Soaring oil prices are weakening global economic demand, exacerbating credit constraints, and heightening recession fears.

The economy is experiencing considerable strain due to high oil prices, a trend that is proving to be disinflationary rather than inflationary. Recent data indicates that the economic impact is not only a short-term increase in the Consumer Price Index (CPI) but also a long-term weakening of demand.

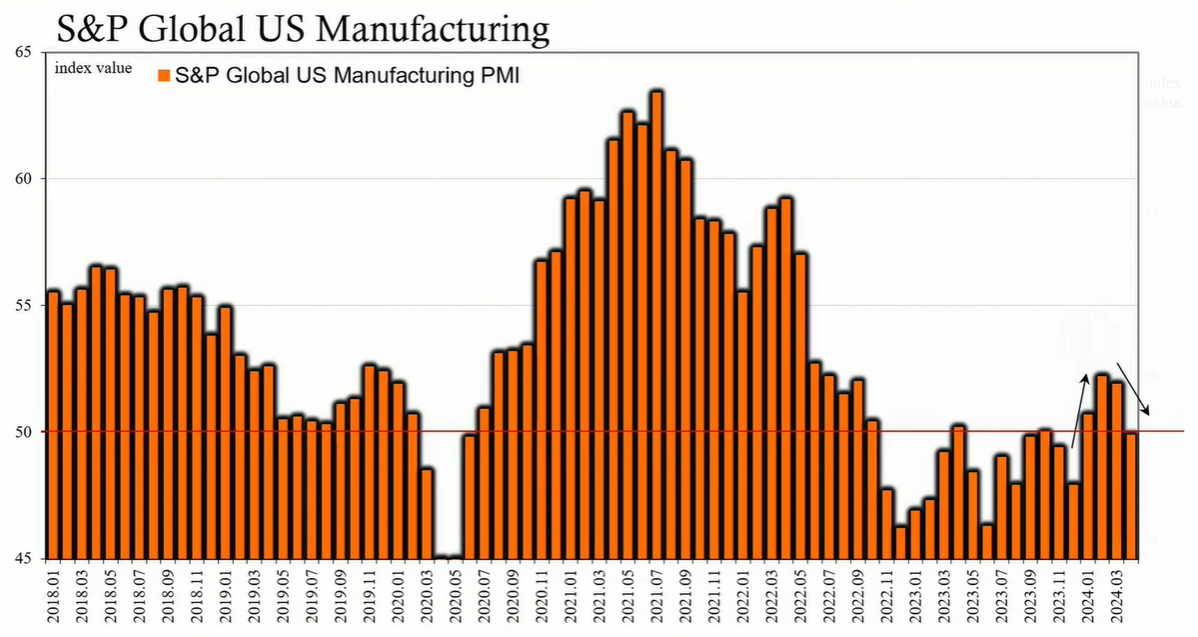

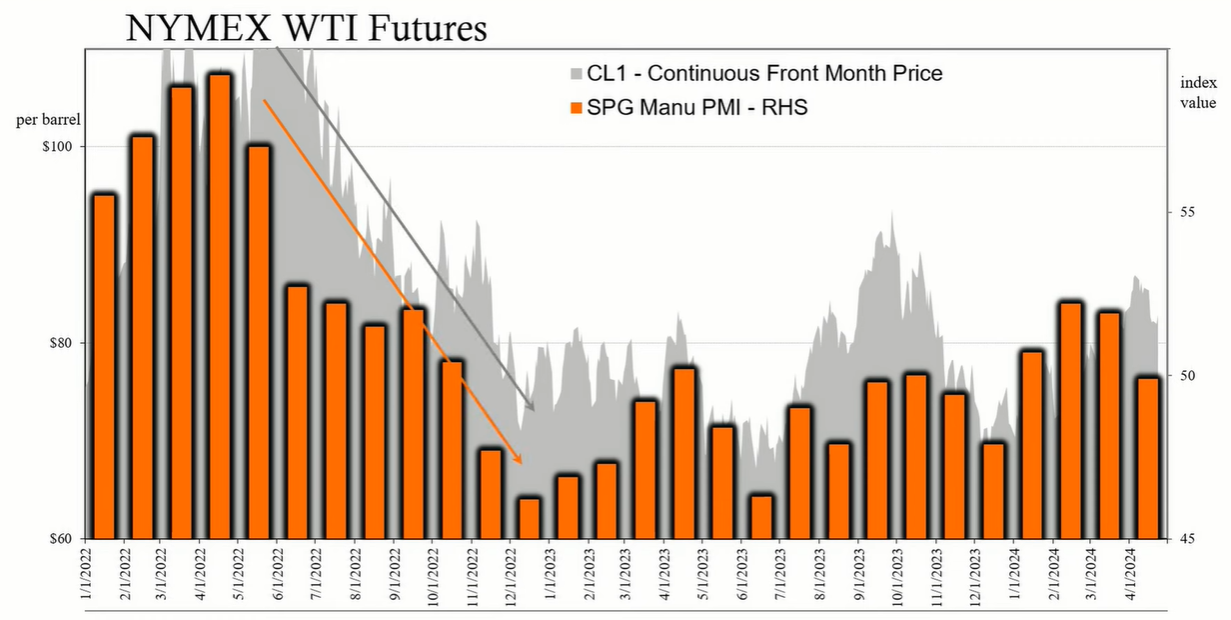

The S&P Global Manufacturing Purchasing Managers' Index (PMI) dropped to 49.9 in April, falling below the growth threshold of 50 for the second consecutive month. This decline suggests weakening demand and a possible correlation with fluctuating oil prices. The initial spike in oil prices in 2022 corresponded with a drop in the PMI, which then saw recovery as West Texas Intermediate (WTI) prices stabilized. However, the banking crisis in April of the same year saw both the PMI and oil prices fall once again.

The rally in crude oil prices during the summer months, despite the PMI's indication of weak manufacturing activity, suggested that oil price increases were largely driven by supply considerations. This divergence continued through September, with the PMI and WTI both dropping towards the end of the year. The PMI reflected a modest recovery as oil prices remained under $90 a barrel, but any demand-driven component of oil prices weakened significantly by April.

