Despite the narrative of the Biden administration, American families face a growing yet often overlooked challenge: the rising cost of food. A significant portion of disposable income is increasingly allocated to food expenses, with implications far beyond household budgets.

A recent Wall Street Journal article has revealed a concerning trend about the cost of food relative to income in the United States. While some economic indicators suggest a thriving economy, a closer look at disposable income allocation towards food expenses tells a different story.

The percentage of income that Americans are spending on food has increased significantly. As food prices consume a larger share of household income, less money is available for other expenses. This shift can have a profound impact on economic health, especially considering that consumer spending accounts for approximately 70% of the U.S. economy.

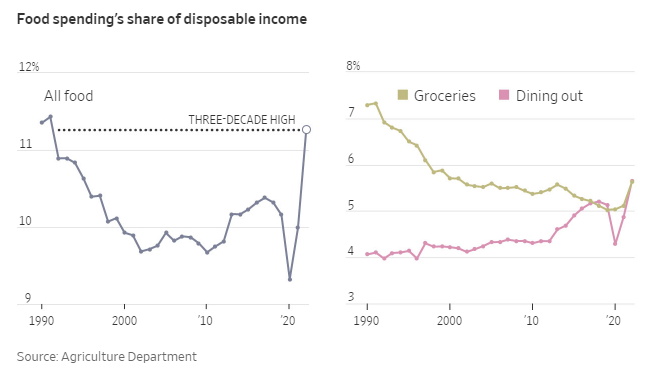

Historical data shows that after periods of inflation, food prices tend not to return to previous levels. According to the U.S. Department of Agriculture, in 1991, U.S. consumers spent 11.4% of their disposable personal income on food, a figure influenced by the inflationary period of the 1970s. This trend suggests a long-term shift in spending patterns, potentially exacerbated by preferences for more expensive, healthier food options which emerged during the 1970s and 1980s.

Despite claims that inflation is easing, food costs continue to rise. The Wall Street Journal reports a 5.1% increase in restaurant prices and a 1.2% increase in grocery costs year over year. These figures, however, seem inconsistent with other data that show higher increases across various food categories.

President Biden has criticized the practice of "shrinkflation," where product sizes decrease while prices remain the same or increase. Consumers are adapting by seeking out cheaper brands, using promotions, and reducing discretionary spending, such as dining out less frequently. This consumer behavior reflects a strain on household budgets and can lead to reduced sales for food makers and restaurant operators.

Businesses are facing higher costs due to increases in minimum wage laws in several states, which in turn leads to higher prices for goods and services. This can create a cyclical effect where consumers, especially those in lower-income brackets, are further pressured by price increases in essential goods such as food.

The proportion of disposable income spent on food is rising, which could indicate either an increase in food costs or a decrease in disposable income. Either scenario can have negative implications for the broader economy, potentially leading to decreased economic activity and potentially a recession.

While some economic indicators paint a picture of a booming economy, the reality for many Americans is a struggle with rising food costs outpacing income growth. This disparity between economic data and lived experience raises questions about the overall health of the economy and the long-term sustainability of current economic trends. As households adjust to higher food prices, the ripple effects may lead to a contraction in consumer spending and broader economic challenges.