Persistent high inflation in the U.S., marked by a significant annualized increase in the CPI, is complicating the Federal Reserve's policy decisions amid economic and political pressures.

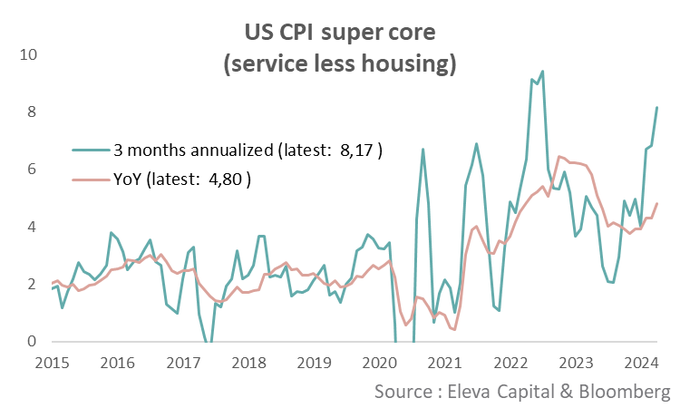

As the nation grapples with the relentless climb of inflation, the recent Consumer Price Index (CPI) numbers deliver a grim message. The inflation rate, which has been a thorn in the Biden administration's side, particularly as election season looms, shows no signs of a quick resolution. The latest data indicates a 4.6% annualized increase in March CPI, with the core CPI, stripped of volatile food and gas prices, at a 4.4% uptick. More alarmingly, the Federal Reserve's favored measure, the "super core CPI" that further excludes housing costs, rocketed to an 8% annualized rate.

This marks the fifth consecutive month of inflation's upward trajectory, a stark contrast to the 0.9% annualized figure from the more economically halcyon days of October. The escalation of inflation, despite the Federal Reserve's assurances of progress, has now likely quashed any remaining hopes for an interest rate cut within the year. A rate cut now, as some experts suggest, could be construed as a politically motivated move to interfere with the impending elections—a line the Federal Reserve has historically been wary to cross.

The implications of sustained high inflation are far-reaching. Consumers now face the reality of 7% mortgage rates and credit card rates soaring to 24%, immobilizing the housing market and altering the fabric of the American dream, as millennials find themselves in financially straitened circumstances. Wall Street, however, remains insulated from the brunt of these economic woes, having secured funds at lower rates during the pandemic and benefiting from the liquidity provided by the Federal Reserve's policies.

For the broader economy, higher interest rates spell further distress. The productive economy and domestic workforce continue to erode, with government spending, deficit-spending, and the reliance on undocumented workers propping up headline spending and employment figures, painting a deceptively rosy picture of economic health.

Internationally, the Federal Reserve's commitment to high rates exerts pressure on global economies, drawing capital away from local currencies—evidenced by the immediate plunge of the yen and the dip of the euro following the CPI announcement. China, facing the prospect of a Trump administration return, may be poised to devalue its currency, potentially exacerbating the challenges to American manufacturing.

At the beginning of the year, optimism reigned with predictions of up to seven rate cuts. Yet, the harsh reality is a stark deviation from this forecast, with not a single rate cut in sight and even the possibility of rate hikes. The Federal Reserve's optimistic reliance on supply chain corrections and economic reopening as solutions to inflation has proven inadequate, echoing the missteps of the 1970s when the Fed prematurely withdrew from its inflation-curbing efforts.