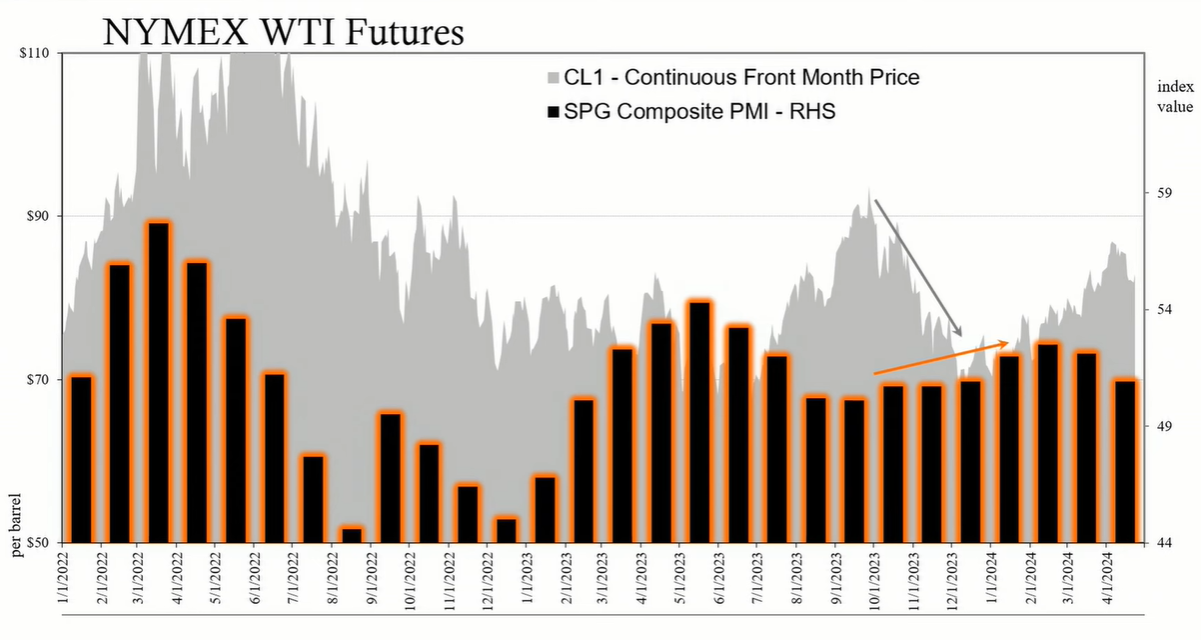

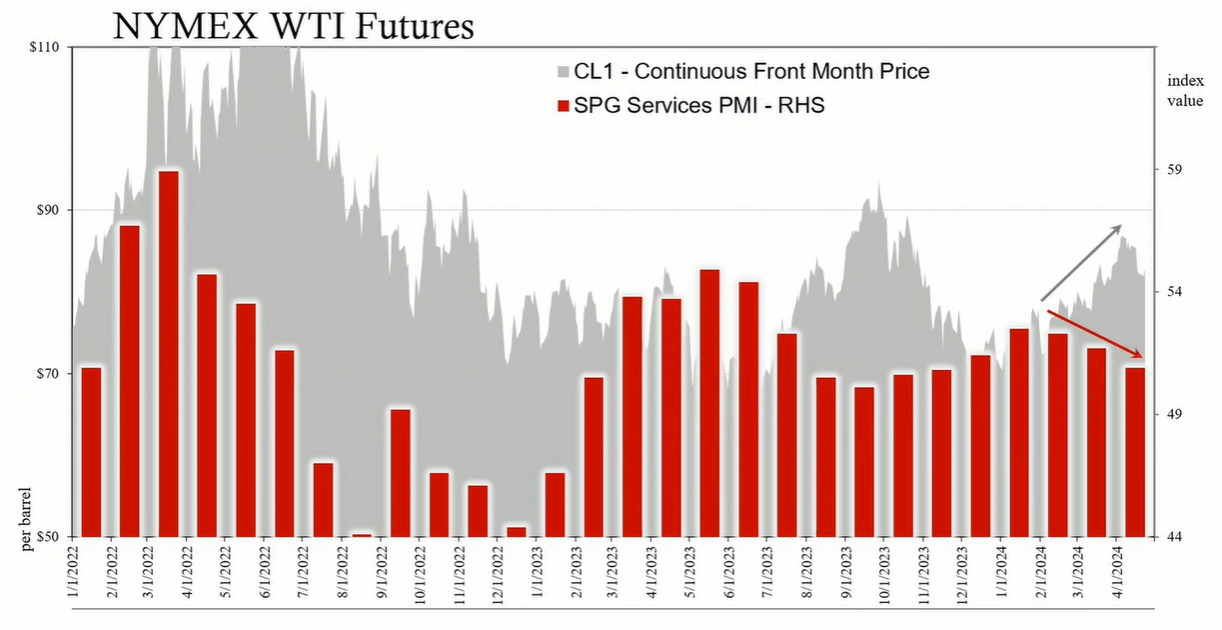

The S&P Global Services and Composite PMI show a more pronounced inverse correlation with oil prices, indicating that higher energy costs, driven by supply restrictions rather than demand increases, reduce disposable income and, in turn, service sector spending. This demand destruction is most evident in the service sector.

