Salesforce's revenue miss and stock plunge, alongside Kohl's sales decline, highlight a broader economic downturn driven by cautious spending.

Big business software provider Salesforce has reported its first revenue miss since 2006, attributing the shortfall to increased budget scrutiny. This has led to a significant drop in its stock value, with shares plummeting by 20%.

Salesforce shares experienced a dramatic decrease, marking the company's worst trading day since its public offering in 2004. Following the fiscal first-quarter results, which failed to meet Wall Street's expectations for revenue, the company also projected a single-digit revenue growth for the second fiscal quarter of 2024, a first in its history.

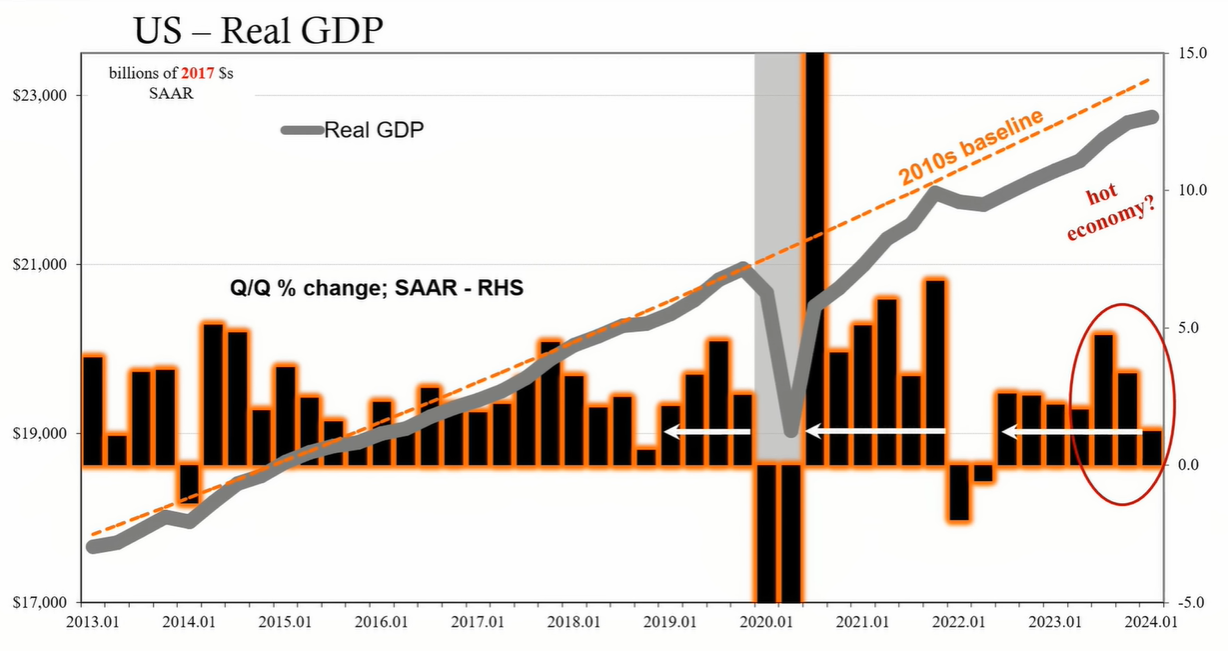

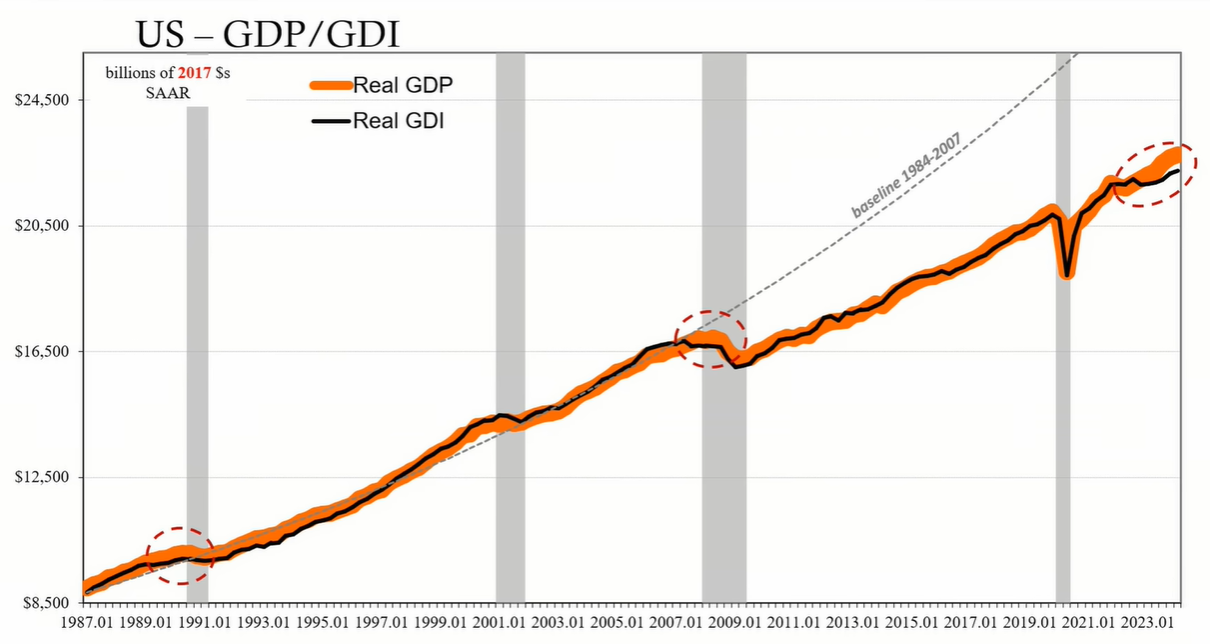

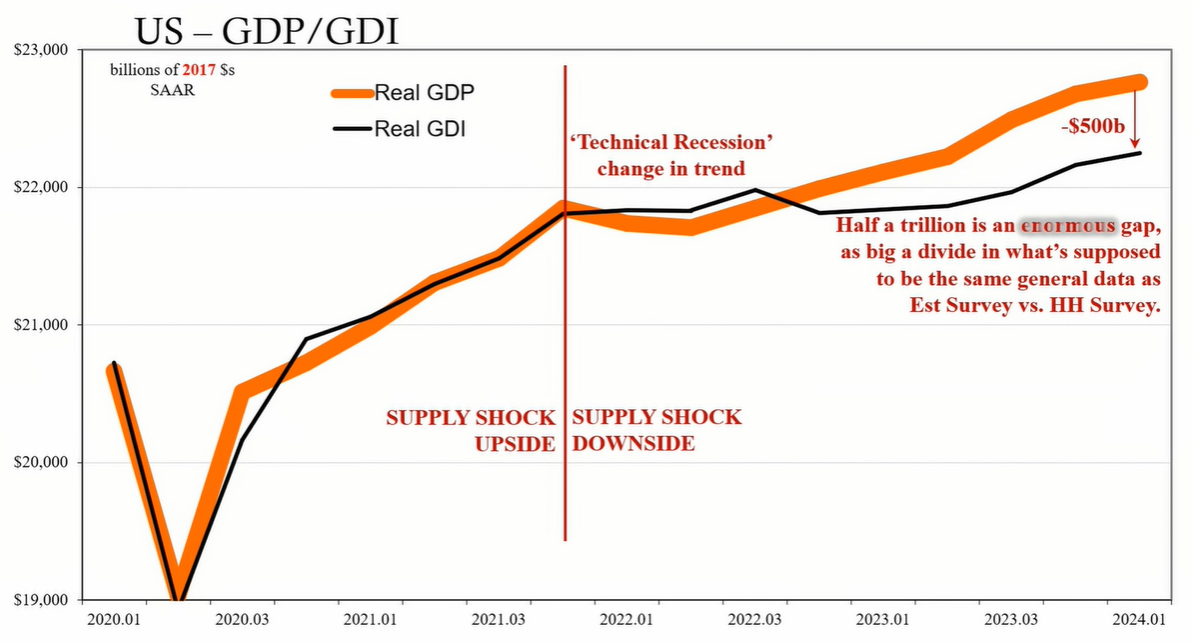

The disappointing performance by Salesforce is seen as a symptom of broader economic issues. Updated GDP estimates for the first quarter have been revised lower, reinforcing the perception of a struggling economy. Gross Domestic Income (GDI) and corporate profits, both new data points for the quarter, also support the narrative of economic slowdown.

