The latest data from the Bureau of Labor Statistics showcases a worrying trend.

The latest data from the Bureau of Labor Statistics showcases a worrying trend. According to the freshly released Consumer Price Index (CPI) numbers, the annualized inflation rate surged to 3.7% last month—an alarming increase from the 2.8% of the preceding month, the 1.9% before that, and a stark contrast to the sub-1% levels witnessed during the halcyon days of October. The core inflation rate, which the Federal Reserve considers more indicative of long-term trends as it excludes volatile food and energy prices, presented an even grimmer picture at an annualized 4.8%, a jump from 3.4%.

The persistence of inflationary pressures is underscored by this being the 34th consecutive month with annual inflation remaining stubbornly above 3%. This persistent rise has quashed any remaining beliefs in its transitory nature. In response, prediction markets have adjusted their outlook significantly. Expectations of impending rate cuts have been slashed, with only four anticipated by year-end, down from seven forecasted a month ago. This recalibration indicates a projected year-end rate of around four and a quarter percent, just a percent below current levels, which could translate to mortgage rates hovering around 6.5%. A month prior, markets were predicting a more optimistic 3.5%.

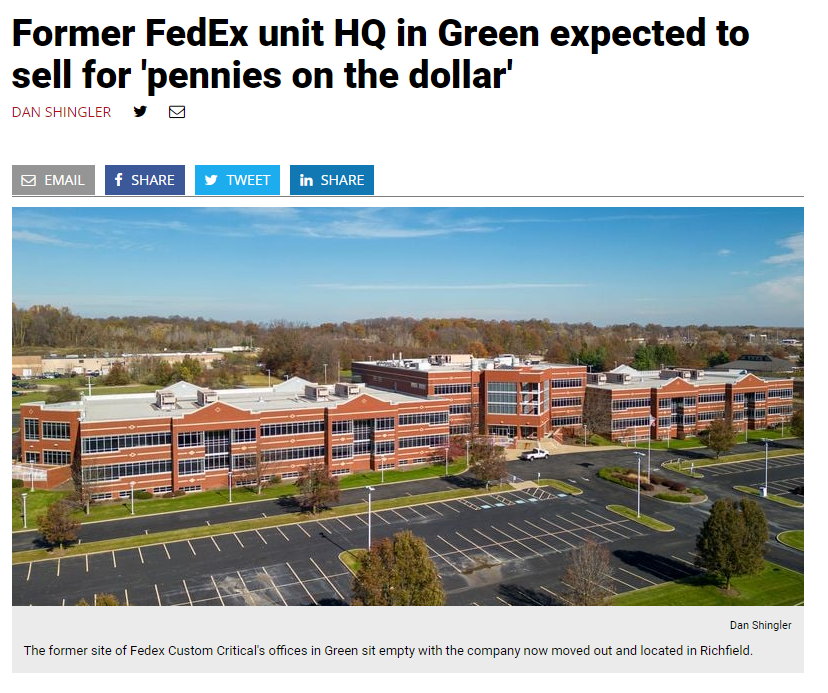

This rate environment maintains pressure on the banking sector, particularly regional banks, which find themselves submerged in commercial real estate debt. A stark illustration of the issue is the recent sale of a prime office building in Ohio, a former FedEx complex, for a paltry $9 per square foot—a price that would equate to roughly $18,000 for a typical house. At this valuation, it is evident that the construction costs far exceeded the selling price, leading to considerable losses. This is not an isolated incident, with regional banks holding an estimated $300 billion in commercial real estate debt, which constitutes a third of their loan portfolios.

Federal Reserve Chairman Jerome Powell recently appeared on "60 Minutes," providing assurances that banking risks are manageable despite the recent bailout of New York Community Bank. However, Powell conceded that regional banks might fail but would likely be acquired by larger institutions. With high interest rates set to continue, this consolidation could accelerate.

The video also touches on the haunting prospect of a double peak in inflation, akin to the scenario of the 1970s when unchecked federal spending and a stop-and-start monetary policy led to a protracted period of high inflation. The presenter suggests that current federal spending has led the Fed to be subservient to government whims, and with the Fed cutting rates amidst rising inflation, it signals a potential severe recession ahead. This situation mirrors the stagflation of the 1970s, a combination of stagnant economic growth and inflation, which could be prolonged given the current state of affairs in Washington.

In conclusion, the economic outlook appears fraught with challenges, from persistent inflation and banking sector vulnerabilities to the specter of stagflation. With these factors in play, the Fed's current policies and the government's fiscal behavior will be critical in shaping the economic landscape ahead.