Discrepancies in rising commodity prices and interest rates cast doubt on the authenticity of the perceived economic recovery, challenging the traditional reflation narrative.

As the global economy navigates its way out of a downturn, discussions of reflation are becoming increasingly prevalent. Reflation is the process whereby economies move from a period of stagnation or contraction to one of recovery and growth, often characterized by rising demand, commodity prices, and interest rates.

The reflation argument is gaining traction, supported by indicators such as rising consumer prices, surging commodity costs, and climbing interest rates. Advocates of the reflation camp contend that the global economy is on the cusp of a revival, signaling an end to the pervasive downturn experienced in several regions over recent years.

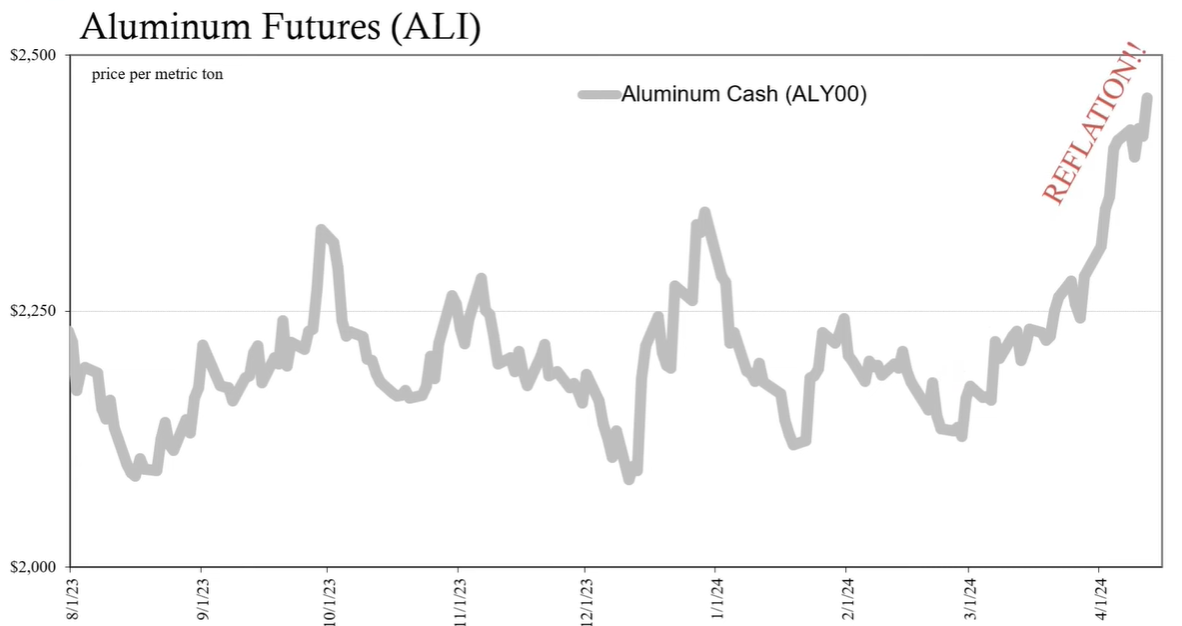

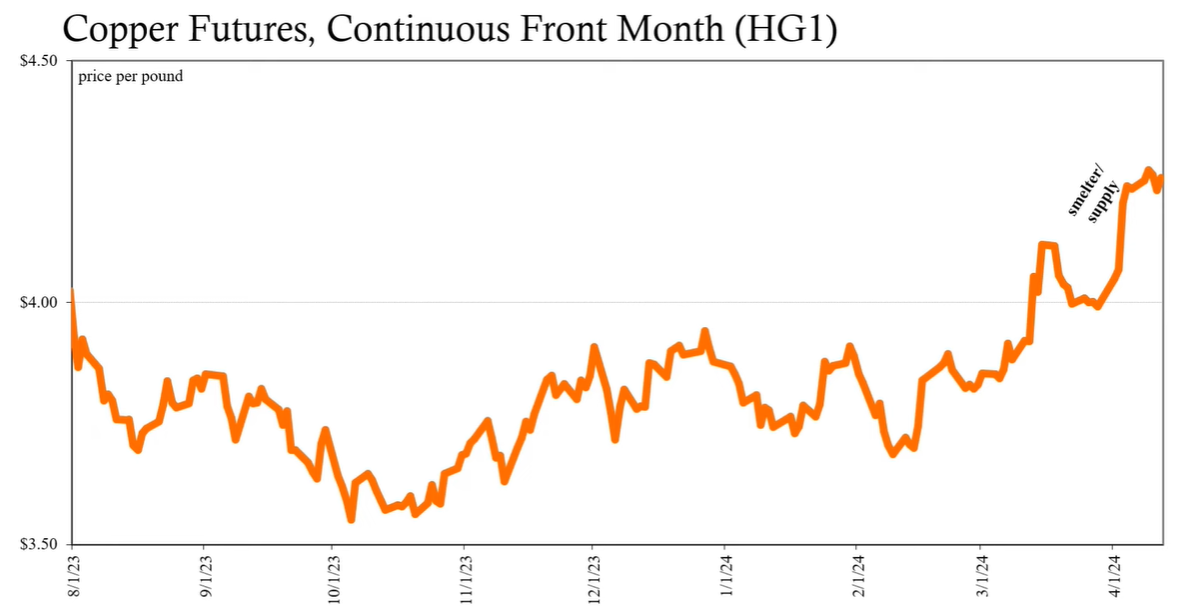

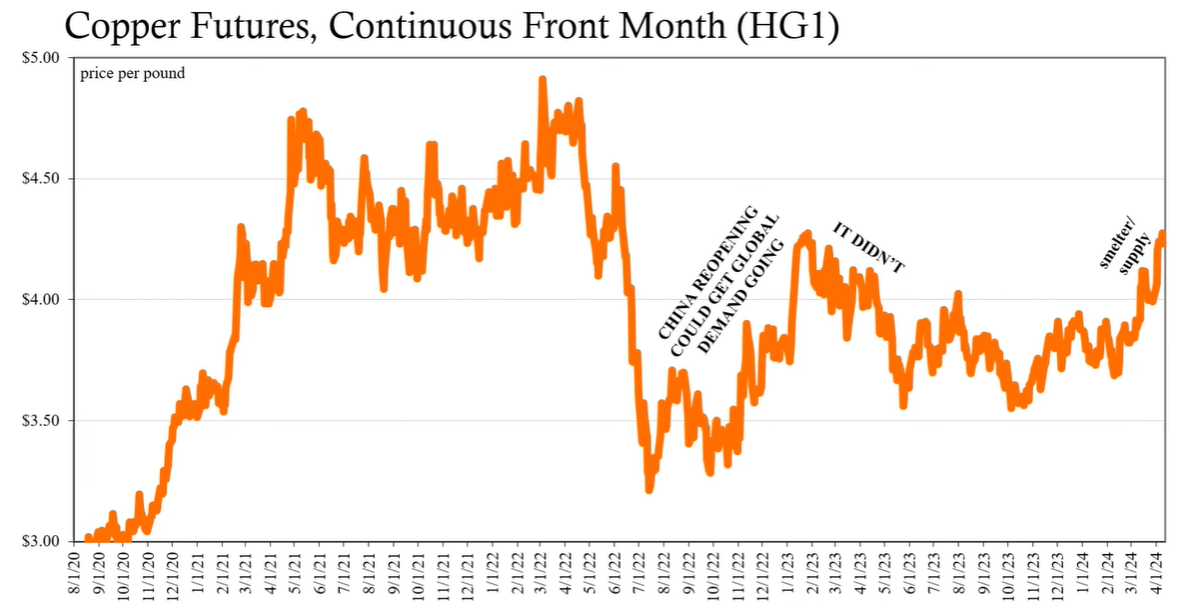

Key commodities have witnessed price hikes, with oil often cited as a beneficiary of increasing demand. 'Doctor Copper', a moniker for copper due to its economic predictive power, is also experiencing significant price jumps, alongside aluminum. These trends are accompanied by rising interest rates, suggesting that bond markets may be pricing in higher growth and inflation expectations.