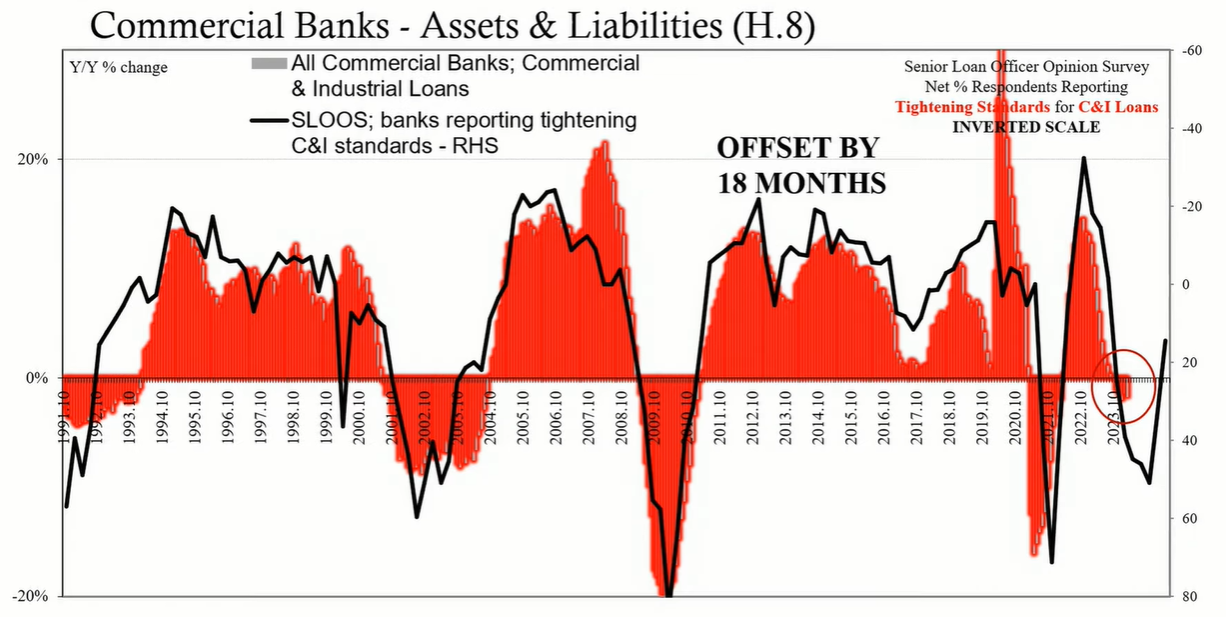

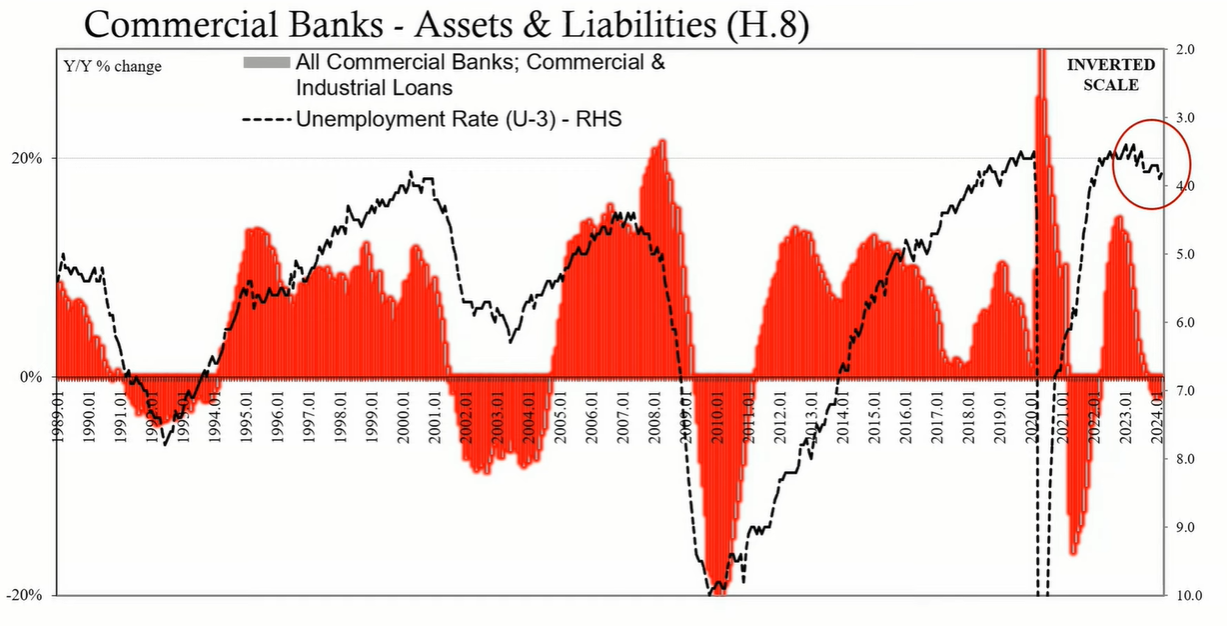

The credit environment, characterized by restrictions in loan availability, has also contributed to economic drag. The H.8 statistics highlighted a contraction in consumer lending and a downturn in commercial and industrial loans, which are closely tied to broader macroeconomic factors such as employment rates.

