Rising oil prices might trigger a global recession, mirroring historical oil shocks and impacting consumer behavior and central bank policies.

Recent trends in the financial markets have sparked discussions regarding the relationship between commodity prices, particularly oil, and the broader economy. With gold prices on the rise, there is speculation about the implications of this trend and whether it signals an impending economic downturn akin to the 1973 oil crisis.

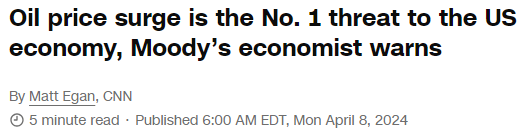

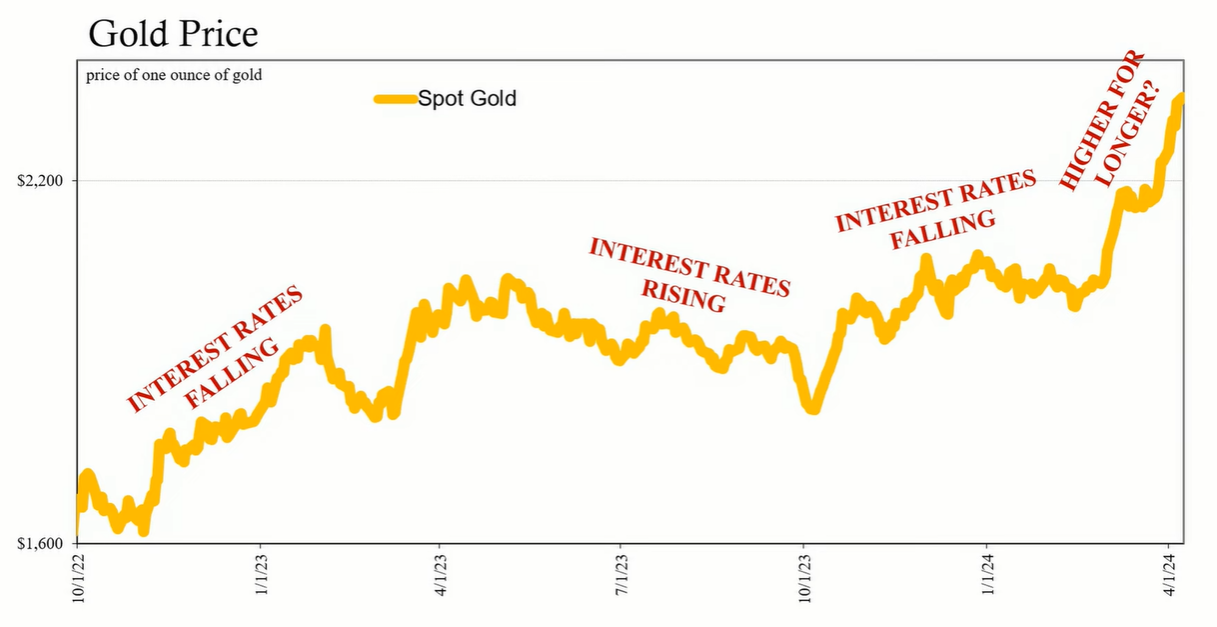

Gold is traditionally viewed as a safe haven asset, and its price often increases in times of economic uncertainty. Contrary to popular belief, gold does not necessarily correlate with inflation. Instead, it reflects safe haven demand, influenced by global economic perceptions and expectations for interest rates. As interest rates decrease or are anticipated to decrease, the opportunity cost of holding gold diminishes, making it more attractive to investors.

