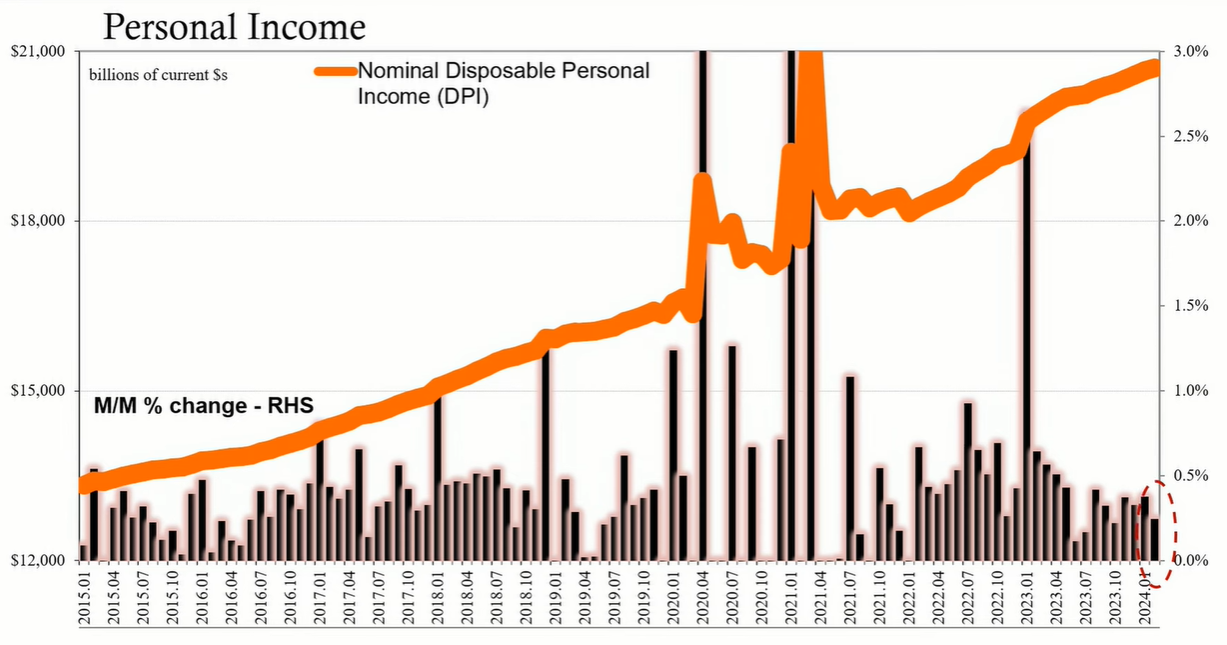

The current increase in oil prices raises questions about their effect on consumer behavior and the broader economy. If rising oil prices are driven by non-economic factors, the typical correlation between higher energy costs and increased inflation may not hold. Instead, consumers might reduce their spending in other areas to cope with the higher energy costs, leading to a decrease in overall consumption.