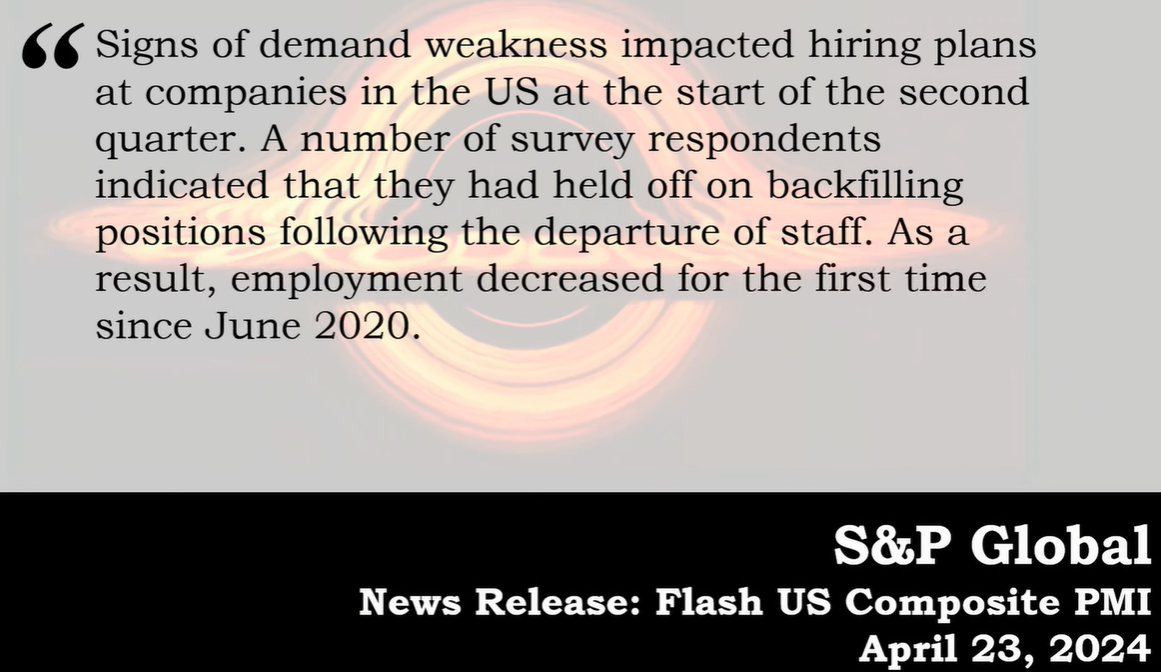

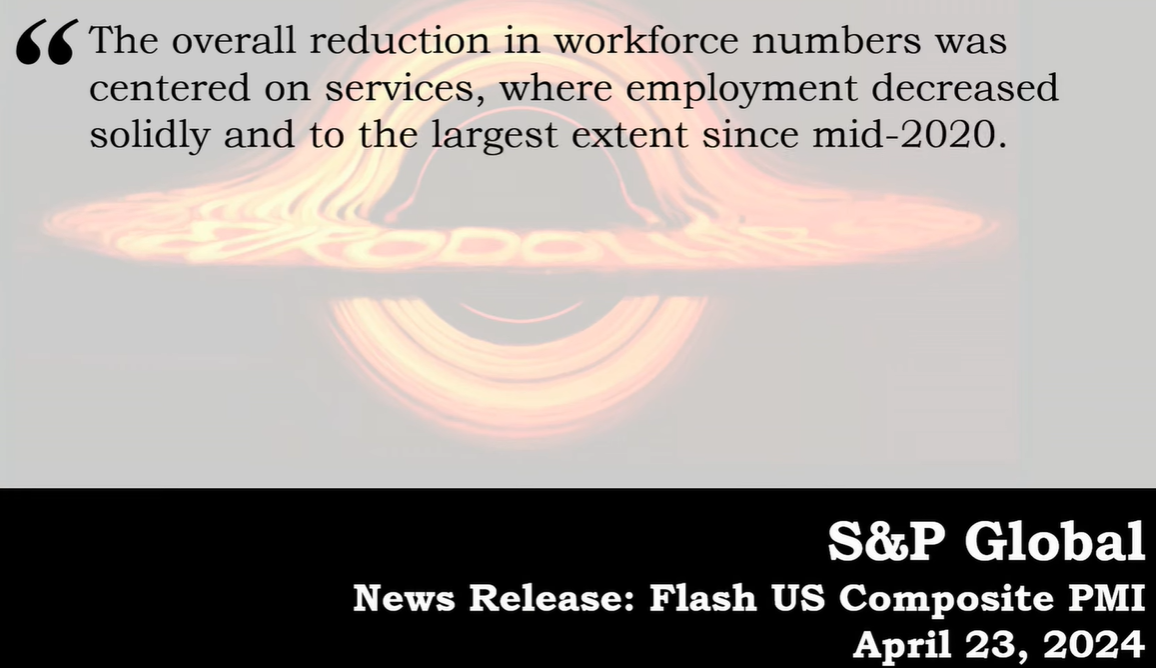

For the first time since June 2020, employment decreased, as companies refrained from filling vacancies. The reduction was most notable in the service sector, reinforcing the notion of demand destruction.