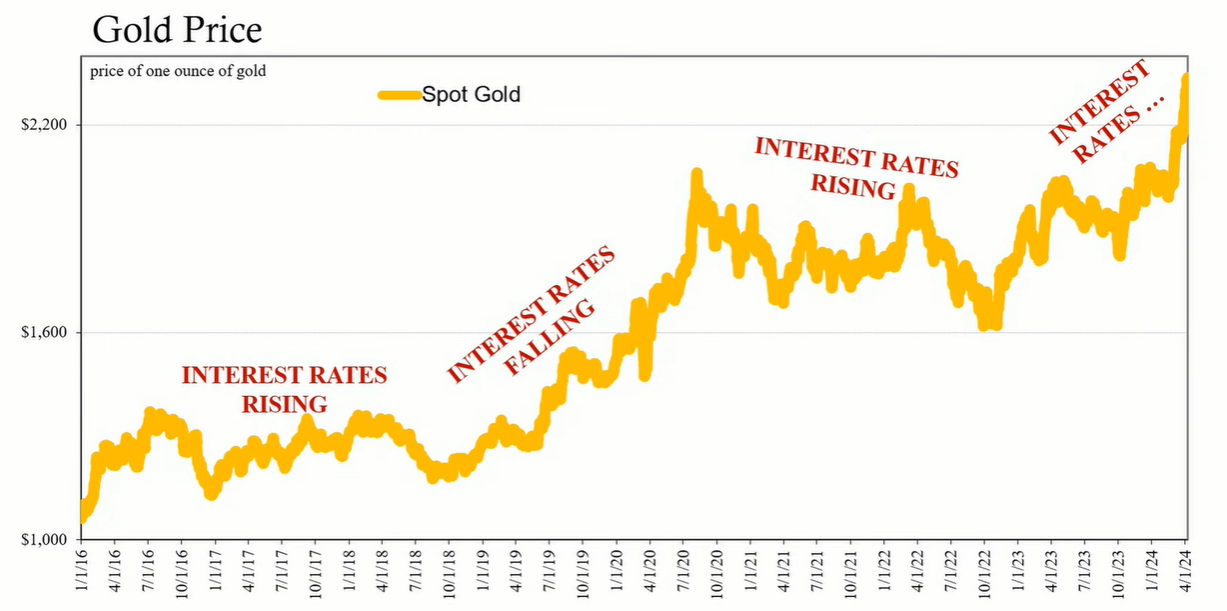

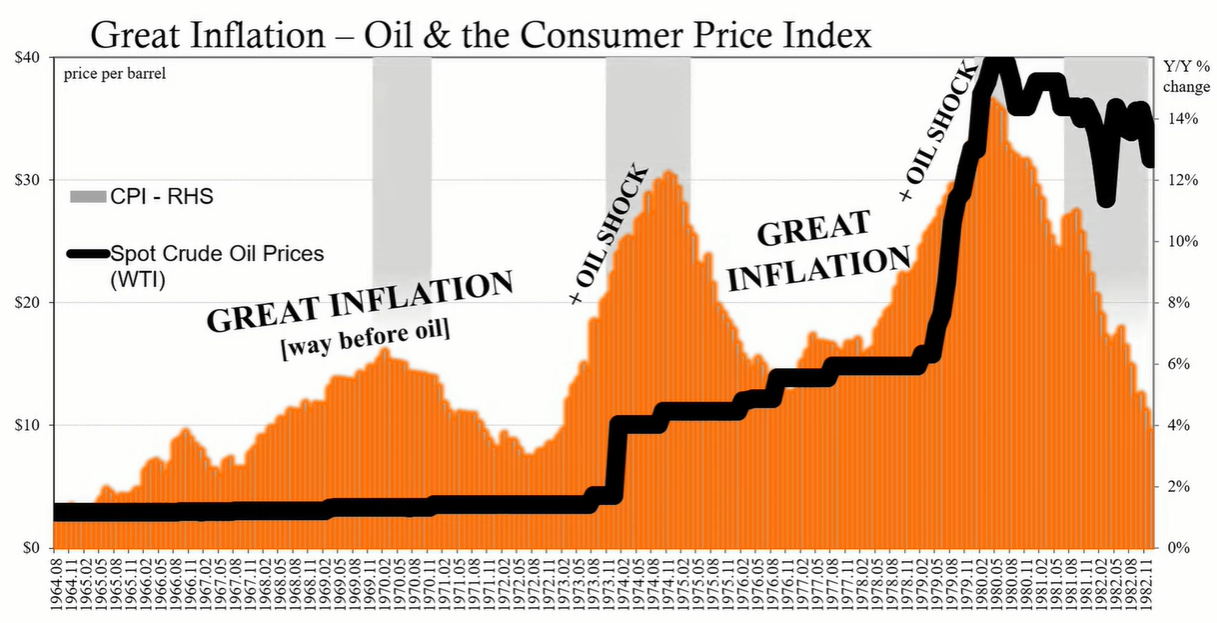

Historically, oil price shocks have been associated with subsequent disinflation, rather than inflation. This phenomenon is attributed to the dampening effect high oil prices have on economic activity. As oil prices rise, they reach a threshold that strains the economy, leading to reduced consumer spending and a general slowdown, which in turn results in disinflation.