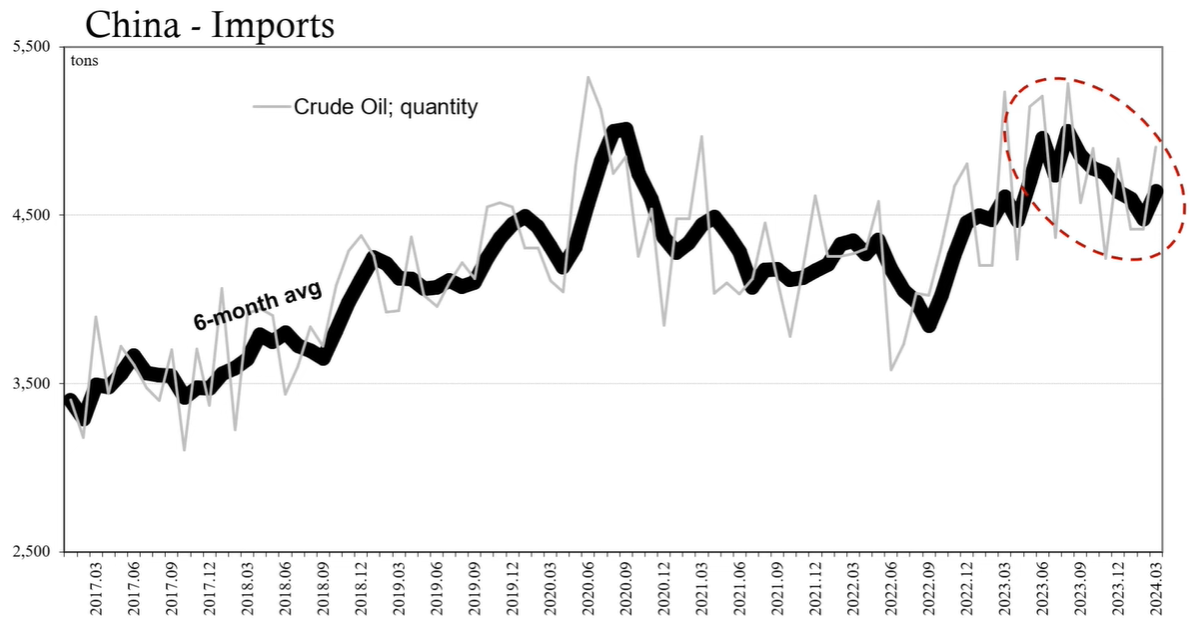

Despite these observations, there are critical components of reflation that appear to be absent. A closer examination of commodity prices reveals they may be influenced more by supply constraints than by an uptick in demand. For instance, geopolitical factors and supply chain disruptions are notable forces driving oil prices, rather than a resurgence in consumption.

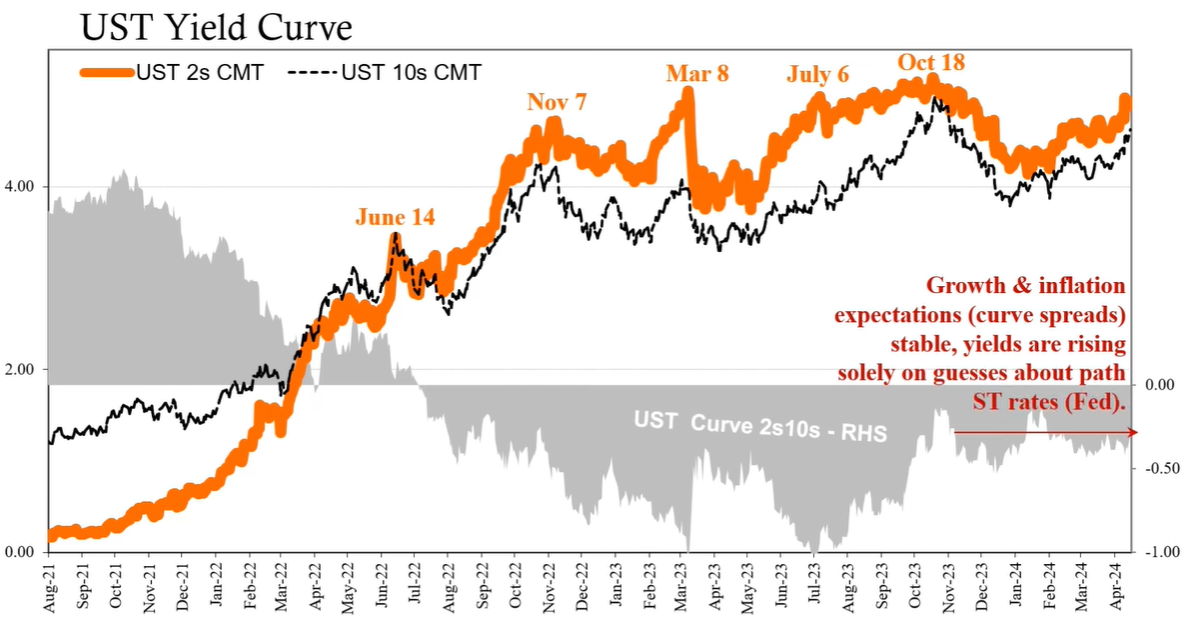

Furthermore, the rise in interest rates may not reflect genuine growth or inflation expectations but rather market speculation about central bank policies, particularly those of the Federal Reserve.