The Federal Reserve's April 2024 Financial Stability Report revealed growing concerns over a severe U.S. and global recession among market participants, a sentiment that had not been present in the previous October report.

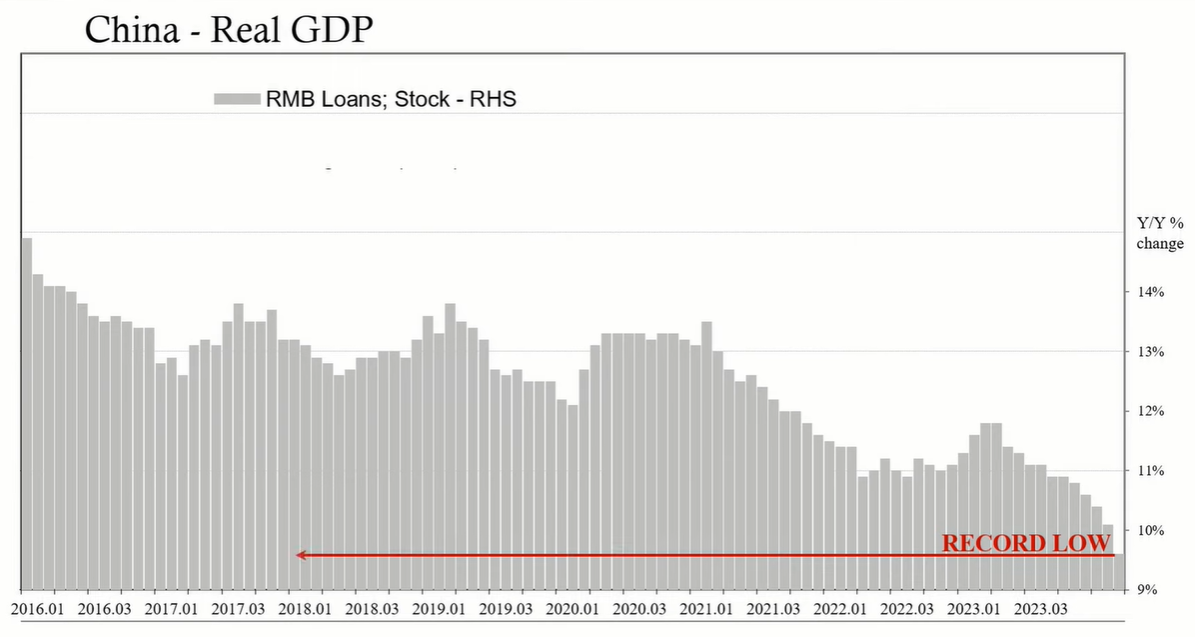

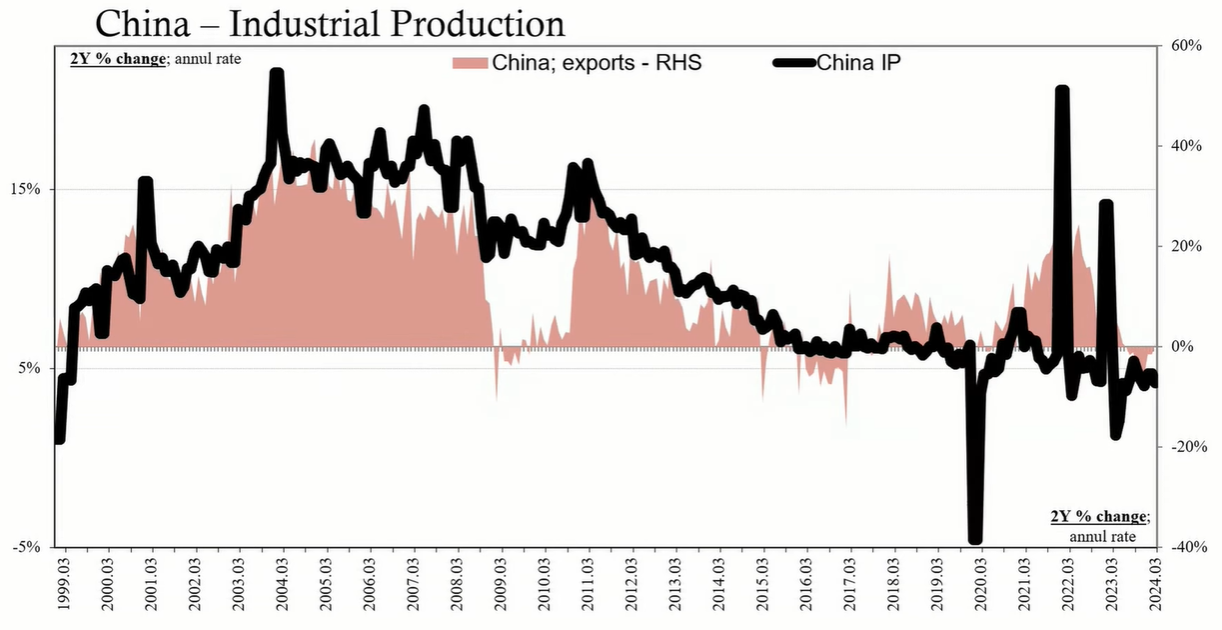

China's bond market has seen a persistent rally, with yields on government bonds nearing 20-year lows. This trend reflects market pricing for lower growth and inflation expectations. The latest economic data from China, encompassing GDP, industrial production, retail sales, and fixed asset investment, points to an economy that is not improving but rather deteriorating, particularly in the real estate sector.