Parallel to Salesforce, retailer Kohl's reported a sharp decline in overall sales, with its stock value decreasing by 25%. The company's decision to reduce clearance sales has resulted in fewer customers and a significant drop in revenue. This is indicative of a broader trend where consumers are showing increased price sensitivity, impacting retail businesses.

Kohl's also noted a 13% reduction in inventory, a move that affects the supply chain, causing wholesalers to cut back on production due to reduced demand from retailers. This "reverse bullwhip effect" is evident in various economic indicators, including soft surveys and hard data like industrial production numbers.

The revised GDP figures for the first quarter show a marked downgrade, with nominal GDP revised significantly lower. This reflects a deceleration in consumer spending, which has a cascading effect across the economy. GDI figures, which are supposed to mirror GDP, suggest the economy has been weaker than previously thought, aligning more closely with the household survey rather than the establishment survey.

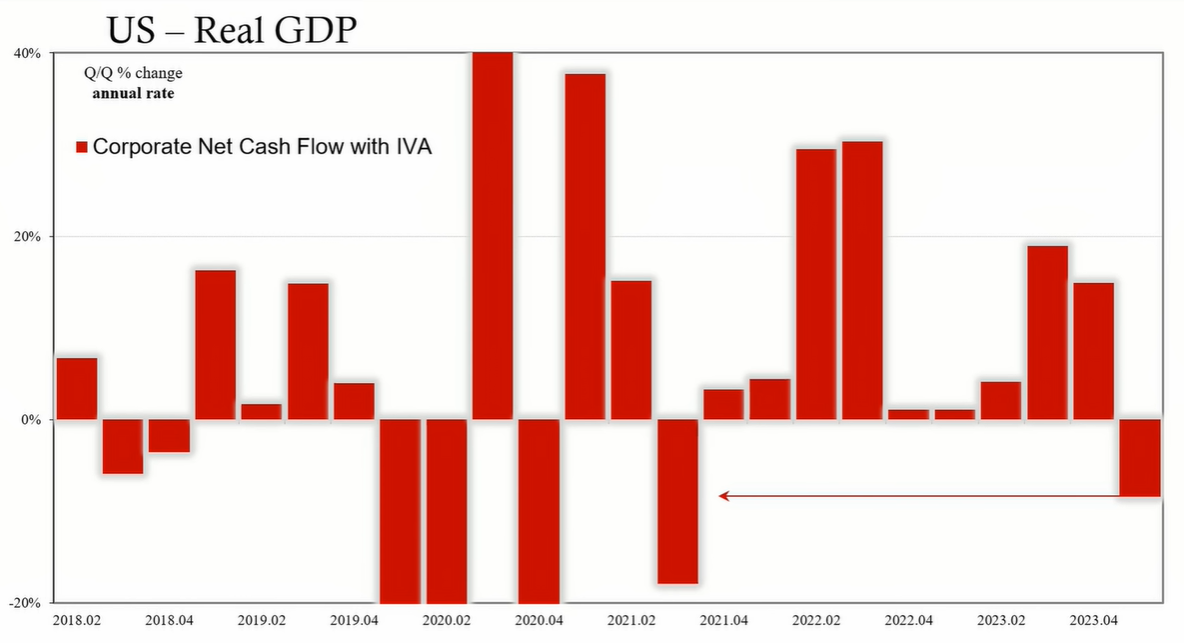

The initial estimates for corporate profits show a decline, corroborating the narrative of businesses facing a challenging economic environment. A decrease in corporate net cash flow further emphasizes the need for companies to exercise budget caution.

The economy is characterized by various indicators, including company reports and GDP data, pointing towards a downturn. Both Salesforce and Kohl's serve as examples of the wider impact on businesses, reflecting a consumer environment that is less robust than portrayed by some economic models. The data unambiguously supports the view of a continuing economic contraction, more severe than a mere "vibe session" or other euphemisms might suggest.