The recent surge in 401(k) hardship withdrawals paints a bleak picture of America's financial health, with a significant number of citizens resorting to their retirement savings to manage immediate expenses.

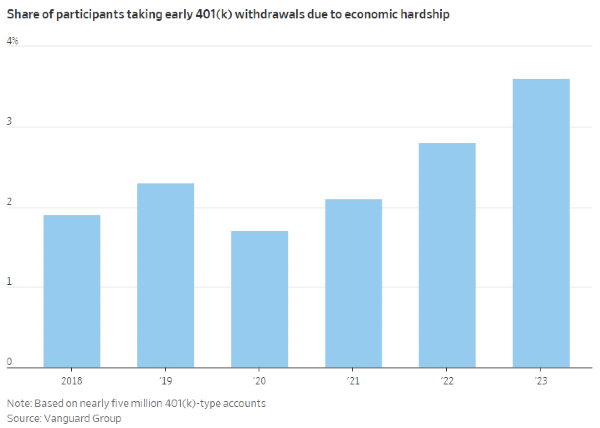

In a disquieting sign of the financial strain gripping the nation, Americans are increasingly tapping into their 401(k) retirement accounts to cover immediate expenses, setting new records for hardship withdrawals under the Biden administration. A recent study, highlighted by the Wall Street Journal, reveals that emergency withdrawals from these primary retirement savings vehicles reached consecutive records in 2022 and 2023.

Data showcases a concerning trend: nearly one in seven Americans with a 401(k) account currently has a loan outstanding. Alarming figures from renowned financial institutions such as Vanguard, which recorded a 30% uptick in new hardship withdrawals this year, and Fidelity, noting 6.9% of plan participants have taken out a new hardship loan, underline the growing desperation.

The principal reasons for these withdrawals are stark indicators of the economic challenges faced by middle-class Americans. Approximately 40% of these distributions were taken to stave off the threat of foreclosure, while a significant number of others were claimed to cover insurmountable medical bills.

Federal law permits 401(k) account holders to borrow up to half of their account value for "immediate and heavy financial need," a provision meant for dire situations. However, this often leads to a reduction in retirement income, exacerbated by an already underfunded American savings landscape.

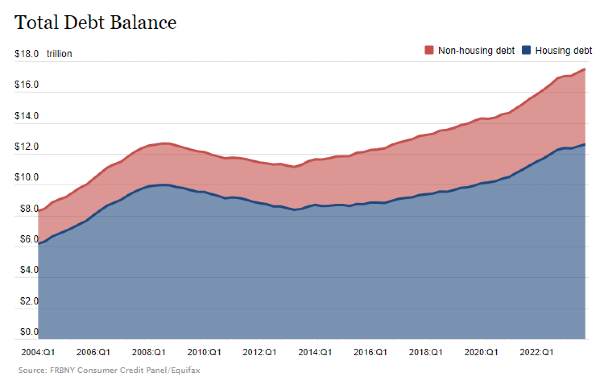

This surge in retirement account raids is attributed to the confluence of rising costs and stagnating real wages. The temporary relief provided by stimulus checks has dissipated, leaving many to grapple with mounting debt, which has soared to a staggering $17.5 trillion in household debt, or nearly $150,000 per household.

The predicament is even more severe for those without full-time incomes, with Wharton's study indicating that households earning under $20,000 annually are the hardest hit by inflation. With limited assets to offset these effects, the majority of Americans find themselves unable to cope with an unplanned $1,000 expense.

As policymakers and media suggest austerity measures, such as skipping meals, to combat economic woes, the public discourse is shifting towards the need for more sustainable solutions like federal spending restraint and fostering an economy that provides secure, well-paying jobs.

As the crisis deepens, the debate continues on how best to navigate from this financial precipice, with a clear call for action that extends beyond mere platitudes and towards concrete economic reform.