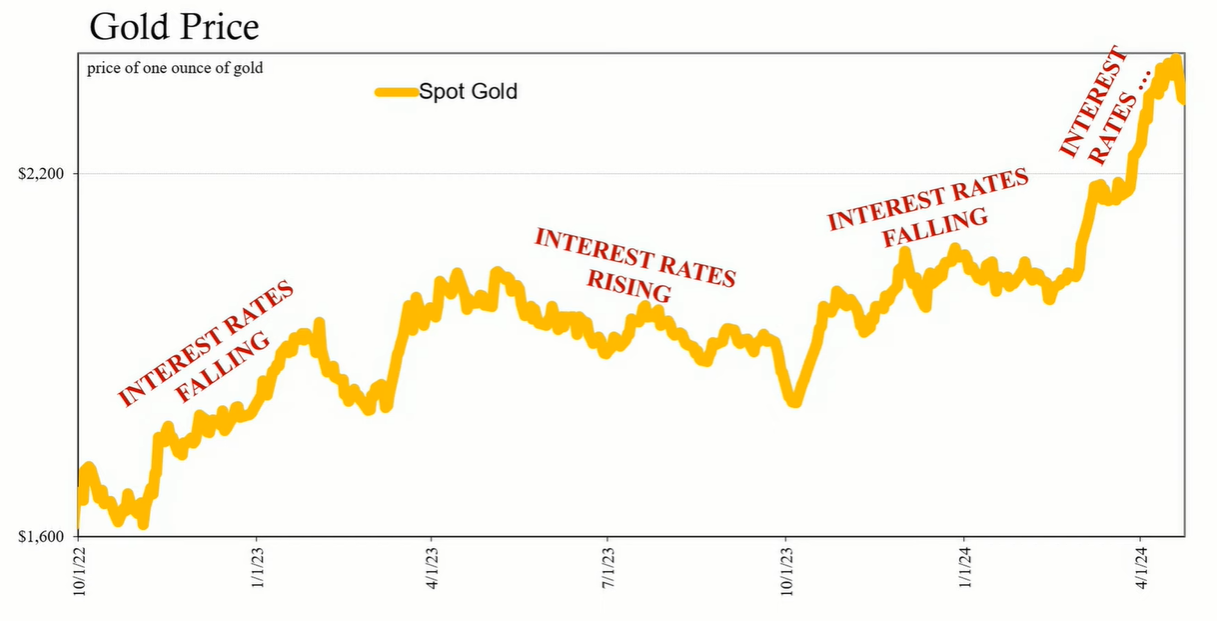

Gold prices reached an all-time high of $2,400 per ounce, attributed not to inflation fears but to safe-haven demand amid geopolitical tensions and the prospect of lower U.S. interest rates. China's increased consumption of gold further indicates a flight to safety in times of uncertainty.

The data indicates that high oil prices, driven by supply-side factors, are contributing to economic weakening by destroying demand. This, combined with a constrained credit environment, is reflected in various economic indicators, including PMIs and employment statistics. The global economic outlook, especially concerning China's downturn, exacerbates these concerns, leading to a surge in gold as a safe-haven asset.