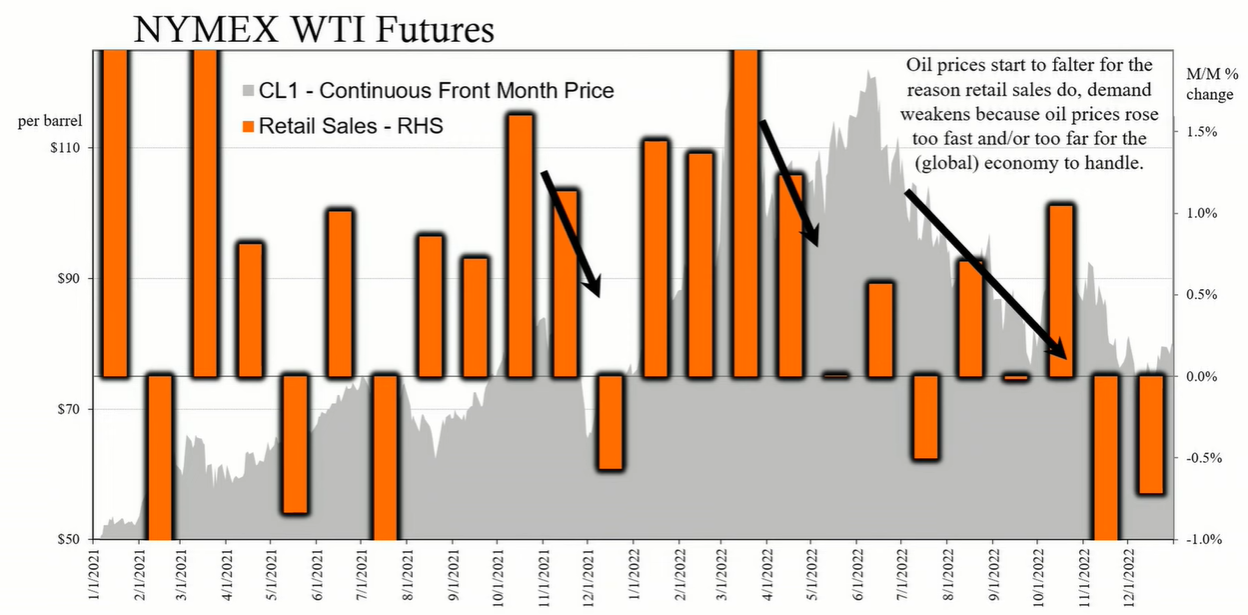

In the past year, oil prices have been volatile, but predictions of sustained $100 oil and a resulting inflationary spiral have not materialized. Instead, the global economy showed signs of weakness, with disinflation evident in consumer price indices worldwide. This outcome has been observed despite the actions of central banks, suggesting that their policies are more a response to economic conditions rather than a primary driver of these conditions.

The anticipation of central bank rate cuts in response to economic weakness leads to further safe haven demand for gold. This demand is reinforced by the expectation of lower interest rates, which reduces the opportunity cost of holding gold compared to other safe investments, such as U.S. Treasuries.

The impact of rising oil prices on the economy is complex. While there is a short-term increase in consumer prices due to higher energy costs, the longer-term effect tends to be disinflationary. This is because elevated oil prices erode disposable income, leading to a contraction in consumer spending and overall economic activity.

Data from retail sales supports the argument that oil price shocks lead to a weaker economy. Following a surge in oil prices, retail sales often soften, indicating reduced consumer spending. This trend is consistent across various oil price shocks and holds true even when excluding gasoline station sales from the analysis.

The evidence suggests that non-economic oil shocks are disinflationary and signal potential economic weakness ahead. The rising gold prices reflect this anticipation of a softer economy and lower interest rates rather than inflationary pressures. With the current state of the economy appearing weaker than in previous years, the effects of an oil price shock may be even more pronounced, potentially leading to a recession and further interest rate reductions. The current behavior of gold prices underscores these concerns and aligns with historical patterns observed during previous oil price shocks.