A pivotal aspect not aligning with the reflation narrative is the behavior of the US dollar. In a true reflationary environment, one would expect the dollar to depreciate, making way for stronger foreign currencies. However, the dollar has maintained or even strengthened its position, contradicting the reflation hypothesis.

The increase in crude oil prices is largely attributed to geopolitical tensions and supply limitations. Data on oil imports, such as those from China, suggest that demand remains subdued. Similarly, aluminum prices have soared due to sanctions and export bans affecting supply rather than burgeoning demand.

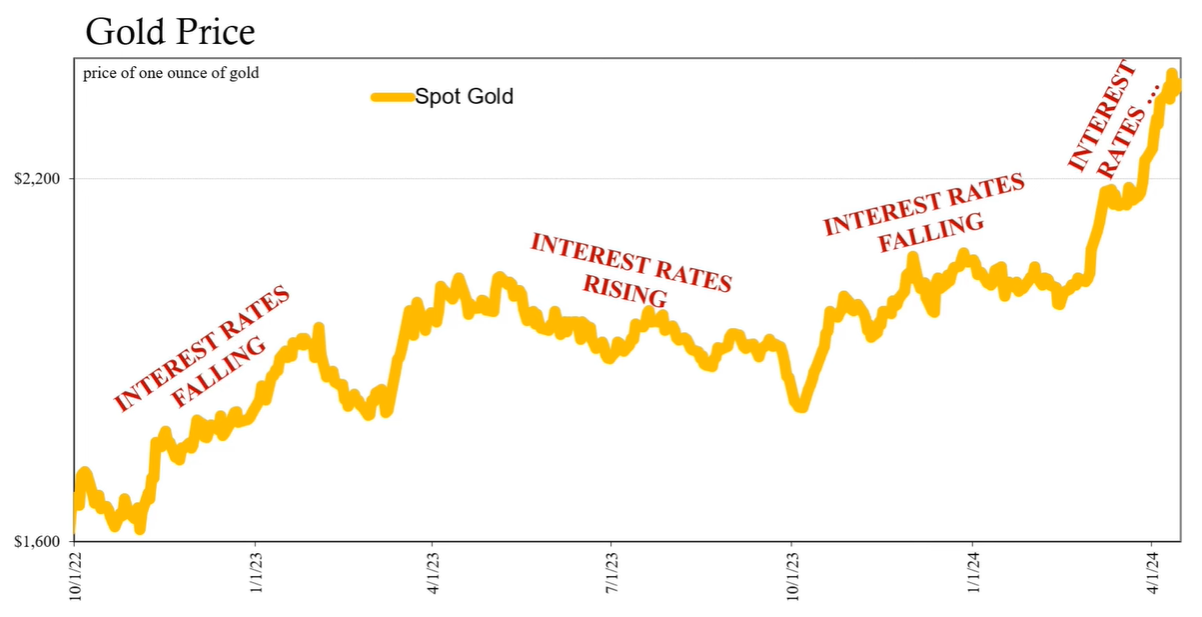

Copper, a bellwether for economic health, shows a rise in prices not because of demand but due to a reduction in smelting activity caused by profitability concerns. Precious metals like gold and silver, typically seen as safe havens, are also on the rise, which historically occurs during disinflationary or deflationary periods, not reflationary ones.

The bond market's response, with rising interest rates, seems to be more of a reaction to anticipated central bank rate adjustments rather than a reflection of heightened growth and inflation expectations. This suggests a disconnect between financial markets and the underlying economic conditions.

Key commodities and rising interest rates may give the impression of reflation, but the lack of demand-driven price increases, a strengthening US dollar, and an absence of corroborating signs from the bond market reveal a more complex reality. Given these observations, the likelihood of the current reflation narrative being another false dawn remains considerable.