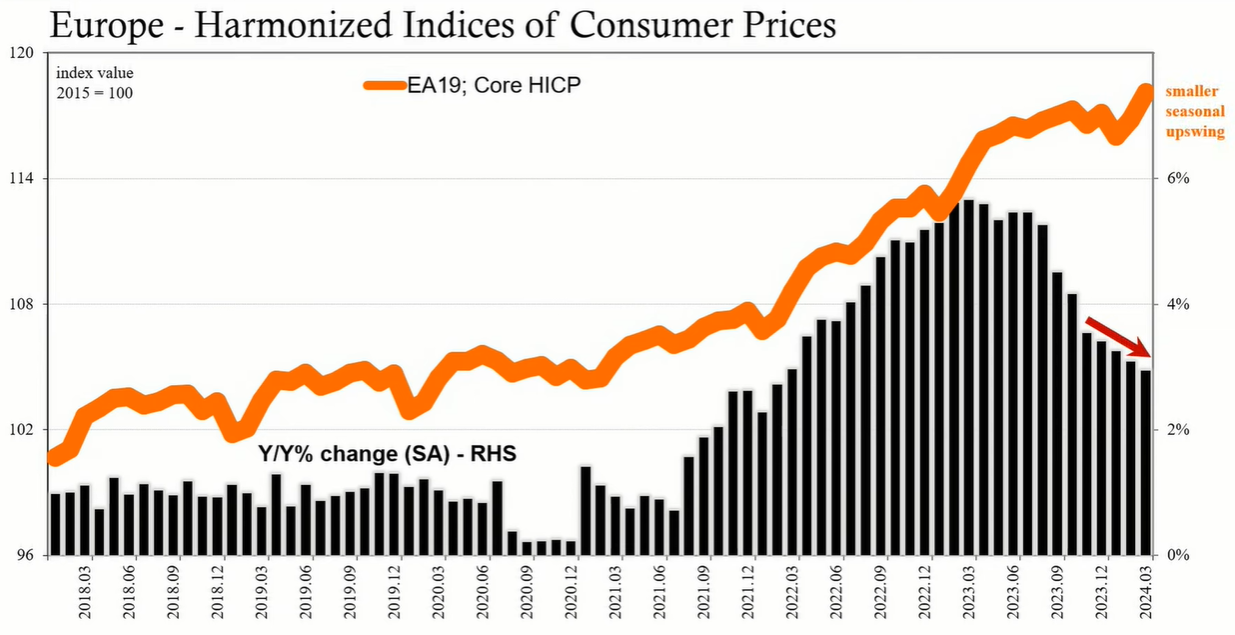

Observations of the Consumer Price Index (CPI) indicate a trend of disinflation despite the rising oil prices. This suggests that consumers may not be experiencing an improvement in their financial outlook, which would normally lead to increased energy consumption and economic growth. Europe's experience with disinflation amidst climbing oil prices may offer further insight into the real demand situation and the ability of economies to absorb such shocks.

For policymakers like Federal Reserve Chair J Powell, the decision to adopt a hawkish or dovish stance is complicated by the current dynamics. On one hand, rising consumer prices due to higher energy costs could warrant a hawkish approach to prevent unanchored inflation expectations. On the other hand, the recognition that past oil price surges have led to economic slowdowns might suggest a more dovish response to support a potentially softening economy.

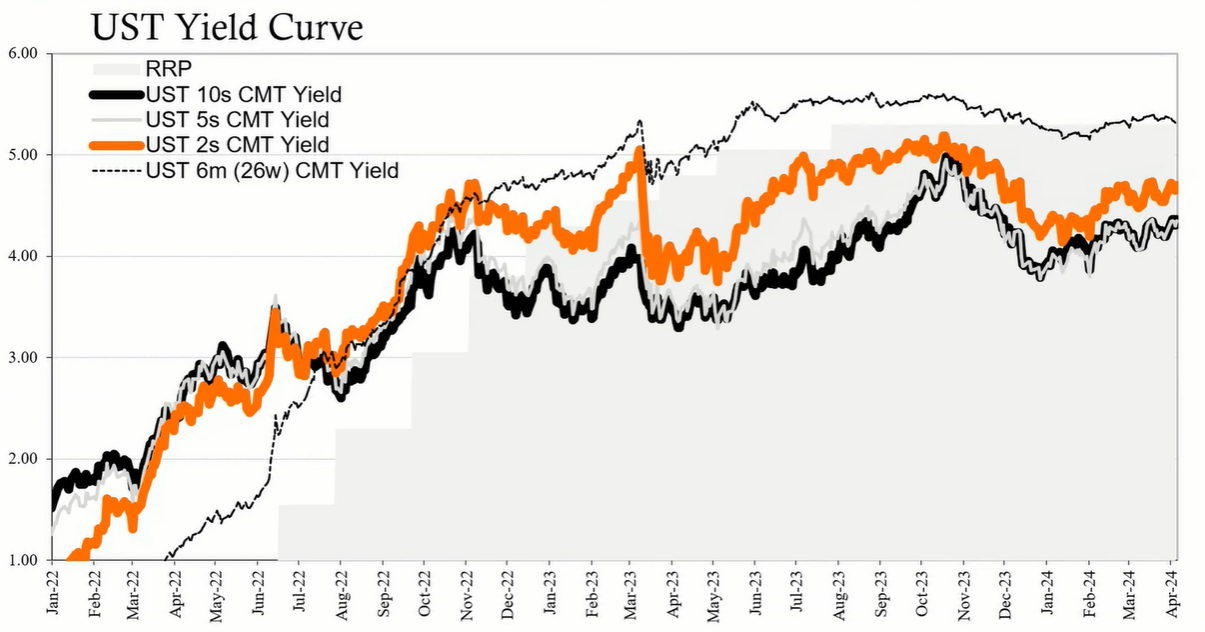

The bond market's response to the situation has been relatively stable, possibly reflecting an anticipation of rate cuts. This stability contrasts with the equity markets, which have experienced fluctuations but no significant directional moves. The bond market may be factoring in the potential for broader global economic weakness, which could eventually impact the U.S. economy.

The recent surge in oil prices poses a complex challenge for the economy and policymakers. While the immediate reaction may be to associate higher energy costs with inflation, past experiences suggest the potential for a disinflationary outcome and broader economic slowdown.