When you own a single-member LLC, choosing the right health insurance can feel overwhelming. You should typically compare traditional insurance with alternatives like CrowdHealth.

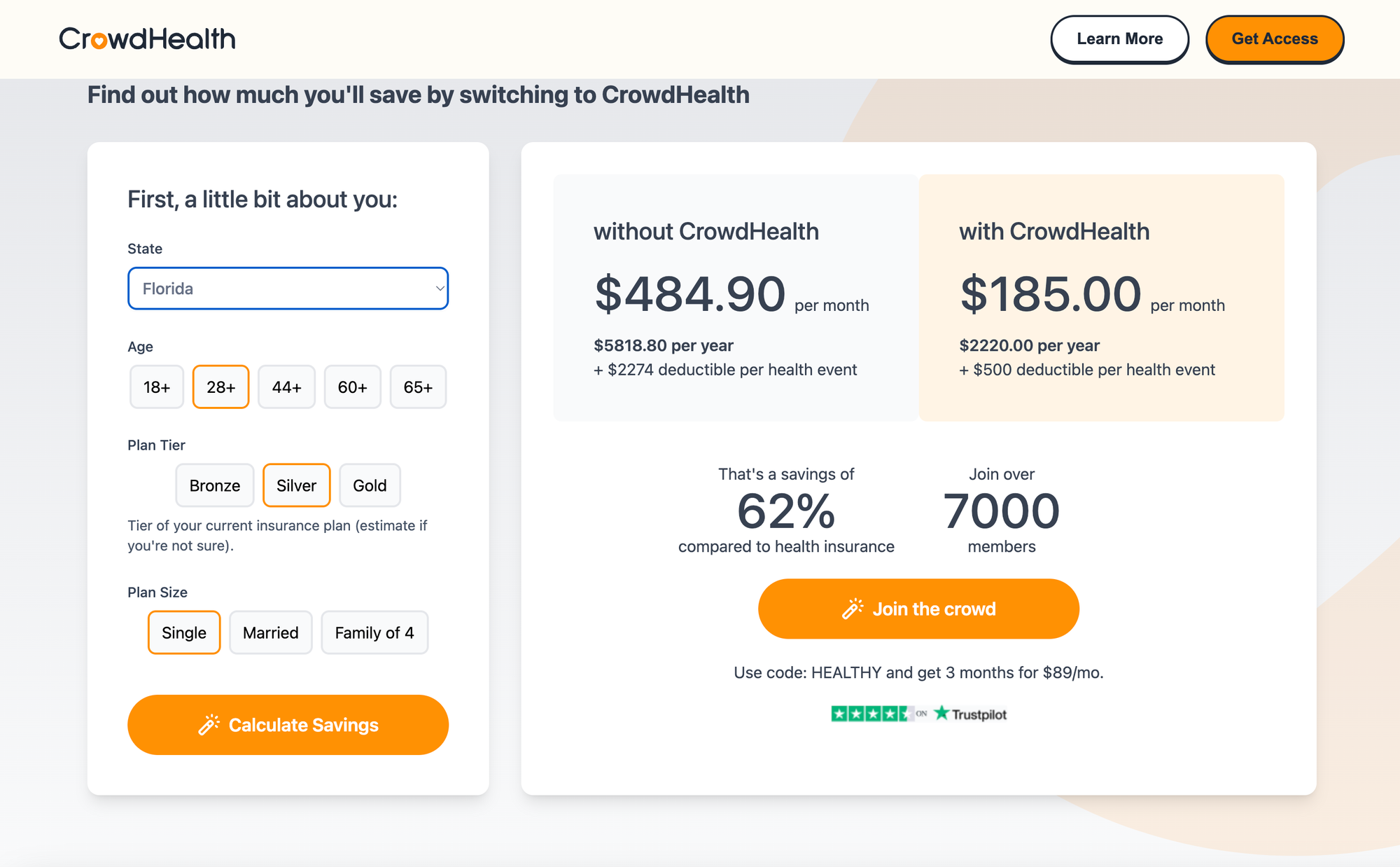

CrowdHealth offers a community-powered model where members contribute to each other's medical expenses. This can be a flexible and cost-effective solution compared to traditional insurance plans.

With a single-member LLC, you can consider several health insurance options.

Traditional plans often come with predictable coverage but can be expensive.

On the other hand, CrowdHealth provides a contractual community-based approach, potentially saving you money by pooling resources.

Traditional insurance may offer more comprehensive coverage, but it can be costly. CrowdHealth provides an innovative, budget-friendly alternative that allows you to control your healthcare spending more.

As a single-member LLC owner, you have several options for health insurance. Your choices will depend on budget, coverage needs, and tax implications.

Individual Health Insurance Plans

You can purchase an individual plan through the Health Insurance Marketplace. These plans offer a variety of coverage levels and premiums. You may qualify for subsidies based on income, making these plans more affordable.

Self-Employed Health Insurance Deduction

Buying an individual plan might make you eligible for the self-employed health insurance deduction. This allows you to deduct your health insurance premiums from your income taxes, which can reduce your tax bill.

Group Health Insurance Plans

Although rare for single-member LLCs, you can explore group coverage. These plans often provide better rates and extensive coverage. However, they typically require more administrative effort and higher costs.

Health Sharing With Crowdhealth

Some single-member LLC owners are considering joining health-sharing programs like CrowdHealth. These programs are not traditional insurance but can help cover medical expenses. They involve members pooling their funds to cover healthcare costs. CrowdHealth covered 100% of its members' "health events" in 2023.

We are done crowdfunding for the year.

— CrowdHealth (@JoinCrowdHealth) December 28, 2023

3,506 submitted to the community for crowdfunding

3,506 funded by the community

We had some doozies. Brain surgery, cancer cases, motor vehicle accidents, NICU babies, a whole bunch of MSK surgeries, and a host of other large events.… pic.twitter.com/isPNN9ue9O

Short-Term Health Insurance

If you need temporary coverage, short-term health insurance may be an option. These plans usually have lower premiums but offer limited coverage. They are ideal for bridging gaps between long-term plans.

CrowdHealth was founded in 2021 in Austin, Texas. It offers a unique approach to healthcare by crowdfunding medical expenses. Unlike traditional health insurance, CrowdHealth operates on a community-based model.

Key Features:

Knocked this one out of the park…if we do say so ourselves. pic.twitter.com/9EDMlHt8P6

— CrowdHealth (@JoinCrowdHealth) February 12, 2023

Mission:

CrowdHealth's mission is to shift away from the profit-driven model of the traditional healthcare system. Instead, it focuses on empowering consumers to manage and pay for their healthcare affordably.

CrowdHealth is designed to be lean and efficient. It prioritizes reducing costs for its members while maintaining quality care. The idea is to fund people, not administrative costs.

The average US family health insurance premium has increased from $6,000 in 2000 to $21,000 in 2022. That’s a 249% increase, or 5.8% per year, more than double inflation.

— Peter Mallouk (@PeterMallouk) October 6, 2023

The biggest beneficiaries of this massive increase in costs: health insurance companies. UnitedHealth… pic.twitter.com/dZ98txRdeB

Why Choose CrowdHealth:

Learn more about the benefits of CrowdHealth at CrowdHealth - Healthcare Crowdfundingsingle-member LLC against services like Crowdhealth, it's essential to consider.

When comparing health insurance options for a single-member LLC against services like Crowdhealth, it's important to consider the specifics of coverage and benefits.

Traditional Health Insurance

Crowdhealth

| Aspect | Traditional Health Insurance | Crowdhealth |

|---|---|---|

| Monthly Costs | Higher, varying with plan | Lower, cost-sharing model |

| Provider Network | Restricted to in-network providers | Any provider |

| Preventive Services | Often included | Varies by group |

| Telehealth | Sometimes included | Often included |

| Out-of-pocket Caps | Yes, there are maximums | Varies |

When comparing health insurance options for a single-member LLC, you must consider financial and tax implications.

Single-Member LLC Health Insurance:

Crowdhealth:

Comparison Table:

| Aspect | Single-Member LLC Health Insurance | Crowdhealth |

|---|---|---|

| Tax Deduction | Yes, if following IRS guidelines | No, monthly fees are not tax-deductible |

| Reimbursement Plans | Possible with an HRA | Not applicable |

| Inclusion in W-2 | Required for shareholders with >2% stake, if taxed as S corp | Not applicable |

Single-member LLC owners have different health insurance options compared to other business structures. CrowdHealth offers an alternative to traditional health insurance, which might benefit self-employed individuals differently.

Single-member LLC owners can buy individual health insurance plans through the ACA marketplace. If eligible, they can also join a group health plan, often through professional organizations.

CrowdHealth is a health-sharing plan in which members share medical costs instead of paying premiums to an insurance company. It often has a lower monthly cost than traditional insurance but might offer less comprehensive coverage.

Yes, single-member LLCs can deduct health insurance premiums on their tax return. This applies if the LLC does not have employees other than the owner. Details about how this works can be found on Lively.

Health-sharing plans like CrowdHealth often have lower monthly costs and more flexibility in choosing healthcare providers.

Single-member LLC health insurance costs vary based on the individual’s health and plan choice. Small business group plans might provide more predictable costs and potentially lower rates due to pooling resources with other employees.

Consider the monthly premium, out-of-pocket costs, and coverage limitations. Also, evaluate the flexibility of choosing healthcare providers.